Lubin School of Business

advertisement

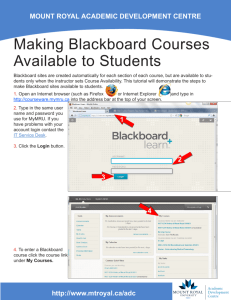

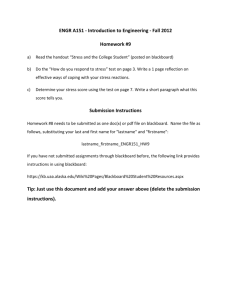

Lubin School of Business Pace University Spring 2012 Graduate Center and Web Assisted Course Information ACC 645: THEORY AND ANALYSIS OF FINANCIAL STATEMENTS Instructor Information Dr. Roberta Cable Email: rcable@pace.edu Text Penman: Financial Statement Analysis and Security Valuation, Fourth Edition Reference For students who have NOT taken Intermediate Accounting, it is advisable to review the Accounting Clinics posted on Blackboard under Course Documents. In addition, students can consider purchasing a used edition (4th through 6th) of Spiceland-SepeTomassini: Intermediate Accounting. Course Description This course deals with analysis of financial reports for making investment decisions. The main focus is to help students be able to interpret financial statements for decision-making. Understanding how financial statements provide information regarding an enterprise is essential for any corporate manager. This course will help students understand the difference between the economic processes that generates the reported numbers from the accounting process that can obscure them. It will highlight the assumptions and approximations needed to analyze the reported financial numbers. Topics include models of accrual accounting concepts, valuation, ratio analysis and detailed analysis of various financial statement sections. The course will be taught from the perspective of a security analyst although the material covered will be relevant to the corporate financial analyst for evaluating acquisitions, restructurings and other investments, and for calculating the value generated by strategy scenarios. By the end of the course, the student should feel competent in writing a thorough, convincing equity research report. Learning Objectives By the end of the course students should have answers to the following questions: How are fundamental values (or “intrinsic values”) estimated? How are business strategies analyzed in order to understand the value they create? What business activities determine value? How is “value created for shareholders” identified? What is the role of financial statements in calculating equity values? How does one pull apart the financial statements to get at the relevant information for valuing equities? 1 What is the relevance of cash-flows? Of dividends? Of earnings? Of book values? How does ratio analysis help in valuation? How does profitability tie into valuation? What is growth? How does one analyze growth? How does one value a growth firm? How does one analyze the quality of financial reports? How does one deal with the accounting methods used in financial statements? How is financial analysis developed for strategy and planning? What determines a firm's P/E ratio? What determines a firm's market-to-book (P/B) ratio? How does one evaluate risk? For equity? For debt? How does one evaluate an equity research report? How does one trade on fundamental information? Teaching Methodology and Class Preparation A combination of online lectures, case discussions and problem solving is used. The course covers elements of financial and accounting analysis and the emphasis will be towards application by examining several financial reports. Students who lack adequate background should do any additional reading as needed. Relevant accounting clinics are posted under Course Documents in Blackboard. Course Requirements and Grading The overall course grade is determined out of 100 points distributed as follows: Homework and Cases Mid-term exam Final exam Project Total 15 30 30 25 100 Please make sure you have satisfied the pre-requisites for this course and are able to handle the material for this course. Also make sure you are able to commit the time needed to understand the subject matter in order to solve the problems to do well in the exams. It is expected that all students will adhere to the due dates stated in the Syllabus. Homework and case assignments will not be accepted late. The project will be discussed in detail in the next section. 2 Instruction for project assignment preparation The course project is an individual research paper. The project should involve equity or debt analysis and in most cases is presented as an equity or debt research report. The following are some suggestions: An equity research report of a company. Evaluation of an acquisition from the point of view of the acquiring firm or the target firm. Evaluation of a restructuring. Evaluation of a privatization. The research paper will be grade will be based on creativity, demonstration of depth of knowledge, and clarity in communication. You may choose only publically traded firms from any industry sector. The paper should be approximately 7 – 10 pages (12 font, double spaced). Proper citations for your footnotes and bibliography are required. The APA format is preferred. Do not include the financial statements in your paper as the instructor can access them online. Please submit a short proposal of what you want to look into for your project (including company(ies), industry, issues) by February 11. You may submit your proposal early. The due date of your paper is Session 13. Late submissions will be penalized. Web/Internet Support Please visit http://blackboard.pace.edu and select ACCT-645. As a major portion of this class will require on-line access and communication so you will need access to the Internet on a regular basis. The course materials will be available on the Blackboard website for this course. All announcements will be posted there as well. All assignments should be turned in electronically. Communication will be done using the group discussion board, email and weekly meetings on Blackboard Collaborate (accessed under Course Tools). The class will be using Blackboard Collaborate with FreeConferenceCall.com. Our phone number is 218-862-1000 and the Access Code is 103152#. Make sure you are able to access Blackboard Collaborate before our first on-line class meeting. The site below can be used to determine if the computer you are using meets the necessary system requirements: http://support.blackboardcollaborate.com/ics/support/default.asp?deptID=8336&task=knowle dge&questionID=1473 Also, try using another browser to see if the issue persists. 3 Blackboard uses your Pace email to communicate. Please make sure you either check your Pace email account regularly or have set it up to forward messages to another email that you access on a regular basis. You will not be able to operate in this class without email and Internet access. Academic Integrity All members of the Pace community are expected to behave with honesty and integrity. Do not plagiarize and cheat in either computer projects or exam. Cheating penalties are severe. You are expected to conduct yourself with integrity. If you cheat, plagiarize, or aid someone else in cheating, you violate a trust. Cheating includes, but not limited to, copying answers on tests or assignments, glancing at nearby test papers, stealing, plagiarizing and illicitly giving or receiving help on computer projects, exams or assignments. As a condition of participating in the program, all required papers may be subject to submission for textual similarity review to Turnitin.com for the detection of plagiarism. All submitted papers will be included as source documents in the Turnitin.com reference database solely for the purpose of detecting plagiarism of such papers. No student papers will be submitted to Turnitin.com without a student’s written consent and permission. If a student does not provide such written consent and permission, the instructor may: 1. Require a short reflection paper on research methodology; 2. Require a draft bibliography prior to submission of the final paper; 3. Require the cover page and first cited page of each reference source to be photocopied and submitted with the final paper. 4. Require other steps as deemed appropriate by the instructor. Reasonable Accommodations For Students With Disabilities The University’s commitment to equal educational opportunities for students with disabilities includes providing reasonable accommodations for the needs of students with disabilities. To request an accommodation for a qualifying disability, a student must self-identify and register with the Coordinator of Disability Services for his or her campus. No one, including faculty, is authorized to evaluate the need and arrange for an accommodation except the Coordinator of Disability Services. Moreover, no one, including faculty, is authorized to contact the Coordinator of Disability Services on behalf of a student. For further information, please see Information for Students with Disabilities on the University’s web site. 4 Class Schedule Session Assignment (Homework for Sessions 5, 9 and 13 due on Sundays at 8:00 pm.) 1 Chapters 1 and 2. Introduction to Investing, Valuation and Financial Statements. 2 Do 1.6, 2.5, 2.10 (a, b, c and d). Chapter 3. How Financial Statements Are Used in Valuation. 3 Do 3.1, 3.7, 3.17. Submit Nike Case. Chapters 4. Cash and Accrual Accounting. 4 Project Proposal due. Do 4.1, 4.3, 4.11. Submit 4.8. Chapters 5 and 6. Accrual Accounting and Valuation. 5 Do 5.1, 5-10, 6.1, 6.10. Submit 5.3 (Use Case 3) and 6.3 (Use Case 2) due 8:00 pm on Sunday. 2 points. Chapter 8. Analysis of the Statement of Shareholders’ Equity. 6 Do 8.1, 8.3, 8.7. Submit 8.7 and 8.13. Chapter 7. Viewing the Business Through the Financial Statements. 7 Do 7.1, 7.2, 7.3. Submit 7.8. Chapter 9. Analysis of the Balance Sheet Income Statement. 8 Midterm Exam 9 Do 9.1, 9.3, 9.8 Submit 9.4. Chapter 10. Analysis of the Cash Flow Statement. 10 Do 10.1, 10.2, 10.8. Submit 10.10. Chapter 11. Analysis of Profitability. 11 Do 11.2, 11.6, 11.8. Submit 11.7. Chapter 12. Analysis of Growth and Sustainable Earnings. 12 Do 12.1, 12.2, 12.3, 12.4. Submit 12.7. Chapter 16. Creating Accounting and Economic Value. 13 Project due. 16.2, 16.4. Submit 16.8. Chapter 17. Analysis of the Quality of Financial Statements. 14 Do 17.3, 17.4, 17.8, 17.9, 17.10. Submit Lucent Case. 5 15 Final Exam 6