mt_2_f01_331_soln - University of Windsor

advertisement

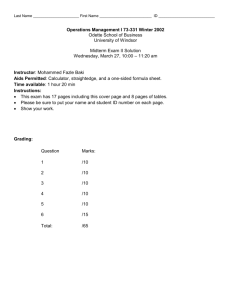

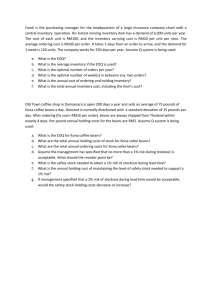

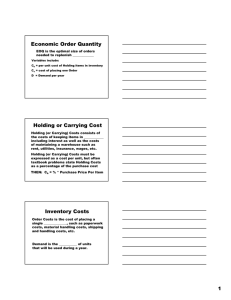

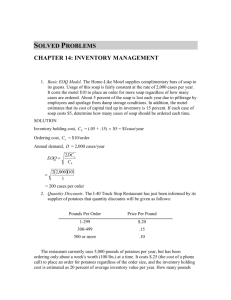

Name (print, please) _______________________________________________ ID ___________________________ Operations Management I 73-331 Fall 2001 Faculty of Business Administration University of Windsor Midterm Exam II Solution Wednesday, November 21, 5:30 – 6:50 pm Instructor: Mohammed Fazle Baki Aids Permitted: Calculator, straightedge, and a one-sided formula sheet. Time available: 1 hour 20 min Instructions: This exam has 11 pages including this cover page and 2 pages of tables. Please be sure to put your name and student ID number on each page. Show your work. Grading: Question Marks: 1 /15 2 /10 3 /10 4 /10 5 /10 6 /20 Total: /75 Name:_________________________________________________ ID:_________________________ Question 1: (1 point 15 questions = 15 points) 1.1 The following are the two major inventory control decisions: a. how to count and when to count b. how much to order and when to order c. how to estimate holding/ordering/stock-out costs and when to compute EOQ d. how to estimate holding/ordering/stock-out costs and when to compute EPQ 1.2 The loss of profit resulting from ordering less than the demand is a part of a. holding cost b. ordering cost c. setup cost d. stock-out cost e. none of the above 1.3 The EOQ model assumes that the on-hand inventory level increases a. instantaneously from zero to Q at time t 0 b. at the rate P at time t 0 c. at the rate P at time t 0 d. at the rate P at time t 0 1.4 The EPQ model assumes that the on-hand inventory level increases a. instantaneously from zero to Q at time t 0 b. at the rate P at time t 0 c. at the rate P at time t 0 d. at the rate P at time t 0 1.5 The annual holding cost is the same as the annual ordering cost a. for any order quantity b. for Q EOQ, but not for Q EPQ c. for Q EPQ, but not for Q EOQ d. for Q EOQ and for Q EPQ 1.6 The total annual holding and setup costs are ______________ to changes in order quantity for Q EOQ a. sensitive b. insensitive c. none of the above 1.7 The total annual holding and setup costs are ______________ to changes in order quantity for Q EPQ a. sensitive b. insensitive c. none of the above 2 Name:_________________________________________________ ID:_________________________ 1.8 The rotation cycle policy a. is applicable when the budget is limited b. is applicable when space is limited c. is assumed when several products are produced in a single facility 1.9 The rotation cycle policy a. assumes that in each production cycle there is only one setup for each product, and the products are produced in the same sequence in each production cycle 2K i i b. dictates that Qi* for the i -th product when the space is limited hi 2wi c. dictates that Qi* mEOQi for the i -th product when the budget is limited 1.10 a. b. c. In a single-period inventory model it is assumed that the ending inventory is salvaged is salvaged and transferred to the next period of one period is the beginning inventory of the next period 1.11 a. b. c. In a multi-period inventory model it is assumed that the ending inventory is salvaged is salvaged and transferred to the next period of one period is the beginning inventory of the next period 1.12 If the shortages are back-ordered, then the annual number of units purchased does not depend on Q, R a. True b. False 1.13 a. b. c. d. What is reorder level? The time between arrival of successive orders The time between placing order and arrival of the order The number of units ordered The number of units on hand when the order is placed 1.14 a. b. c. The standardized loss function is denoted by F z z L(z) 1.15 The standardized loss function is used to compute a. the probability of not stocking out during the lead time b. the proportion of demands that are met from the stock 3 Name:_________________________________________________ ID:_________________________ Question 2: (10 points) Suppose that Item A has a unit cost of $10.00, an ordering cost of $50, and a monthly demand of 25 units. It is estimated that cost of capital is approximately 25 percent per year. Storage cost amounts to 3 percent and breakage to 2 percent of the value of the each item. a. (2 points) Compute holding cost per unit per year. I 0.25 0.03 0.02 0.30 h Ic 0.3010 $3 per unit per year b. (2 points) Compute annual demand. 2512 300 units per year c. (3 points) Compute EOQ of Item A. EOQ= 2 K h 250300 100 units 3 d. (3 points) Suppose that both Items A and B should be purchased and there is only $1800 available for buying Items A and B. The unit cost of Item B is $5 and the EOQ of Item B is 200 units. What is the optimal order quantity of Item A? Fund required by the EOQ order quantity of Item A = 100(10) = $1000 Fund required by the EOQ order quantity of Item B = 200(5) = $1000 Total fund required by the EOQ order quantities of Items A and B = 1000+1000 = $2,000 (1 point) Fund available = $1,800 Hence, m = fund available 1,800 0.90 (1 point) fund required 2,000 Therefore, the optimal order quantity of Item A = m EOQA = 0.90(100) = 90 units (1 point) 4 Name:_________________________________________________ ID:_________________________ Question 3: (10 points) Suppose that Item A has a production rate of 400 items per year. The cost and demand information of Item A are the same as those stated in Question 2. That is, Item A has a unit cost of $10.00, an ordering cost of $50, and a monthly demand of 25 units. It is estimated that cost of capital is approximately 25 percent per year. Storage cost amounts to 3 percent and breakage to 2 percent of the value of the each item. a. (2 points) Compute EPQ of Item A. EOQ= 2 K h' 2 K h1 P 250300 200 units 300 31 400 b. (2 points) What is the cycle time of Item A? T Q* EPQ 200 0.6667 years 300 Item C has a production rate of 2400 items per year, a unit cost of $20.00, an ordering cost of $75, and a monthly demand of 40 units. c. (4 points) What is the cycle time if both Items A and C are produced in a single facility? T* 2 K j h' j j 2K1 K 2 h'1 1 h'2 2 250 75 2 300 31 300 Ic2 1 2 P2 400 2125 0.75 300 4.8 480 250 75 h1 1 1 1 h2 1 2 2 P1 P2 250 75 480 300 31 480 300 0.30201 400 2,400 250 225 2,304 250 = 0.3144 years 2,529 d. (2 point) What is the optimal order quantity of Item A? Q* T * 0.3144300 94.322 units 5 Name:_________________________________________________ ID:_________________________ Question 4: (10 points) Irwin sells a particular model of fan, with most of the sales being made in the summer months. Irwin makes a one-time purchase of the fans prior to each summer season at a cost of $30 each and sells each fan for $50. Any fans unsold at the end of summer season are marked down to $20 and sold in a special fall sale. a. (2 points) What is the underage cost per unit? cu Selling price – purchase price = 50-30 = $20/unit b. (2 points) What is the overage cost per unit? co Purchase price – salvage value = 30-20 = $10/unit c. (3 points) If the demand is uniformly distributed between 200 and 800 units, find the optimal order quantity. For the optimal order quantity Q , Probability(demand Q ), p cu 20 0.6667 cu co 20 10 Hence, Q* a pb a 200 0.6667800 200 600 units d. (3 points) If the demand is normally distributed with a mean of 500 and a standard deviation of 100, find the optimal order quantity. For the optimal order quantity Q , Probability(demand Q ), p cu 20 0.6667 cu co 20 10 Find the standard normal z -value for which cumulative area on the left, F z 0.6667 . (1 point) Since Table A-1 gives area between z 0 and positive z -values, find z -value for which Table A-1 area is 0.6667-0.50 = 0.1667. Hence, z 0.43 (1 point) Q* z 500 0.43 100 543 units (1 point) 6 Name:_________________________________________________ ID:_________________________ Question 5: (10 points) Comptek Computers wants to reduce a large stock of personal computers it is discontinuing. It has offered the University Bookstore a quantity discount pricing schedule if the store will purchase the personal computers in volume, as follows: Quantity Price 1-9 $940 10-49 920 50+ 900 The annual inventory holding cost is 20%, the ordering cost is $150, and annual demand for this particular model is estimated to be 120 units. Compute the optimal order size. First, consider the cheapest price level of c3 $900 per unit. h3 Ic3 0.20 900 $180 /unit/year EOQ3 2 K h3 2150120 14.142 units (1 point for EOQ computation) 180 Since the price level of c3 $900 is not available for an order quantity Q EOQ3 = 14.142 units, EOQ3 is infeasible and a candidate for optimal order quantity is Q3 50 , because 50 is the minimum order quantity for the price level of c3 $900 (1 point) Now, consider the next price level, c2 $920 per unit. h2 Ic2 0.20 920 $184 /unit/year EOQ2 2 K h2 2150120 13.988 184 Since the price level of c2 $920 is available for an order quantity Q EOQ2 = 13.988 units, EOQ2 is feasible and a candidate for optimal order quantity is Q2 13.988 14. (1 point) It’s not necessary to consider the other price level. Now, compute total cost for each candidate for optimal order quantity: j 3 (1 point) (1 point) (1 point) (1 point) Candidate Holding cost Ordering cost Cost of item Total cost Qj h jQ j c j 2 K Qj Holding cost + Ordering cost + Cost of item 180 50 4,500 2 150 120 360 50 900 120 108,000 $112,860 184 14 1,288 2 150 120 1,285.7 14 920 120 110,400 $112,973.71 Q3 50 (1 point) 2 Q2 13.988 (1 point) Conclusion: The total cost is minimum, $112,860 for Q3 50 . Therefore, an optimal order quantity is Q3 50 . (1 point) 7 Name:_________________________________________________ ID:_________________________ Question 6: (20 points) The home appliance department of a large department store is using a lot size-reorder point system to control the replenishment of a particular model of FM table radio. The store sells an average of 600 radios each year. The annual demand follows a normal distribution with a standard deviation of 50. The store pays $25 for each radio, which it sells for $70. The holding cost is 30 percent per year. Fixed costs of replenishment amount to $250. If a customer demands the radio when it is out of stock, the customer will generally go elsewhere. Loss-of-goodwill costs are estimated to be about $15 per radio. Replenishment lead time is three months. Currently, the store is using Q 210 and R 190 . Compute a. (2 points) the mean and standard deviation of the lead time demand 3 3 3 0.25 years, 600 150 units, (1 point) 50 25 units (1 point) 12 12 12 b. (1 point) the annual holding cost per unit h Ic 0.3 25 $7.5 per unit per year c. (1 point) the stock-out cost per unit p = loss of profit + good will = (70-25) +15 =$60 per unit d. (1 point) the safety stock R 190 150 40 units e. (3 points) the expected number of units stock-out per cycle z R 190 150 1.6 (1 point) 25 Lz 0.0232 (1 point) n Lz 250.0232 0.58 units per cycle (1 point) (Continued…) 8 Name:_________________________________________________ ID:_________________________ f. (2 points) the annual holding cost hQ 7.5 210 h R 7.5190 150 787.50 300 $1,087.50 (1 point for each part) 2 2 g. (2 points) the annual ordering cost K 250 600 $714.29 Q 210 h. (2 points) the annual stock-out cost np 0.58 60 600 $99.43 Q 210 i. (1 point) the total annual holding, ordering and stock-out cost 1,087.50 714.29 99.43 $1,901.22 j. (3 points) the probability of not stocking out during the lead time z R 190 150 1.6 (1 point) 25 Table A-4: The probability of not stocking out during the lead time = F z 1.6 = 0.9460 Table A-1: The probability of not stocking out during the lead time = the area on the left of z 1.6 (1 point) = P z 1.6 P z 0 P0 z 1.6 = 0.50 P0 z 1.6 0.5 0.4452 0.9452 (1 point) k. (2 points) the fill rate, up to four decimal places 1 n 0.58 1 0.9972 99.72% Q 210 9