Deals & Deal Makers: SEC Questions Start-Ups' Cheap Stock Sales to Customers

By Scott Thurm

Staff Reporter of The Wall Street Journal

09/26/2000

The Wall Street Journal

C1

(Copyright (c) 2000, Dow Jones & Company, Inc.)

Start-up companies generally have to try harder than established ones to win customers for their

new, untested products. Some may be trying a bit too hard.

The Securities and Exchange Commission is scrutinizing the growing practice by start-up

technology companies of offering cheap stock, or warrants to buy stock, to corporate customers

that place big orders for their products.

These deals are raising concerns among regulators that tech companies may be effectively

lowering prices for their products -- and thus overstating their revenue -- by offering the

inexpensive shares to customers. The customers, in turn, frequently can reap big profits following

a tech company's initial public stock offering.

Such deals are increasingly common in the telecom industry, where start-up equipment makers

can attain breathtaking market valuations based on a few big purchase orders.

In turn, the network operators that write those purchase orders are asking for a piece of the action

in the form of stock.

In a case that could have broad implications, CoSine Communications Inc., which priced its initial

public offering yesterday at $23 a share, recently amended its financial statements, adjusting its

revenue downward by nearly one-third to reflect the value of warrants issued to customers. Six of

CoSine's eight customers hold stock or potentially lucrative warrants to buy stock in the Redwood

City, Calif., company.

The move followed months of discussions between the SEC and CoSine, which filed for its IPO

in April.

The result: CoSine now lists two measures of revenue, including one that excludes "noncash

charges related to equity" issuances.

CoSine reported revenue of $11.3 million for the first six months of the year. Adjusting for the

value of the warrants, however, CoSine says revenue was nearly one-third less, or $7.6 million.

A CoSine spokesman declined to comment, citing the SEC "quiet-period" restrictions around

IPOs.

Investors are taking notice too, analysts say. "The Street will pay attention to the lower number in

some cases," says Christopher Stix, an analyst at Morgan Stanley Dean Witter & Co. "Investors

are becoming increasingly sensitive to and skeptical of revenue that comes from investors."

CoSine isn't the only company to come under the SEC microscope.

Tellium Inc., Oceanport, N.J., a start-up maker of fiber-optic Internet-switching gear, included

similar charges in its initial filing for an IPO on Friday. Tellium has issued warrants to two of its

three customers.

Moreover, people familiar with the matter say that intense SEC questioning delayed for more than

a week the June IPO of ONI Systems Corp., another telecom-equipment maker. In the end, ONI

didn't have to make any changes in its financial statements.

"You're going to see a lot more of it," says Tracy Lefteroff, head of the venture-capital practice at

accounting firm PricewaterhouseCoopers. Regulators, he says, "want to know what customers

are really buying."

An SEC official says accounting questions are "coming up more frequently" because "companies

are doing a lot of different things with equity."

The heightened SEC scrutiny of customer-equity deals has stirred debate among venture

capitalists, lawyers and accountants in Silicon Valley. "We're advising clients to be very careful

about granting warrants or options to customers," says Curtis Mo, an attorney for San Franciscobased Brobeck, Phleger & Harrison.

Some in the valley support the SEC effort. Brooke Seawell, a former chief financial officer for two

software companies who is now a general partner at venture-capital firm Technology Crossover

Ventures, says revenue from sales to warrant-holding customers "should be offset by the value

of the warrants."

Others say they are just looking for clearer guidance from the SEC on how to account for these

deals. But the SEC official says the deals are so different, and so complex, that it is hard to

develop specific rules. For example, some deals prevent customers from exercising warrants for

as long as five years, unless they stick to a prescribed purchase schedule.

Tying the warrants to specific purchases can affect the accounting treatment. "These transactions

are all nuanced with varying facts and circumstances," the SEC official says.

The new initiative follows SEC efforts to require better accounting from start-ups that issue cheap

stock options to lure employees, and cheap stock to lure strategic investors. CoSine has charges

on its income statement for both of those tactics as well.

But cheap stock for employees and investors typically is listed as a special charge, which most

Wall Street analysts and many investors ignore. Requiring companies to deduct the value of

warrants from revenue gives the issue greater prominence, particularly because many newly

public companies are valued by investors as much on their revenues as on their profitability.

The issue isn't confined to telecom firms. Mr. Lefteroff of PricewaterhouseCoopers says he has

advised biotechnology companies, medical-device makers, software concerns and Internet

companies that also issued equity to customers, and now are grappling with the accounting.

But customer-equity deals have become particularly prominent, and particularly lucrative, in

telecom. They are a unique marriage of convenience. Start-up equipment makers competing

against better-known names such as Lucent Technologies Inc., Nortel Networks Corp. and Cisco

Systems Inc. offer cheap stock or warrants to network operators that agree to buy their gear. The

equipment makers go public, frequently in skyrocketing IPOs. The network operators, in turn, can

make far more on their investments than they spend on equipment.

Every equipment maker that has gone public in the past year has had customers that held stock

or warrants, including high-fliers such as Sycamore Networks Inc., Sonus Networks Inc. and

Corvis Corp. A spokeswoman for Corvis declined to comment. A spokesman for Sycamore said

the company only allowed one customer to buy shares at the IPO price. A Sonus representative

couldn't be reached.

Consider the deal between ONI and Williams Communications Group Inc. Williams agreed to buy

$30 million of ONI's gear by next June. ONI granted Williams a warrant to buy 1,580,000 shares

of its stock for $6.32 a share. ONI went public in June at $25 a share. At yesterday's 4 p.m. price

of $97.31, Williams showed a paper profit of $144 million on its ONI warrants. (Williams has said

that it invests in equipment makers to gain influence over their design and to make money to

defray the cost of building its network.)

CoSine's customers that hold warrants could fare equally well. On Friday, the company raised

the indicated offering price for its shares to $20 to $22 from $15 to $17, and in the end priced

even higher than that.

Qwest Communications International Inc., which has agreed to buy $18.3 million of CoSine's

gear, holds a warrant to buy more than 1.2 million shares of CoSine's stock at 81 cents a share.

At $23 a share, Qwest's warrants would be valued at $28.4 million, for a paper profit of $27.4

million.

CoSine's relations with Qwest, its most prominent customer, are deep and complex. The family

of Philip Anschutz, Qwest's founder, chairman and largest shareholder, was an early investor in

CoSine and holds more than a million shares. Vinod Khosla, a venture capitalist at Kleiner

Perkins Caufield & Byers, which is one of CoSine's biggest backers, sits on Qwest's board.

(Another Kleiner Perkins-backed company, BroadBand Office, also is a CoSine customer and

warrant-holder.) A Qwest spokesman declined to comment on the matter.

In its amended filing, CoSine included a charge against revenue to reflect the value of the

warrants it has given to Qwest and others. Using a standard model, CoSine valued Qwest's

warrant at $10.3 million, substantially less than it could be worth after trading today. Future

revenues also will be reduced by the value of the warrants.

--Michael Schroeder contributed to this article.

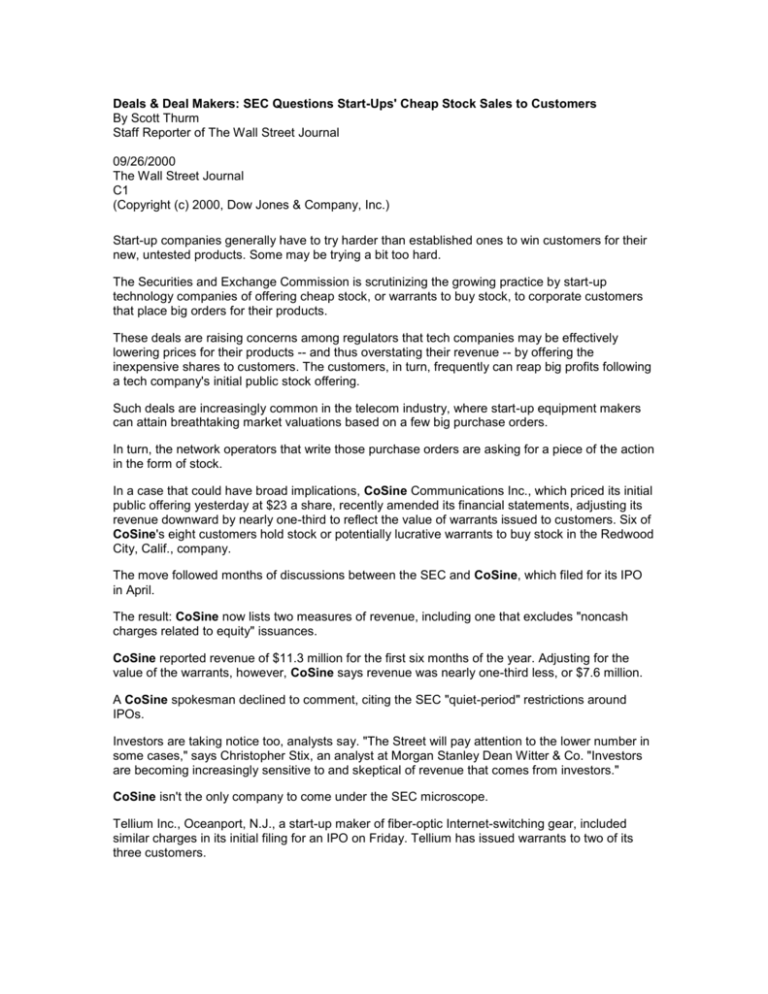

Buying From . . . and Buying In

Deals involving CoSine Communications customers who hold stock or

warrants in the start-up maker of telecommunications switching gear.

CoSine priced its initial public offering last night at $23 a share.

Customer: Qwest

Purchase from CoSine*: $18.3 million

Investment: Warrants for 1.23 million shares at 81 cents

Customer: AduroNet

Purchase from CoSine*: $20.7 million

Investment: Warrants for 200,000 shares at $4

Customer: BroadBand Office

Purchase from CoSine*: $20 million

Investment: Warrants for 468,849 shares at $3.73

Customer: Nissho Electronics

Purchase from CoSine*: Not disclosed

Investment: 100,000 shares at $15

Customer: Internet Initiative Japan

Purchase from CoSine*: Not disclosed

Investment: 44,667 shares at $15

Customer: American MetroComm

Purchase from CoSine*: Not disclosed Undisclosed warrants**

*Agreed upon

**CoSine has agreed to provide American MetroComm with warrants if

American MetroComm obtains financing to complete its purchase;

American MetroComm has filed for bankruptcy protection.

Source: Securities and Exchange Commission filings

Copyright © 2000 Dow Jones & Company, Inc. All Rights Reserved.