New Personal Banking Code Guidance for opening Basic Bank

advertisement

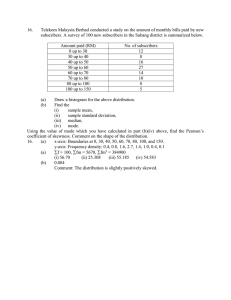

New Personal Banking Code Guidance for opening Basic Bank Accounts Please note: The following new Guidance has been added under Section 3.1 of the Banking Code and applies to the opening process for Basic Bank Accounts only. This new Guidance does not replace any existing provisions within the Code and/or Guidance. Availability of literature Subscribers who provide front of house literature for their current account range should ensure that such literature includes reference to the availability of the subscriber’s Basic Bank Account (if they have one), and how to get further information. This reference might take the form of a separate piece of literature or text within an existing leaflet. ID + V Where possible, subscribers should normally verify ID in branch for Basic Bank Account applications. If a subscriber operates a central account-opening service, it should offer the option for certified copies of ID&V documents to be sent to the central unit rather than original documents. Account opening timescale A Basic Bank Account should take no longer than 10 working days to become operational. The 10 working days are counted from the date the customer’s application is approved, i.e. once any necessary identification and address validation checks have been completed. ‘Operational’ means the ability to pay into and make withdrawals from the account (i.e. via a branch counter or an ATM) Notes on the new Guidance Availability of literature This Guidance is intended to ensure that where front of house literature for current accounts is displayed, reference is made to the availability (where applicable) of a Basic Bank Account. Such literature should also signpost where customers can get further information – although this signposting does not have to appear alongside the reference to the Basic Bank Account i.e. the literature may have a more general section detailing sources of further information about accounts. ID + V This Guidance is intended to ensure that, where possible, customers are not asked to send away important documents in order for subscribers to satisfy identification requirements under Money Laundering rules. Where members have arrangements which allow a third party, such as a housing association, to open Basic Bank Accounts on the member’s behalf, the same principles should apply wherever possible. However, we recognise that such arrangements – which are for the benefit of the customer - might dictate that existing ID verification methods are maintained. 2 Account opening timescale This Guidance is intended to ensure that there are no unnecessary delays to the opening of Basic Bank Accounts. The introduction of 10 working days for an account to be operational (following the completion of satisfactory ID checks), mirrors the Code requirement (under Section 7.3) for switched current accounts to be operational within 10 working days. Implementation Period Subscribers to the Personal Banking Code must implement these new requirements on or before the following dates: Literature – 31st October 2006 ID + V – 30th September 2006 Opening timescale – 30th September 2006