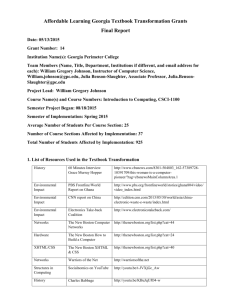

ACCOUNTING

advertisement

Cost Accounting A Managerial Emphasis Fourteenth Edition Copyright © 2012, 2009, 2006, 2003, 2000 By: Charles T. Horngren Stanford University Srikant M. Datar Harvard University Madhav V. Rajan Stanford University Brief Contents 1 The Manager and Management Accounting 2 2 An Introduction to Cost Terms and Purposes 26 3 Cost-Volume-Profit Analysis 62 4 Job Costing 98 5 Activity-Based Costing and Activity-Based Management 138 6 Master Budget and Responsibility Accounting 182 7 Flexible Budgets, Direct-Cost Variances, and Management Control 226 8 Flexible Budgets, Overhead Cost Variances, and Management Control 262 9 Inventory Costing and Capacity Analysis 300 10 Determining How Costs Behave 340 11 Decision Making and Relevant Information 390 12 Pricing Decisions and Cost Management 432 13 Strategy, Balanced Scorecard, and Strategic Profitability Analysis 466 14 Cost Allocation, Customer-Profitability Analysis, and Sales-Variance Analysis 502 15 Allocation of Support-Department Costs, Common Costs, and Revenues 542 16 Cost Allocation: Joint Products and Byproducts 576 17 Process Costing 606 18 Spoilage, Rework, and Scrap 644 19 Balanced Scorecard: Quality, Time, and the Theory of Constraints 670 20 Inventory Management, Just-in-Time, and Simplified Costing Methods 702 21 Capital Budgeting and Cost Analysis 738 22 Management Control Systems, Transfer Pricing, and Multinational Considerations 774 23 Performance Measurement, Compensation, and Multinational Considerations 806 PRACTICAL FINANCIAL ACCOUNTING (Advance Methods, Techniques & Practices) Dr. K.S. Vataliya First Published - 2009 CONTENTS • Preface iii 1. Essential Functions For Financial Accounting 1 2. Principles Of Financial Accounting 11 3. Standardisation Of Financial Accounting 25 4. Effective Financial Accounting Methods 36 5. Corporate Accounting Techniques 51 6. Methodology Of Human Resource Accounting 65 7. Advanced Mechanised Accounting 72 8. Capital Structure 82 9. Partnership Accounting Procedure And Methods 93 to. Data Processing And Programming Languages 106 11. Sensitivity For Business Alternatives 117 12. Assets Categories And Business Transaction 1,l9 13. Practical Accounting For Material, Production And Labour 137 14. Value Added Accounting 161 15. BudgetaryControl 176 16. Working Capital And Financial Decision Making 193 17. Financial System And Leverage 215 18. Ratio Analysis And Financial Statements 226 • Bibliography 264 Intermediate Accounting 14th edition Copyright © 2012 Donald E. Kieso PhD, CPA Northern Illinois University DeKalb, Illinois Jerry J. Weygandt PhD, CPA University of Wisconsin—Madison Madison, Wisconsin Terry D. Warfield, PhD University of Wisconsin—Madison Madison, Wisconsin Brief Contents 1 Financial Accounting and Accounting Standards 2 2 Conceptual Framework for Financial Accounting 42 3 The Accounting Information System 86 4 Income Statement and Related Information 158 5 Balance Sheet and Statement of Cash Flows 212 6 Accounting and the Time Value of Money 308 7 Cash and Receivables 364 8 Valuation of Inventories: A Cost-Basis Approach 434 9 Inventories: Additional Valuation Issues 492 10 Acquisition and Disposition of Property, Plant, and Equipment 554 11 Depreciation, Impairments, and Depletion 604 12 Intangible Assets 664 13 Current Liabilities and Contingencies 720 14 Long-Term Liabilities 782 15 Stockholders’ Equity 842 16 Dilutive Securities and Earnings per Share 904 17 Investments 974 18 Revenue Recognition 1064 19 Accounting for Income Taxes 1142 20 Accounting for Pensions and Postretirement Benefits 1208 21 Accounting for Leases 1288 22 Accounting Changes and Error Analysis 1366 23 Statement of Cash Flows 1434 24 Full Disclosure in Financial Reporting 1512 ACCOUNTING PRINCIPLES 10E Copyright © 2007, 2009, 2012 Jerry J. Weygandt PhD, CPA University of Wisconsin—Madison Madison, Wisconsin Paul D. Kimmel PhD, CPA University of Wisconsin—Milwaukee Milwaukee, Wisconsin Donald E. Kieso PhD, CPA Northern Illinois University DeKalb, Illinois Brief Contents 1 Accounting in Action 2 2 The Recording Process 50 3 Adjusting the Accounts 98 4 Completing the Accounting Cycle 152 5 Accounting for Merchandising Operations 208 6 Inventories 260 7 Accounting Information Systems 314 8 Fraud, Internal Control, and Cash 360 9 Accounting for Receivables 414 10 Plant Assets, Natural Resources, and Intangible Assets 456 11 Current Liabilities and Payroll Accounting 508 12 Accounting for Partnerships 552 13 Corporations: Organization and Capital Stock Transactions 592 14 Corporations: Dividends, Retained Earnings, and Income Reporting 632 15 Long-Term Liabilities 668 16 Investments 722 17 Statement of Cash Flows 760 18 Financial Statement Analysis 824 19 Managerial Accounting 876 20 Job Order Costing 922 21 Process Costing 964 22 Cost-Volume-Profit 1010 23 Budgetary Planning 1052 24 Budgetary Control and Responsibility Accounting 1096 25 Standard Costs and Balanced Scorecard 1146 26 Incremental Analysis and Capital Budgeting 1192 FINANCIAL ACCOUNTING 12E © 2012, 2009 South-Western, Cengage Learning Carl S. Warren Professor Emeritus of Accounting University of Georgia, Athens James M. Reeve Professor Emeritus of Accounting University of Tennessee, Knoxville Jonathan E. Duchac Professor of Accounting Wake Forest University Brief Contents Chapter 1 Introduction to Accounting and Business . ... . . . . . . . .. . . . . . . . . . . . . . . . . . . . 1 Chapter 2 Analyzing Transactions . . . . . . . . . . …... .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51 Chapter 3 The Adjusting Process . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . 103 Chapter 4 Completing the Accounting Cycle . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . 149 Chapter 5 Accounting Systems . . . . . . . . . …….. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 205 Chapter 6 Accounting for Merchandising Businesses . . . . . . . . . . . . . . . . . . . . . . . . . . . . 253 Chapter 7 Inventories . . . . . . …………... . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 311 Chapter 8 Sarbanes-Oxley, Internal Control, and Cash . . . . ... . . . . . . . . . . . . . . . . . . . . . 355 Chapter 9 Receivables . . . . . . . . . . . . . . . . . ….... . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 401 Chapter 10 Fixed Assets and Intangible Assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . 445 Chapter 11 Current Liabilities and Payroll . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 489 Chapter 12 Accounting for Partnerships and Limited Liability Companies . . . . . . . ... . . 537 Chapter 13 Corporations: Organization, Stock Transactions, and Dividends.... . . . . . . . . 581 Chapter 14 Long-Term Liabilities: Bonds and Notes . . . . ……. . . . . . . . . . . . . . . . . . . . 625 Chapter 15 Investments and Fair Value Accounting . . . . . . . . . ….. . . . . . . . . . . . . . . . . 667 Chapter 16 Statement of Cash Flows . . . . . . . . . . . ….... . . . . . . . . . . . . . . . . . . . . . . . . . 717 Chapter 17 Financial Statement Analysis . . . . . . . . . . . . …... . . . . . . . . . . . . . . . . . . . . . 773 Appendix A Interest Tables . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . A-2 Appendix B Reversing Entries . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . B-1 Appendix C Nike, Inc. 2010 Annual Report . . . . . …. . . . . . . . . . . . . . . . . . . . . . . . . . . . C-1 Appendix D International Financial Reporting Standards . . . . . . . . .. . . . . . . . . . . . . . . . D-1 Glossary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ………... . . . . . . . . . . . . . . . . . . . . G-1 ADVANCED ACCOUNTING ELEVENTH EDITION Copyright © 2012, 2009, 2006, 2003, 2000 Floyd A. Beams Virginia Polytechnic Institute and State University Joseph H. Anthony Michigan State University Bruce Bettinghaus Grand Valley State University Kenneth A. Smith University of Washington BRIEF CONTENTS CHAPTER1 Business Combinations 1 CHAPTER2 Stock Investments—Investor Accounting and Reporting 27 CHAPTER3 An Introduction to Consolidated Financial Statements 63 CHAPTER4 Consolidation Techniques and Procedures 99 CHAPTER5 Intercompany Profi t Transactions—Inventories 145 CHAPTER6 Intercompany Profi t Transactions—Plant Assets 185 CHAPTER7 Intercompany Profi t Transactions—Bonds 219 CHAPTER8 Consolidations—Changes in Ownership Interests 247 CHAPTER9 Indirect and Mutual Holdings 279 CHAPTER1 0 Subsidiary Preferred Stock, Consolidated Earnings per Share, and Consolidated Income Taxation 315 CHAPTER1 1 Consolidation Theories, Push-Down Accounting, and Corporate Joint Ventures 369 CHAPTER1 2 Derivatives and Foreign Currency: Concepts and Common Transactions 409 CHAPTER1 3 Accounting for Derivatives and Hedging Activities 429 CHAPTER1 4 Foreign Currency Financial Statements 463 CHAPTER1 5 Segment and Interim Financial Reporting 497 CHAPTER1 6 Partnerships—Formation, Operations, and Changes in Ownership Interests 525 CHAPTER1 7 Partnership Liquidation 561 CHAPTER1 8 Corporate Liquidations and Reorganizations 591 CHAPTER1 9 An Introduction to Accounting for State and Local Governmental Units 625 CHAPTER2 0 Accounting for State and Local Governmental Units—Governmental Funds 663 CHAPTER2 1 Accounting for State and Local Governmental Units—Proprietary and Fiduciary Funds 711 CHAPTER2 2 Accounting for Not-for-Profi t Organizations 737 CHAPTER2 3 Estates and Trusts 775 MANAGEMENT ACCOUNTING Information for Decision-Making and Strategy Execution SIXTHEDITION Copyright © 2012, 2007, 2004, 2001, 1997 Anthony A. Atkinson University of Waterloo Robert S. Kaplan Harvard University Ella Mae Matsumura University of Wisconsin–Madison S. Mark Young University of Southern California BRIEF CONTENTS CHAPTER 1 How Management Accounting Information Supports Decision Making 1 CHAPTER 2 The Balanced Scorecard and Strategy Map 15 CHAPTER 3 Using Costs in Decision Making 62 CHAPTER 4 Accumulating and Assigning Costs to Products 121 CHAPTER 5 Activity-Based Cost Systems 165 CHAPTER 6 Measuring and Managing Customer Relationships 218 CHAPTER 7 Measuring and Managing Process Performance 252 CHAPTER 8 Measuring and Managing Life-Cycle Costs 301 CHAPTER 9 Behavioral and Organizational Issues in Management Accounting and Control Systems 340 CHAPTER 10 Using Budgets for Planning and Coordination 393 CHAPTER 11 Financial Control 462