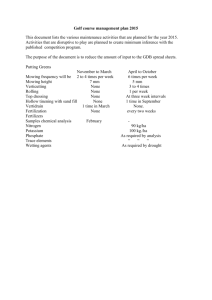

Energy Future Coalition - Global Development Bonds (2004)

advertisement

Discussion Draft January 12, 2004

GLOBAL DEVELOPMENT BONDS

SUMMARY

This paper introduces a proposal to establish a new category of U.S. investment security called

Global Development Bonds (GDBs). The objective is to mobilize a higher flow of capital

investment by U.S. investors, especially institutional investors, to projects and companies in

developing countries, for sustainable development. With certain US government enhancements,

GDBs will strike a risk/reward balance that draws private investors into markets with significant

growth potential that heretofore have been unattractive to them. In so doing, GDBs will employ

the financial creativity and investment judgment of Wall Street and tap previously inaccessible

pools of capital in support of sustainable development goals that public sector aid programs have

not, and cannot, fully achieve. GDBs will not work like foreign aid or other public sector funding

(trade, investment, risk mitigation) programs, but will complement them, leverage their funds and

further their goals. In time, GDBs should reduce the need for some types or levels of aid programs.

INTRODUCTION

The financing of sustainable development in the developing world has been largely the domain of

public sector agencies. While private sector investment in the developing world has surpassed

official development assistance since the end of the 1980s, portfolio investment has been

problematic given its volatility, and foreign direct investment has significantly decreased due to

market problems and economic instabilities since the late 1990s.

The United States and other industrialized nations long have agreed that economic growth is an

indispensable element in sustainable development and that the need for both hard and local

currency investment in sustainable development far exceeds the supply of funds. The

industrialized nations acknowledge that the investment needed must come from private as well as

public sources, and over the years a variety of efforts have been made to combine, relate, or

leverage the two, through public-private partnerships.

Private investment in developing countries is rife with risk. Investors and lenders face unstable

macroeconomic environments, currency devaluation, inadequate legal frameworks, changing

government policy, political forces, corruption, and other challenges. When adjusted for risk, the

cost of capital often becomes too great for the emerging market businesses or projects to bear.

Drawing capital market funding more broadly into the process of sustainable development is a

major challenge; engaging private sector institutional investors such as pension funds and

insurance companies that manage large pools of capital and, by fiduciary duty, invest

conservatively, is particularly difficult. Protections offered today by government and multilateral

agencies such as political risk insurance can be cumbersome and expensive. A principal

characteristic that leads to complexity and cost is the requirement that government support be

applied case-by-case – thus the one-off nature of each investment and lack of a systematized

approach.

This paper puts forth an idea that was born in discussions about the financing of Sustainable

Development in the International Working Group of the Energy Future Coalition (EFC). With

ongoing support from the EFC, a team is developing the GDB concept as a securitized, insured

product analogous to municipal and corporate bonds, asset-backed securities (ABSs), and

collateralized debt obligations (CDOs) as a recognized category of bonds – an asset class – rated

and traded in secondary markets.

The goal is to engage Wall Street creativity in the design of a class of security that can achieve

investment-grade ratings, through a combination of private and public sector enhancements that

can overcome the sovereign and project risks inherent in the countries and regions that are the

intended beneficiaries. As envisioned, GDBs will be a securitized instrument representing an

interest in an underlying pool of loans or other financial assets that originated in the financing of

sustainable development in “emerging markets” or other developing countries that have

demonstrated some level of commitment to and implementation of market economics. GDBs

would receive certain “automatic” risk mitigation coverages from public sector agencies, for which

a fee would be paid. They would be regulated by a government agency. The proceeds of GDBs

would be used in designated countries (“Qualifying Countries”) and for specified “sustainable

development” purposes (“Qualifying Uses”). Given the target assets, obligors, and countries, the

government role is inevitable – but the GDB goal is to have a market product supported by

government, not a government program implemented by the market.

STARTING FROM WALL STREET

Meetings on Wall Street have confirmed that while no GDB-like product has been introduced

successfully in the market, there are more or less analogous precedents and techniques that can be

looked to and employed in structuring GDBs. The intention is to utilize those techniques, from

diversification to over-collateralization, to make the public sector enhancement role as minimal as

possible. While recognizing significant obstacles and an ultimate need for a government

enhancement package to neutralize sovereign risk (including foreign exchange risk), the rating

agencies, investment and commercial banks, monoline insurers, and institutional investors

encourage the initiative and believe it can work.

a. The Techniques of Securitization

Securitization is a recent phenomenon, that in 30 years has grown into a $6.6 trillion market.

Initially it was stimulated by government involvement. In the early 1970s, a government agency,

the Government National Mortgage Association (GNMA), popularly “Ginnie Mae”, issued

guaranteed securities that passed through the principal and interest payments on HUD and Veterans

Administration backed mortgages to investors. Fannie Mae and Freddie Mac, both federallychartered private corporations, soon followed with mortgage-backed securities that explosively

expanded the secondary mortgage market. Collateralized mortgage obligations (CMOs), which

followed in the early 1980s, were designed to address prepayment risk and utilized different bond

classes, with a hierarchy of subordination, to absorb market changes and first loss. The Tax

Reform Act of 1986 added an additional layer of sophistication, the Real Estate Mortgage

Investment Conduit (REMIC), which facilitated CMOs through a simplified tax structure and the

issuance of securities with a range of risk characteristics and coupons.

The first asset-back securities (ABSs), non-mortgage loans or other assets with expected payment

streams, date back only to 1985 and computer leases. This market now includes securitized auto

loans, credit card receivables, home equity loans, student loans, future entertainment royalties, and

an expanding number of other assets.

Collateralized debt obligations (CDOs) are a newer breed of asset-backed securities – structured

finance, securitized products first issued in the late 1980s (sometimes as collateralized loan

obligations or collateralized bond obligations) that may include corporate bonds, bank loans,

emerging market sovereign debt, and project finance debt as well as more traditional asset-backed

securities and credit derivatives. CDOs normally are structured with a number of “tranches” (there

2

can five or more) with varying risk, payment frequency, coupon, and maturity. The safest (often

called the “A Tranche”) may be rated AA or AAA, the lowest tranche is designated as, or is the

effective equivalent of, equity.

It is critical for a securitization to isolate the financial assets supporting the payments to the holder

of the security. Thus, the issuer is usually a special purpose vehicle (SPV), which can be a

corporation, partnership or trust, which buys assets from originators. The originators in the case of

GDBs could include U.S. commercial banks and contractually-related local commercial banks.

The purpose is to ensure that payments to investors are derived from the segregated pool of assets

and are not dependant on the financial performance of the originator. That also protects the

investor from claims against or the bankruptcy of the originator; and it protects the originator by

allowing investors to turn only to the SPV for payment.

The final players are the rating agencies, monoline insurers, underwriters, dealers, and ultimately

investors (bond buyers). Virtually all MBSs, ABSs, and CDOs are rated; GDBs would have to be.

Monoline insurers (as opposed to multi-line), such as Ambac, MBIA, and XL Capital Assurance

are specialized insurers that guarantee, without question, payments to bond holders in the event of a

default. (Ambac and MBIA instituted municipal bond insurance in the US in the early 1970s.

Roughly half of municipal bonds are now insured.) The monolines do extensive due diligence and

for the most part carry AAA ratings themselves – a testament to their business model and

execution. Their insurance (really a guarantee) takes a BBB bond to a AAA rating. Underwriters

are the intermediary between the SPV and the investor – the bonds are exchanged for cash with an

underwriter, which then sells the bonds to investors.

Credit enhancement is common in securitizations. Diversification is a form of enhancement and is

critical in non-homogeneous CDOs, of which GDBs will be a type. Rating agencies have

diversification criteria and assign a diversification score in their due diligence process.

Subordinating one or more tranches also is a form of enhancement – defaults affecting the security

will be absorbed by a subordinate tranche before the senior tranche is affected. Overcollateralization – having a larger payment stream to service principal and interest obligations to

bond holders than would be necessary absent default – is a common practice. The SPV mechanism

and, where appropriate, moving payment streams outside of risky emerging market countries are

not credit enhancement per se, but provide needed security to investors. Finally, the monoline

insurance wrap, which can be utilized only if the bonds already have reached the BBB level, is an

important private sector enhancement.

b. Application to GDBs

GDBs closest parallel to existing market products is the CDO – more specifically an arbitrage cash

flow CDO. (There also are “market value CDOs”, which pay obligations to bond holders through

the trading and sale of collateral. Cash flow CDOs rely on the income streams of the underlying

assets. The arbitrage results from the positive spread between cash flows generated by the

portfolio of non-investment grade assets and the investment grade liabilities to bond holders.

“Arbitrage CDOs” differ from “balance sheet CDOs” in that the latter are essentially securitizations

of commercial and industrial loans.)

Since the late 1990s, there have been CDOs that included “emerging market” debt in the portfolio

of underlying financial assets. A few have been exclusively emerging market debt. Their average

portfolio has been 80% sovereign debt; 20% corporate debt. Many issuances have had difficulty.

The GDB will differ from existing emerging market CDOs in a number of respects, primary among

them that the GDB’s purpose is to finance sustainable development, which probably means that

3

substantial amounts of infrastructure debt will be among the pooled assets, along with some

corporate bonds, bank loans, and ABSs and MBSs if available. (All cash-flow assets could be

considered. For example, some forfeiting debt could qualify as sustainable development.)

Significantly, many Wall Street experts were attracted to the concept of GDBs precisely because,

unlike the CDOs, they wouldn’t be tapping capital markets to finance general obligational

sovereign debt, which has a high risk of diversion for illicit or at least unproductive use by corrupt

or incompetent governments. A substantial portion of a GDB issuance would likely be used to

refinance existing debt but a portion also could be used for new financing of sustainable

development programs, companies, and projects. The issuer would establish its GDB management

group, which would place and manage the funds but rely on local intermediaries or partners to be

the primary lenders.

Thus, prior to looking to Washington, the structure of the GDB will include geographical diversity

(more than one country and probably more than one region), asset diversity, and obligor

(issuer/originator) diversity. It certainly will include tranching and over-collateralization. An

important objective will be to reach the BBB level in order to utilize the monoline insurance wrap.

Additional elements in the structure of the GDB, which would substantially strengthen the security,

could be host country or local government participation in the equity of the SPV, which ensures

risk sharing in the event of default. Host country or local government guarantees also would be

obtained where possible, but these add less security because they are subject to political decision.

One Wall Street expert suggested that wherever possible, a GDB should include a sequence of host

country guarantees or loss protections – from local, provincial and national governments.

Important to the rating agencies in looking at the security of pooled assets will be the credit rating

of the country (local currency and hard currency ratings, the latter always lower because of foreign

exchange risk), the existence of a liquid local capital market, and the existence of legal

infrastructure that permits the creation of security interests in underlying assets. Then the rating

agencies will be interested in available historical data on the assets and obligors in the pool.

Absent that, they will look for “proxies” – that is the historical performance of comparable assets.

The key, obviously, is predictability. MBSs, and ABSs such as car loans and credit card

receivables, have historical data even in emerging markets and the pools can contain thousands of

assets. For GDBs, the fewer the assets, the more assets without discernable historical performance

data for their classes, and the fewer proxies, the greater the need will be for public sector

enhancement.

Wall Street experts with whom the team has discussed GDBs to this point, have a range of views

on whether the spreads between what LDC debtors will pay and US investors will demand is

sufficient without substantial public-sector enhancement. That analysis will be an important

element in the team’s next steps. Overall, however, Wall Street has been positive in its reaction to

the concept of GDBs. Interviewees believe it can be done with the right structure and mix of

private and public enhancement. The less complex the structure the better (though a certain

amount of complexity is inevitable). A good first “deal”, which will enable the rating agencies to

develop a model, will be very important.

THE WASHINGTON ROLE

a. In General

Because their proceeds will be employed in developing countries, GDBs will require certain credit

enhancements from the U.S. Government. In time, the goal will be to have fees for the

enhancements make the U.S. Government participation revenue neutral. (The concept obviously

could be replicated in other industrialized nations or supported by multilateral institutions.)

4

The most logical USG entity to provide the risk mitigation coverage is the Overseas Private

Investment Corporation (OPIC). An entity administering the proposed Millennium Challenge

Account program (about to be authorized in appropriations legislation) also could play a major

role. OPIC has existing authority for a range of enhancements that could be relied upon for GDBs,

and has existing products including, but also beyond, their standard political risk package, such as

the liquidity facility for devaluation risk set up for Latin American countries (though used only

once, in Brazil), that could be adapted for GDBs. As envisioned, GDBs would not utilize OPIC’s

guarantee authority – because of the moral hazard (as well as being politically unpractical) of

shifting the entire risk to the government.

Examples of risk mitigation under consideration include political risk insurance, foreign exchange

risk liquidity facility and/or insurance, partial risk guarantees against nonperformance of

contractual obligations undertaken by governments, and low cost matching or partial first loss

funds. Tax credits of some kind also could be a possibility but appear to the GDB team and Wall

Street experts as a far less practical option.

b. Legislation

New legislation probably would be needed to authorize OPIC or another agencies to license,

monitor and regulate GDBs – as opposed to reviewing, approving, and applying statutory

requirements case by case. Legislation also might be required to authorize the use of funds, such as

those in the Millennium Challenge Account, for partial first loss pools, subsidizing the cost of

political risk insurance or devaluation liquidity facilities. Appropriations legislation also likely

would be required if the government support went beyond political risk insurance.

c. Precedents of Federal Government Support

The Federal Government has long supported certain sectors of the economy or categories of

people, such as home ownership, family farming, and students, through indirect, quasi-market

support programs. As shown above, the original securitization of home mortgage loans, backed by

HUD and the Veterans Administration, were guaranteed through Ginnie Mae, a government

agency.

In fact, the US has created a separate class of securities issued or guaranteed by government

agencies. There are two types: federally regulated institutions that borrow through the Federal

Financing Bank (FFB) and Government Sponsored Entities (GSEs) that issue bonds directly into

the market. There are eight GSEs, many well known, all that enjoy state and local tax exemptions

in addition to lower borrowing costs because of their special federal status. The eight are: the

Federal Farm Credit Bank System (FFCB); the Farm Credit Financial Assistance Corporation

(FACO); the Federal Home Loan Bank System (FHLB); the Federal Home Loan Mortgage

Corporation (Freddie Mac); the Federal National Mortgage Association (Fannie Mae); the Student

Loan Marketing Association (Sallie Mae); and the Financing Corporation (FICO) and the

Resolution Trust Corporation, both created in the wake of the savings and loan crisis. The

Tennessee Valley Authority straddles the two categories, both borrowing through the FFB and

issuing securities directly into the market.

GSEs enjoy a number of economic benefits – tax exemptions, exemptions from SEC registration

requirements, the use of the Federal Reserve as their fiscal agent, and borrowing authority from the

U.S. Treasury (e.g. Fannie Mae and Freddie Mac each $2.25 billion, FHLBs {there are 12 district

banks} $4.0 billion, FICO $10.825 billion.) While not obligations of the U.S. Treasury, GSE

bonds are perceived as safe by investors because of the government backing. As a consequence,

5

they are priced between US Treasuries and AAA corporate bonds – creating a sort of “super-AAA”

category.

Apart from international programs of direct relevance to GDBs such as OPIC’s insurance and

guarantee programs and USAID’s recent employment of its guarantee authority for the

Development Credit Authority (DCA) program, there are many other federal programs that support

private sector initiatives. Two examples that could have relevance to GDBs are the SBIC program

of the Small Business Administration and EPA’s State Revolving Fund (SRF) program. SBICs are

licensed by SBA, must have a management team with venture capital expertise and at least $5

million in private capital investment. They then may receive leverage equal to 300% of their

private capital and issue debentures that are guaranteed by SBA. SRFs are created by the states for

water and waste water projects. They receive matching capitalization grants from EPA that can be

set aside in a debt service reserve fund and/or invested. The SFRs then issue bonds and lend the

proceeds for eligible projects. Investment income from EPA grants may be used as reserves or to

subsidize interest rates.

The US government enhancement wrap for GDBs is likely to be more targeted to the specific

political, foreign exchange, and other sovereign risks that will be the chief obstacles to investmentgrade ratings for GDBs. Nevertheless, the foregoing examples amply demonstrate the wide variety

of techniques that have been employed that could be adapted to GDBs and underscore the

willingness of the U.S. government to use taxpayer-funded mechanisms in support of worthy

public policy goals.

d. The Working Description of the USG Role and Process

Short of creating a new GSE for GDBs, the GDB team initially has envisioned a U.S. government

agency authorizing/licensing a Qualifying Issuer of GDBs to issue GDBs for Qualifying Uses in

Qualifying Countries, supporting the GDBs through targeted, generic (class) enhancements, and

monitoring and regulating their trading in bond markets. The object of the government role is to

cover risks that markets cannot assume sufficiently to achieve the goal of an investment grade,

rated, tradable class of securities that finance sustainable development in poor countries.

(1) Examples of Targeted Government Enhancements

Political Risk insurance: Investors are concerned about unpredictable political risks.

OPIC’s standard insurance package includes currency inconvertibility (where host

country currency restrictions prevent the conversion or transfer of investment returns),

expropriation, and political violence. As envisioned, GBD issuers could receive

“automatic” political risk insurance. OPIC would establish certain criteria for a GDB

to qualify, whereupon it would be entitled to the standard OPIC insurance.

Foreign Exchange Risk Mitigation: OPIC political risk insurance does not cover

foreign exchange risk, which can range from fluctuations during the term of a loan to

longer-term devaluations. OPIC has developed a product for Latin America called a

liquidity facility for devaluation risk. It has been used only once, for the Tiete Project

(sponsored by AES) in Brazil. It is tied to the premise that government regulators will

permit rates to be raised as necessary to support increased debt service, which in time

repay the facility. Whether this type of mechanism is used, separate from or in

combination with private sector hedges, foreign exchange risk is a principal obstacle to

be overcome by GDBs.

Funding to Support First Loss Reserves, Devaluation Facilities, and/or Political

Risk Insurance: While proposals for the Millennium Challenge Account (MCA) are

6

based on more traditional aid approaches, the spirit of its genesis – to reward countries

moving toward market economies – might generate support within the Administration

and Congress for more daring and innovative approaches such as GDBs. The fund

could be used in a variety of ways: as part of a “first loss” fund, as funding for a

devaluation liquidity facility, to pay for political risk insurance etc. Since some of the

proceeds from GDBs may be used prospectively, rather than for refinancing existing

debt, such funds also could be employed as matching funds. All such uses would

leverage the appropriated funds many times over their currently proposed uses.

Partial Risk Guarantees: The World Bank and IFC have partial risk guarantee

products that cover some of the political risks covered by OPIC’s insurance but also

defaults caused by a government’s failure to meet its contractual obligations related to

a private project. Such coverage would be important for GDBs to the extent that the

underlying financial assets in the portfolio include project debt.

(2) Qualifying Countries

GDB rules for qualifying countries could range from existing qualifications for OPIC coverage, to

several more restrictive models in proposed or existing legislation that authorize governmentsponsored financing in developing countries. Fundamentally, qualifying countries would either

have to have or be moving toward the establishment of free market laws, rules, regulations, and

institutions.

Recent examples of such criteria passed by Congress or contained in existing legislation include

country eligibility criteria in various Millennium Challenge Account bills and in the African

Growth and Opportunity Act. (Both examples also contain criteria relating to democracy, human

rights, the rule of law, education, poverty reduction etc. – standard aid criteria, which usually are

necessary to enact legislation. While that might narrow the potential universe of qualifying

countries, it would only apply as a threshold test for eligibility and wouldn’t affect the

implementation of the GDB process.)

(3) Qualifying Uses

From the investor perspective, capital will seek the best risk-adjusted rate of return. From the

public policy perspective, priorities range from economic development, to environmentally clean

development, to poverty alleviation-focused development. A varying balance of these criteria is

often required in today’s world.

Considering the objectives of the EFC, the GDB concept is put forth as a vehicle for financing

“Sustainable Development” as defined from time to time, and might include clean energy, water,

health, housing, communications, and transportation – and corporate and possibly sovereign debt

demonstrably tied to such ends.

(4) Qualifying Issuers

As a U.S. government-supported security, GDBs would need to be raised by entities that are

subject to U.S. laws and tax regulations. As envisioned, the administering agency, OPIC, the SEC,

or some other agency, would need to put forth a regulatory definition of “qualifying” issuers of

GDBs, or establish an entity to award GDB licenses to approved issuers.

7

(5) Implementation Options

There is a wide range of implementation options. For example, a mandate would be given to a U.S.

Government agency to establish and oversee the GDB program. Since GDBs appear to align more

closely with OPIC’s mission, authority, and capabilities than to any other agency, it is a likely

candidate to be the implementing agency. OPIC would issue approvals or licenses to issuers of

GDBs, which would trigger qualification for some or all of the enhancements in the program, such

as political risk insurance. The regulatory function also could be performed by OPIC or by a newly

created agency. Alternatively, this function might be performed by the SEC. In any case, there

will be a need for the kind of “loose-tight” regulation that the SEC applies, requiring certain

reporting and adherence to accounting and ethical standards, but in such a way as to allow the

markets to allocate capital.

POTENTIAL IMPACTS AND NATIONAL BENEFITS

Approximately $50 billion per year is spent by all OECD countries together for official

development assistance, which represents less than 0.3% of the aggregate Gross National Income

(GNI) of those countries. Clearly, this formal aid funding does not reflect the potential of the

OECD nations to advance capital for the purposes of development.

A key feature of GDBs is its scalability based on merit. Just as there are hundreds of mutual funds,

real estate investment trusts, leasing companies, mortgage-backed securities funds, and other

special-purpose investment methods and vehicles, dozens or hundreds of GDB funds could emerge

from a successful GDB program. The net effect would be an acceleration in economic, social, and

human advancement around the world.

A successful program also could mobilize a new generation of U.S financial talent to work in the

developing countries. This is important because “good deals” happen most often as a result of

collaboration between financial professionals and project sponsors.

Government support that results in the widespread employment of a GDB-class of security, has the

potential to return significant benefits to the nation. GDBs would complement existing programs

and leverage scarce foreign aid funds. They would improve the effectiveness of dollars flowing

overseas – GDB funds would flow through many competing channels, seeking best applications

through market forces. They would improve the efficiency of moving the funds into key

developing countries because the private sector works faster and with lower overhead than

government. By causing economic growth, they would open up new export opportunities for U.S.

businesses, create U.S. jobs, and generate tax revenues back to government. Finally, through the

private sector, GDBs would be supporting long-standing U.S. foreign policy, international

economic, development, and trade goals and strengthening international relations – all in a manner

that would be a more efficient and less costly use of U.S. taxpayer dollars.

*

*

*

*

For additional information about the GDB proposal, please contact the EFC study team: Michael

Eckhart at Solar International Management, Inc. (telephone 202-429-2030 and email

meckhart@aol.com) or John E. Mullen at Globalnet Venture Partners (telephone 202-429-2720 or

email mullenj@aol.com).

8

Attachment A

New York (Financial Community) Meetings/Discussions on GDBs

(through January 12, 2004)

Meetings:

Paul V. Applegarth, Chief Executive Officer, Value Enhancement International LLC

Carl Adams, Executive Director, Financial Standards Foundation

John Baumann, Managing Director, JPMorgan Fleming Asset Managment

J. Carter Beese, Riggs Capital Partners

David Beidler, Senior VP & Chief Legal Officer, Radian Asset Assurance Inc.

Anthony Drexel Biddle, III, Hill International, Inc.

Dan Bond, First VP, Sovereign, Ambac

Bill Chew, Managing Director, Corporate & Government Ratings, S&P

Barry Gold, Managing Director, Global Structured Bonds, Citigroup

Frank Fernandez, Senior VP, Chief Economist & Director of Research, SIA

Steven Greenwald, Managing Director Credit Suisse First Boston

Chansoo Joung, Managing Director, Goldman Sachs

T. Wynne Morriss, Senior Managing Director, XL Capital Insurance

Robert Osterwalder, Director, Debt Capital Markets, UBS Investment Bank

Dana Fisk Pitts, Managing Director, JPMorgan Chase Bank

George Sorenson, Chairman, FE Clean Energy Group, Inc.

David Stortz, Managing Director, XL Capital Insurance

William Streeter, Managing Director, Global Project Finance, Fitch

Bill Wicker, Managing Director, Goldman Sachs

Conference calls:

Hilary Ackermann, Managing Director, Project Finance group, Goldman Sachs

Barry Gold, Citigroup

Michael Lucente, Merrill Lynch

Anthony Presisano, Structured Finance, Goldman Sachs (formerly Fitch)

John Salinger, President, AIG Global Trade and Political Risk Insurance Co.

Pat Welch, Asset-Backed Securities group, Goldman Sachs (formerly S&P)

Next Steps in Market Analysis

Determining current spreads and interest rates and trends; determining the pricing and

costing of guarantees.

The size and shape of bond markets – in the US and internationally, to determine supply,

demand, and applications.

The supply of projects and other eligible country assets – the types and availability of

assets that could be pooled.

Determining how much capital market funding is international – and how much of that is

going to 2nd and 3rd world countries – as part of the analysis of what countries can be

eligible.

9

Attachment B

Washington (Public Policy) Meetings/Discussions on GDBs

(through January 12, 2004)

Meetings

Ken Hansen, Partner, Chadborne & Parke (former ExIm GC and OPIC attorney)

Dan Renburg, Arent Fox, former Board of ExIm.

James Brenner, Meadowbrook Advisors

Christopher Walker, Managing Director, Environmental/Greenhouse Gas Solutions, and Cosette

Simon, VP, government and Industry Relations, Swiss Re (55 E. 52nd St NY, and Armonk, NY)

OPIC – Jan Boyer, Senior Advisor to the President, and Tracey Webb, Director, Credit Policy and

Analysis.

State Dept. Meeting: Lori Brutten (State), Griffin Thompson and Paul Freedman (AID), Ginger

Green (OPIC), Francis Hodsoll (DOE) – others

James Fuschetti, Director, WWF Center for conservation Finance

Mark Collins, Partner, Brown Investment Advisory

John Wasielewski, Director of Development, USAID

Center for Global Development – Sheila Herrling, Todd Moss, Bill Cline, Ted Truman (IIE), Mary

Goodman (Moore Capital Strategy Group),

Contacts/Conversations

Mike Kitay – USAID Assistant General Counsel

Drew Luten – USAID, Millennium Challenge Account

Barbara Turner – USAID, Acting Asst. Admin., Policy and Program Coordination (PPC)

Next Steps Regarding the Washington Role

Legal and policy aspects of “eligibility” by location, uses, and issuers.

The minimum types and costs of enhancements necessary to get a hypothetical GDB (with

eligible countries and examples of financial assets in the underlying portfolio).

Cost benefit analysis – the overall budget impact, not only the direct cost of the program

but also the offsets in savings from other “aid” programs and the benefits to the nation in

more broadly achieving foreign policy goals.

The potential US Government “players” and the path in the Washington political process to

present, advance, and succeed in authorizing the program.

Political considerations among key constituencies.

10