Accounting for Passive Investments in Securities

advertisement

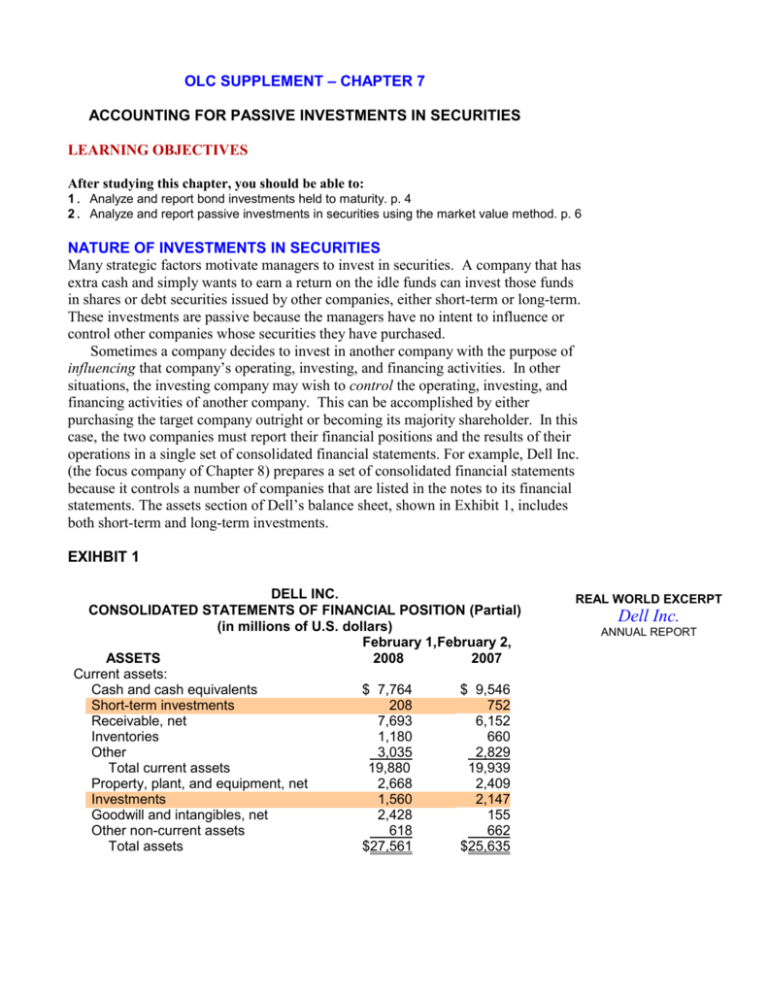

OLC SUPPLEMENT – CHAPTER 7 ACCOUNTING FOR PASSIVE INVESTMENTS IN SECURITIES LEARNING OBJECTIVES After studying this chapter, you should be able to: 1. Analyze and report bond investments held to maturity. p. 4 2. Analyze and report passive investments in securities using the market value method. p. 6 NATURE OF INVESTMENTS IN SECURITIES Many strategic factors motivate managers to invest in securities. A company that has extra cash and simply wants to earn a return on the idle funds can invest those funds in shares or debt securities issued by other companies, either short-term or long-term. These investments are passive because the managers have no intent to influence or control other companies whose securities they have purchased. Sometimes a company decides to invest in another company with the purpose of influencing that company’s operating, investing, and financing activities. In other situations, the investing company may wish to control the operating, investing, and financing activities of another company. This can be accomplished by either purchasing the target company outright or becoming its majority shareholder. In this case, the two companies must report their financial positions and the results of their operations in a single set of consolidated financial statements. For example, Dell Inc. (the focus company of Chapter 8) prepares a set of consolidated financial statements because it controls a number of companies that are listed in the notes to its financial statements. The assets section of Dell’s balance sheet, shown in Exhibit 1, includes both short-term and long-term investments. EXIHBIT 1 DELL INC. CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (Partial) (in millions of U.S. dollars) February 1,February 2, ASSETS 2008 2007 Current assets: Cash and cash equivalents $ 7,764 $ 9,546 Short-term investments 208 752 Receivable, net 7,693 6,152 Inventories 1,180 660 Other 3,035 2,829 Total current assets 19,880 19,939 Property, plant, and equipment, net 2,668 2,409 Investments 1,560 2,147 Goodwill and intangibles, net 2,428 155 Other non-current assets 618 662 Total assets $27,561 $25,635 REAL WORLD EXCERPT Dell Inc. ANNUAL REPORT This supplement discusses the measurement and reporting of passive investments and uses relevant disclosures by Dell Inc. for illustrative purposes. The accounting for active investments in equity securities that provide the investing company with either significant influence or control over another company is covered in Chapter 14, which is available as a supplement on the Online Learning Centre (OLC). PASSIVE INVESTMENTS IN DEBT AND EQUITY SECURITIES Passive investments are made to earn a high rate of return on funds that may be needed for future short-term or long-term purposes. The classification and valuation of passive investments depend on the nature of the investment as well as management’s intent. Investments are classified as cash equivalents if they consist of highly liquid investments with original maturities of three months or less at the date of purchase, such as treasury bills issued by the Federal government and certificates of deposit. These are reported at cost plus accrued interest, which approximates fair market value. Passive investments include both investments in debt (treasury bills, bonds1 and notes) and equity securities (shares). Debt securities are always considered passive investments. If the company intends to hold the securities until they reach their maturity dates, the investments are measured and reported at amortized cost. If they are to be sold before maturity, they are reported using the market value method. For investments in equity securities, the investment is presumed passive if the investment company owns less than 20 percent of the outstanding voting shares of the other company. The market value method is used to measure and report such investments. The accounting methods used to record passive investments are directly related to management intent from holding the investments. The various types of passive investments and the appropriate measuring and reporting methods can be summarized as follows: Investments in Debt Securities of Another Company Level of Ownership Measuring and Reporting Method Held to maturity Amortized cost method Not held to maturity Investments in Shares of Another Company < 20% of outstanding voting shares Market value method The accounting for passive investments is covered in Section 3855, Financial Instruments – Recognition and Measurement, of the CICA’s Accounting Handbook. Publicly traded Canadian companies are expected to apply the requirements of Section 3855 for fiscal years starting after September 30, 20062. Most Canadian companies will implement the requirements of Section 3855 for fiscal years 2007 and beyond. Similar recognition and measurement requirements have been in effect in the United States since 1994. Hence, we 1 A bond is a long-term debt requiring repayment of principal at a specific date along with periodic interest payments. Accounting for bonds is covered in Chapter 11. 2 use real world excerpts from the annual report of Dell Inc., which prepares its financial statements in accordance with US GAAP, in order to illustrate disclosures related to investments in debt and equity securities. DEBT HELD TO MATURITY: AMORTIZED COST METHOD When management plans to hold a bond (note) until its maturity date (when the principal is due), it is reported in an account appropriately called Held-toMaturity Investments. Bonds should be classified as held-to-maturity investments if management has the intent and the ability to hold them until maturity. These investments in debt instruments are listed at cost adjusted for the amortization of any bond discount or premium, not at their fair market value. Bond Purchases On the date of purchase, a bond may be acquired at the maturity amount (at par), for less than the maturity amount (at a discount), or for more than the maturity amount (at a premium).3 The total cost of the bond, including all incidental acquisition costs such as transfer fees and broker commissions, is debited to the Held-to-Maturity Investments account. To illustrate accounting for bond investments, assume that on August 1, 2008, Dell paid $100,000 for 8 percent bonds par-value4 bonds that mature on July 31, 2013, with interest payable each July 31 and January 31. Management plans to hold the bond for five years, until maturity. The journal entry to record the purchase of the bonds follows: Held-to-maturity investments (+A)…………………… Cash (-A)…………………………………………... Assets Cash – 100,000 Held-to-maturity investments +100,000 = Liabilities + 100,000 100,000 Shareholders’ Equity 2 The accounting treatment of short-term investments was previously covered in Section 3010, Temporary Investments, which was removed from the Handbook in April 2005. 3 The determination of the price of the bond is based on the present value techniques discussed in Chapter 10. Many analysts refer to a bond price as a percentage of par. For example, the financial section of a national newspaper might report that a Petro-Canada bond with a par value of $1,000 is selling at 109.85. This means it would cost $1,098.50 (109.85% of $1,000) to buy the bond. 4 When bond investors accept a rate of interest on a bond investment that is the same as interest rate on the bonds, the bonds will sell at par (i.e., at 100 or 100% of face value). 3 Learning Objective 1 Analyze and report bond investments held to maturity. HELD-TO-MATURITY INVESTMENTS are investments in bonds that management has the intent and ability to hold until maturity. AMORTIZED COST METHOD reports investments in debt securities held to maturity at cost, net of any discount or premium. Interest Earned The bonds in the illustration were purchased at par, or face value. Since no premium or discount needs to be amortized, the book value remains constant over the life of the investment. In this situation, revenue earned from the investment each period is measured as the amount of interest collected in cash or accrued at year-end. The following journal entry records the receipt of $4,000 ($100,000 x 8% x 6/12) in interest on January 315: Cash (+A)………………………………………………. Interest revenue (+R, +SE)…..………………….. Assets Cash = Liabilities + +4,000 4,000 4,000 Shareholders’ Equity Interest revenue +4,000 The same entry is made on succeeding interest payment dates. Principal at Maturity When the bonds mature on July 31, 2013, the journal entry to record receipt of the principal payment would be: Cash (+A)…………………………………..…………… Held-to-maturity investments (–A)……………….. Assets Cash +100,000 Held-to-maturity investments –100,000 = Liabilities + 100,000 100,000 Shareholders’ Equity If the bond investment must be sold before maturity, any difference between market value (the proceeds from the sale) and net book value would be reported as a gain or loss on sale. If management intends to sell the bonds before the maturity date, they are treated in the same manner as investments in shares classified as securities available for sale, as discussed in the next section. Learning Objective 2 Analyze and report passive investments in securities using the market value method. PASSIVE SHARE INVESTMENTS: THE MARKET VALUE METHOD When the investing company owns less than 20 percent of the outstanding voting shares of another company, the investment is considered passive. Among the assets and liabilities on the balance sheet, only passive investments in marketable securities are reported using the market value method on the date of the balance sheet.6 This violates the historical cost principle. Before we discuss the specific accounting for these investments, we should consider the implications of using market value: 5 Dell’s fiscal year is the 52- or 53-week period ending on the Friday nearest January 31. For 2008, Dell’s fiscal year ends exactly on January 31, 2009. 6All nonvoting shares are accounted for under the market value method without regard to the level of ownership. 4 1. Why are passive investments reported at fair market value on the balance sheet? Two primary factors determine the answer to this question. ■ Relevance. Analysts who study financial statements often attempt to forecast a company’s future cash flows. They want to know how a company can generate cash for purposes such as expansion of the business, payment of dividends, or survival during an economic downturn. One source of cash is the sale of shares from the company’s portfolio of passive investments. The best estimate of the cash that could be generated by the sale of these securities is their current market value. ■ Measurability. Accountants record only items that can be measured in dollar terms with a high degree of reliability (an unbiased and verifiable measurement). Determining the fair market value of most assets is very difficult because they are not actively traded. For example, the head office building of the Toronto Dominion Bank is an important part of the Toronto skyline. The balance sheet of the Toronto Dominion Bank reports the building in terms of its original cost less accumulated amortization in part because of the difficulty in determining an objective market value for it. Contrast the difficulty of determining the value of a building with the ease of determining the value of securities that TD Bank may own. A quick look at the National Post or an Internet financial service is all that is necessary to determine the current price of shares issues by many companies (e.g., Van Houtte, Gildan Activewear) because these securities are traded each day on established stock exchanges. 2. When an investment account is adjusted to reflect changes in fair market value, what other account is affected when the asset account is increased or decreased? Under the double-entry method of accounting, every journal entry affects at least two accounts. The first account is a valuation allowance that reflects changes in the fair market value of the investment. The account balance is added to or subtracted from the investment account, which is maintained at cost. The other account affected is unrealized holding gains or losses that are recorded whenever the fair market value of investments changes. There are unrealized because no actual sale has taken place; the value of the investment has changed while the shares are being held by the investing company. If the value of the investments increased by $100,000 during the year, an adjusting journal entry records the increase in the allowance account and an unrealized holding gain for $100,000. If the value of the investments decreased by $75,000 during the year, an adjusting journal entry records the decrease in the valuation allowance account and an unrealized holding loss of $75,000. Recording an unrealized holding gain is a departure from the revenue principle which states that revenues and gains should be recorded when the company has completed the earnings process that generated them. However, recording an unrealized loss is consistent with the concept of conservatism. The financial statement treatment of unrealized holding gains or losses depends on the classification of the passive investments in shares. 5 UNREALIZED HOLDING GAINS AND LOSSES are amounts associated with price changes of securities that are currently held. Classifying Passive Investments in Shares Passive investments may be classified as securities held for trading or securities available for sale, depending on management’s intent. SECURITIES HELD FOR TRADING are all investments in shares or bonds held primarily for the purpose of active trading (buying and selling) in the near future (classified as short term). SECURITIES AVAILABLE FOR SALE are all passive investments other than securities held for trading (classified as short or long term). Securities Held for Trading Securities held for trading are actively traded with the objective of generating profits on short-term changes in the price of the securities. This approach is similar to the one taken by many mutual funds. The portfolio manager actively seeks opportunities to buy and sell securities. Securities held for trading are classified as current assets on the balance sheet. Securities Available for Sale Most companies do not actively trade the securities of other companies. Instead, they invest to earn a return on funds they may need for future operating purposes. These investments are called securities available for sale. They are classified as current or noncurrent assets on the balance sheet depending on whether management intends to sell the securities during the next year. Securities held for trading (SHT for short) are most commonly reported by financial institutions that actively buy and sell short-term investments to maximize returns. Most corporations, however, invest in short- and long-term securities available for sale (SAS for short). We will focus on this category in the next section by analyzing Dell’s investing activities. Securities Available for Sale The notes to Dell’s annual report contain the following information concerning its investment portfolio: NOTES TO CONSOLIDATED FINANCIAL STATEMENTS REAL WORLD EXCERPT NOTE 1 — Description of Business and Summary of Significant Accounting Policies Dell Inc. Investments — Dell’s investments in debt securities and publicly traded equity securities are classified as available-for-sale and are reported at fair value (based on quoted prices and market prices) using the specific identification method. Unrealized gains and losses, net of taxes, are reported as a component of stockholders’ equity. Realized gains and losses on investments are included in investment and other income, net when realized. All other investments are initially recorded at cost. Any impairment loss to reduce an investment’s carrying amount to its fair market value is recognized in income when a decline in the fair market value of an individual security below its cost or carrying value is determined to be other than temporary. ANNUAL REPORT For simplification, let us assume that Dell had no passive investments at February 1, 2008. In the following illustration, we will apply the accounting policy used by Dell. Purchase of Shares At the beginning of fiscal year 2008, Dell purchases 10,000 common shares of Computer Components Corporation’s (CCC for short) for $60 per share7. 7 6 Computer Components Corporation is a fictitious company. CCC has 100,000 outstanding shares, so Dell owns 10 percent (10,000 ÷ 100,000) of CCC’s shares, which is treated as a passive investment. Such investments are recorded initially at cost: Investments in SAS (+A)………………....…………… Cash (–A)………………………….……………….. Assets Investment in SAS +600,000 Cash –600,000 = Liabilities 600,000 600,000 + Shareholders’ Equity This entry and those that follow are illustrated in Exhibit 3. Dividends Earned Investments in equity securities earn a return from two sources: (1) price appreciation and (2) dividend income. Price increases (or decreases) are analyzed both at year-end and when a security is sold. Dividends earned are reported as investment income on the income statement and are included in the computation of net income for the period. Assume that during the fourth quarter of fiscal 2008, Dell received a cash dividend of $1 per share from CCC, which totals $10,000 ($1 x 10,000 shares). The journal entry and transaction effects are as follows: Cash (+A)……………….………………....…………… Investment income (+R, +SE)............................. Assets Cash = +10,000 Liabilities + 10,000 10,000 Shareholders’ Equity Investment income +10,000 This entry is the same for securities that are either held for trading or available for sale. Year-End Valuation Passive investments are reported at fair market value on the balance sheet at the end of the accounting period. Assume that CCC had a market value of $58 per share at the end of the year. That is, the investment has lost value of $2 ($60 - $58) per share. However, the loss is not realized since the investment has not been sold. It simply resulted from holding the shares while their market value changed. Reporting the investment in SAS at market value requires adjusting it to market value at the end of each period. The adjusting entry recognizes the unrealized holding gain or loss and creates a new contra asset account Valuation Allowance – Investments in SAS that is similar to the Allowance for Uncollectible Accounts. If the Valuation Allowance account has a debit balance, it is added to the Investment in SAS account. If it has a credit balance, it is subtracted. The following chart is used to compute any unrealized gain or loss in the investment in SAS portfolio: 7 Fiscal Year 2008 Market Value – Cost Balance Needed Unadjusted Balance Amount for = in Valuation Allowance – in Valuation Allowance = Adjusting Entry $580,000 – $600,000 = ($58 x 10,000) ($60 x 10,000) $20,000 – $0 = (We assume there were no passive investments at the end of the prior year.) ($20,000) An unrealized loss for the period The adjusting entry at the end of fiscal 2008 is recorded as follows: Net unrealized gains and losses–SAS (–SE)….….……… Valuation allowance – investments in SAS (–A)…….. Valuation allowance – investments in SAS 0 20,000 20,000 Beg. Bal AJE Assets = Liabilities + Valuation allowance – Investments in SAS –20,000 End. Bal 20,000 20,000 Shareholders’ Equity Net unrealized gains and losses–SAS –20,000 Since the investment in SAS is expected to be held in the future, the unrealized holding gain or loss is not reported as part of income. It is reported in the shareholders’ equity section of the balance sheet as a component of Other Comprehensive Income8. If management of Dell intends to hold the investment in SAS for a long term, it would be reported on the company’s balance sheet at January 31, 2006 under Investments at $580,000 ($600,000 cost less the credit balance of $20,000 in the valuation allowance account). It would also report an unrealized loss of $20,000 on securities available for sale under Other Comprehensive Income. The only item reported on the income statement for 2005 would be investment income of $10,000 from the dividends earned, classified under other non-operating items. We assumed earlier, for illustrative purposes, that Dell did not have any investments at February 1, 2008. In reality, Dell’s balance sheet (in Exhibit 1) reports both short-term investments of $208 million, and long-term investments of $1,560 million. Most of Dell’s investments are in debt securities as disclosed in Note 2 to its financial statements (see Exhibit 2). Let us assume that Dell held the CCC shares through the year 2006, and that the price per share was $61 at year end. The year-end adjustment would be computed as follows: Fiscal Year 2009 Market Value – Cost Balance Needed Unadjusted Balance Amount for = in Valuation Allowance – in Valuation Allowance = Adjusting Entry $610,000 – $600,000 = ($61 x 10,000) ($60 x 10,000) $10,000 – ($20,000) = ($30,000) An unrealized gain for the period The adjusting entry at the end of fiscal 2009 is recorded as follows: 8 A brief explanation of Comprehensive Income is available on the textbook’s Online Learning Centre as a supplement to Chapter 6. 8 Valuation allowance – investment in SAS (+A)…..…….… Net unrealized gains and losses–SAS (+SE)............. Assets = Liabilities Valuation allowance – Investments in SAS +30,000 + 30,000 Valuation allowance – investments in SAS 30,000 20,000 Beg. Bal Shareholders’ Equity 30,000 Net unrealized gains and losses–SAS +30,000 AJE 10,000 End. Bal EXHIBIT 2 NOTE 2 — Financial Instruments REAL WORLD EXCERPT Dell Inc. Disclosures About Fair Values of Financial Instruments The fair value of investments and related interest rate derivative instruments has been estimated based upon quoted rates and pricing models…. ANNUAL REPORT Investments The following table summarizes by major security type, the fair market value and cost of Dell’s investments. All investments with remaining maturities in excess of one year are recorded as long-term investments in the accompanying Consolidated Statements of Financial Position. February 1, 2008 Fair Unrealized Value Cost Gain (Loss) (in millions) Debt securities: $1,013 $991 $22 U.S. government and agencies 571 569 2 U.S. corporate 68 67 1 International corporate 5 5 – State and municipal governments 1,657 1,632 34 Total debt securities 111 111 – Equity and other securities $1,768 $1,743 $34 Investments $ 208 $ 206 $2 Short-term 1,560 1,537 32 Long-term $1,768 $1,743 $34 Total investments Sale of Shares When securities available for sale are sold, three accounts are affected, in addition to Cash: ■ Investment in SAS ■ Valuation Allowance - Investment in SAS ■ Net Unrealized Gains and Losses Let us assume that Dell sold its investment in CCC on November 15, 2008 for $62.50 per share. The company would receive $625,000 in cash ($62.50 x 10,000) for shares purchased for $600,000 in 2008. In entry (1), a gain on sale of $25,000 ($625,000 – $600,000) would be recorded and the Investment in SAS would be eliminated. In entry (2), the valuation allowance and related net unrealized gains and losses would be eliminated. 9 (1) Cash (+A)………………………………………………… 625,000 Investment in SAS (–A)…………………………….. 600,000 Gain on sale of investments (+Gain, +SE)……….. 25,000 (2) Net unrealized gains and losses–SAS (–SE)............... 10,000 Valuation allowance – investment in SAS (–A)...… Assets Cash Investment in SAS = Liabilities +625,000 –600,000 Valuation allowance– Investments in SAS –10,000 10,000 Shareholders’ Equity + Gain on sale of Investments +25,000 Net unrealized gains and losses–SAS +10,000 The effects of these transactions on the various accounts are illustrated in Exhibit 3. EXHIBIT 3 T-Accounts for the Illustrated Transactions Balance Sheet Accounts Investment in SAS (at cost) (A) Beg. 2008 0 Purchase 600,000 End. 2008 600,000 End. 2009 600,000 600,000 2010 Sale End. 2010 0 Valuation Allowance – Investment in SAS (A) 0 Beg. 2008 20,000 AJE 2008 20,000 End. 2008 2009 AJE 30,000 End. 2009 10,000 10,000 2010 Sale 0 End. 2010 Net Unrealized Gains and Losses (SE) Beg. 2008 0 2008 AJE 20,000 End. 2008 20,000 30,000 2009 AJE 10,000 End. 2009 2010 Sale 10,000 0 Income Statement Accounts Investment Income (R) 10,000 Earned 10,000 End. 2008 10 Gain on Sale of Investments (Gain) 25,000 2010 Sale 25,000 End. 2010 Comparing Trading and Available-for-Sale Securities The reporting impact of unrealized holding gains or losses depends on the classification of the investment. Portfolio of securities available for sale. As we learned in the previous section, the balance in net unrealized holding gains and losses is reported as a separate component of shareholders’ equity (under other comprehensive income). It is not reported on the income statement and does not affect net income. At the time of sale, the difference between the proceeds from the sale and the original cost of the investment is recorded as a gain or loss on securities available for sale. At the same time the Net Unrealized Gains and Losses – SAS and the Valuation Allowance – Investments in SAS are eliminated. Portfolio of securities held for trading. The amount of the adjustment to net unrealized holding gains and losses is included in each period’s income statement. Net holding gains increase net income and net holding losses decrease it. This also means that the amount recorded as net unrealized gains and losses on securities held for trading is closed to Retained Earnings at the end of the period. Thus, when selling a security, Cash and only two other balance sheet accounts are affected: Investment in SHT and Valuation Allowance – Investments in SHT. The gain or loss on sale of securities held for trading is the difference between the cash proceeds from the sale and the cost of the investment, net of the valuation allowance. Exhibit 4 provides comparative journal entries and financial statement balances for the transactions illustrated for Dell Inc. from 2008 to 2010. Note that the total income reported for the three years is the same $35,000 for both types of securities. Only the allocation across the three periods differs. Income in Securities Held for Trading 2008 $10,000 dividends (20,000) unrealized loss 30,000 unrealized gain 15,000 realized gain $35,000 2009 2010 Total FINANCIAL ANALYSIS Securities Available for Sale $10,000 dividends – – 25,000 realized gain $35,000 Equity Securities and Earnings Management Most managers prefer to treat their passive investments as securities available for sale. This treatment generally reduces variations in reported earnings by avoiding recognition of unrealized holding gains and losses resulting from quarter-to-quarter changes in share prices. It also allows managers to smooth out earnings fluctuations by selling securities with unrealized gains when earnings decline and by selling those with unrealized losses when earnings increase. Diligent analysts can see through this strategy, however, by examining the required note on investments in the financial statements. 11 EXHIBIT 4 Comparison of Accounting for Securities Held for Trading and Securities Available for Sale Part A: Entries Securities Held for Trading Securities Available for Sale 2008: Purchase (for $600,000 cash) Investment in SHT (+A)……….. Cash (–A)………………......... Receipt of dividends ($10,000 cash) Cash (+A)……………………….. Investment income (+R, +SE) Year-end adjustment to market (market = $580,000) Net unrealized gains/losses– SHT (+Loss, –SE)……………. Valuation allowance– Investment in SHT (–A)…… 600,000 Investment in SAS (+A)…...…... Cash (–A)…………………...... 600,000 600,000 Cash (+A)………………………… Investment income (+R, +SE) 10,000 10,000 20,000 Net unrealized gains/losses– SAS (+Loss, –SE)……………. Valuation allowance– Investment in SAS (–A)….. 30,000 Valuation allowance– Investment in SAS (+A)….….. Net unrealized gains/losses– SAS (+Gain, +SE)………… 10,000 20,000 600,000 10,000 20,000 20,000 2009: Year-end adjustment to market (market = $610,000) Valuation allowance– Investment in SHT (+A)….…... 30,000 Net unrealized gains/losses– SHT (+Gain, +SE)………….. 30,000 30,000 2010: Sale (for $600,000) Part B: Financial Reporting Balance Sheet Reporting: Two balance sheet accounts are eliminated: Three balance sheet accounts are eliminated: Cash (+A)………..……………… 625,000 Valuation allowance– Investment in SHT (–A)…. 10,000 Investment in SHT (–A)...…… 600,000 Gain on sale of investment (+Gain, +SE)……………... 15,000 Cash (+A)………..………………. Investment in SAS (–A)..…... Gain on sale of investment (+Gain, +SE)…………….... Net unrealized gains/losses– SAS (+Loss, –SE)……………. Valuation allowance– Investment in SAS (–A)…. Securities Held for Trading Assets 2010 625,000 600,000 25,000 10,000 10,000 Securities Available for Sale 2009 2008 Assets 2010 2009 2008 Investment in SHT Valuation allowance – SHT – – 600,000 600,000 10,000 (20,000) Investment in SAS Valuation allowance – SAS – – 600,000 10,000 600,000 (20,000) Net investment in SHT – 610,000 580,000 Net investment in SAS – 610,000 580,000 Shareholders’ Equity Other comprehensive income: Net unreal. gains/losses – SAS Income Statement Reporting: Investment income Gain on sale Net unrealized gains/ losses – SHT 12 2010 2009 2008 – 15,000 – – 10,000 – – 30,000 (20,000) Investment income Gain on sale 10,000 (20,000) 2010 2009 2008 – 25,000 – – 10,000 – SELF-STUDY QUIZ Now let us reconstruct the activities that Dell Inc. undertook in a recent year with a few transactions assumed. Answer the following questions using the T-accounts to help you infer the amounts. Dollar amounts are in thousands. Balance Sheet Accounts (In Short-term Investments) Investment in SAS 1/1 4,022 Purchase 19,000 ? 12/31 8,875 Sale (In Accumulated Other Comprehensive Income) 1/1 AJE 12/31 Valuation Allowance – Investment in SAS 1,565 ? 1,092 Sale 5,683 Net Unrealized Gains and Losses – SAS 1,565 1/1 Sale ? ? AJE 5,683 12/31 Income Statement Accounts Investment Income ? 7,771 Earned 12/31 Gain on Sale of Investment 2,384 Sale 2,384 12/31 a. Purchased securities available for sale for cash. Prepare the journal entry. b. Received cash dividends on the investments. Prepare the journal entry. c. Sold SAS investments at a gain. Prepare the journal entries. d. At year-end, the SAS portfolio had a market value of $14,558. Prepare the adjusting entry. e. What amounts would be reported on the balance sheet at December 31 related to the SAS investments? On the income statement for the year? f. How would year-end reporting change if the investments were categorized as securities held for trading instead of securities available for sale? After you have completed your answers, check them with the solutions on page16. REAL WORLD EXCERPT Dell Inc. ANNUAL REPORT DEMONSTRATION CASE A (Try to resolve the requirements for Cases A and B before proceeding to the suggested solutions that follow.) Howell Equipment Corporation sells and services a major line of farm equipment. Both sales and service operations have been profitable. The following transactions affected the company during 2008: Jan. 1 Dec. 28 Dec. 31 Purchased 2,000 common shares of Dear Company at $40 per share. This purchase represented one percent of the shares outstanding. Management intends to trade these shares actively. Received $4,000 cash dividend on the Dear Company shares. Determined that the market price of Dear’s common share was $39. Required: 1. Prepare the journal entry for each of these transactions. 2. What accounts and amounts will be reported on the balance sheet at the end of 2008? On the income statement for 2008? SUGGESTED SOLUTION FOR CASE A 1. Jan. 1 Investment in SHT (+A) ……………………..……. Cash (+A) (2,000 shares x $40) ……...…… Dec. 28 Cash (+A) …………………………………….….. Investment income (+R, +SE) ……….…… Dec. 31 Net unrealized gains/losses—SHT (+Loss, –SE) Valuation Allowance—Investment in SHT (–A) Fiscal Year 2008 Market Value – $78,000 – ($39 x 2,000) Cost 80,000 4,000 4,000 2,000 2,000 Balance Needed Unadjusted Balance Amount for = in Valuation Allowance – in Valuation Allowance = Adjusting Entry $80,000 = $(2,000) – 2. On the Balance Sheet: Current Assets Investment in SHT $78,000 ($80,000 cost – $2,000 allowance) 14 80,000 $0 = $(2,000) An unrealized loss for the period On the Income Statement: Other Nonoperating Items Investment income $4,000 Net unrealized loss on trading securities (2,000) DEMONSTRATION CASE B Assume the same facts as in Case A except that the securities were purchased as securities available for sale rather than as securities held for trading. Required: 1. Prepare the journal entry for each of these transactions. 2. What accounts and amounts will be reported on the balance sheet at the end of 2008? On the income statement for 2008? SUGGESTED SOLUTION FOR CASE B Jan. 1 Investment in SAS (+A) …………………..………….. Cash (+A) (2,000 shares x $40) ……...…………. Dec. 28 Cash (+A) …………………………………….……….. Investment income (+R, +SE) ……….…………. Dec. 31 Net unrealized gains/losses—SAS (+Loss, –SE) …. Valuation Allowance—Investment in SAS (–A) ….. Fiscal Year 2008 Market Value – $78,000 – ($39 x 2,000) Cost 80,000 80,000 4,000 4,000 2,000 2,000 Balance Needed Unadjusted Balance Amount for = in Valuation Allowance – in Valuation Allowance = Adjusting Entry $80,000 = 2. On the Balance Sheet: Current Assets Investment in SAS $78,000 ($80,000 cost – $2,000 allowance) Shareholders’ Equity Accumulated other comprehensive Income: Net unrealized loss on SAS (2,000) $(2,000) – $0 = $(2,000) An unrealized loss for the period On the Income Statement: Other Nonoperating Items Investment income $4,000 15 Solution to Self-Study Quiz a. Investment in SAS (+A) ………………………………. 19,000 Cash (–A) ………………………………………….. 19,000 b. Cash (+A) …………………………………………….. 7,771 Investment income (+R, +SE) …………………….. 7,771 c. (1) Cash (+A) …………………………………………. 16,531 Gain on sale of investments (+Gain, +SE) …….. 2,384 Investment in SAS (–A) ……………………….. 14,147 (2) Net unrealized gains/losses—SAS (–SE) …………. 1,092 Valuation Allowance—Investment in SAS (–A) … 1,092 d. Valuation Allowance—Investment in SAS (+A) ……. 5,210 Net unrealized gains/losses—SAS (+SE) …………. 5,210 Market Value – Cost $14,558 – $8,875 Balance Needed = in Valuation Allowance – = +$5,683 – Unadjusted Balance in Valuation Allowance = $473 = ($1,565 beg. bal. – $1,092 sale) Amount for Adjusting Entry +$5,210 e. Balance Sheet Income Statement Assets Nonoperating Items Short-term investments $14,558 Gain on sale of investments Shareholders’ Equity Investment income Net unrealized gains/losses 5,683 (in Accumulated Other Comprehensive Income) $2,384 7,771 f. If the securities were held for trading, the net unrealized gain would not appear on the balance sheet. Therefore, when the securities are sold in c, there would be a gain on the sale of $1,292 [$16,531 cash – ($14,147 cost + $1,092 allowance)] reported on the income statement. Then at year-end, the net unrealized gain of $5,210 would be reported on the income statement (not in shareholders’ equity). SUPPLEMENT TAKE-AWAYS 1. Analyze and report bond investments held to maturity. p. 2 When management intends to hold a bond investment until it matures, the held-to-maturity bond is recorded at cost when acquired and reported at amortized cost on the balance sheet. Any interest earned during the period is reported on the income statement. 2. Analyze and report passive investments in securities using the market value method. p. 4 • Acquiring less than 20 percent of the outstanding voting shares of an investee’s common shares is presumed to be a passive investment in shares. Passive investments may be classified as securities held for training (actively traded to maximize return) or securities available for sale (acquired to earn a return but are not as actively traded), depending on management’s intent. 16 • The investments are recorded at cost and adjusted to market value at year-end. A valuation allowance is increased or decreased to arrive at market value with the resulting unrealized holding gain or loss that is recorded and reported in net income for securities held for training, or as a component of shareholders’ equity in other comprehensive income for securities available for sale. • Any dividends earned are reported as revenue, and any gains or losses on sales of passive investments are reported on the income statement. FINDING FINANCIAL INFORMATION Balance Sheet Current Assets Investment in trading securities (net of valuation allowance) Investment in securities available for sale (net of valuation allowance) Noncurrent Assets Investment in securities available for sale (net of valuation allowance) Investments held to maturity Shareholders’ Equity Accumulated other comprehensive income: Net unrealized gains and losses on securities available for sale Income Statement Under “Other Items” Investment income Loss or gain on sale of investments Net unrealized gains and losses on trading securities Cash Flow Statement Operating Activities Net income adjusted for: Gains/losses on sale of investments Net unrealized gains/losses on trading Securities Notes In Various Notes Accounting policies for investments Details on securities held as trading and available-for-sale securities QUESTIONS 1. Explain the difference between a short-term investment and a long-term investment. 2. Explain the difference in accounting methods used for passive investments, investments in which the investor can exert significant influence, and investments in which the investor has control over another entity. 3. Explain how bonds held to maturity are reported on the balance sheet. 4. Under the market value method, when and how does the investor company measure revenue? 17 MULTIPLE-CHOICE QUESTIONS 1. Company A purchases 10 percent of Company B’s shares and Company A intends to hold the shares for at least five years. At the end of the current year, how would Company A’s investment in Company B’s shares be reported on Company A’s December 31 (year-end) balance sheet? a. at original cost in the current assets section b. at market value on December 31, in the current assets section c. at original cost in the long-term assets section d. at market value on December 31, in the long-term assets section 2. Dividends received from an investment in shares that is reported as a security available for sale in the long-term assets section of the balance sheet are reported as a. an increase to cash and a decrease to the investment in stock account b. an increase to cash and an unrealized gain on the balance sheet c. an increase to cash and an increase to revenue d. an increase to cash and an unrealized gain on the income statement 3. Which of the following transactions results in recognizing gains and losses that are recorded on the income statement for both securities held for trading and securities available for sale? a. when adjusting a security held for trading to its market value b. when adjusting a security available for sale to its market value c. only when recording the sale of a security held for trading d. when recording the sale of either a security held for trading or a security available for sale 4. Which of the following items is reported in the investing section of the cash flow statement when an investment in shares is sold? a. the subtraction of a resulting gain on the sale b. the addition of a resulting loss on the sale c. the addition of cash sales proceeds d. all of the above EXERCISES Recording Bonds Held to Maturity The Forzani Group Limited is Canada's largest retailer of sporting goods, offering a comprehensive assortment of products, operating stores from coast to coast under the names Sport Chek, Sports Experts, Coast Mountain Sports, Sport Mart and National Sports. The company does more than $1 billion in sales each year. Assume that as part of its cash management strategy, Forzani purchased $10 million in bonds at par for cash on July 1, 2009. The bonds pay 10 percent interest each June 30 and December 31 and mature in 10 years. Forzani plans to hold the bonds until maturity. Required: 1. Record the purchase of the bonds on July 1, 2009. 2. Record the receipt of interest on December 31, 2009. 18 Recording Transactions in the Portfolio of Securities Held for Trading On June 30, 2008, MetroMedia, Inc. purchased 10,000 of Mitek’s common shares for $20 per share. Management purchased the shares for speculative purposes and recorded them in the portfolio of securities held for trading. The following information pertains to Mitek’s price per share: Date Price 12/31/2008 $24 12/31/2009 31 12/31/2010 25 E-2 LO2 MetroMedia sold its investment in Mitek’s shares on February 14, 2011, at a price of $22 per share. Prepare any journal entries that are required by the facts presented in this case. Recording Transactions in the Portfolio of Securities Available for Sale Using the data in E-2, assume that MetroMedia management purchased Mitek’s shares for the portfolio of securities available for sale instead of the portfolio of securities held for trading. Prepare any journal entries that are required by the facts presented in the case. E-3 LO2 Reporting Gains and Losses in Passive Investments in Securities On March 10, 2008, General Solutions, Inc. purchased 5,000 of MicroTech’s common shares for $50 per share. Management purchased the shares for speculative purposes and recorded it in the portfolio of securities held for trading. The following information pertains to the MicroTech’s price per share: E-4 LO2 Date 12/31/2008 12/31/2009 12/31/2010 Price $55 40 42 General Solutions sold its investment in MicroTech’s shares on September 12, 2011, at a price of $39 per share. Prepare any journal entries that are required by the facts presented in this case. Required: 1. Assume that management purchased the shares for speculative purposes and recorded the investment in the portfolio of securities held for trading. Prepare any journal entries that are required by the facts presented in this case. 2. Assume that management purchased the shares for speculative purposes and recorded the investment in the portfolio of securities available for sale. Prepare any journal entries that are required by the facts presented in this case. 19 PROBLEMS Determining Financial Statement Effects for Bonds Held to Maturity (AP-1) Starbucks is a rapidly expanding company that provides high-quality coffee products. Assume that as part of its expansion strategy, Starbucks plans to open numerous new stores in Mexico in five years. The company has $5 million to support the expansion and has decided to invest the funds in corporate bonds until the money is needed. Assume that Starbucks purchased bonds with $5 million face value at par for cash on July 1, 2008. The bonds pay 8 percent interest each June 30 and December 31 and mature in five years. Starbucks plans to hold the bonds until maturity. P-1 LO1 Starbucks Corporation Required: 1. What accounts are affected when the bonds are purchased on July 1, 2008? 2. What accounts are affected when interest is received on December 31, 2008? 3. Should Starbucks prepare a journal entry if the market value of the bonds decreased to $4,000,000 on December 31, 2008? Explain. Recording Passive Investments (AP-2) On March 1, 2007, HiTech Industries purchased 10,000 common shares of Integrated Services Company for $20 per share. The following information applies to Integrated’s price per share: Date 12/31/2007 12/31/2008 12/31/2009 P–2 LO2 Price $17 24 31 Required: 1. Prepare journal entries to record the facts in the case, assuming that HiTech purchased the shares for the portfolio of securities held for trading. 2. Prepare journal entries to record the facts in the case, assuming that HiTech purchased the shares for the portfolio of securities available for sale. Recording Passive Investments (AP-3) During January 2008, Ka-Shing Company purchased shares of the following companies as a long-term investment: Company and Type of Share Q Corporation – Common R Corporation – Preferred, nonvoting 20 Number of Shares Outstanding 90,000 20,000 Purchase 12,600 12,000 Cost per Share $ 5 30 P–3 LO2 Subsequent to acquisition, the following data were available: Net income reported at December 31: Q Corporation R Corporation Dividends declared and paid during the year (per share): Q Corporation – Common R Corporation – Preferred Market value per share at December 31: Q Corporation – Common R Corporation – Preferred 2008 2009 $30,000 40,000 $36,000 48,000 $0.85 1.00 $0.90 1.10 $ 4.00 29.00 $ 4.00 30.00 Required: 1. What accounting method should be used for the investment in Q Corporation’s common shares? R Corporation’s preferred shares? Why? 2. Prepare the journal entries to record the following events for each year using parallel columns (if none, explain why): a. Purchase of the investments. b. Income reported by Q and R Corporations. c. Dividends received from Q and R Corporations. d. Market value effects at year-end. 3. For each year, show how the following amounts should be reported on the financial statements of Ka-Shing Company: a. Long-term investment. b. Shareholders’ equity—net unrealized gains and losses. c. Revenues. Recording Passive Investments On August 4, 2007, Osaka Corporation purchased 1,000 common shares of Tremblay Ltée for $45,000. The following information applies to the Tremblay’s shares: Date 12/31/2007 12/31/2008 12/31/2009 Price $52 47 38 Tremblay Ltée declares and pays cash dividends of $2 per share on June 1 of each year. Required: 1. Prepare journal entries to record the facts in the case, assuming that Osaka purchased the shares for the portfolio of securities held for trading. 2. Prepare journal entries to record the facts in the case, assuming that Osaka purchased the shares for the portfolio of securities available for sale. 21 P–4 LO2 ALTERNATE PROBLEMS Determining Financial Statement Effects for Bonds Held to Maturity (P-1) AP–1 Krispy Kreme operates and franchises a worldwide chain of quick-service drive-in doughnut stores. LO1 Customers drive up to a parking space and order doughnuts through an intercom speaker system. Krispy Kreme The ordered quantity is then delivered to the customer. Assume that Krispy Kreme has $10 million Doughnuts, Inc. in cash to support future expansion and has decided to invest the funds in corporate bonds until the money is needed. Krispy Kreme purchases bonds with $10 million face value for $10.3 million cash on January 1, 2009. The bonds pay 8 percent interest each June 30 and December 31 and mature in four years. Krispy Kreme plans to hold the bonds until maturity. Required: 1. What accounts were affected when the bonds were purchased on January 1, 2009? 2. What accounts were affected when interest was received on June 30, 2009? 3. Should Krispy Kreme prepare a journal entry if the market value of the bonds decreased to $9,700,000 on December 31, 2009? Explain. Recording Passive Investments (P-2) On September 15, 2008, MultiMedia Corporation purchased 10,000 common shares of Community Broadcasting Company for $32per share. The following information applies to Community Broadcasting’s price per share: Date 12/31/2008 12/31/2009 12/31/2010 AP–2 LO2 Price $34 24 21 Required: 1. Prepare journal entries to record the facts in the case, assuming that MultiMedia purchased the shares for the portfolio of securities held for trading. 2. Prepare journal entries to record the facts in the case, assuming that MultiMedia purchased the shares for the portfolio of securities available for sale. Recording Passive Investments (P-3) During January 2008, Hexagon Company purchased 12,000 of the 200,000 outstanding common shares of Smiley Corporation at $30 per share. This block of shares was purchased as a long-term investment. Assume that the accounting period for each company ends December 31. Subsequent to acquisition, the following data were available: 2008 2009 Net income reported by Smiley Corporation at December $40,000 $60,000 31 60,000 80,000 Cash dividends declared and paid by Smiley Corporation during the year 28 29 Market price of Smiley Corporation’s share at December 31 Required: 1. What accounting method should Hexagon Company use to record the investment in Smiley Corporation’s common shares? Why? 22 AP–3 LO2 2. 3. Prepare the journal entries to record the following events for each year using parallel columns (if none, explain why): a Purchase of the investment. b. Net income reported by Smiley Corporation. c. Dividends received from Smiley Corporation. d. Market value effects at year-end. For each year, show how the following amounts should be reported on the financial statements of Hexagon Company: a. Long-term investment. b. Shareholders’ equity—net unrealized gains and losses. c. Revenues. Critical Thinking Case Evaluating an Ethical Dilemma: Using Inside Information Assume that you are on the board of directors of a company that has decided to buy 80 percent of the outstanding shares of another company within the next three or four months. The discussions have convinced you that this company is an excellent investment opportunity, so you decide to buy $10,000 worth of the company’s shares for your personal portfolio. Is there an ethical problem with your decision? Would your answer be different if you planned to invest $500,000? Are there different ethical considerations if you don’t buy the shares but recommend that your brother do so? July 27, 2008 23 CP7-1