Solutions to Cases

advertisement

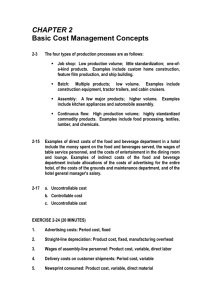

SELECT SOLUTIONS CH.2 EXERCISE 2-24 (20 MINUTES) 1. Advertising costs: Period cost, fixed 2. Straight-line depreciation: Product cost, fixed, manufacturing overhead 3. Wages of assembly-line personnel: Product cost, variable, direct labor 4. Delivery costs on customer shipments: Period cost, variable 5. Newsprint consumed: Product cost, variable, direct material 6. Plant insurance: Product cost, fixed, manufacturing overhead 7. Glass costs: Product cost, variable, direct material 8. Tire costs: Product cost, variable, direct material 9. Sales commissions: Period cost, variable 10. Wood glue: Product cost, variable, either direct material or manufacturing overhead (i.e., indirect material) depending on how significant the cost is 11. Wages of security guards: Product cost, variable, manufacturing overhead 12. Salary of financial vice-president: Period cost, fixed EXERCISE 2-25 (10 MINUTES) The general formula for solving all three cases is as follows: Beginning inventory of finished goods + Cost of goods manufactured during period – Ending inventory of = finished goods Cost-ofgoods sold expense EXERCISE 2-25 (CONTINUED) Using this formula, we can find the missing amounts as follows: I Beginning inventory of finished goods ............... $ 21,000* Add: Cost of goods manufactured ....................... 104,750 Subtract: Ending inventory of finished goods .... 24,500 Cost of goods sold ................................................ $101,250 Case II $ 18,000 142,500 12,000 $148,500* III $ 3,500 159,000* 10,500 $152,000 *Amount missing in exercise. EXERCISE 2-26 (10 MINUTES) 1. Hours worked ........................................................................................................ Wage rate .............................................................................................................. Total compensation .............................................................................................. 2. Classification: Direct labor (36 hours $16) .......................................................................... Overhead (idle time: 4 hours $16) .............................................................. Total compensation ........................................................................................ 40 $ 16 $640 $576 64 $640 EXERCISE 2-27 (10 MINUTES) 1. Regular wages (40 hours $17) ....................................................................... Overtime wages (3 hours $22)....................................................................... Total compensation ........................................................................................... 2. Overtime hours .................................................................................................. Overtime premium per hour ($22 $17) .......................................................... Total overtime premium .................................................................................... 3. Classification: Direct labor (43 hours $17) ....................................................................... Overhead (overtime premium: 3 hours $5) ............................................. Total compensation ..................................................................................... EXERCISE 2-28 (25 MINUTES) 1. ALHAMBRA ALUMINUM COMPANY $ 680 66 $ 746 3 hrs. $ 5 $ 15 $ 731 15 $ 746 SCHEDULE OF COST OF GOODS MANUFACTURED FOR THE YEAR ENDED DECEMBER 31, 20X1 Direct material: Raw-material inventory, January 1 ........................................ Add: Purchases of raw material ............................................. Raw material available for use ............................................... Deduct: Raw-material inventory, December 31..................... Raw material used ................................................................... Direct labor.................................................................................... Manufacturing overhead: Indirect material ...................................................................... Indirect labor ........................................................................... Depreciation on plant and equipment ................................... Utilities ..................................................................................... Other ........................................................................................ Total manufacturing overhead ............................................... Total manufacturing costs ........................................................... Add: Work-in-process inventory, January 1 ............................... Subtotal ......................................................................................... Deduct: Work-in-process inventory, December 31 .................... Cost of goods manufactured ....................................................... 2. $ 55,000 240,000 $295,000 75,000 $220,000 420,000 $ 12,000 22,000 110,000 23,000 35,000 202,000 $842,000 110,000 $952,000 125,000 $827,000 ALHAMBRA ALUMINUM COMPANY SCHEDULE OF COST OF GOODS SOLD FOR THE YEAR ENDED DECEMBER 31, 20X1 Finished-goods inventory, January 1 ........................................................... Add: Cost of goods manufactured ................................................................ Cost of goods available for sale .................................................................... Deduct: Finished-goods inventory, December 31........................................ Cost of goods sold ......................................................................................... $160,000 827,000 $987,000 155,000 $832,000 EXERCISE 2-28 (CONTINUED) 3. ALHAMBRA ALUMINUM COMPANY INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 20X1 Sales revenue ................................................................................................. Less: Cost of goods sold ............................................................................... Gross margin .................................................................................................. Selling and administrative expenses ............................................................ Income before taxes ....................................................................................... Income tax expense (at 35%) ......................................................................... Net income ...................................................................................................... $1,210,000 832,000 $ 378,000 105,000 $ 273,000 95,550 $ 177,450 4. The electronic version of the Solutions Manual “BUILD A SPREADSHEET SOLUTIONS” is available on your Instructors CD and on the Hilton, 8e website: www.mhhe.com/hilton8e EXERCISE 2-30 (15 MINUTES) Number of Muffler Replacements 600 700 800 Total costs: Fixed costs .................................................................. Variable costs .............................................................. Total costs ............................................................. Cost per muffler replacement: Fixed cost .................................................................... Variable cost ................................................................ Total cost per muffler replacement ...................... *Rounded. (a) $56,000 (c) 24,000 (e) $80,000 $56,000 28,000 $84,000 (b) $56,000 (d) 32,000 (f) $88,000 (g) $ 93.33 * (h) $ 80 (j) 40.00 (k) 40 (m) $133.33 (n) $120 (i) $ 70 (l) 40 (o) $110 EXERCISE 2-30 (CONTINUED) Explanatory Notes: (a) Total fixed costs do not vary with activity. (c) Variable cost per replacement = $28,000/700 = $40 Total variable cost for 600 replacements = $40 600 = $24,000 (g) Fixed cost per replacement = $56,000/600 = $93.33 (rounded) (j ) Variable cost per replacement = $24,000/600 = $40 EXERCISE 2-31 (5 MINUTES) Thomas Cleverly’s expenditure is a sunk cost. It is irrelevant to any future decision Cleverly may make about the land. EXERCISE 2-32 (15 MINUTES) 1. Phone bill, January: $200 + ($.15 7,000) ........................................ Phone bill, February: $200 + ($.15 8,000) ....................................... $1,250 $1,400 2. Cost per call, January: $1,250/7000 ................................................... Cost per call, February: $1,400/8000 ................................................. $ .179 (rounded) $ .175 3. Fixed component, January ................................................................. Variable component, January: $.15 7,000 ...................................... Total ..................................................................................................... $ 200 1,050 $1,250 4. Since each phone call costs $.15, the marginal cost of making the 7,001st call is $.15. 5. The average cost of a phone call in January (rounded) is $.179 ($1,250/7,000). EXERCISE 2-33 (5 MINUTES) 1. The $12,500 is the opportunity cost associated with using the computer in the Department of Education for work in the governor's office. 2. The $12,500 leasing cost should be assigned to the governor's office. It was incurred as a result of activity in that office. EXERCISE 2-34 (10 MINUTES) 1. Your decision to see the game really cost you $100, the amount forgone when you refused to sell the ticket. A convenient way to think about this is as follows: You could have sold the ticket for $100, thereby resulting in a profit on the deal of $25 ($100 sales proceeds minus $75 out-of-pocket purchase cost). Instead, you went to the game, which left you relieved of your $75 out-of-pocket cost. The difference between the $75 reduction in your wealth and the $25 profit you could have had is $100. Thus, $100 is the true cost of going to the game. 2. The $100 is an opportunity cost. At the time you made the decision to attend the game, the $75 you actually had paid for the ticket is a sunk cost. It is not relevant to any future decision. EXERCISE 2-35 (5 MINUTES) Annual cost using European component: $9,100 15 ............................................ Annual cost using Part A200: ($4,900 + $650) 15 .................................................. Annual differential cost .............................................................................................. $136,500 83,250 $ 53,250 EXERCISE 2-36 (15 MINUTES) 1. The marginal cost of a flight would include the aircraft fuel, wages of the flight crew and airport maintenance personnel, and the food and beverages consumed by the passengers and crew. 2. The marginal cost would include the additional wages or commissions earned by the agency employees and the additional electricity used for light, heat, and computer equipment. 3. The marginal cost of the skis would include the direct material. It is unlikely that labor and other costs would change with the addition of only one more product unit. EXERCISE 2-36 (CONTINUED) 4. The marginal cost would include any food and beverages consumed by the passenger and perhaps an imperceptible increase in fuel costs. 5. In most cases, only the cost of the food and beverage consumed by the customer would be a marginal cost. It is unlikely that the restaurant would need to employ additional service personnel, dishwashers, and so on. solutions to Problems PROBLEM 2-37 (25 MINUTES) 1. a. Total prime costs: Direct material ................................................................................... Direct labor: Wages ............................................................................................ Fringe benefits .............................................................................. Total prime costs .............................................................................. b. $ 57,500 70,000 22,500 50,000 15,000 4,500 27,500 20,000 $ 267,000 Total conversion costs: Direct labor ($242,500 + $47,500) ..................................................... Manufacturing overhead .................................................................. Total conversion costs ..................................................................... d. 242,500 47,500 $ 1,340,000 Total manufacturing overhead: Depreciation on factory building ..................................................... Indirect labor: wages ........................................................................ Production supervisor's salary ........................................................ Service department costs ................................................................ Indirect labor: fringe benefits........................................................... Fringe benefits for production supervisor ...................................... Total overtime premiums paid ......................................................... Cost of idle time: production employees ........................................ Total manufacturing overhead ......................................................... c. $ 1,050,000 $ 290,000 267,000 $ 557,000 Total product costs: Direct material ................................................................................... Direct labor ........................................................................................ Manufacturing overhead .................................................................. Total product costs ........................................................................... $1,050,000 290,000 267,000 $1,607,000 PROBLEM 2-37 (CONTINUED) e. Total period costs: Advertising expense ......................................................................... Administrative costs ......................................................................... Rental of office space for sales personnel ..................................... Sales commissions ........................................................................... Product promotion costs ................................................................. Total period costs ............................................................................. 2. $ 49,500 75,000 7,500 2,500 5,000 $ 139,500 The $7,500 in rental cost for sales office space is an opportunity cost. It measures the opportunity cost of using the former sales office space for raw-material storage. Solutions to Cases CASE 2-59 (50 MINUTES) 1. a. The previous purchase price of the endor on hand, $10.00 per gallon, and the average cost of the endor inventory, $9.50 per gallon, are sunk costs. These costs were incurred in the past and will have no impact on future costs. They cannot be changed by any future action and are irrelevant to any future decision. Although the current price of endor is $11.00 per gallon, no endor will be purchased at this price. Thus, it too is irrelevant to the current special order. If the order is accepted, the required 900 gallons of endor will be replaced at a cost of $11.50 per gallon. Therefore, the real cost of endor for the special order is $10,350 (900 $11.50). b. The $40,000 paid by Alderon for its stock of tatooine is a sunk cost. It was incurred in the past and is irrelevant to any future decision. The current market price of $22 per kilogram is irrelevant, since no more tatooine will be purchased. If the special order is accepted, Alderon will use 1,400 kilograms of its tatooine stock, thereby losing the opportunity to sell its entire 1,900kilogram stock for $28,000. Thus, the $28,000 is an opportunity cost of using the tatooine in production instead of selling it to Solo Industries. Moreover, if Alderon uses 1,400 kilograms of tatooine in production, it will have to pay $2,000 for its remaining 500 kilograms to be disposed of at a hazardous waste facility. This $2,000 disposal cost is an out-of-pocket cost. The real cost of using the tatooine in the special order is $30,000 ($28,000 opportunity cost + $2,000 out-of-pocket cost). CASE 2-59 (CONTINUED) 2. a. CopyFast Company would be indifferent to acquiring either the small-volume copier, 1500S, or the medium-volume copier, 1500M, at the point where the costs for 1500S and 1500M are equal. This point may be calculated using the following formula, where X equals the number of copies: (Variable costS X) + fixed costS = (variable costM X) + fixed costM 1500S 1500M $.07X + $4,000 = $.045X + $5,500 $.025X = $1,500 X = 60,000 copies The conclusion is that the company would be indifferent to acquiring either the 1500S or 1500M machine at an annual volume of 60,000 copies. b. A decision rule for selecting the most profitable copier, when the volume can be estimated, would establish the points where management is indifferent to each machine. The volume where the costs are equal between alternatives can be calculated using the following formula, where X equals the number of copies: (Variable costS X) + fixed costS = (variable costM X) + fixed costM For the 1500S machine compared to the 1500M machine: 1500S 1500M $.07X + $4,000 = $.045X + $5,500 $.025X = $1,500 X = 60,000 copies For the 1500M machine compared to the 1500L machine: 1500M 1500L $.045X + $5,500 = $.025X + $10,000 $.02X = $4,500 X = 225,000 copies CASE 2-59 (CONTINUED) The decision rule is to select the alternative as shown in the following chart. Anticipated Annual Volume 060,000 60,000225,000 225,000 and higher 3. Optimal Model Choice 1500S 1500M 1500L The projected donations from the wildlife show amount to $200,000 (10 percent of the TV audience at $20,000 per 1 percent of the viewership). The projected donations from the manufacturing series amount to $150,000 (15 percent of the TV audience at $10,000 per 1 percent of the viewership). Therefore, the differential revenue is $50,000, with the advantage going to the wildlife show. However, if the manufacturing show is aired, the station will be able to sell the wildlife show to network TV. Therefore, airing the wildlife show will result in the incurrence of a $50,000 opportunity cost. The conclusion, then, is that the station's management should be indifferent between the two shows, since each would generate revenue of $200,000. Wildlife show (10 $20,000) $200,000 donation Manufacturing show (15 $10,000) Manufacturing show (sell wildlife show) $150,000 donation 50,000 sales proceeds $200,000 total revenue