Inventory Management Solved Problems: EOQ & Discounts

advertisement

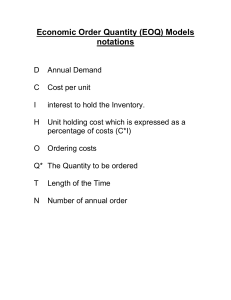

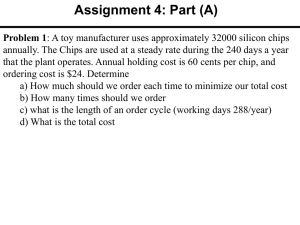

SOLVED PROBLEMS CHAPTER 14: INVENTORY MANAGEMENT 1. Basic EOQ Model. The Home-Like Motel supplies complimentary bars of soap to its guests. Usage of this soap is fairly constant at the rate of 2,000 cases per year. It costs the motel $10 to place an order for more soap regardless of how many cases are ordered. About 5 percent of the soap is lost each year due to pilferage by employees and spoilage from damp storage conditions. In addition, the motel estimates that its cost of capital tied up in inventory is 15 percent. If each case of soap costs $5, determine how many cases of soap should be ordered each time. SOLUTION Inventory holding cost, C h = (.05 + .15) $5 = $l/case/year Ordering cost, Co = $10/order Annual demand, D = 2,000 cases/year EOQ 2DC o Ch 22,00010 1 = 200 cases per order 2. Quantity Discounts. The I-40 Truck Stop Restaurant has just been informed by its supplier of potatoes that quantity discounts will be given as follows: Pounds Per Order Price Per Pound 1-299 $.20 300-499 .15 500 or more .10 The restaurant currently uses 5,000 pounds of potatoes per year, but has been ordering only about a week's worth (100 lbs.) at a time. It costs $.25 (the cost of a phone call) to place an order for potatoes regardless of the order size, and the inventory holding cost is estimated as 20 percent of average inventory value per year. How many pounds should be ordered each time to minimize total annual variable costs? Assume that potatoes can be kept without spoilage for a long period of time. SOLUTION Inventory holding cost, Ch = .20 price per pound Inventory ordering cost, Co = $.25/order Demand, D = 5,000 pounds/year Step 1. The lowest price per unit is $.10/pound, which gives a holding cost, Ch , of .20(.10) = $.02/pound/year. EOQ= 2DCo Ch 25, 000.25 = 353.55 or 354 pounds .02 This EOQ is not feasible since at least 500 pounds must be ordered to obtain the $.10 unit price. Therefore, we calculate the total annual variable costs associated with ordering 500 pounds each time. Total annual variable costs = Q D Ch Co Dv 2 Q 500 5,000 .02 .25 5,000.10 2 500 = $507.50 Step 2. Proceed to the next higher unit price, $.15 per pound. The holding cost, Ch , is .20(.15) = $.03/pound/year. EOQ = 25,000.25 = 288.68 or 289 pounds .03 This EOQ is also infeasible for its unit price, so we calculate the total annual variable costs of ordering 300 pounds. Q D Total annual variable costs = Ch Co Dv 2 Q 300 .03 5,000 .25 5,000.15 2 300 = $758.67 We now proceed to the next higher unit price of $.20 per pound. The holding cost will be .20(.20) = $.04/pound/year. EOQ = 25,000.25 = 250 pounds .04 This EOQ is feasible, so we stop here and calculate its total annual variable costs. Total annual variable costs = 250 5,000 .04 .25 5, 000.20 2 250 = $1,010.00 Next, we compare the order quantities and costs, which are listed below. Order Quantity Total Annual Variable Costs 500 $ 507.50 300 758.67 250 1,010.00 Our comparison reveals that the lowest price strategy is to order 500 pounds of potatoes each time. 3. Order Point and Safety Stock for a Perpetual System. The Kleenway Supermarket maintains a continuous review inventory system and reorders based on an orderpoint calculation. The company has found that demand for canned tomatoes averages fifty cases per week and has calculated an EOQ of 200 cases. The lead time for these tomatoes averages one week, with a standard deviation of ten cases during the lead time. If Kleenway wants to maintain a service level of at least 95 percent, what reorder point should be used for canned tomatoes? SOLUTION The z value corresponding to a 95 percent probability is 1.645. L =10 Expected demand during lead time =50 cases Safety stock = z L = 1.645(10) = 16.45 or 17 (rounding up) Order point, OP = expected demand during lead time + safety stock = 50 + 17 = 67 cases 4. Order-Up-to Level and Safety Stock for a Periodic System. Easy-Mart is a discount store that uses a periodic review inventory control system. One item has an average annual demand of 12,000 units. Inventory holding cost for the item is $2.40 per unit per year, and ordering cost is $25 per order. Ordering lead time averages one-half month, and the standard deviation of monthly demand is 200 units. What should the order-up-to level be for this item if Easy-Mart wants a 90 percent service level? SOLUTION For a service level of 90 percent, z = 1.28. Inventory holding cost, Ch = $2.40/unit/year Inventory ordering cost = $25/order Annual demand, D = 12,000 units/year EOQ = 2DCo Ch 212,00025 = 500 units 2.40 Optimal review interval, R = EOQ D = 500/12,000 = 1/24 year or 1/2 month Thus, review interval (1/2 month) + lead time (1/2 month) = 1 month, and expected demand during the review interval plus the lead time = 12,000/12 = 1000. Safety stock, s = z R L = 1.28(200) = 256 units Order-up-to level = expected demand during review interval and lead time + safety stock = 1,000 + 256 = 1,256 units