Income Maintenance Assistance Programs

advertisement

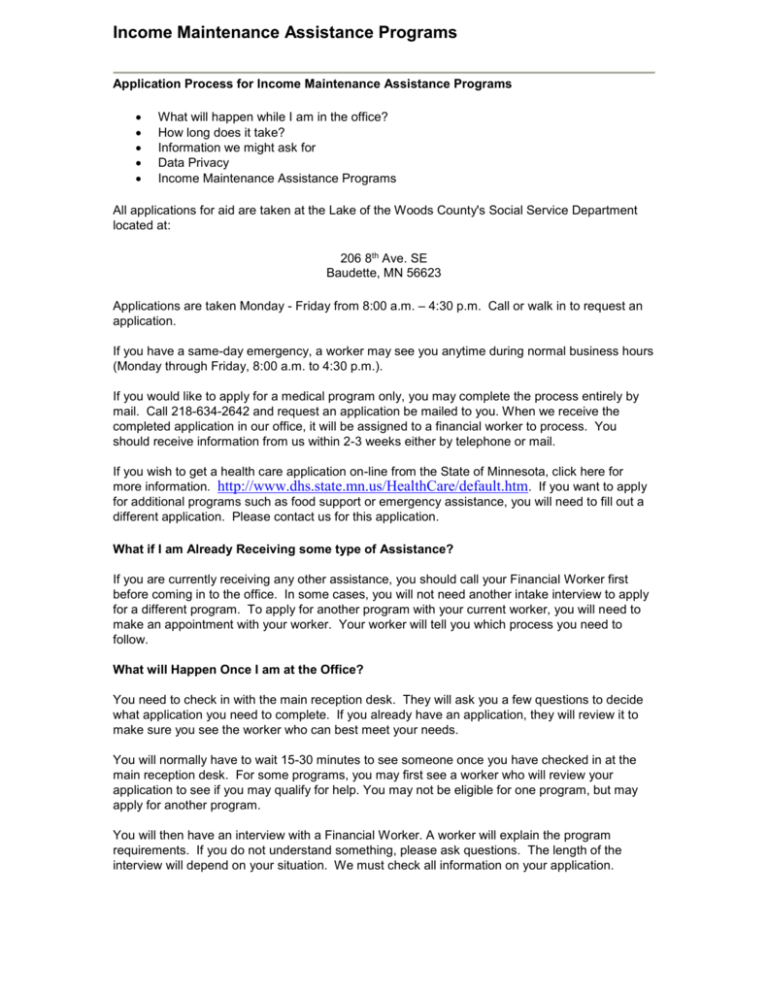

Income Maintenance Assistance Programs Application Process for Income Maintenance Assistance Programs What will happen while I am in the office? How long does it take? Information we might ask for Data Privacy Income Maintenance Assistance Programs All applications for aid are taken at the Lake of the Woods County's Social Service Department located at: 206 8th Ave. SE Baudette, MN 56623 Applications are taken Monday - Friday from 8:00 a.m. – 4:30 p.m. Call or walk in to request an application. If you have a same-day emergency, a worker may see you anytime during normal business hours (Monday through Friday, 8:00 a.m. to 4:30 p.m.). If you would like to apply for a medical program only, you may complete the process entirely by mail. Call 218-634-2642 and request an application be mailed to you. When we receive the completed application in our office, it will be assigned to a financial worker to process. You should receive information from us within 2-3 weeks either by telephone or mail. If you wish to get a health care application on-line from the State of Minnesota, click here for more information. http://www.dhs.state.mn.us/HealthCare/default.htm. If you want to apply for additional programs such as food support or emergency assistance, you will need to fill out a different application. Please contact us for this application. What if I am Already Receiving some type of Assistance? If you are currently receiving any other assistance, you should call your Financial Worker first before coming in to the office. In some cases, you will not need another intake interview to apply for a different program. To apply for another program with your current worker, you will need to make an appointment with your worker. Your worker will tell you which process you need to follow. What will Happen Once I am at the Office? You need to check in with the main reception desk. They will ask you a few questions to decide what application you need to complete. If you already have an application, they will review it to make sure you see the worker who can best meet your needs. You will normally have to wait 15-30 minutes to see someone once you have checked in at the main reception desk. For some programs, you may first see a worker who will review your application to see if you may qualify for help. You may not be eligible for one program, but may apply for another program. You will then have an interview with a Financial Worker. A worker will explain the program requirements. If you do not understand something, please ask questions. The length of the interview will depend on your situation. We must check all information on your application. How Long Does it Take? The time it takes to complete the process depends on your situation. Normally, you can be in the office for an hour or two. Once all the information has been checked, the worker will decide if you are eligible for aid. You will be informed of the decision by mail. Your notice will explain when the aid begins. Information We Might Ask For Here is a list of required items to verify your eligibility for a particular program. The items you will be requested to supply depend on your situation. Identification Social Security Card Driver's License Certified Birth Certificate Marriage License Divorce Decree Proof of Residence Income Check Stubs Tax Forms Court Orders Benefits Award Notice Resources Bank Account Statements Certificates Vehicle Titles or Registrations Life and Medical Insurance Policies Property Tax Statements The application forms you receive before your interview will include a list that will identify specifically the information required for each program. Data Privacy Your right to privacy and your right to review information kept on file about you is protected by state and federal laws. The Minnesota Government Data Practices Act (Minnesota Statutes, Chapter 13 as amended) gives you the right to be informed about the information about you that is kept by this department. Information about your rights under the Federal and State Privacy Laws The Minnesota Government Data Practices Act, the Federal Privacy Act and the Federal Health Ins. Portability & Accountability Act (HIPAA) were passed to protect the privacy of the people that government agencies collect information about. The Federal Freedom of Information Act and the Minnesota Government Data Practices Act also allows the release of information that is public. These acts require that, whenever we ask you to give us private or confidential information about yourself, you must be told: The purpose and intended use of the information by this agency. If you are legally required to give us the information. What will or might happen if you give us the information, and what will or might happen if you do not give us the information. The identity of other persons or agencies that may legally see the information. The information we collect about you may be classified as: Public - anyone can see the information; Private - only you or your authorized representative can see the information; or Confidential - you cannot see the information. Unless the information is used in an aggregate statistical report (with no names or any other identification of individuals), or the information is legally to be used for another purpose, all information about you that this agency collects, keeps and uses is private. For more information ask for a copy of the County brochure "Your Right to Data Privacy." Income Maintenance Assistance Programs You can call 218-634-2642 to request this information in a brochure or to request an application to apply for aid. If you wish to request an application or brochure by e-mail, please provide us with the following information: your name, full postal address and zip code, phone number where you can be reached in case we have questions, what type of assistance you are requesting, and whether you are single or have children under 21 living with you. Minnesota Family Investment Program (MFIP) Diversionary Work Program (DWP) Diversionary Assistance (DA) Emergency Assistance (EA) Emergency General Assistance (EGA) Food Support (FS) General Assistance (GA) Medical Assistance (MA) Qualified Medical Beneficiary (QMB) Service Limited Medicare Beneficiary (SLMB) General Assistance Medical Care (GAMC) General Assistance Hospital Only (GHO) Prescription Drug Program (PDP) Minnesota Care Minnesota Supplemental Aid (MSA) Group Residential Housing (GRH) Emergency Assistance Minnesota Supplemental Aid (EMSA) Child Support/Collection Services Workforce Services Child Care Assistance For additional information from the State of Minnesota on Income Maintenance Programs, click here www.dhs.state.mn.us/cfs/services/ Minnesota Family Investment Program (MFIP) MFIP is a work-focused program that provides assistance to families with little or no income. This assistance can include cash benefits, food benefits, and Child Care Assistance. The goal of this program is to help families become self-sufficient. These families include one or two parent households, pregnant women or children being cared for by relatives. Child Support is pursued in those situations where one or both parents are absent. Income and resource guidelines of the program must be met. This is a time-limited program with a 60-month lifetime limit and there are work expectations for most adults. Diversionary Work Program (DWP) The Diversionary Work Program is a mandatory four-month program that families must participate in before they become eligible for MFIP. Under this program, families are required to develop an employment plan before they can receive cash assistance. The program is intended to immediately engage new applicants for MFIP assistance in employment and training activities and reinforce the “work first” emphasis of MFIP. Certain cases will be excluded from the fourmonth program and allowed to enroll in MFIP at the time of application (e.g. child-only cases; teen parents; over age 60; pending SSI/RSDI for 1-parent household). If a participant beings to work, cash benefits will continue for the four-month period and wages will not reduce the grant. Families will be eligible for child-care assistance as they would under MFIP. Families are also eligible for Food Support benefits and healthcare benefits based upon income and not work requirements. Diversionary Assistance (DA) DA is a one-time payment to an individual or third-party to divert a family from MFIP. Issuance of DA makes a family ineligible to receive MFIP for a specific time period. DA is potentially available to families who are not on MFIP and who have experienced an unexpected occurrence that makes it impossible to retain or obtain employment, or when a caregiver has a temporary loss of income that places the family at risk of needing to apply for MFIP. Examples of what these payments may be used for are car repair, childcare, shelter, etc. The funding will need to help resolve the situation and ensure that the family will remain financially stable. Income guidelines of the program must be met. Emergency Assistance EA is short-term assistance for families experiencing a financial hardship such as an eviction or a utility shutoff. EA may also be able to help with moving expenses and damage deposits. Damage deposit issuance is limited to the amount of one month's rent. The EA Family Unit must have gross income under 200% of federal poverty guidelines. The amount of assistance is limited to 4 times the MFIP Cash Assistance Standard. The allowance is based on costs provided the EA payment will resolve the financial hardship. Eligibility is limited to one 30-day period in any 12 consecutive months. Any income not needed for basic needs will be considered available to meet the emergency as well as any cash or other resources you might have. Emergency General Assistance (EGA, State Funded Program) EGA is short-term assistance for single individuals or families experiencing a financial hardship such as an eviction, foreclosure, utility shutoff, or in a situation that threatens someone’s health or safety. Additional criteria includes: The family must not have, without good cause used more than 50% of its income and liquid assets for purposes other than basic needs during the 60 days before application. Must meet citizenship or immigration status. Must have lived in Minnesota for at least 30 days. Must not currently be receiving MFIP. Eligible recipients are limited to EGA benefits one time only during a 12-month period. Food Support Program The Food Support Program provides help to purchase food products. Food Support allows eligible households to increase their food purchasing power. Food Support benefits may be used for food products at any participating store. The amount of Food Support you receive is dependent upon your income and household expenses. Eligibility is also subject to resource guidelines. General Assistance (GA) GA is a monthly check for Lake of the Woods County residents who have little or no income and who are not eligible for MFIP or MSA. Applicants must meet one of 17 possible categories of eligibility and be unable to work. Adults with children, see MFIP. Applicants must also meet the income and resource guidelines of the program. Resource limitations may be waived under certain conditions. Certain disabled GA recipients may have to apply for Medical Assistance (MA) and Social Security. Nondisabled GA recipients are automatically eligible for General Assistance Medical Care (GMAC) and may be eligible for Food Support. Medical Assistance (MA) MA pays all or part of most medical expenses for persons who are: Over 65 years of age Under 21 years of age Blind or disabled Parents with dependent children Pregnant women and meet the income and resources limits of the program. The medical services that may be paid by MA include: physician care, hospital care, prescriptions, eye care, routine dental care, mental health treatment, chemical dependency care, nursing home care and others. Reimbursement for medical transportation and other health care access services is also available. The fee-for-service providers of medical care are paid directly for services to eligible MA recipients. Payment is made after they have billed any other third-party that may be liable. If you have unpaid medical bills from the last three months, or if you incur any medical bills while your application is pending, ask your Intake worker for the brochure explaining Fee for Service Medical Assistance. Qualified Medicare Beneficiary (QMB) The QMB program will pay monthly Medicare premiums and Medicare deductibles and coinsurance for elderly or disabled individuals who are enrolled in Medicare Part A and B. Income and resource guidelines set by the program must be met. Service Limited Medicare Beneficiary (SLMB) The SLMB program is limited to payment of the Medicare Part B premium for elderly or disabled individuals who are enrolled in Medicare Part A. Income and resource guidelines set by the program must be met. General Assistance Medical Care Hospital Only (GHO) The GHO program is for people who do not have a basis of eligibility for MA and who meet the technical eligibility requirements for GAMC, but who have income and assets in excess of the limit for full GAMC benefits, may qualify for GAMC for inpatient hospitalization. Benefits are limited to inpatient hospital charges and physician’s services received during the inpatient hospitalization. Eligibility beings the date of application or the date of inpatient hospital admission, whichever is later, and ends effective the date of discharge from inpatient hospitalization. General Assistance Medical Care (GAMC) GAMC pays for all or part of most medical expenses for persons who do not qualify for MA or do meet the income and resource limits of the MA program. The providers of medical care are paid directly for their services to eligible GAMC recipients. The medical services that may be paid by GAMC vary depending on which GAMC program you are qualified to receive. Income and resource guidelines as set by the program must be met. Recipients are given a membership card and are seen and treated as any other member of a health plan. They use the clinics, doctors, dentists, pharmacies, and hospitals in the community. Prescription Drug Program This program helps pay prescription drug costs for individuals who are disabled or over the age of 65 and receive Medicare. Applicants must meet income and asset guidelines. MinnesotaCare This is a State subsidized health care program for low-income families and individuals. People can currently apply at either the State or pick up an application at Lake of the Woods County Social Services Enrollees must meet income guidelines and may be required to pay a premium. Call 651-297-3862 if you wish to apply for this program through the State. Minnesota Supplemental Aid (MSA) MSA is a monthly check for persons who are over age 65, disabled or blind and who are recipients of Supplementary Social Security Income (SSI) or ineligible for SSI due to excess income. Benefits for MSA are based on shared and nonshared household situations. Clients who are recipients of MSA may also qualify for an additional special cash diet supplement if they meet certain criteria. The resource limits are the same as those of the SSI Program. Additional cash payments may be available for major home repairs, moving expenses, and repair or replacement of essential furniture or appliances. Most MSA recipients are automatically eligible for MA and may be eligible for Food Support. Income and resource guidelines as set by the program must be met. Group Residential Housing Program (GRH) Group Residential Housing is a state funded income supplement program that pays for room and board costs for low income adults who have been placed in a licensed or registered setting with which a county human service agency has negotiated a monthly rate. GRH may make service payments for disabled and elderly adults in foster care and other settings if the person cannot access service payment from another source, such as Home and Community Based waiver programs. Emergency Minnesota Supplemental Aid (EMSA) To be eligible for Emergency EMSA, a person must be a MSA recipient or GRH participant based on age 65 or over, blindness, age 18 or over. Issuance of EMSA is limited to one time per 12-month period. Child Support/Collection Services The Child Support Unit collects child support payments from noncustodial parents. The unit also helps establish paternity for children born out of wedlock. Single parents who receive MFIP are referred to the Child Support unit for establishment and/or collection of child support payments. The current payments collected are sent to the custodial parent. Single parents who receive Medical Assistance, MinnesotaCare, or Child Care Assistance are also referred to the Child Support Unit for child support services. The child support payments collected are sent to the custodial parent. Payments collected for childcare obligations for county Child Care Assistance cases are kept by the county as a reimbursement. There are no income or resource limits to qualify for this service. There is a $25 application fee for those not receiving MFIP, Medical Assistance, Child Care Assistance, or MinnesotaCare. Call 218-634-2642 if you wish to learn more about this service or to apply for child support enforcement services. Workforce Services Rural Minnesota CEP, Inc. contracts with Lake of the Woods County Social Services to provide employment and training services to unemployed, underemployed and economically disadvantaged youth and adults who are residents of Lake of the Woods County. Program eligibility, based on family income or employment status, is required for some programs. The range of services includes: Career Assessment Job Seeking Skills Resume Preparation Employment Referrals On-the-job Training Classroom Training Case Management Job Search and Placement Assistance Dislocated Worker Programs Youth Employment Programs Employment for Senior Citizens Child Care Assistance Child Care Assistance is a "limited funding" program. When funding is not available to serve all requests, we will have a waiting list. Assistance is available for people with low incomes or some people on MFIP who are attending school or working. For employed individuals not on MFIP, assistance is based on a Sliding Fee Schedule. Qualified individuals pay a part of their childcare based on income and family size. Child support is pursued in those situations where there is an absent parent. Individuals select their own provider and may choose from the following options: 1. Licensed Child Care Center 2. Licensed Family Home 3. Legally Unlicensed Provider For inquires about payments, call Lake of the Woods County Social Services at 218-634-2642. If you are already on MFIP or Child Care, contact your Financial Worker for an application. If you are not on MFIP or child care now, call us at 218-634-2642 to request childcare assistance or to be added to the childcare waiting list.