Model Budget Template - 2007-2008

advertisement

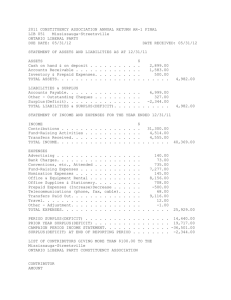

LG System Inc – Model Budget Template, 2007-08 Model Budget Template 2007 - 2008 This project has been assisted by the Local Government Research & Development Scheme LG System Inc – Model Budget Template, 2007-08 TABLE OF CONTENTS 1. BUDGET OVERVIEW ........................................................................................................ 1 2. KEY FINANCIAL INDICATORS ....................................................................................... 3 3. SERVICES PROVIDED TO THE COMMUNITY ........................................................... 6 4. ANALYSIS OF OPERATING BUDGET .......................................................................... 8 Operating Revenue ............................................................................................................ 8 Operating Expenses......................................................................................................... 10 Operating Result ............................................................................................................... 11 5. ANALYSIS OF CAPITAL EXPENDITURE.................................................................... 12 Net Outlays on Existing assets....................................................................................... 12 Net Outlays on New and Upgraded Assets .................................................................. 12 Capital Works Program ................................................................................................... 13 Infrastructure and Asset Management Plan ................................................................. 13 6. ANALYSIS OF BUDGETED BALANCE SHEET ......................................................... 14 Net Financial Liabilities .................................................................................................... 15 7. RATING STRATEGY ....................................................................................................... 16 8. FINANCING THE BUDGET ............................................................................................ 18 APPENDICES ........................................................................................................................ 20 BUDGETED INCOME STATEMENT ............................................................................ 21 BUDGETED BALANCE SHEET .................................................................................... 22 BUDGETED CASH FLOW STATEMENT .................................................................... 23 UNIFORM PRESENTATION OF FINANCES .............................................................. 24 SUMMARY OF LONG-TERM FINANCIAL PLAN ....................................................... 25 CAPITAL WORKS PROGRAM ...................................................................................... 26 DETAILS OF COST OF PROVIDING SERVICES ...................................................... 27 GLOSSARY............................................................................................................................ 28 LG System Inc – Model Budget Template, 2007-08 1. BUDGET OVERVIEW The Council considers that its budget is a fundamental instrument of accountability and an essential pre-requisite to deciding the annual rate impost on the community. The Council has budgeted for an operating surplus/deficit of $[Click here and type details] in 2007-08 after including general and other rates of $[Click here and type details]. Capital spending on infrastructure and other assets of $[Click here and type details] is proposed. Note: In future years, it is proposed that this Budget Overview section will also include a high level summary of the Council’s:(1) Key Budget assumptions and influences; (2) Annual Business Plan consultation outcomes; (3) Rating Regime; (4) Any increased service levels. Planning framework The 2007-08 Budget has been developed within the Council’s overall planning framework. The Council’s suite of strategic management plans includes a 10-year long-term financial plan supported by an infrastructure and asset management plan, the latter currently under development. A summary of the long-term financial plan is shown in Appendix E. Its purpose is to express, in financial terms, the activities that the Council proposes to undertake over the medium to longer-term to achieve its stated goals and objectives. Note: It is expected that the data covering the long-term financial plan will be available as an output of the Financial Planning software product provided to Councils free of charge by the LGA/LG Financial Management Group. That product, which was developed by Jigsaw Services Ltd and funded by the Local Government Research and Development Scheme, currently is being updated and improved (again with funding from the Research and Development Fund). To guide the preparation of its 2007-08 Budget, the Council prepared and undertook community consultation on a draft annual business plan. The draft annual business plan for 2007-08 includes the Council’s planned objectives, activities and performance measures for the financial year as well as its proposed rating structure and policies. The annual business plan as adopted provides a linkage between the Council’s suite of strategic management plans and its annual Budget. Highlights of the Budget Highlights of the 2007-08 Budget include: [Click here and type details] [Click here and type details] Section 1: Budget Overview -1- LG System Inc – Model Budget Template, 2007-08 Note: We could give examples of the sorts of things to put in highlights in a User Manual. Indeed, throughout this draft document, there are a number of areas where examples and further guidance could be provided in a User Manual. Highlights should be expressed in terms of outcomes wherever possible. LG System Inc – Model Budget Template, 2007-08 2. KEY FINANCIAL INDICATORS This section of the 2007-08 Budget provides information about five key indicators of the Council’s financial performance and financial position. Analysis on each of the indicators is included in the following sections of the document. Further explanatory notes on the indicators are provided in the Glossary. Operating Surplus / (Deficit) Operating Surplus/(Deficit) $Mill 2.0 1.0 0.0 -1.0 -2.0 -3.0 -4.0 2004-05 Actual 2005-06 Actual 2006-07 Estimate 2007-08 Budget An operating surplus / deficit of $[Click here and type details] is targeted in 2007-08. This represents an improvement / deterioration of $[Click here and type details] on the estimated operating result for 2006-07. Note: The Operating Result has, as an integral part, the level of rates to be raised for the Budget period. This document does not culminate in a Rates Determination Statement as may have occurred traditionally. Instead, the level of rates is part of a range of expenditure and revenue decisions made in the context of ensuring the long-term sustainability of the Council’s financial performance and financial position. All financial information is assembled on an accrual accounting basis. Note: The LGA has issued an information paper on financial indicators (including to explain the reason for indicators) which promotes seven standard indicators for use by the Local Government sector (five of which are used in this document). Subsequently, the LGA General Meeting in April 2007 decided to adopt all seven indicators. It is proposed that the additional two indicators (Interest Cover Ratio and Asset Consumption Ratio) will be added to future additions of this document. Indicators are measures of outcomes. Individually and without associated analysis, they only tell part of the story. The usefulness of indicators is not in the numbers themselves but the analysis of what is driving the indicator. Section 2: Key Financial Indicators -3- LG System Inc – Model Budget Template, 2007-08 Operating Surplus Ratio 60% 40% Ratio % 20% 0% -20% -40% -60% -80% 2004-05 Actual 2005-06 Actual 2006-07 Estimate 2007-08 Budget The estimated operating surplus / deficit in 2007-08 expressed as a percentage of general and other rates (the operating surplus ratio) is estimated at [Click here and type details]% / negative [Click here and type details]%. Net Financial Liabilities Net Financial Liabilities $Mill 10 8 6 4 2 0 -2 2004-05 Actual 2005-06 Actual 2006-07 Estimate 2007-08 Budget The Council’s level of net financial liabilities is expected to be $[Click here and type details] / negative $[Click here and type details] at 30 June 2008. This represents an increase / a decrease of $[Click here and type details] on the estimated level of net financial liabilities at 30 June 2007. Section 2: Key Financial Indicators -4- LG System Inc – Model Budget Template, 2007-08 Net Financial Liabilities Ratio 100 75 Ratio % 50 25 0 -25 -50 -75 2004-05 Actual 2005-06 Actual 2006-07 Estimate 2007-08 Budget The Council’s net financial liabilities at 30 June 2008 expressed as a percentage of estimated operating revenue in 2007-08 (the net financial liabilities ratio) is expected to be [Click here and type details]% / negative [Click here and type details]%. Asset Sustainability Ratio 175 150 Ratio % 125 100 75 50 25 0 2004-05 Actual 2005-06 Actual 2006-07 Estimate 2007-08 Budget The Council’s asset sustainability ratio in 2007-08 is expected to be [Click here and type details]% calculated by comparing planned capital expenditure on renewal and replacement of assets against depreciation expenses in 2007-08 / calculated by comparing planned capital expenditure on renewal and replacement of assets against the optimal level for such expenditure in 2007-08 as shown in the Council’s Infrastructure and Asset Management Plan. Section 2: Key Financial Indicators -5- LG System Inc – Model Budget Template, 2007-08 3. SERVICES PROVIDED TO THE COMMUNITY Note: The aim here is to link the budget to achieving the Council’s strategic objectives. More generally, this document attempts to present information which is useable and understandable by the community and which can be reconciled with audited financial statements This section would be supported by core information in an Appendix which essentially would be the underlying basis for assembling the Budget. To the maximum extent possible, it is planned that the process of “feeding” that core information into the other higher level tables and charts scattered throughout this document would be automated using software developed within or integrated into the LGS System. Meantime, some general wording for this section is provided below. To a large extent, this section of the document is a summary of what will have earlier been included in the Council’s draft Annual Business Plan. This section provides a summary of the activities to be funded in the Budget for the 2007-08 year and how these will contribute to achieving the Council’s strategic objectives. In planning its activities for 2007-08, the Council has split its activities into two categories – “core” and “discretionary”. Core activities of the Council are those which more or less continue to be provided each year. Discretionary activities are those which will be undertaken only if sufficient revenue is available. Often, discretionary activities support the current strategic focus of the Council and may involve shortterm or one-off initiatives. Note: We could show here a list of functions /or programs /or objectives /or service categories, a description of what the service delivery associated with that function/program/objective/service category involves, and the gross cost of providing the service. The sum of the gross cost figures should equal the operating expenses budget included in Section 4 of this document. As a suggested starting point, the following table summarises the Council’s budgeted operating expenses under Organisational Units and lists the main activities under each Unit. Such an approach may be attractive to some Councils as actual performance reports against the budget during the year ahead could then be prepared on a consistent basis. This structure may also help facilitate the assessment of each Managers performance in meeting targets? The following table summarises activities under the Council’s organisational units. The table is followed by a brief summary of the key outputs of each one of the organisational units for 2007-08:- Section 5: Community Services -6- LG System Inc – Model Budget Template, 2007-08 Organisational Unit/Activity Core Operating Expenses $’000 Discretionary Operating Expenses $’000 Total Operating Expenses $’000 Works and Technical Services Roads Footpaths Trees Street Lighting Parks and Reserves Waste Management Community Wastewater Management Total Works and Technical Services Community and Economic Services Library Services Community Transport xxxx Total Community and Economic Services Environmental and Inspectorial Services xxxx xxxx Total Environ and Inspectorial Services Governance and Administration xxxx xxxx Total Governance and Administration Total Operating Expenses Key outputs of each one of the Organisational Units for 2007-08 are as follows:[Click here and type details] Note: Elected Members need appropriate information and advice to enable decisions on expenditure and rating effort. The range of community expectations can never be completely fulfilled without increasing rates and/or reducing expenditure on other services. This section of the document could be used to highlight that Elected Members therefore need to make choices about which expectations deserve priority and that they are accountable to their communities for these choices. Separately, we probably need to highlight in this section where planned expenditure is conditional upon grants being received. Section 6: Operating Budget Analysis -7- LG System Inc – Model Budget Template, 2007-08 4. ANALYSIS OF OPERATING BUDGET This section of the document analyses the expected revenues and expenses of the Council for the 2007-08 financial year. It also provides commentary on the budgeted operating result for 2007-08. Operating Revenue Revenue Types Ref Rates – General Rates – Other Statutory Charges User Charges Grants, Subsidies and Contributions Investment Income Reimbursements Other Revenue Total Operating Revenue 4.1 4.2 4.3 4.4 4.5 4.6 4.7 4.8 2005-06 Actual $’000 2006-07 Estimate $’000 2007-08 Budget $’000 Source: Appendix A 4.1 General Rates General rate revenue of $[Click here and type details] is planned for 2007-08, an increase of $[Click here and type details] compared with 2006-07. This represents an increase of [Click here and type details]% (excluding general rate revenue associated with new development). Section 7 of this document includes further discussion and analysis of rates to be levied in 2007-08 together with summary information about the Council’s rating structure. The Council’s Annual Business Plan for 2007-08 [Click here and incude a reference on how to access the Annual Business Plan] provides detailed information on the Council’s rating structure and policies. 4.2 Other Rates Other rate revenue in 2007-08 includes the State Government’s Natural Resources Management (NRM) levy collected on behalf of the [Click here and type details] NRM Board ($[Click here and type details]), a separate rate covering [Click here and type details] ($[Click here and type details]) and [Click here and type details] ($[Click here and type details]). 4.3 Statutory Charges Statutory charges are fees for regulatory services. They are associated with the granting of a permit/licence or the regulation of an activity. They include Section 6: Operating Budget Analysis -8- LG System Inc – Model Budget Template, 2007-08 Development Act fees and parking fines. Increases in statutory charges are made in accordance with legislative requirements. Statutory charges in 2007-08 are forecast to increase by $[Click here and type details] compared with 2006-07. 4.4 User Charges User charges relate mainly to the recovery of service delivery costs through the charging of fees to users of Council’s services. They include hire of community facilities and cemetery fees. User charges also include income from commercial activities (such as operating a caravan park) which traditionally have been shown as a separate income item. User charges in 2007-08 are projected to increase by $[Click here and type details] compared with 2006-07. This represents an increase of [Click here and type details] % and aims to ensure that the Council recovers the costs of service delivery. 4.5 Grants, Subsidies and Contributions This item covers grants, subsidies and contributions from all sources but excludes amounts specifically received for new/upgraded assets (i.e. the acquisition or enhancement of assets). The following table summarises the main grants involved:Grant Funding Types 2005-06 Actual $’000 2006-07 Estimate $’000 2007-08 Budget $’000 LG Grants Commission – General Purpose Grant LG Grants Commission – Identified Local Road Grant LG Grants Commission – Special Local Roads Grant Roads to Recovery Home and Community Care XXXXXXXX Other Total Grants, Subsidies and Contributions Overall, Local Government Grants Commission grants (representing funding provided by the Australian Government) are estimated to be $[Click here and type details] in 2007-08. This represents [Click here and type details]% of the Council’s estimated total operating revenue in 2007-08. 4.6 Investment Income Interest earnings on the investment of funds not immediately required and interest received on loans to community groups are estimated at $[Click here and type details] in 2007-08. Section 6: Operating Budget Analysis -9- LG System Inc – Model Budget Template, 2007-08 4.7 Reimbursements Reimbursements are amounts received as payment for work done by the Council acting as an agent for others (e.g. reimbursement for road works by the State Government). Revenue of $[Click here and type details] is estimated in 2007-08. 4.8 Other Revenues Other revenue is revenue not separately classified above. Of the estimated revenue of $[Click here and type details] in 2007-08, $[Click here and type details] is attributable to [Click here and type details]. Operating Expenses Expense Types Ref Employee Costs Materials, Contracts & Other Expenses Finance Costs Depreciation Total Operating Expenses 4.9 4.10 4.11 4.12 2005-06 Actual $’000 2006-07 Estimate $’000 2007-08 Budget $’000 Source: Appendix A 4.9 Employee Costs Employee costs include all labor related expenses such as wages and salaries, and on-costs such as allowances, leave entitlements and employer superannuation. Employee costs are forecast to increase by $[Click here and type details] (or [Click here and type details]%) in 2007-08 compared with 2006-07. This increase relates to: [Click here and type details] [Click here and type details] Average staff numbers during 2007-08 have been budgeted as follows: 4.10 Materials, Contracts & Other Expenses Materials cover payments for physical goods. This includes purchase of consumables, water and energy. Contract Services involve payments for the external provision of services. This may include indirectly provided labour and materials or sub-contractors which are part of a contract. Overall, the increase / decrease of $[Click here and type details] in materials, contract and other expenses in 2007-08 mainly reflects[Click here and type details]. Section 6: Operating Budget Analysis - 10 - LG System Inc – Model Budget Template, 2007-08 4.11 Finance Costs Finance costs cover the costs of financing the Council’s activities through borrowings or other types of financial accommodation. The increase / decrease in 2007-08 mainly reflects [Click here and type details]. 4.12 Depreciation Depreciation is an accounting measure which records the consumption of the Council’s infrastructure, property, plant and equipment. The increase of $[Click here and type details] in depreciation expenses in 2007-08 reflects the combined effect of a full year’s impact of depreciable assets created by capital expenditure on new/upgraded assets in 2006-07, the part year impact of capital expenditure on new/upgraded assets in 2007-08 and the ongoing impact of regularly revaluing infrastructure assets on a ‘fair value’ basis. Operating Result Operating Surplus/(Deficit) 2005-06 Actual $’000 2006-07 Estimate $’000 2007-08 Budget $’000 Operating Revenue less: Operating Expenses Equals: Operating Surplus/(Deficit) Source: Appendix A As shown in the above table, the Council has budgeted for an operating surplus / deficit of $[Click here and type details] in 2007-08. A key financial target of the Council is to continue to achieve a modest operating surplus each year / is to strive to achieve a modest operating surplus by [Click here and type year] /[Click here and type year] so as to ensure ongoing financial sustainability and therefore avoid future potential cuts to services and/or significant increases in rates. Any operating surplus generated is applied to meet capital expenditure and thus reduces the amount of borrowings otherwise needed for that purpose. Where such capital expenditure is not required in a particular year, the amount of the operating surplus is held for capital expenditure needs in future years by either increasing financial assets or, where possible, reducing outstanding debt in the meantime. Put another way, the amount of the operating surplus not needed for capital expenditure in a particular year automatically leads to a reduction in the level of the Council’s net financial liabilities. Note: Some additional commentary may be desirable here given the fundamental importance of the operating result measure to the long-term financial sustainability of the Council. This could include reference to planned future operating results showing in the Long-term Financial Plan at Appendix E. Section 6: Operating Budget Analysis - 11 - LG System Inc – Model Budget Template, 2007-08 5. ANALYSIS OF CAPITAL EXPENDITURE Net Outlays on Existing assets The following table summarises capital outlays on existing assets: Net Outlays on Existing Assets 2005-06 Actual $’000 2006-07 Estimate $’000 2007-08 Budget $’000 Capital Expend on Renewal/Replacement of Assets less: Proceeds from Sale of Replaced Assets less: Depreciation Equals: Net Outlays on Existing Assets Source: Appendix D The Asset Sustainability Ratio in 2007-08 is expected to be [Click here and type details]% and has been calculated by comparing the capital expenditure on renewal and replacement of existing assets (net of the sale proceeds of replaced assets) with depreciation expenses / and has been calculated by comparing planned capital expenditure on renewal and replacement of assets against the optimal level for such expenditure in 2007-08 as shown in the Council’s Infrastructure and Asset Management Plan. An analysis of this ratio shows [Click here and type details]. Net Outlays on New and Upgraded Assets The following table summarises capital outlays on new/upgraded assets: Net Outlays on New and Upgraded Assets 2005-06 Actual $’000 2006-07 Estimate $’000 2007-08 Budget $’000 Capital Expenditure on New/Upgraded Assets less: Proceeds from Sale of Surplus Assets less: Amounts received specifically for New/Upgraded Assets Equals: Net Outlays on New and Upgraded Assets Source: Appendix D The ongoing maintenance and depreciation expenses associated with the capital expenditure on new/upgraded assets has been factored into the Council’s Long-term Financial Plan. Section 7: Capital Expenditure Analysis - 12 - LG System Inc – Model Budget Template, 2007-08 Capital Works Program The following table summarises the Council’s planned Capital Works Program in 2007-08. A listing of individual projects comprising the Program for 2007-08 is shown in Appendix F. Capital Works Area 2005-06 2006-07 2007-08 Actual Estimate Budget $’000 $’000 $’000 Roads Drains Footpaths Buildings Community Wastewater Management Waste Management Information Technology Plant, Equipment and Other Total Capital Works Capital Works represented by: Asset renewal/replacement New/upgraded assets Total Capital Works Source: Appendix F Highlights of the 2007-08 Capital Works Program are as follows: [Click here and type details] [Click here and type details] Infrastructure and Asset Management Plan The Council is developing an Infrastructure and Asset Management Plan which sets out the capital expenditure requirements of the Council for the next 10 years by class of asset and project and is a key input to the Long-term Financial Plan. When completed, it will predict infrastructure consumption and renewal needs and will consider new infrastructure needs to meet future community service expectations. The Plan will be subject to a rigorous process of consultation and evaluation. Key elements of the process are as follows: Long term capital planning which integrates with the Council’s Strategic Management Plans; Listing of all known capital projects, prioritised within classes of assets on the basis of evaluation criteria; Transparent process for evaluating and prioritising capital projects. A key objective of the Infrastructure and Asset Management Plan is to maintain or preserve Council’s existing assets at desired condition levels, and thus minimise whole of life cycle costs of assets. Section 7: Capital Expenditure Analysis - 13 - LG System Inc – Model Budget Template, 2007-08 6. ANALYSIS OF BUDGETED BALANCE SHEET This section analyses the estimated balance sheet movements between 30 June 2007 and 30 June 2008 and discusses the level of the Council’s net financial liabilities (being the key measure of the Council’s financial position). Ref Current assets Non-current Assets Total Assets 6.1 6.2 Current Liabilities Non-current Liabilities Total Liabilities 6.3 6.4 Equity 6.5 2005-06 2006-07 2007-08 Actual Estimate Budget $’000 $’000 $’000 Source: Appendix B 6.1 Current assets The increase / decrease in current assets in 2007-08 primarily is due to [Click here and type details]. Outstanding rates and other debtor balances are not expected to change significantly and are at acceptable levels. 6.2 Non-current assets The increase in non-current assets in 2007-08 essentially reflects the combined effect of all capital expenditure, the depreciation of existing assets, the book value of assets sold and the ongoing revaluation of infrastructure assets on a ‘fair value’ basis. 6.3 Current liabilities The increase / decrease in current liabilities in 2007-08 (that is, obligations the Council must pay within the next 12 months) primarily is due to [Click here and type details]. Section 8: Budgeted Balance Sheet Analysis - 14 - LG System Inc – Model Budget Template, 2007-08 6.4 Non-current liabilities The increase / decrease in non-current liabilities in 2007-08 (i.e. obligations that the Council must pay beyond 30 June 2008) primarily is due to[Click here and type details]. 6.5 Equity The net increase / decrease in equity of $[Click here and type details] in 2007-08 results directly from the net surplus / deficit showing in the Budgeted Income Statement (see Appendix A). Net Financial Liabilities Net Financial Liabilities 2005-06 Actual $’000 2006-07 Estimate $’000 2007-08 Budget $’000 Net Financial Liabilities at 1 July less: Net Lending / (Borrowing) for financial year less: Other miscellaneous transactions Equals: Net Financial Liabilities at 30 June Source: Appendix D and E A secondary financial target for the Council is to ensure that the accumulated level of net financial liabilities does not exceed [Click here and type details]% of total operating revenue in any year. The estimated level of net financial liabilities at 30 June 2008 is $[Click here and type details] which represents [Click here and type details]% of the Council’s expected operating revenue in 200708. Section 8: Budgeted Balance Sheet Analysis - 15 - LG System Inc – Model Budget Template, 2007-08 7. RATING STRATEGY This section summarises the Council’s rating arrangements and describes the proposed rate increases in 2007-08. 7.1 Background Excluding the NRM levy collected on behalf of the State Government’s [Click here and type details] Natural Resource Management Board, general and other rates are expected to account for [Click here and type details]% of the Council’s operating revenue in 2007-08. The Council’s rating structure and policies are set out in the 2007-08 Annual Business Plan. The rating structure is comprised of two key elements. These are: Property values, which generally reflect capacity to pay; and User pays component to reflect usage of some services provided by Council. Striking a proper balance between these elements provides equity in the distribution of the rate burden across ratepayers. 7.2 Rate increases in 2007-08 The Valuer-General has provided capital values for all ratable properties totalling $[Click here and type details]. This represents an increase of [Click here and type details]% over the values adopted in 2006-07 and is made up of the following components: Natural Valuation Increase New Development (i.e. Growth) Total Valuation Increase [Click here and type details]% [Click here and type details]% [Click here and type details]% The adopted Budget contains an average general rate increase of x.x% (including / excluding? new development). Overall, general rate revenue in the adopted Budget for 2007-08 (including from new development) will be $[Click here and type details]. This is $[Click here and type details] greater than general rate revenue in 2006-07. The total increase is comprised as follows: Increase in Valuations Additional Income from Growth Total General Rate Revenue Increase Section 7: Rating Strategy $[Click here and type details] $[Click here and type details] $[Click here and type details] - 16 - LG System Inc – Model Budget Template, 2007-08 7.3 Minimum Rate / Fixed Charge The minimum rate / fixed charge has increased from $[Click here and type details] to $[Click here and type details] for the 2007-08 financial year. This increase is broadly in line with the average general rate revenue increase of [Click here and type details] %. 7.4 Natural Resources Management (NRM) Levy The Council is required to collect the NRM levy on behalf of the State Government. The State Government’s [Click here and type details] NRM Board has indicated that the contribution payable by the Council for the 2007-08 year is $[Click here and type details], which is a [Click here and type details]% increase on the amount in 2006-07. This levy will be collected by way of a separate rate charged to each rateable property within the council area and forwarded to the $[Click here and type details] NRM Board. The levy is required to be raised as a fixed charge per assessment / at a particular rate in the dollar of property values per assessment. 7.5 Rating structure The differential rating structure of the Council $[Click here and type details] The following table summarises the general rates proposed to be adopted for the 2007-08 financial year. Rate type Residential Commercial Industry Primary Production Vacant Land Minimum Rate/Fixed Charge 2006-07 2007-08 Cents in $ of CV Cents in $ of CV Cents in $ of CV Cents in $ of CV Cents in $ of CV $ per property Note: This draft Budget document deliberately attempts to have less focus on Rates than traditional Budget documents prepared by LGS Councils. This approach recognises that the Annual Business Plan would have explained the proposed rating arrangements in detail. Traditional Budget documents of some Councils do not appear to have focused sufficiently on other revenue items as well as the expenses side of the Budget. A focus is required on the cost of services being provided to communities and the necessity for elected members to continually review expenditure policies and priorities. Some Budget documents appear to provide a mass of detailed financial data on inputs with little or no data or explanations on outputs/outcomes. However, the views and judgement of individual Councils on these matters is what is important. Thus, it is appreciated that additional information about Rates (over and above that shown above) may be necessary in this document. Section 7: Rating Strategy - 17 - LG System Inc – Model Budget Template, 2007-08 8. FINANCING THE BUDGET The following table shows the Council’s estimated net lending / (borrowing) result for 2007-08. The data is drawn from the Council’s uniform summary of operating and capital investment activities which has been prepared on a consistent basis with other Councils (see Appendix D). The Council’s Budget for 2007-08 is expected to result in a net lending of $[Click here and type details]. / The Council’s Budget for 2007-08 is expected to result in a net borrowing of $[Click here and type details]. The expected net lending result in 2007-08 will lead to a reduction in the level of net financial liabilities during 2007-08 by approximately the amount of the net lending / The expected net borrowing result will lead to an increase in the level of net financial liabilities in 2007-08 by approximately the amount of the net borrowing: Net Lending/(Borrowing) 2005-06 Actual $’000 2006-07 Estimate $’000 2007-08 Budget $’000 Operating Surplus/(Deficit) less: Net Outlays on Existing Assets less: Net Outlays on New and Upgraded Assets Equals: Net Lending/(Borrowing) Source: Appendix D Financing transactions associated with applying the surplus funds stemming from the expected net lending result in 2007-08 / associated with accommodating the expected net borrowing result in 2007-08 are set out in the following table: Financing Transactions 2005-06 Actual $’000 2006-07 Estimate $’000 2007-08 Budget $’000 New Borrowings less: Repayment of Principal on Borrowings less: Increase/(Decrease) in Cash and Cash Equivalents Less: Increase/(Decrease) in Trade and Other Receivables less: Decrease/(Increase) in Trade and Other Payables less: Decrease/(Increase) in Provisions less: Other (including movement in Inventories) Equals: Financing Transactions Source: Appendix B and C The Council plans to apply the surplus funds expected to be available as a result of a net lending result in 2007-08 by, first, repaying the principal instalments due on earlier borrowings and, second, by increasing the level of its deposits with the Local Government Finance Authority. / The Council plans to apply the surplus funds expected to be available as a result of a net lending result in 2007-08 by, first, repaying the principal instalments due on earlier borrowings undertaken by the Council and, second, by repaying a portion of the Council’s borrowings outstanding Section 10: Financing the Budget - 18 - LG System Inc – Model Budget Template, 2007-08 under its Cash Advance Debenture facility with the Local Government Finance Authority, a facility where voluntary principal repayments can be made at any time. The Council plans to finance the expected net borrowing result in 2007-08 by liquidating cash and investments otherwise being held on deposit at the Local Government Finance Authority. / The Council plans to finance the net borrowing result in 2007-08 by borrowing that amount from the Local Government Finance Authority under its Cash Advance Debenture facility, where the interest rate on the borrowing (currently 7.25% p.a.) is reset only when official interest rates (as determined by the Reserve Bank of Australia) change. In this way, the Council will ensure that a portion of its portfolio of borrowings will be exposed to short-term interest rates and thus spread the Council’s interest rate risks. Note: It is planned that the User Manual explain the deliberate proposal here to keep the funding of activities of the Council separate and distinct from how the net impact of those activities will be financed (i.e. being the financing transactions as set out in the table above). Funding refers to how the Council’s costs are paid for using Council revenue (e.g. rates, user charges, Commonwealth financial assistance grants). Financing essentially is about arranging borrowings or running down the level of cash and cash equivalents to meet any shortfall between Council expenditure (both operating and capital) and the current year’s revenue. Section 10: Financing the Budget - 19 - LG System Inc – Model Budget Template, 2007-08 APPENDICES A. B. C. D. E. F. G. Budgeted Income Statement Budgeted Balance Sheet Budgeted Cash Flow Statement Uniform Presentation of Finances Summary of Long-term Financial Plan Capital Works Program Details of Cost of Providing Services Appendices - 20 - LG System Inc – Model Budget Template, 2007-08 APPENDIX A BUDGETED INCOME STATEMENT for the year ended 30 June 2008 2005-06 Actual $’000 2006-07 Estimate $’000 2007-08 Budget $’000 REVENUE Rates – general Rates – other Statutory charges User charges Grants, Subsidies and Contributions Investment Income Reimbursements Other Revenues Total Operating Revenue EXPENSES Employee Costs Materials, Contracts and Other Expenses Finance Costs Depreciation Total Operating Expenses OPERATING SURPLUS / (DEFICIT) BEFORE CAPITAL AMOUNTS Amounts received specifically for new/upgraded assets Net Gain / (Loss) on disposal or revaluation of assets Physical resources received free of charge NET SURPLUS / (DEFICIT) Appendices - 21 - LG System Inc – Model Budget Template, 2007-08 APPENDIX B BUDGETED BALANCE SHEET As at 30 June 2008 2005-06 Actual $’000 2006-07 Estimate $’000 2007-08 Budget $’000 ASSETS Current Assets Cash and cash equivalents Trade & other receivables Other financial assets Inventories Non-current Assets held for Sale Total Current Assets Non-current Assets Financial Assets Investment Property Infrastructure, Property, Plant & Equipment Other Non-current Assets Total Non-current Assets Total Assets LIABILITIES Current Liabilities Trade & Other Payables Borrowings Short-term Provisions Other Current Liabilities Liabilities relating to Non-current Assets held for Sale Total Current Liabilities Non-current Liabilities Trade & Other Payables Long-term Borrowings Long-term Provisions Other Non-current Liabilities Total Non-current Liabilities Total Liabilities NET ASSETS EQUITY Accumulated Surplus Asset Revaluation Reserve Other Reserves TOTAL EQUITY Appendices - 22 - LG System Inc – Model Budget Template, 2007-08 APPENDIX C BUDGETED CASH FLOW STATEMENT For the year ended 30 June 2008 2005-06 Actual $’000 2006-07 Estimate $’000 2007-08 Budget $’000 CASH FLOWS FROM OPERATING ACTIVITIES Receipts Operating Receipts Investment Receipts Payments Operating Payments to Suppliers and Employees Finance Payments Net Cash provided by (or used in) Operating Activities CASH FLOWS FROM INVESTING ACTIVITIES Receipts Amounts specifically for new/upgraded assets Sale of replaced assets Sale of surplus assets Sale of Investment Property Sale of Real Estate Developments Repayments of loans by community groups Payments Expenditure on renewal/replacement of assets Expenditure on new/upgraded assets Loans made to community groups Net Cash provided by (or used in) Investing Activities CASH FLOWS FROM FINANCING ACTIVITIES Receipts Proceeds from Borrowings Proceeds from Aged Care Facility Deposits Payments Repayments of Borrowings Repayment of Finance Lease Liabilities Repayment of Aged Care Facility Deposits Net Cash provided by (or used in) Financing Activities Net Increase (Decrease) in cash held Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period Appendices - 23 - LG System Inc – Model Budget Template, 2007-08 APPENDIX D UNIFORM PRESENTATION OF FINANCES 2005-06 Actual $’000 2006-07 Estimate $’000 2007-08 Budget $’000 Operating Revenue less: Operating Expenses Operating Surplus/(Deficit) before Capital Amounts Less: Net Outlays on Existing Assets Capital Expenditure on renewal and replacement of Existing Assets less: Depreciation less: Proceeds from Sale of Replaced Assets Less: Net Outlays on New and Upgraded Assets Capital Expenditure on New and Upgraded Assets less: Amounts received specifically for New and Upgraded Assets less: Proceeds from Sale of Surplus Assets Equals: Net Lending / (Borrowing) for Financial Year Appendices - 24 - LG System Inc – Model Budget Template, 2007-08 APPENDIX E SUMMARY OF LONG-TERM FINANCIAL PLAN 2006-07 Estimate $’000 2007-08 Budget $’000 2008-09 Plan $’000 2009-10 Plan $’000 2010-11 Plan $’000 2011-12 Plan $’000 2012-13 Plan $’000 2013-14 Plan $’000 2014-15 Plan $’000 2015-16 Plan $’000 2016-17 Plan $’000 2006-07 Estimate 2007-08 Budget 2008-09 Plan 2009-10 Plan 2010-11 Plan 2011-12 Plan 2012-13 Plan 2013-14 Plan 2014-15 Plan 2015-16 Plan 2016-17 Plan Operating Revenue less: Operating Expenses Operating Surplus / (Deficit) before Capital Amounts Less: Net Outlays on Existing Assets Capital Expenditure on Renewal/Replacement of Assets less: Proceeds from Sale of Replaced Assets less: Depreciation Net Outlays on Existing Assets Less: Net Outlays on New and Upgraded Assets Capital Expenditure on New/Upgraded Assets less: Proceeds from Sale of Surplus Assets less: Amounts received specifically for New/Upgraded Assets Net Outlays on New and Upgraded Assets Equals: Net Lending / (Borrowing) for Financial Year Key Financial Indicators Operating Surplus - $’000 Operating Surplus Ratio - % Net Financial Liabilities - $’000 Net Financial Liabilities Ratio - % Asset Sustainability Ratio - % Appendices - 25 - LG System Inc – Model Budget Template, 2007-08 APPENDIX F CAPITAL WORKS PROGRAM Note: Suggestion would be for a table here showing details of the planned Capital Works Program, but not too much detail! Need to be sure to distinguish capital expenditure between that on renewal/replacement of assets on one hand, and new/upgraded assets on the other. Again, the views and judgement of individual Councils is what is important here as to the level of detail. As a starting point, an example of a ‘‘minimalist” approach is shown below: Capital Projects for 2007-08 Asset Renewal & Replacement $’000 New & Upgraded Assets $’000 Total $’000 Playground Upgrade - LGS Park Replacing roof of Senior Citizens Hall – LGS Grove Sealing LGS Street – between Moore St and Carey Drive Resurfacing of bitumen footpath – LGS Avenue Replace grader with new LGS model 057 Total Capital Works Appendices - 26 - LG System Inc – Model Budget Template, 2007-08 APPENDIX G DETAILS OF COST OF PROVIDING SERVICES Note: Essentially, it is proposed that this Appendix provides the detail of material shown in Section 3 of this document. To a large extent, this is likely to include the sort of information (albeit not so detailed) that currently makes up the main budget documents of some Councils. The information could show, for example, under each Organisational Unit, the various inputs (eg employee costs, materials etc) broken down to whatever detail is considered appropriate. This information then could be “rearranged” (hopefully automatically by way of future enhancements to the LGS System) to help complete many of the tables in the rest of this document. Instead of preparing separate documents covering an Annual Business Plan (ABP) on one hand and a Budget on the other, some councils will decide to prepare one consolidated document with two distinct components (i.e. ABP and Budget). In these circumstances, Appendix G of this template (and some other Appendices) will relate to both components. Appendices - 27 - LG System Inc – Model Budget Template, 2007-08 GLOSSARY Asset Sustainability Ratio Asset Sustainability Ratio indicates whether the Council is renewing or replacing existing non-financial assets at the same rate as its overall stock of assets is wearing out. The ratio is calculated by measuring capital expenditure on renewal and replacement of assets relative to the level of depreciation. Where a Council has a soundly based Infrastructure and Asset Management Plan, a more meaningful asset sustainability ratio would be calculated by measuring the actual level of capital expenditure on renewal and replacement of assets (or proposed in the Budget) with the optimal level identified in the Plan. Financial Assets Financial Assets include cash, cash equivalents, trade and other receivables, and other financial assets, but excludes equity held in Council businesses. Also, inventories and land held for resale are not regarded as financial assets. Financial Sustainability Financial Sustainability is where planned long-term service and infrastructure levels and standards are met without unplanned and disruptive increases in rates or cuts to services. Net Financial Liabilities Net Financial Liabilities equals total liabilities less financial assets, where financial assets for this purpose includes cash, cash equivalents, trade and other receivables, and other financial assets, but excludes equity held in Council businesses, inventories and land held for resale. Net Financial Liabilities Ratio Net Financial Liabilities Ratio expresses Net Financial Liabilities as a percentage of total operating revenue. The ratio allows interested parties to readily equate the outstanding level of the Council’s accumulated financial obligations against the level of one-year’s operating revenue. Where the ratio is falling over time, it generally indicates that the Council’s capacity to meet its financial obligations is strengthening. Net Lending/ (Borrowing) Net Lending/ (Borrowing) equals Operating Surplus / (Deficit), less net outlays on nonfinancial assets. The Net Lending / (Borrowing) result is a measure of the Council’s overall (i.e. operating and capital) budget on an accrual basis. Achieving a zero result on the Net Lending / (Borrowing) measure in any one year essentially means that the Council has met all of its expenditure (both operating and capital) from the current year’s revenues. Non-financial or Physical Assets Appendices - 28 - LG System Inc – Model Budget Template, 2007-08 Non-financial or Physical Assets means infrastructure, land, buildings, plant, equipment, furniture and fittings, library books and inventories. Operating Deficit Operating Deficit is where operating revenues less operating expenses is negative and operating income is therefore not sufficient to cover all operating expenses. Operating Expenses Operating Expenses are operating expenses including depreciation but excluding losses on disposal or revaluation of non-financial assets. Operating Revenues Operating Revenues are operating revenues shown in the Income Statement but exclude profit on disposal of non–financial assets and amounts received specifically for new/upgraded assets, e.g. from a developer. For ratios calculated where the denominator specified is total operating revenue or rate revenue, Natural Resource Management (NRM) levy revenue is excluded. Operating Surplus Operating Surplus is where operating revenues less operating expenses is positive and operating revenue is therefore sufficient to cover all operating expenses. Operating Surplus Ratio Operating Surplus Ratio expresses the operating surplus (deficit) as a percentage of general and other rates. C:\Documents and Settings\ssalter\Local Settings\Temporary Internet Files\Content.Outlook\6OEL39O4\ModelBudget LGS Councils_0708 (4).doc Appendices - 29 -