Stipulation of Excess in Understanding and Misunderstanding Riba

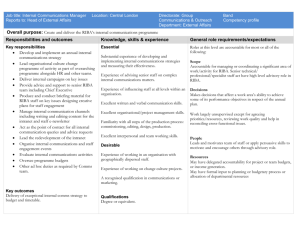

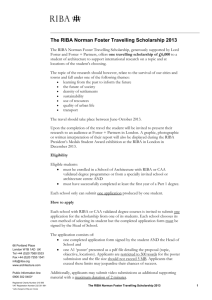

advertisement