Economics 201

advertisement

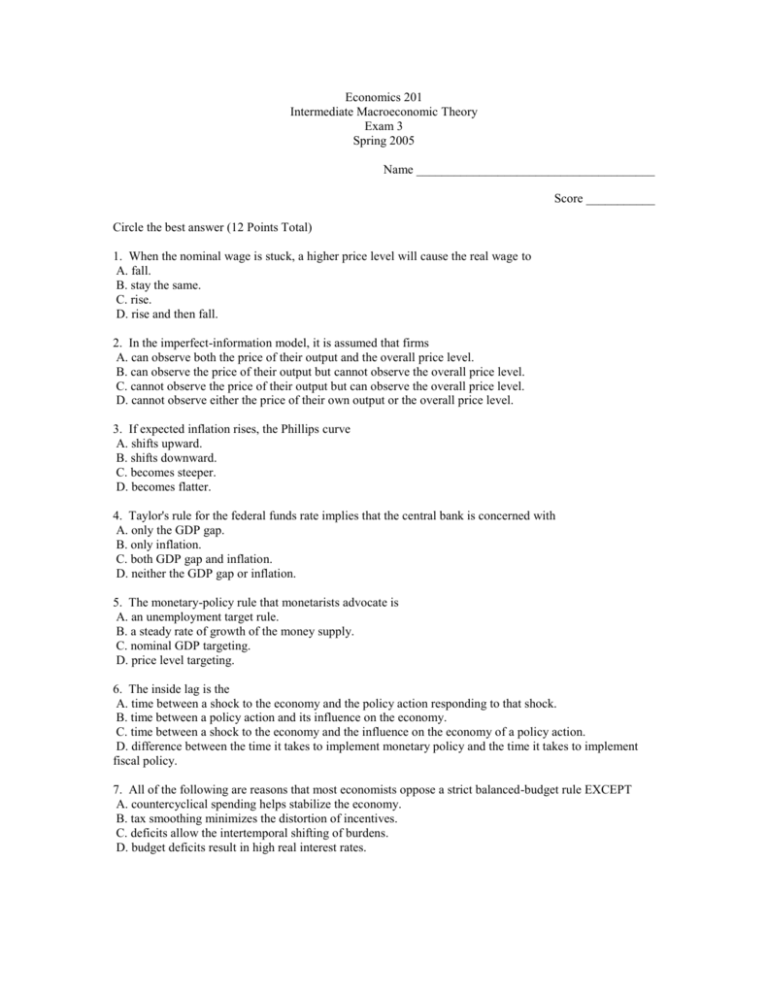

Economics 201 Intermediate Macroeconomic Theory Exam 3 Spring 2005 Name ______________________________________ Score ___________ Circle the best answer (12 Points Total) 1. When the nominal wage is stuck, a higher price level will cause the real wage to A. fall. B. stay the same. C. rise. D. rise and then fall. 2. In the imperfect-information model, it is assumed that firms A. can observe both the price of their output and the overall price level. B. can observe the price of their output but cannot observe the overall price level. C. cannot observe the price of their output but can observe the overall price level. D. cannot observe either the price of their own output or the overall price level. 3. If expected inflation rises, the Phillips curve A. shifts upward. B. shifts downward. C. becomes steeper. D. becomes flatter. 4. Taylor's rule for the federal funds rate implies that the central bank is concerned with A. only the GDP gap. B. only inflation. C. both GDP gap and inflation. D. neither the GDP gap or inflation. 5. The monetary-policy rule that monetarists advocate is A. an unemployment target rule. B. a steady rate of growth of the money supply. C. nominal GDP targeting. D. price level targeting. 6. The inside lag is the A. time between a shock to the economy and the policy action responding to that shock. B. time between a policy action and its influence on the economy. C. time between a shock to the economy and the influence on the economy of a policy action. D. difference between the time it takes to implement monetary policy and the time it takes to implement fiscal policy. 7. All of the following are reasons that most economists oppose a strict balanced-budget rule EXCEPT A. countercyclical spending helps stabilize the economy. B. tax smoothing minimizes the distortion of incentives. C. deficits allow the intertemporal shifting of burdens. D. budget deficits result in high real interest rates. 8. Far over the seas, there is a country called Hypothetica, in which Ricardian equivalence reigns supreme. Suppose the Hypothetican government raises taxes to redeem some of the government debt outstanding. What happens to public saving and national saving? A. Public saving rises, but national saving remains constant. B. Both public and national saving remain constant. C. Public saving rises and national saving falls. D. Public saving falls, but national saving remains constant. 9. If the Fed increases the discount rate that it charges when it makes loans to banks, then the monetary base will A. fall and the money supply will also fall. B. fall and the money supply will rise. C. rise and the money supply will fall. D. rise and the money supply will rise. 10. Economists often say money is a dominated asset. This means that there are other assets with A. the same risk and higher returns. B. higher risk and higher returns. C. lower risk and lower returns. D. higher risk and the same return. 11. To improve the liquidity position of a country's ailing banking system, the central bank increases the minimum required reserve-deposit ratio. If the central bank does not want the money supply to change, the combination of policies it could adopt is to A. raise the discount rate and buy government bonds. B. raise the discount rate and sell government bonds. C. lower the discount rate and buy government bonds. D. lower the discount rate and sell government bonds. 12. Theories of money demand that emphasize the role of money as a medium of exchange are called A. transactions theories. B. portfolio theories. C. quantity theories. D. q theories. 2. Describe how the worker misperception model (Lucas Island model) leads to a positively sloped aggregate supply curve. Your explanation must be complete. (5 Points) 3. Using an aggregate supply and aggregate demand model (either AS-AD model is acceptable) show graphically and describe verbally how the Lucas Critique would apply in a situation where the economy is currently operating at full employment and the Fed increases the money supply. What are the short-run and long-run effects of the change in monetary policy? What are the important assumptions involved? (6 Points) 4. Describe four ways in which the national debt may be mis-measured. (4 Points) 5. Describe both the Traditional view and the Ricardian view of debt that results from a tax cut. Show your results in an AS-AD graph. What are the important assumptions for each case? What happens to public savings, private savings, and national savings in both cases? (6 Points) 6. Both verbally and graphically (AS-AD model) compare a Keynesian tax cut and a supply side tax cut. (You may want to use separate graphs). Be sure to discuss both the short-run and long-run effects of each policy. What are the important assumptions in each case? (6 Points) 7. Draw a graph of the Phillips Curve. Explain the trade-off illustrated by the Phillips Curve. According to the Lucas critique, why should policy makers not rely upon the Phillip's curve relationship between inflation and unemployment as the formula for monetary policy? (5 Points) 8. Suppose the banks in an economy have a reserve-deposit ratio of 10 percent and the currency-deposit ratio is 20 percent. (6 Points) a. If the Federal Reserve increases the monetary base by $500 through open market operations, what will be the increase in the money supply? b. If the Federal Reserve increases the discount rate and firms react by increasing the reserve-deposit ratio to 15 percent, what is the change in the multiplier? Will this change increase or decrease the money supply? c. Ultimately, what determines the Fed’s ability to control the money supply?