Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

CHAPTER 5

FINANCIAL POSITION AND CASH FLOWS

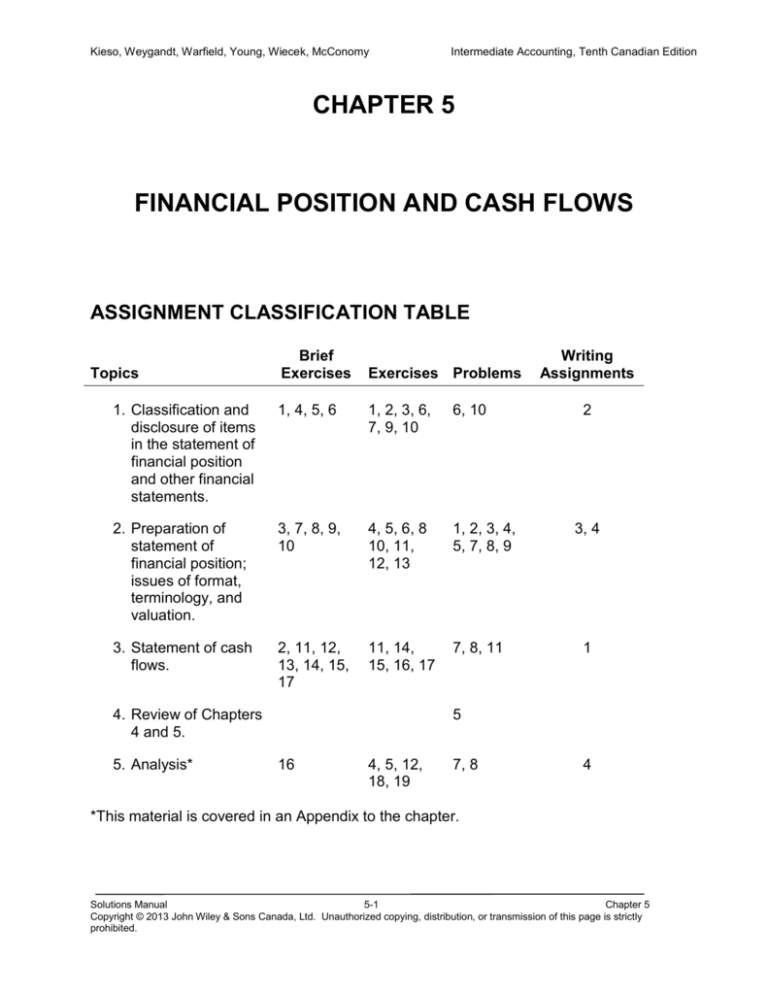

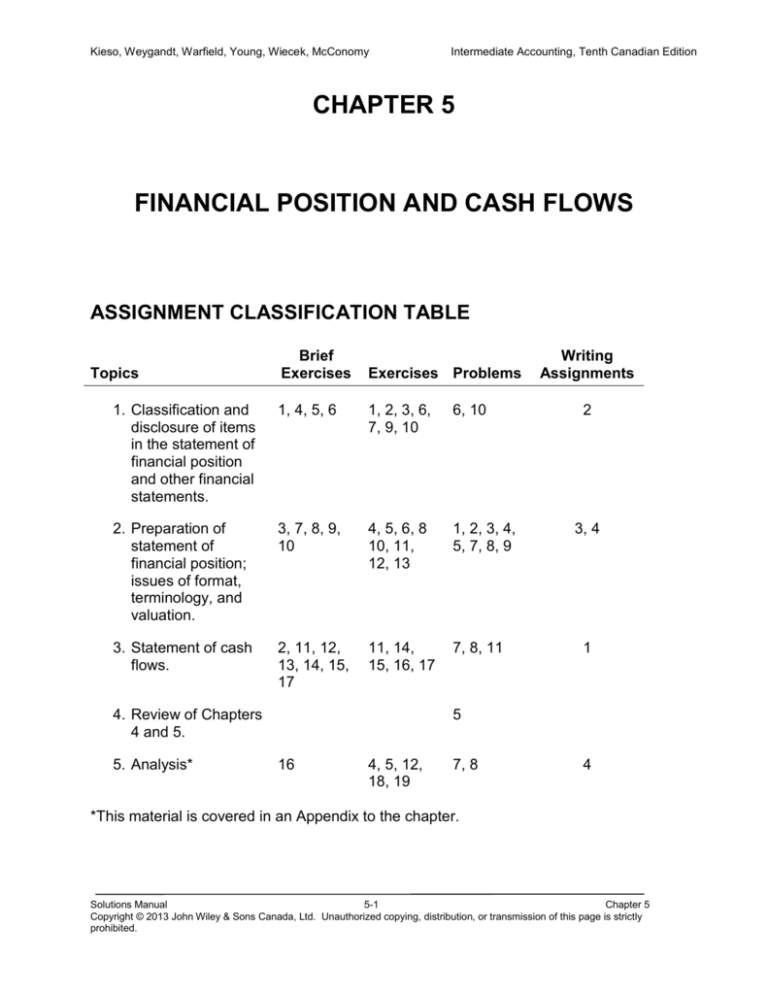

ASSIGNMENT CLASSIFICATION TABLE

Topics

Brief

Exercises

Exercises Problems

1. Classification and

disclosure of items

in the statement of

financial position

and other financial

statements.

1, 4, 5, 6

1, 2, 3, 6,

7, 9, 10

6, 10

2. Preparation of

statement of

financial position;

issues of format,

terminology, and

valuation.

3, 7, 8, 9,

10

4, 5, 6, 8

10, 11,

12, 13

1, 2, 3, 4,

5, 7, 8, 9

3. Statement of cash

flows.

2, 11, 12,

13, 14, 15,

17

11, 14,

15, 16, 17

7, 8, 11

4. Review of Chapters

4 and 5.

5. Analysis*

Writing

Assignments

2

3, 4

1

5

16

4, 5, 12,

18, 19

7, 8

4

*This material is covered in an Appendix to the chapter.

Solutions Manual

5-1

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

ASSIGNMENT CHARACTERISTICS TABLE

Item

E5-1

E5-2

E5-3

E5-4

E5-5

E5-6

E5-7

E5-8

E5-9

E5-10

E5-11

E5-12

E5-13

E5-14

E5-15

E5-16

E5-17

*E5-18

*E5-19

P5-1

P5-2

P5-3

P5-4

P5-5

Description

Statement of financial position

classifications.

Classification of statement of financial

position accounts.

Classification of statement of financial

position accounts.

Preparation of a corrected statement of

financial position and analysis.

Correction of a statement of financial

position and analysis.

Preparation of a classified statement of

financial position.

Current vs. long-term liabilities.

Preparation of a statement of financial

position.

Current liabilities.

Current asset section of the statement of

financial position.

Preparation of a statement of financial

position and statement of cash flows.

Current assets and current liabilities and

analysis.

Supplemental disclosures

Statement of cash flow and comments.

Statement of cash flows—classifications.

Operating activities – direct and indirect.

Statement of cash flow – indirect method.

Analysis.

Analysis.

Preparation of a classified statement of

financial position.

Statement of financial position

preparation.

Statement of financial position

adjustment and preparation.

Preparation of a corrected statement of

financial position.

Income statement and statement of

financial position preparation.

Level of

Difficulty

Time

(minutes)

Simple

15-20

Simple

15-20

Simple

15-20

Moderate

35-40

Moderate

35-40

Simple

30-35

Moderate

Moderate

10-15

35-40

Moderate

Moderate

15-20

20-25

Moderate

40-45

Complex

30-35

Moderate

Moderate

Moderate

Moderate

Moderate

Moderate

Moderate

Moderate

20-25

15-20

15-20

30-35

15-20

15-20

15-20

30-35

Moderate

35-40

Moderate

40-45

Complex

40-45

Moderate

30-40

Solutions Manual

5-2

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

ASSIGNMENT CHARACTERISTICS TABLE (Continued)

P5-6

P5-7

P5-8

P5-9

P5-10

P5-11

Reporting for financial effects of varied

transactions.

Statement of financial position and cash

flow preparation and analysis.

Preparation of a statement of financial

position, statement of cash flows and

analysis.

Statement of financial position

adjustment and preparation.

Critique of statement of financial position

format and content.

Preparation and analysis of a statement

of cash flows

Moderate

25-30

Moderate

40-50

Moderate

40-50

Complex

40-45

Moderate

25-30

Moderate

25-30

Solutions Manual

5-3

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

SOLUTIONS TO BRIEF EXERCISES

BRIEF EXERCISE 5-1

(a)

The statement of financial position provides information about a

company’s liquidity, solvency, and financial structure. If Larsen

has poor liquidity, or poor coverage and solvency, or if Larsen is

financed heavily by debt, lending funds to (and investing in) the

company is riskier.

(b) The statement of cash flows provides information about the

company’s sources and uses of cash during the period. If Larsen

relies significantly on external financing as a result of negative

cash flow from operations, lending funds to (and investing in) the

company is riskier. The statement of cash flows also helps users

assess earnings quality. For example, if Larsen’s net income is

significantly higher than cash flow from operations, this is a sign

of poor earnings quality, and a potential cause for concern to a

possible lender to the company.

BRIEF EXERCISE 5-2

The statement of cash flows helps users to evaluate the company’s

liquidity, solvency, and financial flexibility. Companies that are more

financially flexible are better able to survive economic downturns, and

have low risk of business failure.

Users of Gator Printers’ statement of cash flows include

shareholders, creditors, potential bondholders, management,

employees, and customers. Shareholders, creditors, and potential

bondholders will analyze the company’s liquidity, solvency, and

financial flexibility in making their investment decisions. Management

will use the statement of cash flows to analyze sources and uses of

cash in deciding whether or not to expand, and in deciding how to

fund the expansion, if any. Employees and customers may use the

statement of cash flows to assess the company’s liquidity, solvency,

and financial flexibility, if they are seeking a long-term employer or

supplier.

Solutions Manual

5-4

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 5-3

Three examples of financial statement items, which are omitted from

the statement of financial position because they cannot be objectively

measured, and therefore not recorded, include:

1. Internally-generated goodwill

2. Intellectual capital developed from research

3. Contingent liabilities that cannot be reasonably estimated

BRIEF EXERCISE 5-4

Current assets

Cash and cash equivalents

FV-NI investments

Accounts receivable

Less allowance for doubtful accounts

Inventory

Prepaid insurance

Total current assets

$7,000

11,000

$90,000

(4,000)

86,000

30,000

5,200

$139,200

Cash and cash equivalents and accounts receivable are monetary

assets. Fair value-net income investments could be monetary assets

depending on the nature of the investments.

BRIEF EXERCISE 5-5

Long-term investments

FV – OCI investments

$ 62,000

Land held for investment

139,000

Total investments

$201,000

Fair Value-OCI investments are financial instruments.

Solutions Manual

5-5

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 5-6

Property, plant, and equipment

Land

Buildings

Less accumulated depreciation

Equipment

Less accumulated depreciation

Machinery under capital leases

Less accumulated depreciation

Total property, plant, and equipment

$71,000

$207,000

(45,000)

190,000

(19,000)

229,000

(103,000)

162,000

171,000

126,000

$530,000

BRIEF EXERCISE 5-7

Intangible assets

Patents

Franchises

Trademarks

Total intangible assets

33,000

47,000

10,000

$90,000

Note: Goodwill would be shown separately from intangibles.

Solutions Manual

5-6

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 5-8

(a)

Current liabilities

Accounts payable

Unearned revenue

Salaries and wages payable

Interest payable

Income tax payable

Notes payable

Total current liabilities

$251,000

141,000

127,000

42,000

9,000

__97,000

$667,000

All of the above with the exception of unearned revenue are monetary

liabilities. Unearned revenue is non-monetary as it will generally be

satisfied by delivery of goods or services, rather than monetary

amounts.

Note: Any current portion for the Obligation under Capital Leases and

the current portion of long term debt, such as bonds payable,

would be included if listed in the balances.

Note: For the notes payable, as at statement of financial position date,

there is no unconditional right to defer payment of the financial

liability beyond one year. Therefore under IFRS, the financial

liability must be shown as a current liability.

(b)

Under ASPE, since the notes payable are refinanced by the

issue date of the financial statements, with payment terms

beyond one year as at statement of financial position date, the

notes payable may be presented as a non-current liability.

Solutions Manual

5-7

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 5-9

(a) Under IFRS

Non-current liabilities

Bonds payable

Less discount on bonds payable

Obligations under capital leases

Total non-current liabilities

$600,000

142,000

$458,000

175,000

$633,000

In each case, these amounts would be shown net of current portion, if

any.

(b) Under ASPE

Non-current liabilities

Bonds payable

Less discount on bonds payable

Obligations under capital leases

Notes payable

Total non-current liabilities

$600,000

142,000

$458,000

175,000

__97,000

$730,000

In each case, these amounts would be shown net of current portion, if

any.

BRIEF EXERCISE 5-10

Shareholders’ equity

Share capital

Preferred shares

Common shares

Contributed surplus

Total share capital

Retained earnings

Accumulated other comprehensive income

(loss)

Total shareholders’ equity

$50,000

700,000

200,000

950,000

120,000

(150,000)

$920,000

Solutions Manual

5-8

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 5-11

The purpose of a statement of cash flows is to provide relevant

information about the cash receipts and cash payments of an

enterprise during a period, in order for users to determine the

significant operating, investing and financing items and amounts. It

differs from the statement of financial position and the income

statement in that it reports the sources and uses of cash by

operating, investing, and financing activity classifications. While the

income statement and the statement of financial position are accrual

basis statements, the statement of cash flows is a cash basis

statement—non-cash items are omitted.

BRIEF EXERCISE 5-12

Cash flows from operating activities

Net income ($500 - $300)

Adjustments to reconcile net income to

net cash provided by operating activities

Increase in accounts receivable

Decrease in accounts payable

Net cash used by operating activities

$200

(150)

(400)

(550)

$(350)

BRIEF EXERCISE 5-13

Cash flows from operating activities

Net income

$151,000

Adjustments to reconcile net income to

net cash provided by operating activities

Depreciation expense

$44,000

Increase in accounts payable

9,500

Increase in accounts receivable

(13,000)

40,500

Net cash provided by operating activities

$191,500

Solutions Manual

5-9

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 5-14

Proceeds from sale of land and building

Purchase of land

Purchase of equipment

Net cash provided by investing activities

$196,000

(43,000)

(35,000)

$118,000

BRIEF EXERCISE 5-15

(a) Under IFRS

Issuance of common shares

Repurchase of company’s own shares

Retirement of bonds

Net cash used by financing activities

$140,000

(25,000)

(200,000)

$(85,000)

(b) Under ASPE, because payment of cash dividend is charged to

retained earnings, it would be treated as a financing activity.

Issuance of common shares

Repurchase of company’s own shares

Payment of cash dividend

Retirement of bonds

Net cash used by financing activities

$140,000

(25,000)

(58,000)

(200,000)

$(143,000)

Solutions Manual

5-10

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 5-16

Free Cash Flow Analysis

Net cash provided by operating activities

Less: Purchase of equipment

Purchase of land*

Dividends

Free cash flow

$400,000

(35,000)

(43,000)

(58,000)

$264,000

*If the land were purchased as an investment, it would be excluded in

the computation of free cash flow.

Solutions Manual

5-11

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 5-17

(a)

Operating Activities

Net income

$40,000

Depreciation expense

4,000

Increase in accounts receivable

(10,000)

Increase in accounts payable

7,000

Net cash provided by operating activities

$41,000

Investing Activities

Purchase of equipment

(8,000)

Financing Activities

Issue note payable

20,000

Dividends paid

(5,000)

Net cash provided by financing activities

15,000

Net change in cash ($41,000 – $8,000 + $15,000)

$48,000

Free Cash Flow = $41,000 (Net cash provided by operating activities) –

$8,000 (Purchase of equipment) – $5,000 (Dividends) = $28,000.

(b)

Cash Flow per share = $48,000/100,000 = $0.48

(c)

Midwest would be prohibited from providing cash flow per share

in its financial statements under ASPE.

Solutions Manual

5-12

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

SOLUTIONS TO EXERCISES

EXERCISE 5-1 (15-20 minutes)

1.

Long-term investment. Fair Value-OCI investments are not held

with the intention of realizing direct investment gains. They are

acquired for longer term strategic purposes.

Nonmonetary and Financial Instrument.

2.

Capital shares in shareholders’ equity.

Nonmonetary and Financial Instrument.

3.

Current liability.

Monetary and Financial Instrument.

4.

Property, plant, and equipment (as a deduction or contra asset

account).

Nonmonetary and not a Financial Instrument.

5.

If the warehouse in process of construction is being constructed

for another party, it is classified as an inventory account in the

current asset section. This account will be shown net of any

billings on the contract. On the other hand, if the warehouse is

being constructed for use by this particular company, it should

be classified as a separate item in the property, plant, and

equipment section.

Nonmonetary and not a Financial Instrument.

6.

Current asset.

Monetary and Financial Instrument.

7.

Current liability.

Monetary and Financial Instrument.

8.

Retained Earnings with a debit balance in shareholders’ equity.

Nonmonetary and not a Financial Instrument.

Solutions Manual

5-13

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-1 (Continued)

9.

Current asset.

Nonmonetary and Financial Instrument. Fair value-net income

investments could be monetary depending on the nature of the

investments.

10.

Current liability.

Monetary and not a Financial Instrument. The income tax

payable is an obligation that stems from regulatory

requirements and is not contractual in nature.

11.

Current liability.

Nonmonetary and not a Financial Instrument.

12.

Current asset.

Nonmonetary and not a Financial Instrument.

13.

Current liability.

Monetary and Financial Instrument.

14.

Current liability.

Nonmonetary and not a Financial Instrument. Could be seen as a

Monetary Financial Instrument in the event that the company

does not provide the goods or services (in which case, the

company owes the deposit back to the customer in cash).

Solutions Manual

5-14

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-2 (15-20 minutes)

(a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

(i)

(j)

(k)

8

4

6

6

3

1

6

7

1

1

7

(l)

(m)

(n)

(o)

(p)

(q)

(r)

(s)

(t)

(u)

6

1

7

3

2

1

1

6

6

11

Solutions Manual

5-15

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-3 (15-20 minutes)

(a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

(i)

(j)

(k)

(l)

(m)

(n)

(o)

(p)

(q)

(r)

(s)

Classification

1.

2.

6. or 7.

1.

6.

4.

1.

6.

1.

6.

1.*

3.

2.

6.

X.

3.

11.

6.

2.

Monetary

Financial

Instrument

X

X

X

X

X

X

X

X

X

X

X

X

X

X

* Under IFRS, a non-current asset may be reclassified as a current

asset when it meets the criteria to be classified as held for sale.

Solutions Manual

5-16

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-4 (35-40 minutes)

(a)

Bruno Corp.

Statement of Financial Position

December 31, 2014

Assets

Current assets

Cash

FV - NI Investments

Accounts receivable

Less allowance for doubtful accounts

Inventory, at lower of cost and net realizable

value

Prepaid expenses

Total current assets

Long-term investments

Land held for future use

Investment in bonds to be held to maturity

Property, plant, and equipment

Building

Less accumulated

depreciation—building

Equipment

Less accumulated depreciation—

equipment

Goodwill

Total assets

$ 290,000

120,000

$357,000

17,000

340,000

401,000

12,000

1,163,000

175,000

90,000

265,000

$730,000

160,000

265,000

570,000

105,000

160,000

730,000

80,000

$2,238,000

Solutions Manual

5-17

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-4 (Continued)

Liabilities and Shareholders’ Equity

Current liabilities

Accounts payable

Bank overdraft

Notes payable (due next year)

Rent payable

Total current liabilities

Long-term liabilities

Bonds payable

Add premium on bonds payable

Pension obligation

Total liabilities

Shareholders’ equity

Common shares, unlimited authorized

issued 290,000 shares

Contributed surplus

Retained earnings*

Total shareholders’ equity

Total liabilities and

shareholders’ equity

$ 195,000

30,000

125,000

49,000

399,000

$500,000

53,000

$553,000

82,000

635,000

1,034,000

290,000

180,000

734,000

1,204,000

$2,238,000

*$2,238,000 – $1,034,000 – $290,000 – $180,000 = $734,000

Solutions Manual

5-18

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-4 (Continued)

*(b)

The bank overdraft is classified as a current liability, as there is

no legal right to offset the bank overdraft against the positive

cash balance. The bank accounts are at different banks. Had the

bank overdraft been off set (netted) against the cash balance as

originally prepared by the bookkeeper, there would have been

no effect on working capital. The net amount of current assets,

less current liabilities would not change in absolute amount.

However, the classification change does affect the current ratio

(current assets / current liabilities):

Overdraft netted

$1,163 – $30

$399 – $30

= 3.07

Proper classification

$1,163

$399

= 2.91

Those who prepared the statement of financial position likely did

not do the misclassification of the bank overdraft on purpose.

The bank account in overdraft is likely one of several bank

accounts used by Bruno Corp. This particular account happens

to fall in a temporary overdraft position as of the fiscal year end

of the business.

Solutions Manual

5-19

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-5 (35-40 minutes)

(a)

Garfield Corp.

Statement of Financial Position

As at July 31, 2014

Assets

Current assets

Cash

Accounts receivable

Less allowance for doubtful accounts

Inventory

Total current assets

$ 66,000*

$ 46,700**

3,500

Long-term investments

Bond sinking fund investment

Property, plant, and equipment

Equipment

Less accumulated depreciation—

equipment

43,200

65,300***

174,500

12,000

112,000

28,000

84,000

Intangible assets

Patents

Total assets

21,000

$291,500

Liabilities and Shareholders’ Equity

Current liabilities

Notes and accounts payable

Income tax payable

Total current liabilities

$ 52,000****

9,000

61,000

Long-term liabilities

Total liabilities

Shareholders’ equity

Total liabilities and shareholders’ equity

* ($69,000 – $12,000 + $9,000)

** ($52,000 – $5,300)

*** ($60,000 + $5,300)

**** ($44,000 + $8,000)

75,000

136,000

155,500

$291,500

Solutions Manual

5-20

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-5 (Continued)

*(b)

Since there is no legal right to offset the credit balances in

accounts receivable against any other amounts owing from

customers, these balances need to be classified as a current

liability, unless the amounts are deemed to be immaterial. Had

the credit balances in accounts receivable been offset (netted)

against other debit balances as originally presented, there

would have been no effect on working capital. The net amount

of current assets, less current liabilities would not change in

absolute amount.

However, the classification change does affect the current ratio

(current assets / current liabilities) as demonstrated below:

Credit balances netted

$174,500 – $8,000

$61,000 – $8,000

= 3.14

Proper classification

$174,500

$61,000

= 2.86

The persons preparing the statement of financial position likely

did not feel that the credit balances in accounts receivable

warranted a reclassification. They likely were not aware of the

impact the credit balances would have on the current ratio.

Materiality would also be a basis for leaving the credit balances

to offset the debit balances in accounts receivable.

Solutions Manual

5-21

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-5 (Continued)

The credit balances in accounts receivable represent amounts

owing to specific customers. The following are possible

conditions or situations that would give rise to a credit balance

in accounts receivable:

1. Customers have returned goods after paying for a

shipment and credit memorandums for the sales returns

have been applied subsequent to collection on account.

2. A customer has inadvertently overpaid an account.

3. Garfield’s policy on returned items does not allow a cash

refund. Instead the policy calls for the credit to be applied

to a future purchase on account.

4. Some accounting software packages treat customer

prepayments (unearned revenues) as credit balances in

accounts receivable, since the customer information is

part of the accounts receivable subsidiary ledger.

Solutions Manual

5-22

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-6 (30-35 minutes)

Iris Inc.

Statement of Financial Position

December 31, 20–

Assets

Current assets

Cash

Less cash restricted for plant expansion

Accounts receivable

Less allowance for doubtful accounts

Notes receivable

Accounts receivable—officers

Inventory

Finished goods

Work in process

Raw materials

Total current assets

Long-term investments

FV - OCI Investments

Land held for future plant site

Cash restricted for plant expansion

Total long-term investments

Property, plant, and equipment

Buildings

Less accumulated depreciation—buildings

Intangible assets

Copyrights

Total assets

$XXX

XXX $XXX

XXX

XXX

XXX

XXX

XXX

XXX

XXX

XXX

XXX

$XXX

XXX

XXX

XXX

XXX

XXX

XXX

XXX

XXX

$XXX

Solutions Manual

5-23

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-6 (Continued)

Liabilities and Shareholders’ Equity

Current liabilities

Salaries and wages payable

Unearned subscriptions revenue

Unearned rent revenue

Total current liabilities

$XXX

XXX

XXX

$XXX

Long-term liabilities

Bonds payable, due in four years

Total liabilities

Shareholders’ equity

Common shares

Retained earnings

Total shareholders’ equity

Total liabilities and share holders’ equity

XXX

XXX

$XXX

XXX

XXX

$XXX

Note to instructor: An assumption made here is that cash includes the

cash restricted for plant expansion. If it did not, then a subtraction

from cash would not be necessary, or the cash balance would be

“grossed up” and then the cash restricted for plant expansion would

be deducted.

Solutions Manual

5-24

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-7 (10-15 minutes)

(a)

1.

Dividends payable of $2,500,000 will be reported as a current

liability (1,000,000 X $2.50).

2.

No amounts are reported as a current or long-term liability.

Stock dividends distributable are reported in the shareholders'

equity section.

3.

Bonds payable of $25,000,000 and interest payable of $1,750,000

($100,000,000 X 7% X 3/12) will be reported as a current liability.

Bonds payable of $75,000,000 will be reported as a long-term

liability.

4.

Customer advances of $27,000,000 will be reported as a current

liability ($12,000,000 + $40,000,000 – $25,000,000).

5.

No amounts are reported as a current or long-term liability.

Retained earnings appropriations are reported and often

segregated in the shareholders' equity section or as a note to

the financial statements related to retained earnings.

6.

Demand bank loans must be classified as current liabilities.

(b)

Liabilities have two essential characteristics: they represent an

economic burden or obligation, and the entity has a present

obligation (which is enforceable). When Samson accepts an

advance from a customer, an economic burden or obligation

arises, which is satisfied when Samson provides the related

goods or services. The obligation is a present obligation (which

is enforceable), until the related goods or services are delivered.

Earned customer advances of $25 million no longer represent a

liability because the economic burden or obligation has been

satisfied.

Solutions Manual

5-25

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-8 (35-40 minutes)

(a)

Zeitz Corporation

Statement of Financial Position

December 31, 2014

Assets

Current assets

Cash

FV - NI investments

$205,000

153,000

Accounts receivable

Less allowance for doubtful

accounts

Inventory

Total current assets

$515,000

(25,000)

Long-term investments

Bond investments at amortized cost

FV - OCI Investments

Total long-term investments

Property, plant, and equipment

Land

Building

1,040,000

Less accumulated depreciation

(152,000)

Equipment

600,000

Less accumulated depreciation

(60,000)

Total property, plant, and equipment

Intangible assets

Intangible Assets-Franchises

Intangible Assets-Patents

Total intangible assets

Total assets

490,000

687,000

$1,535,000

299,000

345,000

644,000

260,000

888,000

540,000

1,688,000

160,000

195,000

355,000

$4,222,000

Solutions Manual

5-26

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-8 (Continued)

Liabilities and Shareholders’ Equity

Current liabilities

Accounts payable

Commissions payable

Notes payable (due in six

months)

Accrued liabilities

Total current liabilities

Long-term liabilities

Notes payable

Bonds payable

Total long-term liabilities

Total liabilities

Shareholders’ equity

Common shares

Retained earnings**

Accumulated other comprehensive income

Total shareholders’ equity

Total liabilities and

shareholders’ equity

* FV-OCI investments – gain

($345,000–$277,000)

Add opening balance

**Calculation of Retained Earnings:

Sales revenue

Unrealized gain or loss (on investments)

Unusual gain

Cost of goods sold

Selling expenses

Administrative expenses

Interest expense

Net income

Beginning retained earnings

Net income

Correction of prior year’s error

Ending retained earnings

$ 545,000

136,000

98,000

96,000

$ 875,000

900,000

1,000,000

1,900,000

2,775,000

$ 809,000

490,000

148,000*

1,447,000

$4,222,000

$68,000

80,000

$148,000

$7,960,000

63,000

160,000

(4,800,000)

(1,860,000)

(900,000)

(211,000)

$ 412,000

$ 218,000

412,000

(140,000)

$ 490,000

Solutions Manual

5-27

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-8 (Continued)

(b)

A classified statement of financial position requires the

reporting of current assets and liabilities, and the classifications

are used for measurement of liquidity. The length of the

operating cycle will determine what items are classified as

current where the operating cycle is longer than one year.

Should the business have several segments, such as in the case

of Bombardier Inc., (aerospace, transportation and financing

services) and the operating cycles are very different, applying

one cycle length to all business segments becomes

meaningless. In cases such as this, the consolidated statement

of financial position is not classified.

Solutions Manual

5-28

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-9 (15-20 minutes)

1.

Because the likelihood of payment is remote, accrual of a

liability is not required. Case by case examination is required

with respect to all lawsuits.

2.

A current liability of $150,000 should be recorded.

3.

A current liability for accrued interest of $6,000 ($900,000 X 8% X

1/12) should be reported. Any portion of the $900,000 note that is

payable within one year from the statement of financial position

date should be shown as a current liability. Otherwise, the

$900,000 note payable would be a long-term liability.

4.

Although bad debts expense of $200,000 should be debited and

the allowance for doubtful accounts credited for $200,000, this

does not result in a liability. The allowance for doubtful accounts

is a valuation account (contra asset) and is deducted from

accounts receivable on the statement of financial position.

5.

A current liability of $80,000 ($2 X 40,000) should be reported.

The liability is recorded on the date of declaration.

6.

Customer advances of $110,000 ($160,000 – $50,000) will be

reported as a current liability if the advances are expected to be

earned within one year.

Solutions Manual

5-29

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-10 (20-25 minutes)

(a)

Current assets

Cash

Less cash restricted for plant expansion

FV - NI investments

Accounts receivable (of which $50,000 is

pledged as collateral on a bank loan)

Less allowance for doubtful accounts

Notes receivable

Interest receivable **

Inventory at lower of FIFO cost and

net realizable value

Finished goods

Work-in-process

Raw materials

Total current assets

$ 92,000*

(50,000)

161,000

(12,000)

52,000

34,000

187,000

$42,000

29,000

149,000

40,000

1,600

273,000

$534,600

*An acceptable alternative is to report cash at $42,000 and report the

cash restricted for plant expansion in the non-current investments

section of the statement of financial position. ($50,000 + $50,000 –

$8,000)

** [($40,000 X 6%) X 8/12]

Solutions Manual

5-30

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-10 (Continued)

(b)

An alternative to the presentation of the details (for example of

the three categories of inventory) as shown above is to provide

disclosure in a table within the notes to the financial statements.

This provides a more condensed format of the statement of

financial position. This allows easier comparisons of balances,

especially when presented on a comparative basis. References

to the notes containing the detail would be added to the

captions appearing on the face of the statement of financial

position as a cross-reference.

A second possible alternative to the presentation of information

is parenthetical disclosure on the face of the statement of

financial position. Although not a required disclosure, the

balance of accounts receivable could be presented: “net of

allowance for doubtful accounts of $12,000.”

Solutions Manual

5-31

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-11 (40-45 minutes)

(a)

Zezulka Corporation

Statement of Financial Position

December 31, 2014

Assets

Current assets

FV – OCI Investments

Property, plant, and equipment

Land

Building ($1,120,000 + $31,000)

$1,151,000

Less accumulated depreciation

($130,000 + $4,000)

(134,000)

Equipment ($320,000 – $20,000)

300,000

Less accumulated depreciation

($11,000 – $8,000 + $9,000)

(12,000)

Total

Intangible assets

Patents, net ($40,000 – $3,000)

$1,580,500a

20,500

$ 30,000

1,017,000

288,000

1,335,000

37,000

Total assets

$2,973,000

Liabilities and Shareholders’ Equity

Current liabilities ($1,020,000 + $213,000)

Long-term liabilities

Bonds payable ($1,100,000 + $75,000)

Total liabilities

Shareholders’ equity

Common shares

Retained earnings*

Total shareholders’ equity

Total liabilities and shareholders’ equity

$1,233,000

1,175,000

2,408,000

$180,000

385,000

565,000

2,973,000

* ($174,000 + $391,000 – $180,000)

a

The amount determined for current assets is calculated last

and is a forced figure. That is, total liabilities, shareholders’

equity and other asset balances are calculated because

information is available to determine these amounts.

Solutions Manual

5-32

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-11 (Continued)

(b)

Zezulka Corporation

Statement of Cash Flows

For the Year Ended December 31, 2014

Cash flows from operating activities

Net income

$391,000

Adjustments to reconcile net income to

net cash provided by operating activities:

Loss on sale of equipment

[($20,000 – $8,000) – $10,000]

$ 2,000

Depreciation expense

($4,000 + $9,000)

13,000

Patent amortization expense

3,000

Increase in current liabilities

213,000

Increase in current assets (other

than cash)

(229,000)

2,000

Net cash provided by operating activities

393,000

Cash flows from investing activities

Proceeds from sale of equipment

Addition to building

Purchase of investment in shares

Net cash used by investing activities

Cash flows from financing activities

Issuance of bonds

Payment of dividends

Net cash used by financing activities

Net increase in cash

b

10,000

(31,000)

(20,500)

(41,500)

75,000

(180,000)

(105,000)

$246,500b

An additional proof to arrive at the increase in cash is provided as

follows:

Total current assets—end of period [from part (a)]

Total current assets—beginning of period

Increase in current assets during the period

Increase in current assets other than cash

Increase in cash during year

$1,580,500

1,105,000

475,500

229,000

$ 246,500

Solutions Manual

5-33

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-12 (30-35 minutes)

(a)

Agincourt Corp.

Partial Statement of Financial Position

As at December 31, 2014

Current assets

Cash

Accounts receivable

Less allowance for doubtful

accounts

Inventory

Prepaid expenses

Total current assets

$30,476*

$91,300**

7,000

Current liabilities

Accounts payable

Notes payable

Total current liabilities

* Cash balance

Add: Cash disbursement after

discount [$35,000 X 98%)]

Less: Cash sales in January

($30,000 – $21,500)

Cash collected on account

Bank loan proceeds ($35,324 – $23,324)

Adjusted cash

** Accounts receivable balance

Add: Accounts reduced from January

collection ($23,324 plus 2% discount of $476)

Deduct: Accounts receivable in January

Adjusted accounts receivable

84,300

161,000***

9,000

$284,776

$113,000a

55,000b

$168,000

$ 40,000

34,300

74,300

(8,500)

(23,324)

(12,000)

$30,476

$ 89,000

23,800

112,800

(21,500)

$ 91,300

Solutions Manual

5-34

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-12 (Continued)

*** Inventory

Less: Inventory received on consignment

Adjusted inventory

a

b

*(b)

Accounts payable balance

Add: Cash disbursements

Purchase invoice omitted

($27,000 – $10,000)

Adjusted accounts payable

$ 61,000

$35,000

17,000

Notes payable balance

Less: Proceeds of bank loan

Adjusted notes payable

52,000

$113,000

$ 67,000

(12,000)

$ 55,000

Current ratio – Deteriorated dramatically

Before Restatement

$302,000

$128,000

= 2.359

(c)

$171,000

(10,000)

$161,000

Restated

$284,776

$168,000

1.695

Adjustment to retained earnings balance:

Add: January sales discounts

[($23,324 ÷ 98%) X .02]

Deduct:

January sales

$30,000

January purchase discounts

($35,000 X 2%)

700

December purchases

($27,000 – $10,000)

17,000

Consignment inventory

10,000

Decrease to retained earnings

$ 476

(57,700)

$(57,224)

Solutions Manual

5-35

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-12 (Continued)

(d)

Agincourt’s bank manager is relying on the information in the

statement of financial position as at December 31, 2014 to

assess if a new bank loan should be extended to the company.

Before restatement, Agincourt’s current ratio is 2.359, and after

restatement, Agincourt’s current ratio is 1.695. The adjustments

are material because they result in a current ratio that is much

closer to the minimum required current ratio, and would likely

affect the bank manager’s decision to extend a new bank loan to

Agincourt. In order for financial statements to be useful,

relevant, and faithfully representative, they must be free from

error and bias. Recording of the adjustments is necessary in

order to provide financial statement users with useful and

complete information to use in their investment and credit

decisions.

Solutions Manual

5-36

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-13 (20-25 minutes)

1. Contingency. Under IFRS, a provision is recognized in income and

as a liability if it is probable (more likely than not) that the

confirming future event will occur. In this example, it is not likely

that damages will be awarded to the plaintiff, and so it is

considered a contingent loss that is not recognized. However, the

contingency would be disclosed in the notes to financial

statements if the possibility of an outflow of company resources is

not remote.

2. Subsequent event. This event provides evidence about conditions

that did not exist at the statement of financial position date, but

arose subsequent to that date, and therefore adjustment of the

statement of financial position as at December 31, 2014 is not

required. However, this event may have to be disclosed in the

notes to financial statements to keep the financial statements from

being misleading.

3. Provision. Under IFRS, a provision is recognized in income and as

a liability if it is probable (more likely than not) that the confirming

event will occur. According to Janix’s legal counsel, Janix will

likely lose the lawsuit; therefore a provision should be recognized.

IFRS requires that the “expected value” of the loss be used to

measure the liability. If $850,000 payout and $950,000 payout are

equally probable, the liability should be measured at $900,000.

4. Commitment. Under IFRS, if the unavoidable costs of completing

the contract are higher than the benefits expected from receiving

the contracted goods or services, a loss provision is recognized. In

this example, the cost per inventory unit has decreased, therefore

under IFRS, if the contract is non-cancellable, a loss provision

should be recognized in the amount of $400,000 (200,000 X [$12 $10]).

5. Commitment. Commitments that obligate a company must be

disclosed if they are material. A restriction on payment of

dividends should be disclosed in the notes to financial statements,

because it is likely to be considered material.

Solutions Manual

5-37

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-13 (Continued)

6. Subsequent event. This event provides evidence about conditions

that did not exist at the statement of financial position date, but

arose subsequent to that date, and therefore adjustment of the

statement of financial position as at December 31, 2014 is not

required. However, this event may have to be disclosed in the

notes to financial statements to keep the financial statements from

being misleading.

Solutions Manual

5-38

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-14 (15-20 minutes)

(a)

Carmichael Industries Inc.

Statement of Cash Flows

For the Year Ended December 31, 2014

Cash flows from operating activities

Net income

$129,000

Adjustments to reconcile net income to

net cash provided by operating activities:

Depreciation expense

$27,000

Increase in accounts receivable

(50,000)

Increase in inventory

(31,000)

Decrease in accounts payable

(7,000) (61,000)

Net cash provided by operating activities

68,000

Cash flows from investing activities

Purchase of equipment

(60,000)

Proceeds from sale of land

39,000

Net cash used by investing activities

(21,000)

Cash flows used by financing activities

Payment of cash dividends

(60,000)

Net cash used by financing activities

(60,000)

Net decrease in cash

(13,000)

Cash at beginning of year

34,000

Cash at end of year

$21,000

Note: During the year, Carmichael retired $50,000 in bonds payable

by issuing common shares.

(b)

Carmichael managed to generate sufficient cash from

operations to finance a strong dividend payout ratio of 46.5%

($60,000 divided by $129,000). The cash generated from the sale

of land was used to purchase equipment. There are some

indications that too much cash is tied up in current assets, from

the dramatic increase in both the accounts receivable and the

inventory balances over the year.

Solutions Manual

5-39

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-15 (15-20 minutes)

A) Direct method

(a)

3.

(b)

2.

(c)

3.

(d)

2.

(e)

4.

(f)

4.

(g)

4.

(h)

3.*

(i)

4.

(j)

4.

(k)

1.

(l)

1.

(m) 1.*

(n)

1.**

B) Indirect method

(a)

3.

(b)

2.

(c)

3.

(d)

2

(e)

1.

(f)

1.

(g)

4.

(h)

3.*

(i)

4.

(j)

1.

(k)

1.

(l)

1.

(m) 1.*

(n)

1.**

* Under ASPE, interest and dividends paid are operating activities if

recognized in net income. If charged directly to retained earnings,

they are presented as financing activities. (Under IFRS, interest and

dividends paid may be presented as either operating or financing

activities.)

Solutions Manual

5-40

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-15 (Continued)

** Under ASPE, interest and dividends received are presented as

operating activities. (Under IFRS, interest and dividends received may

be presented as either operating or investing activities.)

Solutions Manual

5-41

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-16 (30-35 minutes)

(a)

Kneale Transport Inc.

Partial Statement of Cash Flows

For the Year Ended December 31, 2014

Cash flows from operating activities

Net income

$148,000

Adjustments to reconcile net income to

net cash provided by operating activities:

Depreciation expense

$70,000

Gain on sale of equipment

(25,000)

Decrease in accounts receivable

10,000

Increase in prepaid insurance

(3,000)

Decrease in accounts payable

(11,000)

Increase in interest payable

1,250

Increase in income taxes payable

3,500

Decrease in unearned revenue

(4,000) 41,750

Net cash provided by operating activities

$189,750

(b)

Kneale Transport Inc.

Partial Statement of Cash Flows

For the Year Ended December 31, 2014

Cash flows from operating activities

Cash received from customers (1)

Cash payments

For operating expenses (2)

For interest (3)

For income tax (4)

Net cash provided by operating activities

$551,000

$314,000

8,750

38,500

361,250

$189,750

Solutions Manual

5-42

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-16 (Continued)

(a)

(1) Cash received from customers

Revenues from fees

Add: Decrease in accounts receivable

($60,000 – $50,000)

Less: Decrease in unearned revenue

($14,000 – $10,000)

Cash receipts from customers

(2) Cash payments for operating expenses

Operating expenses

Add: Increase in prepaid insurance ($5,000 – $8,000)

Decrease in accounts payable ($41,000 – $30,000)

Cash payments for operating expenses

$545,000

$10,000

(4,000)

$551,000

$300,000*

3,000

11,000

$314,000

* $370,000 – $70,000 = $300,000

(3) Cash payments for interest

Interest expense

Less: Increase in interest payable ($2,000 – $750)

Cash payments for interest

$10,000

(1,250)

$ 8,750

(4) Cash payments for income tax

Income tax expense

$42,000

Less: Increase in income tax payable ($8,000 – $4,500)

(3,500)

Cash payments for income tax

$38,500

Solutions Manual

5-43

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-16 (Continued)

(c)

The indirect method focuses on the differences between net

income and cash flow from operating activities. A user of

Kneale’s financial statements would find this information useful

in that it provides a useful link between the statement of cash

flows, the income statement, and the statement of financial

position. The direct method shows operating cash receipts and

payments, which is more consistent with the objective of the

statement of cash flows (that is, to provide information about the

company’s sources and uses of cash). A user of Kneale’s

financial statements would find this information useful in

estimating future cash flow from operating activities.

Solutions Manual

5-44

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 5-17 (15-20 minutes)

Marubeni Corporation

Statement of Cash Flows

For the Year Ended December 31, 2014

Cash flows from operating activities

Net income

Adjustments to reconcile net income to

net cash provided by operating activities:

Depreciation expense

$6,000

Gain on sale of equipment

(3,000)*

Increase in accounts receivable

(3,000)

Increase in accounts payable

5,000

Net cash provided by operating activities

Cash flows from investing activities

Proceeds from sale of equipment

8,000

Purchase of equipment

(17,000)**

Net cash used by investing activities

Cash flows from financing activities

Issuance of common shares

20,000

Payment of cash dividends

(13,000)

Net cash provided by financing activities

Net increase in cash

Cash at beginning of year

Cash at end of year

$37,000

5,000

42,000

(9,000)

7,000

40,000

13,000

$53,000

* $8,000 - $5,000

** $27,000 + $12,000 - $22,000

Solutions Manual

5-45

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

*EXERCISE 5-18 (15-20 minutes)

(a) Current Ratio :

2014

$53,000 + $91,000

$20,000

= 7.20

Debt to total assets ratio:

2014

$20,000

$161,000

= 12.4%

2013

$13,000 + $88,000

$15,000

= 6.73

2013

$15,000

$112,000

= 13.4%

Free cash flow:

2014

Net cash provided by operating activities

$42,000

Less: Purchase of equipment

(17,000) *

Dividends paid

(13,000)

Free cash flow

$12,000

*Some companies may use the net investing cash outflow of

$9,000, which would increase the amount of free cash flow to

$20,000. It is important to understand how companies define free

cash flow when interpreting the ratio.

(b) Marubeni’s current ratio has increased slightly from 2013 to 2014,

and remains in excess of 6. The debt to total assets ratio has

declined and remains at a very low percentage. The accounts

receivable are climbing slightly and could be investigated. The

company has excellent liquidity and financial flexibility.

Solutions Manual

5-46

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

*EXERCISE 5-19 (15-20 minutes)

(a)

Current ratio*

Acid test ratio**

2014

6.63

2.40

2013

4.69

1.49

*2014: ($21,000 + $104,000 + $220,000)/$52,000

2013: ($34,000 + $54,000 + $189,000)/$59,000

**2014: ($21,000 + $104,000)/$52,000

2013: ($34,000 + $54,000)/$59,000

(b) Current cash debt coverage – Net cash provided from operating

activities divided by average current liabilities:

$68,000

$55,500

Its current cash debt coverage is 1.23 to 1

(c)

Carmichael’s current and acid test ratios are both in excess of 1

and they both exhibit an increasing trend from 2013 to 2014. Its

current cash debt coverage is excellent at 1.23 to 1. However,

free cash flow ($68,000 - $60,000 - $60,000) is negative in 2014.

Note also that accounts receivable and inventories have

increased substantially from 2013 to 2014. While these increases

impact liquidity ratios positively, if Carmichael has difficulty in

collecting receivables or if sales slow and the inventory is not

converted to cash, Carmichael’s liquidity and financial flexibility

will be negatively affected.

Solutions Manual

5-47

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

TIME AND PURPOSE OF PROBLEMS

Problem 5-1

(Time 30-35 minutes)

Purpose—to provide the student with the opportunity to prepare a statement of financial

position, given a set of accounts. No monetary amounts are to be reported.

Problem 5-2

(Time 35-40 minutes)

Purpose—to provide the student with the opportunity to prepare a complete statement

of financial position, involving dollar amounts. A unique feature of this problem is that

the student must solve for the retained earnings balance. Providing additional disclosure

is also required.

Problem 5-3

(Time 40-45 minutes)

Purpose—to provide an opportunity for the student to prepare a statement of financial

position in good form. Emphasis is given in this problem to additional important

information that should be disclosed. For example, an inventory valuation method, bank

loans secured by long-term investments, and information related to the share capital

accounts must be disclosed.

Problem 5-4

(Time 40-45 minutes)

Purpose—to provide the student with the opportunity to analyze a statement of financial

position and correct it where appropriate. The statement of financial position as reported

is incomplete, uses poor terminology, and is in error. This is a challenging problem.

Problem 5-5

(Time 30-40 minutes)

Purpose—to review Chapters 4 and 5. The student must prepare an income statement

and statement of financial position using information from records prepared on a cash

basis.

Problem 5-6

(Time 25-30 minutes)

Purpose—to provide a varied number of financial transactions and events and then

determine how each of these items should be reported in the financial statements.

Accounting principle changes, additional assessments of income taxes, corrections of

prior years’ errors, and changes in estimates and subsequent events are some of the

financial transactions presented.

Solutions Manual

5-48

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

TIME AND PURPOSE OF PROBLEMS (Continued)

Problem 5-7

(Time 40-50 minutes)

Purpose—to provide the student with an opportunity to prepare a condensed statement

of financial position and a more complex statement of cash flows from selected

transactions and perform some ratio analysis. The student is also required to explain

the patterns of the cash flows that are being reported.

Problem 5-8

(Time 40-50 minutes)

Purpose—to provide the student with an opportunity to prepare a complete statement of

cash flows. A condensed statement of financial position is also required along with

selected ratios. The student is also required to explain the usefulness of the statement

of cash flows and discuss the patterns of the cash flows that are being reported.

Problem areas flagged on the cash flow must be discussed and addressed. Because

the textbook does not explain in Chapter 5 all of the steps involved in preparing the

statement of cash flows, assignment of this problem is dependent upon additional

instruction by the instructor or knowledge gained in introductory financial accounting.

This is a comprehensive problem.

Problem 5-9

(Time 40-45 minutes)

Purpose—to provide the student with the opportunity to prepare a statement of financial

position in good form. Additional information is provided on each asset and liability

category for purposes of preparing the statement of financial position. Students are also

asked about the appropriateness about possible condensed formats of presenting

information on the statement of financial position. This is a challenging problem.

Problem 5-10

(Time 25-30 minutes)

Purpose—to present a statement of financial position that must be analyzed to assess

its deficiencies. Items such as improper classification, terminology, and disclosure must

be considered.

Problem 5-11

(Time 25-30 minutes)

Purpose—to provide the student with an opportunity to prepare a complete statement of

cash flows. A comparative statement of financial position is provided. The student is

also required to analyze the statement of cash flows from the perspective of a

shareholder.

Solutions Manual

5-49

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

SOLUTIONS TO PROBLEMS

PROBLEM 5-1

Company Name

Statement of Financial Position

December 31, 20XX

Assets

Current assets

Cash*

Less restricted cash

FV - NI investments

Accounts receivable

Less allowance for doubtful accounts

Interest receivable

Advances to employees

Inventory

Prepaid rent

Total current assets

Long-term investments

Notes receivable due in five years

Land Held for future plant site

FV – OCI investments

Restricted cash

Total long-term investments

Property, plant, and equipment

Land

Buildings

Less accumulated depreciation—buildings

Equipment

Less accumulated depreciation—equipment

Total property, plant, and equipment

Intangible assets

Patents (net of amortization)

Copyrights (net of amortization)

Total intangible assets

Total assets

Solutions Manual

5-50

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

PROBLEM 5-1 (Continued)

Liabilities and Shareholders’ Equity

Current liabilities

Notes payable

Income tax payable

Salaries and wages payable

Dividends payable

Unearned subscriptions revenue

Total current liabilities

Long-term liabilities

Bonds payable

Plus premium on bonds payable

Pension obligation

Total long-term liabilities

Total liabilities

Shareholders’ equity

Capital shares

Preferred shares (description)

Common shares (description)

Total capital shares

Retained earnings

Accumulated other comprehensive income

Total shareholders’ equity

Total liabilities and shareholders’ equity

* Cash includes cash and petty cash

Solutions Manual

5-51

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

PROBLEM 5-2

(a)

Montoya Inc.

Statement of Financial Position

December 31, 2014

Assets

Current assets

Cash

FV - NI

$ 360,000

Investments

121,000

445,700

97,630

239,800

87,920

1,352,050

Notes receivable

Income taxes receivable

Inventory

Prepaid expenses

Total current assets

Property, plant, and equipment

Land

Building

Less accumulated

depreciation—building

Equipment

Less accumulated

depreciation—equipment

$ 480,000

$1,640,000

270,200

1,470,000

1,369,800

292,000

1,178,000

Goodwill

Total assets

3,027,800

125,000

$4,504,850

Liabilities and Shareholders’ Equity

Current liabilities

Accounts payable

Notes payable

Payroll taxes payable

Income tax payable

Rent payable

Total current liabilities

$ 490,000

265,000

177,591

98,362

45,000

1,075,953

Solutions Manual

5-52

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

PROBLEM 5-2 (Continued)

Long-term liabilities

Notes payable

Bonds payable, due 2019,

net of discount of $15,000

Rent payable

Total liabilities

Shareholders’ equity

Capital shares

Preferred shares; 20,000

shares authorized, 15,000

shares issued

150,000

Common shares; 400,000

shares authorized, 20,000

shares issued

200,000

Retained earnings

Total shareholders’ equity

Total liabilities and shareholders’ equity

$1,600,000

285,000

480,000

2,365,000

3,440,953

350,000

713,897*

1,063,897**

$4,504,850

*

**

($1,063,897 – $350,000)

($4,504,850 – $3,440,953)

(b)

In order to allow the reader of the statement of financial position

to assess the timing of the future cash outflows concerning

future rentals, a table illustrating the amount and the timing of

the cash flows for each of the next five years and amounts

beyond five years would be provided in the notes to the financial

statements.

Solutions Manual

5-53

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly

prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

PROBLEM 5-3

(a)

Eastwood Inc.

Statement of Financial Position

December 31, 2014

Assets

Current assets

Cash

Accounts receivable

Less allowance for doubtful

accounts

Inventory—at lower of FIFO cost/NRV

Prepaid insurance

Total current assets

$ 41,000

$163,500

8,700

154,800

208,500

5,900

$ 410,200

Long-term investments

FV – OCI investments, of which investments

costing $120,000 have been pledged as

security for notes payable to bank

478,000

Property, plant, and equipment

Cost of uncompleted plant facilities

Land

Building in process of construction

Equipment

Less accumulated depreciation

$ 85,000

124,000

400,000

240,000

Intangible assets

Patents (net of accumulated amortization of $4,000)

Total assets

209,000

160,000

369,000

36,000

$1,293,200

Solutions Manual

5-54

Chapter 5

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly