Population by Type of Locality

advertisement

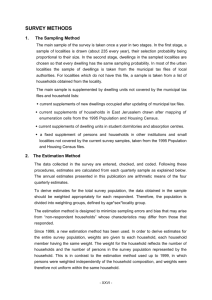

CBS, STATISTICAL ABSTRACT OF ISRAEL 2010 5 שנתון סטטיסטי לישראל,למ''ס HOUSEHOLDS AND FAMILIES LABOUR FORCE SURVEYS HOUSEHOLDS AND FAMILIES - DEMOGRAPHIC CHARACTERISTICS (Tables 5.1-5.13) The estimates for households and families are obtained from current labour force surveys. For a description of the survey, see the Introduction to Chapter 12 - Labour and Wages. DEFINITIONS Population of households: The tables refer to all households, with the exception of households in kibbutzim, institutions, students’ dormitories and people living outside localities (Bedouins in the South and others) (see Table at the end of the Introduction). A household is defined as one person or a group of persons living together in one dwelling on a permanent basis most of the week, who have a common expense budget for food. A household may include persons who are not a family. Size of household is determined by the number of persons in the household, according to the above definition. Type of household is determined by the relationships between the persons residing in the household, as well as by other demographic variables. Type of household includes family households and non-family households. The data according to this variable have been published since 1997. A family household is a household that contains at least one “family”. A “family household” can include: one family, one family with other persons, or two families or more. A non-family household includes one person only or a group of persons who are not a family. Children up to age 17 in a household includes all children up to age 17 (inclusive) in a household. Does not include persons aged 15-17 in the HOUSEHOLDS AND FAMILIES 2010 )42( household who have partners and/or children of their own. Family: A nuclear family of two persons or more who share the same household and are related to one another as husband and wife, as an unmarried couple, or as parent and child. Thus, a family can be only a couple, a couple with children (in various age groups, defined by the age of the youngest child), or a single parent with children. A single-parent family includes also families in which the parent is married but the spouse does not reside in the household most of the week or does not belong to the survey population. A “family” also includes a family of grandparents with grandchildren aged 15 and over without parents, or only siblings aged 15 and over who live together without spouses or children. Family size is determined by the number of persons in the family, as defined above. Other persons in the household: Persons without a family of their own, who live in a household together with a “family” that is not their nuclear family. Religion and Population group: The head of the household is the only household member who is questioned regarding his religion. The head of the household’s religion is registered as the religion of all the members of the household. The classification according to religion includes: Jews, Moslems, Christians, Druze and other religions (other religions also include no religion or religion unknown). The category “Other Religions” includes all those who replied that they are not Jews. Until the beginning of the 1990s, “Other Religions” mainly included Arabs. Following the wave of immigration in the 1990s, the population group “Others” was added to this category (see below). As of 2002, this group was divided into two population groups: - “Arabs”: a. live in non-Jewish localities, or b. live in Jewish or mixed localities, משקי בית ומשפחות were born in Israel or arrived in Israel before 1990. - “Others”: live in Jewish or mixed localities, and arrived in Israel in 1990 and after. District: See the definition of district and sub-district in the paragraph “Labour Force Surveys - Households - Economic Characteristics and Housing” below. Continent of origin: For those born abroad, the continent of birth was recorded; for those born in Israel - the father’s continent of birth. Highest diploma received: See definition in the Introduction to Chapter 12 - Labour and Wages. For additional weighting groups. The main change was to break the weighting group of the immigrants, which now includes only immigrants residing up to 4 years in the country, see Introduction to Chapter 12 Labour and Wages. The sampling errors for the estimates in tables 5.1-5.13 were calculated for each of the estimates separately. Until 2005, calculation of the sampling errors for the estimates was based on the assumption that the demographic characteristics of households do not change during the course of a year, and that those characteristics remain constant during the different quarters of a given year. As of 2006, the method of calculation was changed. The new method includes a calculation of the correlations of the demographic characteristics of households between every two quarters of a year, for households in which data were collected for two quarters in the course of a given year. To caution the reader against data with low levels of reliability, estimates with a relative sampling error (sampling error divided by the estimate) ranging from 25% to 40% are set in parentheses. For estimates with a relative sampling error exceeding 40% no numerical values are presented and two dots (“..”) are indicated in their place. Regarding tables 5.14-5.25, calculations of the sampling error are approximate. Therefore, data based on a population estimate below 3,000 are set in parentheses, see explanation in Chapter 12 - Labour and Wages. explanations, see definitions of Levels of education in the Introduction to Chapter 8 - Education. Type of locality by which data are classified is the permanent type of locality (see definitions in “Geographical Distribution of the Population” in the introduction to Chapter 2 - Population). Since 2002, localities have been classified according to the type of locality as determined according to population estimates at the end of 2001, as of 2007, the classification is based on estimates of population size at the end of 2005. Development localities: See definition in the Introduction to Chapter 12 - Labour and Wages. ESTIMATION For each of the estimates presented here, a “weighting coefficient” was determined for each household participating in the sample. This coefficient reflects the number of units in the survey population represented by each unit in the sample. The “weighting coefficient” was identical for each of the “households” “families”, “couples”, and “persons” in the same household. The “weighting coefficient” system is determined through an iterative process, so that after the “weighting” there is a correlation between the distribution of persons in the sample households by primary variables and the corresponding distribution of persons by current demographic estimates. For more details about methods of collecting, processing and estimation, see Introduction to Chapter 12 - Labour and Wages. In 2002, a number of changes were introduced in the definitions of the HOUSEHOLDS AND FAMILIES )43( משקי בית ומשפחות aged 18 or over (except households where the only wage earner is aged 15-17 and households where there are only 1517 year old persons). Working age: Men aged 15-64; women aged 15-59. As of 2009: Men aged 15-66; women aged 15-61. LABOUR FORCE SURVEYS HOUSEHOLDS - ECONOMIC CHARACTERISTICS AND HOUSING (Tables 5.14-5.25) DEFINITIONS AND EXPLANATIONS Population of households - see above definition. The investigation unit is a household. Household : See above definition. Size of household: See above definition. Characteristics of the labour force: The labour force includes persons aged 15 and over who were employed (incl. permanent army) or unemployed during the determinant week. In this chapter, employed persons are divided according to the extent to which they usually work: - Usually employed full time: Employed persons usually working 35 or more hours a week, including those who belong to the permanent army. - Usually employed part time: Employed persons usually working up to 34 hours a week. For further details, see the Labour Force Surveys and the paragraph “Employed, Employees/Jobs, Employee Jobs” in the Introduction to Chapter 12 - Labour and Wages. Head of household is the economic head of household. As of 1995, the definition of head of household was changed and determined by the degree of belonging to the labour force, without regard of age or sex. - The head of household is the main wage earner of the household, i.e., an employed person who usually works 35 or more hours per week (including soldiers in the permanent army), and precedes an employed person who works up to 34 hours a week, who precedes an unemployed person. - If more than one person in the household fits the definition of head of household, the head is determined by the interviewee. - If there is no wage earner in the household, the head of household is determined by the interviewee. Household with working age persons: A household with at least one person of working age. Household with persons over working age only (pensioners): Persons entitled to old age pensions from the National Insurance Institute. Number of rooms in the dwelling: All rooms used by the household as living quarters. The following were not included in the number of rooms: kitchens, bathrooms, toilets, verandas, rooms used for business purposes or for work only and rooms let to tenants. Until 1979, half a room was counted as a room. In January 1980, a full registration of rooms and half rooms was made, and consequently, 1980 data were processed twice. Number of persons per room (housing density) was calculated by dividing the number of persons who live in the household by the total number of rooms occupied by members of the household. Religion and Population group: see above definition. Type of locality: see above definition. Development localities: see definition in the Introduction to Chapter 12 - Labour and Wages. District and sub-district were defined according to the official administrative division of the state, which includes 6 districts and 15 sub-districts. As of 1972, Judea, Samaria and the Gaza Areas were added, in order to characterize the Israeli localities in those areas. The data for 2005 relate to the residents of the Judea, Samaria and Gaza Areas, and do not reflect changes in the population following the evacuation of the Israeli localities in the Gaza Area and in northern Samaria under the Disengagement Plan Law, 2005. As of 2006 - Judea and Samaria Area. Note: The head of household is a person HOUSEHOLDS AND FAMILIES )44( משקי בית ומשפחות See definition in the Introduction to Chapter 2 - Population. conducted annually. The population: As of 1997, includes the entire urban and rural population, excluding kibbutzim, collective moshavim, and Bedouins living outside localities (see table at the end of the Introduction). DEFINITIONS AND EXPLANATIONS Household: See definition above. Components of the budget in the Household Expenditure Survey: All the goods and services are divided into ten main items: food (excl. fruit, vegetables); vegetables and fruit; housing; dwelling and household maintenance; furniture and household equipment; clothing and footwear; health; education, culture and entertainment; transport and communications; miscellaneous goods and services. Within each item there is a division into sub-groups, and each subgroup contains the goods and services as reported by the households, e.g., Health is divided into four sub-groups: health insurance, dental treatment, health services and other health expenditures. Each such sub-group contains single products, e.g., Health insurance includes supplementary insurance in all of the various health funds, as well as other health insurance policies. Earner: A person who worked for pay at least one day during the three months before the interviewer’s visit to the household. It should be mentioned that this definition differs from the one used in the Labour Force Surveys. Deciles: See definition below in the explanations on income surveys. Standard person: see definition below in the explanations on income surveys. Net income per standard person: The total current financial income of a household, after deduction of compulsory payments; and the household’s total income from services provided as a result of ownership of a dwelling or vehicle; divided by the number of standard persons in the household. Compulsory payments: Direct taxes imposed on current income, i.e., Income Tax, National Insurance, and National Health Insurance. These payments were calculated according to the tax rules operating in the economy, and were not obtained directly from households. SOURCES Data on households by economic characteristics and housing are annual averages obtained from the current investigations of the Labour Force Surveys, and they relate to all of the households in the country (excluding kibbutzim, institutions, students’ dormitories, and people living outside localities (Bedouins in the South and others). Data on housing also exclude absorption centers. As of 1999, population estimates obtained from the Labour Force Surveys have been based on the results of the 1995 Census of Population and Housing. In addition, a new weighting method has been implemented. Data for 1998 were processed according to the new system in order to enable comparison with the 1999 data. As of 2002, a number of changes have been made in the weighting groups. The data for 2001 were processed according to the “new” method, in order to make it possible to compare them with data from 2002. For additional details, see Introduction to Chapter 12, Labour and Wages. HOUSEHOLD EXPENDITURE SURVEY, 2008 (Tables 5.26-5.29 and 5.33-5.35) The purposes and the uses of the survey are to obtain the components of household budget and additional data used for characterizing the living conditions of households in aspects such as: consumption patterns, standard and composition of nutrition, income level and its composition, housing conditions, models for forecasting consumer behaviour, and the incidence of the indirect tax on various groups in the population. One of the most important purposes of the survey is to determine the “weight” for the basket of the consumer price index. The survey was first conducted at the beginning of the 1950s, and until 1997 was conducted approximately every five years. Since 1997, the survey has been HOUSEHOLDS AND FAMILIES )45( משקי בית ומשפחות Compulsory payments are included in non-consumption expenditures. Consumption expenditure: All household payments for the purchase of goods or services, as well as the imputation of expenditure on the consumption of housing services and vehicles (the purchase of which is defined as investment and not as consumption). Expenditures on housing services were calculated by imputation of alternative rent payments for dwellings of the same size in the same locality or region. The imputation data for rent were obtained from three sources: (1) The current rent survey conducted in the framework of the Consumer Price Index; (2) Rent data for households residing in rented dwellings, from the household expenditure survey itself; (3) External sources. For key money dwellings, the difference between the actual rent paid and the full rent value was imputed, on the basis of the values obtained from the sources mentioned above. Expenditures for vehicle services were estimated according to the value of the services deriving from the asset. For example, for every household that owns a car, the value of services deriving from the asset is estimated according to the value of its depreciation and the alternative interest that was imputed also as income for that household. Purchase of products: A product is considered purchased according to the day in which it was received and the full sum of purchase is considered an expenditure on product when the product reaches the dwelling, even if it was only partially paid for at the time. Therefore, money paid in advance by the household for a product or a service not yet received or debts paid for a product that is already in the dwelling are not considered as consumption expenditures but as an increase in savings. Compulsory payments are not included, because they don’t represent direct purchase of a given product or service. Money consumption expenditure: consumption expenditures as defined above, without imputation of services on housing and vehicles. HOUSEHOLDS AND FAMILIES Ownership of durable goods: the percentage of households in a given group that own or have at their disposal durable goods such as: the percentage of households in Jerusalem that have a washing machine, colour TV, personal computer, car, mobile phone, etc. SOURCES The survey data on expenditures were obtained from the investigation of a sample of 5,971 households in 171 localities which were investigated for a year, in the period between January 2008 and January 2009. Data on income are based on the combined sample of the income survey and household expenditures survey (an explanation of the income survey sample is presented below). Sampling framework: Arnona [municipal property tax] lists of the local authorities were used as the framework for drawing the sample. Completion was made from a framework of new building. Sampling unit: residential dwelling. Investigation unit: a ‘household’ (see definition above, in the paragraph “Labour Force Surveys Households Demographic Characteristics”. METHOD OF INVESTIGATION AND PROCESSING Three questionnaires were filled in for each household investigated: 1. A questionnaire on the composition of the household which was filled in by the interviewer. The questionnaire contains demographic and basic economic data for each household member. 2. A biweekly ledger in which the household recorded the daily expenditures of all household members for two weeks. 3. A summary questionnaire in which the interviewer recorded details of household expenditures over the last three months or 12 months preceding the interview. In this questionnaire, data on all household incomes were also obtained. All the budget components for each household were expressed in terms of a common denominator: a monthly estimate at a uniform price level reflecting the average for the 2008 survey period. That )46( משקי בית ומשפחות average was 124.0 points, according to the base 1998=100. Estimation: The survey used weighting coefficients in order to minimize, to the extent possible, sampling errors, as well as biases that may result from the fact that the characteristics of households that did not participate in the survey may differ from those of the participating households. For an explanation of the weighting coefficients, see the above section on demographic characteristics. Details on the Household Expenditure Survey can be found in Publication no. 1404, Household Expenditure Survey 2008, General Summary (see the list below). household is not working: households where the head of the household did not work for even one day over the three months preceding the visit of the interviewer. Employee: Any survey participant who had some salaried income over the three months preceding the visit of the interviewer. Gross money income of households: The total current money income of the household before deduction of compulsory payments (income tax, National Insurance, and Health Insurance). Gross money income includes income of all household members from salaried or self employed, property, interest, dividends, current income from support and pensions, or any other income. Gross money income does not include non-recurrent payments (e.g., inheritance, severance pay from the place of work, restitution from Germany, etc). Nor does it include imputations for income from use of own dwelling or other types of income in kind. Net money income: Gross money income after deduction of compulsory payments. Data on net income were not obtained directly from the households surveyed, but were calculated on the basis of gross income and the tax rules as applied in Israel. Standard person: the size of a household affects the level of living that can be maintained on a given income. In order to provide a basis for comparing the level of living of households with varying numbers of members, they are usually classified by income per person. It is also assumed that the number of household members does not have a uniform impact on the potential level of living that can be attained from a given income. Accordingly, there are advantages to a large household. Therefore the number of household members was weighted into a uniform scale. The scale establishes the twoperson household as a base unit. The larger the number of household members, the smaller the marginal influence of each additional person. Based on this scale, the number of persons in a household is expressed in terms of standard persons per household. The full scale is presented in the following table. INCOME SURVEYS (Tables 5.30 -5.32) The data presented here were obtained from income surveys. The surveys have been conducted regularly since 1965 as part of the Labour Force Survey. As of 1997, income data obtained from two surveys - the Labour Force Survey and the Household Expenditure Survey - have been combined into one combined Income Survey (see the “Sample” paragraph in the “Sources” section at the end of this chapter.) The findings relate to the income of households, where the head of the household was an employee, selfemployed, or not working. More detailed results of the Income Surveys and a comprehensive description of the methods and definitions used can be found in Publication no. 1403, Income Survey 2008. DEFINITIONS AND EXPLANATIONS Household: See definition above, in the paragraph “Labour Force Surveys Households Demographic Characteristics”. Earner: See definition above, in the paragraph “Household Expenditure Survey”. Head of household: See definition above, in the paragraph “Labour Force Surveys Households - Economic Characteristics and Housing” Households of employees: households where the head of the household is an employee or member of a cooperative. Households where the head of the HOUSEHOLDS AND FAMILIES )47( משקי בית ומשפחות Actual number of persons in household Marginal Weight per Person No. of Standard Persons 1 person 1.25 2 persons 0.75 3 persons 0.65 4 persons 0.55 5 persons 0.55 6 persons 0.50 7 persons 0.50 8 persons 0.45 9+ persons 0.40(1) (1) For each additional person. 1.25 2.00 2.65 3.20 3.75 4.25 4.75 5.20 Force Surveys 2008). One-fourth of the participants in the labour force survey sample that are included in the definition of the Income Survey were asked about their income. 2. Household Expenditure Survey (details of the sampling procedure appear also in Publication no. 1404, Household Expenditure Survey 2008, General Summary, Jerusalem, 2010) - conducted annually as of 1997. In the survey, household members are asked about their expenditures as well as their income. In both surveys, the survey sample is a dwelling sample. In each dwelling selected for the sample, all of the households residing in the same dwelling were surveyed (in most cases, there was one household per dwelling). In general, the samples of both surveys were drawn in two stages: in the first stage, a stratified sample of localities was drawn. In the second stage, a systematic random sample of households was drawn in each of the localities selected for the sample. The main source for drawing the sample of dwellings was the municipal property tax file of the local authority. The main dwelling samples were supplemented by samples of dwelling units in student dormitories, absorption centers, and sheltered housing for the elderly. In addition, the samples were updated during the course of the survey year, as new apartments were selected for the sample were added from a special framework of new construction. In 2008, the data were based on a sample of 14,167 households - 8,196 were taken from the income survey, and 5,971 were taken from the household expenditures survey. The survey period: The Income Survey examines the income of each individual aged 15 and over during the three months preceding the interviewer’s visit. In this way, every annual survey examines the quarterly income of the survey population over a period of 15 months. The Household Expenditure Survey is conducted for a period of 13 months, during which data are collected on the income of every household member aged 15 and over, and on the income of each household. Here, too, the survey Net income per standard person: The net household income is divided by the number of standard persons in the household. Decile: A decile is a group including 10 percent of the surveyed population, arranged by income level (the classifying income), from households with the lowest income levels to households with the highest income levels (the top decile). The income used to classify households can be either gross or net, per household, per capita, or per standard person. Gini coefficient: A measure of inequality in income distribution, ranging from 0 (“complete equality”) to 1 (“maximum inequality”). SOURCES The population: The combined survey conducted as of 1997 represents all of the residents of Israel in Jewish localities, non-Jewish localities, and mixed localities - excluding kibbutzim and Bedouins living outside of localities. In 2000-2001, there were problems investigating the population of East Jerusalem. Therefore, the latest data do not include that population (see table at the end of the Introduction). The sample: As of 1997, the Income Survey is based on income data collected both in the Income Survey and in the Household Expenditure Survey: 1. The Income Survey was conducted together with the regular Labour Force Survey (for details on the sampling procedures, see Chapter 12, “Labour and Wages”, and see publication no. 1377 of the Central Bureau of Statistics series Labour HOUSEHOLDS AND FAMILIES )48( משקי בית ומשפחות examines income of each household during the three months preceding the month of the interviewer’s visit, and the income data collected over the entire survey for each household over a period of 15 months. Adjustment of prices: All of the income data are presented according to the average level of prices during the survey year. Estimation: See above, in the section on demographic characteristics of households. Table of Populations Included in Estimates of Households in Household Surveys(1) Population Labour Force Surveys Population by Type of Locality: Urban localities (2,000 or more residents) Rural localities (up to 2,000 residents): Kibbutzim Other rural localities (including moshavim, collective moshavim, community localities, etc.) Special Populations: Bedouins in the south living outside of localities Places, living outside of localities (excluding Bedouins in the south) and households in institutional localities Institutions Absorption centers(2) Student dormitories at the 7 major universities Sheltered housing(3) Other institutions(4): Residents of institutions (protected residents, patients) Households in institutions Household Expenditure Survey and Income Survey Yes Yes No No Yes Yes )excl. collective moshavim) No No No Yes Yes No Yes Yes Yes Yes No No No Yes 1. The discrepancy between household estimates in the Labour Force Survey, Household Expenditure Survey, and Income Survey amounts to about 20,000 households. Of those, about 10,000 are households in institutions, about 7,000 households are in student dormitories, and about 3,000 households are in places, or living outside of localities, or in institutional localities. 2. Housing density estimates: absorption centers are included in the Household Expenditure Survey, and are not included in the Labour Force Surveys. 3. Only some of the population living in sheltered housing is included in the Labour Force Surveys. 4. Includes student dormitories in colleges, hospitals, old age homes without sheltered housing, schools, etc. HOUSEHOLDS AND FAMILIES )49( משקי בית ומשפחות SELECTED PUBLICATIONS TECHNICAL SERIES 73 Typology of Households and Families in Israel, 1999 78 Labour Force Surveys - Changes in the Methodology, in the Definitions, and in the Questionnaire 1954-2003 (Internet only) SPECIAL PUBLICATIONS 1222 Characteristics and Classification of Local Authorities by the SocioEconomic Level of the Population 2001 1231 Household Expenditure Survey 20002002: Households of Immigrants from the USSR (Former) 1308 Arab Households: Income and Expenditures 2006 1376 Households Economic Characteristics and Housing Density Based on Labour Force Surveys 2008 (Internet only) HOUSEHOLDS AND FAMILIES )50( 1377 1400 1403 1404 Labour Force Surveys 2008 (Internet only) Households and Families Demographic Characteristics 20072008, Based on Labour Force Surveys (Internet only) Income Survey, 2008 Household Expenditure Survey, 2008, General Summaries CENSUS OF POPULATION AND HOUSING 1995 1 Population and Household Provisional Results 8a Socio-Economic Characteristics of Population and Households in Localities with 2,000 Inhabitants and More - Selected Findings (Hebrew only) משקי בית ומשפחות