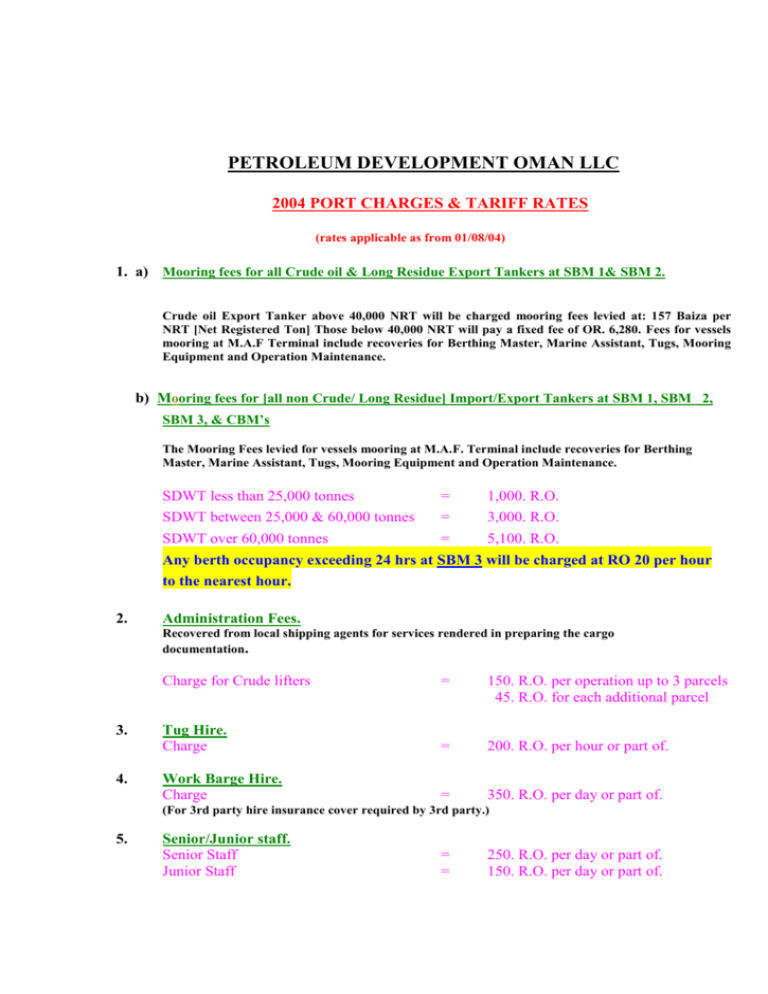

PETROLEUM DEVELOPMENT OMAN LLC

advertisement

PETROLEUM DEVELOPMENT OMAN LLC 2004 PORT CHARGES & TARIFF RATES (rates applicable as from 01/08/04) 1. a) Mooring fees for all Crude oil & Long Residue Export Tankers at SBM 1& SBM 2. Crude oil Export Tanker above 40,000 NRT will be charged mooring fees levied at: 157 Baiza per NRT [Net Registered Ton] Those below 40,000 NRT will pay a fixed fee of OR. 6,280. Fees for vessels mooring at M.A.F Terminal include recoveries for Berthing Master, Marine Assistant, Tugs, Mooring Equipment and Operation Maintenance. b) Mooring fees for [all non Crude/ Long Residue] Import/Export Tankers at SBM 1, SBM 2, SBM 3, & CBM’s The Mooring Fees levied for vessels mooring at M.A.F. Terminal include recoveries for Berthing Master, Marine Assistant, Tugs, Mooring Equipment and Operation Maintenance. SDWT less than 25,000 tonnes SDWT between 25,000 & 60,000 tonnes SDWT over 60,000 tonnes = = = 1,000. R.O. 3,000. R.O. 5,100. R.O. Any berth occupancy exceeding 24 hrs at SBM 3 will be charged at RO 20 per hour to the nearest hour. 2. Administration Fees. Recovered from local shipping agents for services rendered in preparing the cargo documentation. 3. 4. Charge for Crude lifters = 150. R.O. per operation up to 3 parcels 45. R.O. for each additional parcel Tug Hire. Charge = 200. R.O. per hour or part of. Work Barge Hire. Charge = 350. R.O. per day or part of. (For 3rd party hire insurance cover required by 3rd party.) 5. Senior/Junior staff. Senior Staff Junior Staff = = 250. R.O. per day or part of. 150. R.O. per day or part of. 6. Vessel Inspection. Minimum charges for 3rd party vessel inspections Vessel up to 10,000 Tonnes DWT Vessel 10,000 to 25,000 Tonnes DWT Vessel over 25,000 Tonnes DWT 7. = = = 150. R.O. 200. R.O. 250. R.O. Port Dues. Port dues are collected by PDO on behalf of the Government and levied on all vessels Loading hydrocarbon substances with the following exception:1) Vessel loading hydrocarbons for discharge in any other part in Oman. 2) Vessel loading fuel of any kind for there own use. 3) Vessel discharging hydrocarbons. Port dues are calculated as follows: Percentage of total cargo loaded in relation to Tropical Deadweight rounded up to the next 10% with a minimum of 40% multiplied by full tariff being Gross Tonnes x R.O. 0.0525. e.g. Lampas (GRT 161,632 Trop. DWT 326,162 tonnes) (loads 90,000 tonnes crude and takes 4,500 tonnes gas oil not for his own use.) Calculation: 90,000 + 4,500 = 29% so the minimum of 40% is applicable. 326,168 Full Tariff = 161,632 x 0.0525 = 8,486. R.O. Payable = 40% x 8,486 = 3,394. R.O. 8. Light Dues. Navigational Aid Dues are payable to AMNAS [Arabian Maritime & Navigation Aid Service]. Inchcape Shipping Services are the collection Agency. Applied to vessels at Oman Ports traveling to or from International Ports. Charges are OR 1.100 per 100 NRT [Minimum OR 50,000]