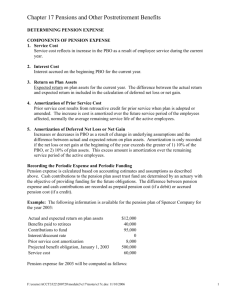

ch20-accounting-for-pensions

advertisement