Income Tax - Rakowski - 2005 Fall - outline 1

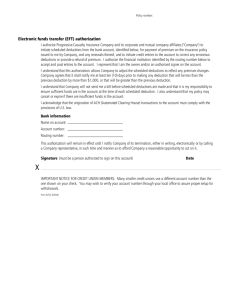

advertisement