(考試日期: 節次: 份數: ) 命題老師簽 章:

advertisement

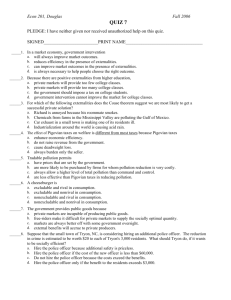

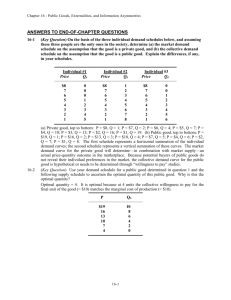

考試日期: 節次: 德明技術學院 94 份數: 學年度第 □單面□雙面列印 2 學期 □五專□二專 考試共 科 系 考試 Principles of Economics 科目 □二技□四技 2 年 頁第 班 □需□不需答案紙 命題老師 章:劉景中 頁 簽 班級: □要□不要裝訂 A卷 姓名: 學號: Multiple Choice: 1. 142. According to the Coase theorem a. private parties can bargain to reach an efficient outcome. b. government assistance is necessary for markets with externalities to reach an efficient outcome. c. externalities, both positive and negative, will always cause markets to be inefficient. d. no market will experience long-term externalities, since normal market adjustments will eliminate externalities. ANSWER: a. private parties can bargain to reach an efficient outcome. 156. Assume that your roommate, Vanessa, is very messy, and according to campus policy, you have a right to live in an uncluttered apartment. Suppose she gets a $200 benefit from being messy but imposes a $100 cost on you. The Coase theorem would suggest that an efficient solution would be for your roommate to a. stop her messy habits or else move out. b. pay you at least $100 but less than $200 to live with the clutter. c. continue to be messy and force you to make other living arrangements elsewhere. d. demand payment of at least $100 but no more than $200 to clean up after herself. ANSWER: b. pay you at least $100 but less than $200 to live with the clutter. 164. Pigovian taxes are enacted to a. raise revenue from those most able to pay. b. correct the effects of negative externalities. c. discourage production of undesirable products. d. adjust markets with positive externalities. ANSWER: b. correct the effects of negative externalities. 170. Which of the following statements is most correct? a. Pigovian taxes are often preferred over direct regulation because they typically reduce externalities at a lower cost. b. Pigovian taxes are less preferred than direct regulation because they typically reduce externalities at a higher cost. c. Pigovian taxes are often preferred over direct regulation because they typically reduce externalities at a faster rate. d. Pigovian taxes are less preferred than direct regulation because they typically reduce externalities at a slower rate. ANSWER: a. Pigovian taxes are often preferred over direct regulation because they typically reduce externalities at a lower cost. 182. The difference between a Pigovian tax and pollution permits is a. a Pigovian tax sets the price of pollution and permits set the quantity of pollution. b. a Pigovian tax provides a more efficient outcome than permits. c. a Pigovian tax sets the quantity of pollution and permits set the price of pollution. d. permits provide a more efficient outcome than a Pigovian tax. ANSWER: a. a Pigovian tax sets the price of pollution and permits set the quantity of pollution. 11. Goods that are excludable include both a. natural monopolies and public goods. b. public goods and common resources. c. common resources and private goods. d. private goods and natural monopolies. ANSWER: d. private goods and natural monopolies. 24. Public goods are a. excludable but not rival. b. rival but not excludable. c. both excludable and rival. d. neither excludable nor rival. ANSWER: d. neither excludable nor rival. 40. A free-rider is a person who a. will only purchase a product on sale. b. receives the benefit of a good but avoids paying for it. c. can produce a good at no cost . d. takes advantage of tax loop-holes to lower his taxes. ANSWER: b. receives the benefit of a good but avoids paying for it. 65. As with many public goods, determining the appropriate level of government support for the production of general knowledge is difficult because a. benefits are hard to measure. b. patents correct for an unknown portion of the externality. c. members of Congress are often experts in the sciences. d. the costs always exceed the benefits. ANSWER: a. benefits are hard to measure. 16. Corporate profits (if they are distributed as dividends) are a. never taxed. b. taxed twice. c. taxed once. d. taxed three times. ANSWER: b. taxed twice. On Taxable Income 41. The Tax Rate is Up To $27,050 15.0% From $27,050 to $65,550 27.5 From $65,550 to $136,750 30.5 From $136,750 to $297,350 35.5 Given the tax table, if Danielle makes $38,000 this year on her new job, her tax liability would be approximately 考試日期: 節次: 德明技術學院 94 份數: 學年度第 □單面□雙面列印 2 學期 □五專□二專 考試 Principles of Economics 科目 □二技□四技 考試共 科 系 2 年 頁第 班 班級: □需□不需答案紙 □要□不要裝訂 命題老師 章:劉景中 頁 簽 A卷 姓名: 學號: a. $4,058. b. $5,700. c. $7,069. d. $10,450. ANSWER: c. $7,069. 42. Given the tax table, if Janice makes $97,500 this year, her tax liability would be approximately a. $23,431. b. $24,390. c. $26,815. d. $29,740. ANSWER: b. $24,390. 108. The deadweight loss of an income tax is determined by the a. amount of total tax revenue to the government. b. marginal tax rate. c. average tax rate. d. loss in consumer surplus when the tax is imposed. ANSWER: b. marginal tax rate. 167. The "flypaper theory" of taxation suggests that a. the individual or corporation who actually pays the tax is able to shift the burden of the tax to others. b. the benefits principle of taxation is not a viable option for policymakers. c. taxes are never paid by the most wealthy citizens. d. the individual or corporation who actually pays the tax cannot share the burden of the tax. ANSWER: d. the individual or corporation who actually pays the tax cannot share the burden of the tax. 172. The theory that the wealthy should contribute more to police protection than the poor because they have more to protect is based on a. the ability-to-pay principle. b. a consumption tax plan. c. the benefits principle. d. property tax assessments. ANSWER: c. the benefits principle. Joe wants to start his own business. The business he wants to start will require that he purchase a factory that costs $300,000. To finance this purchase, he will use $100,000 of his own money, on which he has been earning 10 percent interest. In addition, he will borrow $200,000, and he will pay 12 percent interest on that loan. 23. For the first year of operation, what is the explicit cost of purchasing the factory? a. $12,000 b. $20,000 c. $24,000 d. $44,000 ANSWER: c. $24,000 24. For the first year of operation, what is the opportunity cost of purchasing the factory? a. $10,000 b. $20,000 c. $24,000 d. $34,000 ANSWER: d. $34,000 27. Economic profit is equal to (i) total revenue – (explicit costs + implicit costs). (ii) total revenue – opportunity costs. (iii) accounting profit + implicit costs. a. (i) only b. (i) and (ii) c. (ii) and (iii). d. All of the above are correct. ANSWER: b. (i) and (ii) 93. Diminishing marginal product suggests that the marginal a. cost of an extra worker is unchanged. b. cost of an extra worker is less than the previous worker’s marginal cost. c. product of an extra worker is less than the previous worker’s marginal product. d. product of an extra worker is greater than the previous worker’s marginal product. ANSWER: c. product of an extra worker is less than the previous worker’s marginal product. 99. When marginal cost is less than average total cost, a. marginal cost must be falling. b. average variable cost must be falling. c. average total cost is falling. d. average total cost is rising. ANSWER: c. average total cost is falling. Short answer: 1. The text says that both public goods and common resources involve externalities. a. Are the externalities associated with public goods generally positive or negative? Use examples in your answer. Is the free-market quantity of public goods generally greater or less than the efficient quantity? b. Are the externalities associated with common resources generally positive or negative? Use examples in your answer. Is the free-market use of common resources generally greater or less than the efficient use? 2. Consider the following table of long-run total cost for three different firms: Quantity 1 Firm A $60 2 3 $70 $80 4 5 6 7 $90 $100 $110 $120 考試日期: 德明技術學院 節次: 94 份數: 學年度第 □單面□雙面列印 2 學期 □五專□二專 考試 Principles of Economics 科目 □二技□四技 考試共 科 系 2 年 頁第 班 班級: □需□不需答案紙 □要□不要裝訂 命題老師 章:劉景中 頁 簽 A卷 姓名: 學號: Firm B 11 24 39 56 75 96 119 Firm C 21 34 49 66 85 106 129 Does each of these firms experience economies of scale or diseconomies of scale? 3. Figure 4 shows that for any given demand curve for the right to pollute, the government can achieve the same outcome either by setting a price with a Pigovan tax or by setting a quantity with pollution permits. Suppose there is a sharp improvement in technology for controlling pollution. a. Using graphs similar to those in Figure 4, illustrate the effect of this development on the demand for pollution rights. b. What is the effect on the price and quantity of pollution under each regulatory system? Explain. ( 原題複印製版,請用黑色墨水正楷書寫或電腦繕打,且莫超出線框範圍; 表 頭 資 料 請 詳 填 )