July 23, 2003

advertisement

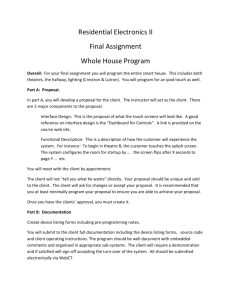

CIRCULAR TO MEMBERS April 22, 2005 Circular No.TEC/011/04/2005/W BURSA MALAYSIA SECURITIES BERHAD AMENDMENTS TO LISTING REQUIREMENTS Members are informed that Bursa Malaysia Securities Berhad (Bursa Securities) has issued the following amendments to the Listing Requirements for the Main Board and Second Board and the Listing Requirements for the MESDAQ Market. I. Amendments to Chapter 16 of the Listing Requirements Amendments have been made to Chapter 16 of the Listing Requirements for the Main Board and Second Board with regard to suspension, withdrawal and de-listing of a listed issuer. The key changes are: To empower the Exchange to suspend the trading of and de-list any class of the listed securities of a listed issuer under certain circumstances To reflect the current arrangements with the Securities Commission in relation to enforcement actions taken by Bursa Securities pursuant to the Listing Requirements. The above amendments took effect from the date of Bursa Securities’ circular letter of November 8, 2004. II. Amendments to the Listing Requirements in Relation to Financial Condition and Level of Operations Amendments have been made to the Listing Requirements for the Main Board and Second Board in relation to the financial condition and level of operations of listed issuers. Consequent to the amendments, two new Practice Notes have been issued pursuant to para 2.08 of the Listing Requirements, namely Practice Note No. 16/2005 (PN 16) and Practice Note No. 17/2005 (PN 17). The existing PN 4 and PN 10 framework, which was introduced in 2001, is to ensure that sufficient disclosure is made about listed issuers that are financially distressed or have inadequate level of operations and that the affected listed issuers take steps to expeditiously restructure to address their unsatisfactory condition. The above-mentioned amendments are aimed at expediting the time taken for regularisation. Listed issuers are required to regularise within the prescribed time frames and extension of time would only be granted in exceptional circumstances. Key Changes The salient changes to the Listing Requirement are as follows: (a) Para 8.14 and 8.16 of the Listing Requirement, PN 4 and PN 10 are repealed. (b) The treatment for listed issuers with unsatisfactory financial condition and level of operations (excluding Cash Companies) will be the same and this has been provided under a new rule (para 8.14C of the Listing Requirement) and Practice Note (PN 17). The new requirements prescribe, inter alia, that: (i) (ii) Any listed issuer that triggers the criteria under para 2.1 of PN 17 shall comply with: - the obligation to regularise its financial condition within the prescribed time frame; and - the disclosure obligations which are the same as that provided under PN 4 but with some modification. An affected listed issuer that fails to comply with the obligation to regularise its financial condition within the prescribed timeline shall be suspended and de-listing procedures shall be commenced accordingly. (c) Requirements similar to PN 10 but with modifications will continue to apply to “Cash Companies” as provided under a separate new rule (para 8.14B of the Listing Requirement) and Practice Note (PN 16). Under these requirements, a Cash company is required to regularise its level of operations within the prescribed time frame, failing which such company may have its listed securities suspended and subsequently de-listing procedures commenced against the Cash Company. (d) As a transitional measure, listed issuers that triggered any of the criteria set out in paragraph 2.1 of PN 4 or fall within the ambit of PN 10 prior to the effective date of the said amendments (existing PN 4 and PN 10 companies) must continue to comply with para 8.14 of the Listing Requirements and PN 4 or paragraph 8.16 of the Listing Requirements and PN 10 respectively. Implementation The amendments took effect from January 3, 2005. The new framework shall only apply to listed issuers that trigger the revised criteria after the effective date. The new framework shall not apply to existing PN 4 and PN 10 companies. They will continue to be bound by para 8.14 of the Listing Requirements and PN 4 or para 8.16 of the Listing Requirements and PN 10 respectively. However, Bursa Securities will be adopting a stricter stance when considering any application for extension of time from such listed issuers. Extension of time will only be considered in exceptional circumstances. In conjunction with the said amendments, the PN 4 condition sector classification will be removed with effect from January 3, 2005. The existing PN 4 companies will be placed into their respective sectors prior to them triggering the PN 4 requirements. 2 III. Amendments to the Listing Requirements in Relation to Perusal of Draft Circulars and Other Documents Amendments have been made to the Listing Requirements for the Main Board and Second Board in relation to perusal by Bursa Securities of draft circulars and other documents to be issued by listed issuers to their securities holders. Consequent to the amendments, a new Practice Note 18/2005 (PN 18) has been issued pursuant to paragraph 2.08 of the Listing Requirements to address the following issues: The prescription of circulars which fall under the category of Exempt Circulars; The imposition of obligations in relation to the issuance of an Exempt Circulars; The prescription of circulars which fall within the Category of Limited Review Circulars; and An explanation of Bursa Securities’ regulatory approach to Limited Review Circulars. Key Changes The adoption of the new framework will result in the following: (a) Cessation of pre-vetting of certain circulars (Exempt Circulars). In this respect, a listed issuer will no longer be required to obtain the clearance of Bursa Securities for an Exempt Circular prior to its issuance pursuant to para 8.09 of the Listing Requirements. (b) Bursa Securities will continue to review all other circulars in the following manner: (i) A limited review will be conducted for circulars where disclosure is fairly standard (Limited Review Circulars). In conducting its review, Bursa Securities will only focus on key disclosure areas and not the entire circular. Bursa Securities may conduct a full review where it deems fit. Clearance of Bursa Securities for Limited Review Circulars is still required pursuant to para 8.09 of the Listing Requirements. (ii) A complete review will continue to be conducted for circulars which do not fall within the category of “Exempt” or “Limited Review” Circulars (NonRoutine Circulars). Clearance of Bursa Securities for Non-Routine Circulars is still required pursuant to para 8.09 of the Listing Requirements. With the changes in the regulatory approach, the following amendments have been made to the Listing Requirements: Amendment to para 8.09 of the Listing Requirements to reflect that clearance from Bursa Securities is no longer required for Exempt Circulars; A new provision imposing an obligation on the listed issuers to obtain shareholders’ approval for material amendments, variations or modifications to a proposal previously approved by shareholders except where such amendments, variations or modifications are made pursuant to a direction and/or condition imposed by the relevant authorities; and Secondary or additional amendments. 3 Implementation The amendments took effect from January 3, 2005. All draft circulars submitted to Bursa Securities on or before December 31, 2004 will still be subject to perusal by Bursa Securities. As such, clearance of Bursa Securities for such circulars must still be obtained pursuant to paragraph 8.09 of the Listing Requirements notwithstanding that such circulars may fall within the category of Exempt Circulars. IV. Cessation of Approval by Bursa Securities in Relation to the Issue and Listing of Securities on the MESDAQ Market Bursa Securities has ceased to approve the issue and listing of securities on the MESDAQ Market (cessation) with effect from January 1, 2005. In this regard, all applications for the issue and listing of securities on the MESDAQ Market or any appeals in relation to the same shall be made to and decided solely by the SC with effect from January 1, 2005. Bursa Securities will, however, continue to be the approving authority for admission to the Official List and quotation for trading of the securities on the MESDAQ Market. In order to give effect to the cessation, the Listing Requirements of the MESDAQ Market (MMLR) shall be applied with necessary modifications as directed by Bursa Securities. The MMLR is not being amended at this juncture to reflect the cessation as Bursa Securities is in the midst of revamping the MMLR. The changes to the MMLR arising from the cessation will be incorporated in the revamped MMLR. Implementation The cessation and the directive of Bursa Securities on the application of the existing requirements of the MMLR and the new requirements took effect from January 1, 2005. Unless otherwise notified by Bursa Securities in writing, all applications for issue and listing of securities on the MESDAQ Market or appeals in relation to the same, which have been submitted to Bursa Securities but for which decisions have not been communicated to the applicant companies by December 31, 2004, shall be solely decided by the SC. V. Amendments to the Listing Requirements for the Main Board and Second Board and MESDAQ Market (MMLR) in Relation to Employee Share Schemes Amendments have been made to para 6.30 E (b) of the Listing Requirements and Rule 3.14.5 (b) of the MMLR to allow listed issuers to make adjustments to the price or number of shares to be issued under an employee share scheme (ESOS) provided such adjustments are consistent with the provisions for adjustments under the by-laws of the scheme. 4 The formula for adjustments are expressly set out in the relevant documents for shareholders’ approval, which is in line with the current approach to adjustments in relation to warrants. Implementation The amendments took effect from January 10, 2005. VI. Amendments to the Listing Requirements in Relation to the Public Spread Requirement Amendments have been made to para 8.15(5) of the Listing Requirement to clarify that the provision applies to corporate proposals other than take-overs such as schemes of arrangement, amalgamation or reconstruction pursuant to section 176 of the Companies Act 1965. A new provision, para 8.15(6) of the Listing Requirement has been incorporated to clarify Bursa Securities’ current practice in relation to de-listing in situations where 90% or more of the listed issuer’s shares are held by a shareholder, either singly or jointly with its associates pursuant to a take-over or such other corporate proposals. Implementation The amendments took effect from January 10, 2005. VII. Amendments to Chapter 3 of the Listing Requirements for the Main Board and Second Board and Chapter 2 of the Listing Requirements for the MESDAQ Market in Relation to Transfers to the Main Board The above-mentioned amendments have been made in view of changes effected by the SC to its relevant Guidelines which allow for the MESDAQ Market and Second Board listed companies to transfer their listing to the Main Board based on, amongst others, the market capitalisation test. The amendments facilitate and expedite the process of transferring listing from the MESDAQ Market to the Main Board. Prior to the amendments, such companies would have had to apply to Bursa Securities for removal from the MESDAQ Market as well as for listing and quotation on the Main Board. Under the said amendments, companies are only required to apply for a transfer and provide additional disclosure where the transfer to the Main Board is based on the market capitalisation test. Implementation The amendments took effect from the date of Bursa Securities’ circular letter of February 15, 2005. VIII. Amendments to the Listing Requirements in Relation to Real Estate Investment Trusts Amendments have been made to the Listing Requirements for the Main Board and Second Board in relation to real estate investment trusts. The amendments have been made in view of and consequential to the issuance by the SC of the new Guidelines on Real Estate Investment Trusts (REITs Guidelines), which 5 supersede the SC’s earlier Guidelines on Property Trust Funds issued on November 13, 2002. Under the REITs Guidelines, property trust funds have been re-branded as real estate investment trusts or REITs. Accordingly, “property trust funds” are now referred to as “real estate investment trusts” under the Listing Requirements. Implementation The amendments took effect from April 6, 2005. Additional Information The amendments to the Listing Requirements are available for reference on the website of Bursa Malaysia at http://www.bursamalaysia.com. For further information or any enquiries on the amendments, kindly contact: Legal Advisory and Corporate Legal Affairs Bursa Malaysia Berhad 9th Floor Exchange Square Bukit Kewangan, 50200 Kuala Lumpur Tel: 03-20347000 Fax: 03-22730065 Contact Persons Ms Emilia Tee (Ext 7335) Ms Yew Yee Tee (Ext 7336) Ms Lai Fui Sim (Ext 7079) Ms Boo Huey Fang (Ext 7019) Ms Tan Ai Chia (Ext 7089) Ms Anisah Suyuti Low (Ext 7295) Ms Noraishah Ismail (Ext 7297) TAN SHOOK KHENG (Ms) Secretary 6