ch6p4

advertisement

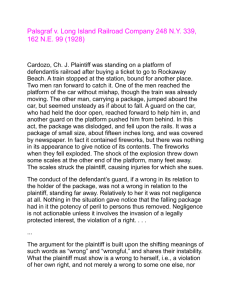

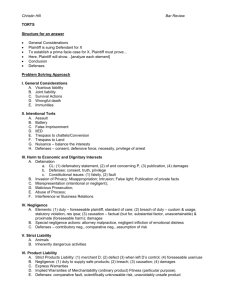

172 Tort Law v/ v// §6.4 i/ Victim Fault: Contributory and Comparative Negligence, Assumption of Risk, and Duties to Trespassers That the burden of precaution is less than the probability times magnitude of loss if the precaution is not taken is only a necessary, and not a sufficient, condition for the precaution to be efficient. If another precaution would do the trick at even lower cost, that is the efficient precaution. Since, as every pedestrian knows, many accidents can be prevented by victims at lower cost than by injurers, the law must be careful not to impair the incentives of potential accident victims to take efficient precautions. Suppose that an expected accident cost of $1,000 could have been avoided by the defendant at a cost of $100 but by the plaintiff at a cost of only $50. The efficient solution is to make the plaintiff "liable" by refusing to allow him to recover damages from the defendant. If the defendant is liable, the plaintiff will have no incentive to take preventive measures because he will be fully compensated for his injury, and the efficient solution will not be obtained. No doubt there is exaggeration here. As we shall see, tort damages are not always fully compensatory, especially where serious personal injuries are concerned; and to the extent they are not, potential victims will have an incentive to take precautions even if their failure to do so would not cut down their entitlement to damages §6.3 1. The T.J. Hooper, 60 F.2d 737 (2d Cir. 1932). Victim Fattit 173 by one cent if they were injured. But the incentive will be less (maybe zero in cases of property damage, as in the railroad spark case discussed in Chapter 3 and below). How should victim care be worked into the Hand Formula? The traditional common law approach, which goes by the name of "contributory negligence," was, after asking whether the defendant had been negligent and concluding that he had (if he had not, that would be the end of the case), to turn around and ask whether the plaintiff had been negligent. If the answer was "yes," the plaintiff lost. This works fine in the example given above, but suppose we reverse the cost-of-precaution figures, so that the cost is $50 for the defendant and $100 for the plaintiff. It seems that the defendant will be deemed negligent but the plaintiff will be contributorily negligent (because $100 is less than $1,000) and so will lose, and that the defendant will have no incentive for the future to take a precaution that by hypothesis is the efficient one. However, the appearance is misleading, provided that the law defines due care--as it does--as the care that is optimal if the other party is exercising due care. Since, in our example, if the defendant is exercising due care the plaintiff's optimal care will be zero, the plaintiff will have no incentive to take care, and knowing this the defendant will spend $50 on care and the accident will be avoided at least cost. Why won't the court listen to the defendant if he says that if the plaintiff were exercising due care, the defendant's optimal care would be zero, so he should be let off the hook? In the above examples the implicit assumption was that the case was one of "alternative care," that is, that the efficient solution was for one party, but not both, to take care. The goal therefore was to make sure that the lower-cost avoider was encouraged to take care. In a "joint care" case, in contrast, we want each party to take some care rather than one to take care and the other to do nothing. Table 6.1 illustrates with an example involving flax and locomotive sparks. PL is $150. Different levels of care by railroad and by farmer are costed, and the total costs compared on the third row of the table. S.A. means spark arrester; a super spark arrester is just a better quality (and more expensive) spark arrester. The number of feet is the distance of the flax from the tracks. The farther away the flax is, the safer it is; but there is a cost to the farmer. Thus the three columns represent three different combinations of safety precautions by the railroad and the farmer, all of which have the same benefits ($150, the expected accident cost that the combination averts) but different costs. The middle combination, in which the railroad installs a spark arrester of average quality and the farmer moves the flax 75 feet from the tracks, is the least costly. But will a negligence/contributory-negligence rule induce the parties to adopt it? It will. For suppose that the railroad, seeking to minimize its cost of accident prevention, does nothing, hoping that the farmer will be deemed negligent because he can prevent the accident at a cost ($110) that is less than the expected accident cost ($150). Knowing that he will be deemed contributorfly negligent only for failing to keep his flax at the distance that will prevent its destruction if the railroad Table 6.1 Super S.A., O' Railroad care Farmer care Total cost S.A., 75' $100 0100 No S.A., 200' $50 25 75 $0 110 110 174 .Tort Law ...... takes the precaution that it is supposed to take (i.e., installs the spark arrester), the ...... farmer wilt place the flax just 75 feet from the tracks. It will be destroyed, but since ...... the railroad will be held negligent and the farmer will not be held contributorily ...... negligent, the farmer won't care. ~ Knowing all this, the railroad will be driven to ...... install the spark arrester. The analysis for the farmer if he starts by placing his flax ...... right next to the tracks is similar. The railroad will not buy the super spark arrester, ...... because the farmer would be held contributorily negligent if there were a fire, and ...... contributory negligence is a complete defense to liability. ...... Should it be a complete defense, though --or indeed any defense? Under a ...... negligence regime, if the injurer is not negligent the victim will bear the whole cost ...... of the accident whether negligent or not. The defense of contributory negligence / ..... comes into play only when the injurer is negligent as well as the victim. And if the ,/ .... injurer is negligent, why should he get off scot-free and the victim be left to bear ...... the whole cost of the accident? The economic answer is that shifting the cost from ...... the victim xo the injurer will not do any good as far as creating incentives to take ...... due care in the future is concerned, but will be cosily. Both parties already have ...... incentives that in the generality of cases are adequate. The injurer has an incentive ...... to take care to avoid having to pay damages if he is careless, an accident occurs, ,/ .... and the victim was not careless; the victim has an incentive to take care to avoid ...... the cost of the accident if it occurs though the injurer was careful. Since efficiency ,/ .... is not enhanced by making the negligent injurer pay damages to the negligent ...... victim, the common law traditionally allowed the cost of the accident to lie where " ..... it fell, in order to minimize the costs of administering the legal system. A transfer ...... payment from injurer to victim will cost something to make but will not increase ...... the wealth of society by creating incentives to efficient behavior. ...... Most states have, however, replaced contributory negligence with comparative / ..... negligence, whereby if both parties (injurer and victim) are negligent the plaintiff's ...... damages are reduced, but not to zero. Surprisingly, comparative negligence has the ,/ .... same effects on safety as contributory negligence. Go back to Table 6.1 and suppose ...... (to make the example dramatic) that even if the farmer takes no precautions at all, ...... the damages that the court will award him for the loss of his crop will be reduced / by only 10 percent--not 100 percent as under contributory negligence. It might ~,~ seem that since he therefore faces an expected accident cost of only $15 (10 percent of the PL of $150), he will not spend the $25 that due care requires him to spend on precaution. But this is incorrect. If he does not spend that amount, then the railroad, knowing it will not be liable, whatever happens, unless it is negligent, will have every incentive to invest $50 in precautions to avert an expected judgment cost to it of $135 (90 percent of $150); and knowing this, the farmer will have an incentive to incur the $25 cost of moving his flax back 75 feet. = Otherwise he will end up bearing the whole accident cost, since, if the railroad is not negligent, comparative negligence does not come into play, and the victim gets nothing. So the optimal allocation of resources to safety is achieved, just as when contributory negligence is a complete defense to liability. It does not follow that there is no economic difference between contributory and comparative negligence. Comparative negligence entails a transfer payment §6.4 1. This is an example of simple game theory. Each party's optimal decision depends on the other party's reaction to what, but for that reaction, would be the most advantageous course of action. 2. Does it matter by what percentage the damages are reduced if the plaintiff is found to be negligent? Victim Fault 175 /' / that generates no allocative gain, s and transfer payments involve administrative costs. Comparative negligence also injects an additional issue into litigation (the relative fault of the parties). This requires the expenditure of additional resources by the parties and the courts, and by making it harder to predict the extent of ; liability may increase the rate of litigation. The problem of prediction is exacerbated by the fact that there is no objective way of determining relative fault; this is an aspect of the problem of allocating joint costs, discussed in later chapters. Yet it is unclear at the level of theory which rule-contributory negligence or comparative negligence--is more productive of uncertainty, and likewise unclear is the effect of uncertainty on the amount of care taken by injurers and victims respectively. 4 The only full-scale empirical study to date finds, however, less careful driving in states that follow comparative negligence than in those that follow contributory · negligence. ~ Comparative negligence makes most economic sense when society/ wants to use the tort system to provide insurance to accident victims, because it gives the careless victim of a careless injurer something; contributory negligence gives him nothing. It is, therefore, no surprise that comparative negligence got its first foothold in admiralty law. The rule in collision cases when both vessels were at fault was that each party was liable for one-half of the total damage to both ships. The result was that the less heavily damaged ship picked up part of the tab for the damage to the other ship. (Recently admiralty has moved toward a relative-fault approach.) Until modern times, maritime transportation was an extraordinarily risky business because of the great value of ships and their cargoes and the significant probability of disaster, yet market insurance was difficult to come by and as a result there was a demand for insurance via the tort system, which was met by several doctrines of which divided damages was one. 6 It has the nice property of providing insurance without encouraging the insured to be careless, for if he is careless and the other party to the collision is not, he bears the full accident cost. Comparative negligence has insurance properties similar to divided damages in admiralty. But why in an age of much more widely available market insurance than when contributory negligence held sway in tort law there should be a desire to ./ provide insurance through the tort system is a mystery to the positive economic theorist of the common law. 3. For evidence that the comparative-negligence rule indeed leads to more suits, because it imparts a positive expected value to a claim that would have a zero expected value under a system of contributory negligence, see Stuart Low & Janet Kiholm Smith, Decisions to Retain Attorneys and File Lawsuits: An Examination of the Comparative Negligence Rule in Accident Law, 24J. Leg. Stud. 535 (1995). 4. Richard Craswell & John E. Calfee, Deterrence and Uncertain Legal Standards, 2 J. Law, Econ. & Organization 279 (1986). Why might contributory negligence be more uncertain? 5. Michelle J. White, An Empirical Test of the Comparative and Contributory Negligence Rules in Accident Law, 20 RANDJ. Econ. 308 (1989). For corroboration, see George P. Flanigan et al., Experience From Early Tort Reforms: Comparative Negligence Since 1974, 56J. Risk & Ins. 525 (1989); Frank A. Sloan, Bridget A. Reilly & Christoph Schenzler, Effects of Tort Liability and Insurance on Heavy Drinking and Drinking and Driving, 38J. Law & Econ. 49 (1995). 6. Another interesting such doctrine, of remarkable antiquity, goes by the uninformative name "general average." If it becomes necessary for the master of the ship to cast cargo overboard, the loss is divided up among the shippers and shipowner according to their relative stakes in the venture (i.e., their fractional shares of the sum of the value of the ship and the value of the cargoes), rather than being left to fall on the shipper whose cargo was actually jettisoned. The rule gives each shipper a form of insurance without impairing the master's incentive to jettison the cargo that is heaviest in relation to its value. William M. Landes & Richard A. Posner, Salvors, Finders, Good Samaritans, and Other Rescuers: An Economic Study of Law and Altruism, 7J. Leg. Stud. 83, 106-108 (1978). 176 v/ TortLaw Another important doctrine of victim responsibility is assumption of risk. It is like contributory negligence in being a complete bar to recovery of damages but differs in important respects that economics can illuminate. Suppose a person enters a roller-skating derby with full awareness of the risks of falling down, and indeed he does fall down and is hurt. He may have been extremely careful in the sense that, given the decision to enter the derby, he conducted himseft as would a reasonable roller-skate racer. And the risk to which he is subjected may seem undue in Hand Formula terms. Suppose that by reducing the speed limit by 2 m.p.h, the owner of the rollerskating rink could have avoided substantial accident costs at a seemingly trivial time cost to the patrons; the owner will nevertheless be protected by the assumption-of-risk defense from liability to the injured patrons. To understand the economic function of the defense, we must ask why the patrons do not demand greater safety precautions by the owner. There are several possibilities: 1. The Hand Formula has been misapplied. The cost of the lower Speed limit is not a trivial time cost but a substantial diminution in the thrill of racing. 2. The formula has been applied too narrowly. It might have been easy for the victim to avoid the accident simply by not going skating. Care in conducting an activity is only one method of precaution; another is avoiding the activity, or doing less of it. 3. The speed permitted to the skaters would be an undue hazard to most people, but this particular fink attracts skaters who are above average in skill. The defense of assumption of risk enables people with different capacities for avoiding danger to sort themselves to activities of different dangerousness and thus introduces some play into the joints of the reasonable-person rule. 4. The fink attracts risk preferrers. The Hand Formula assumes risk neutrality and will therefore induce potential injurers to take precautions that are excessive for potential victims who like risk. Another rule of victim responsibilits; although one in decline and subject to many exceptions, is that a landowner is not liable for negligent injuries to trespassers. This rule can be reconciled with the Hand Formula by noting that in the usual case such an injury can be prevented at lower cost by the trespasser, simply by not trespassing, than by the landowner. If the cost of avoidance by the trespasser is higher, he can purchase the land (or an easement in it) and so cease to be a trespasser. The rule thus serves the function--by now familiar to the reader--of encouraging market rather than legal transactions where feasible. Occasionally, however, a transaction between landowner and trespasser will not be feasible, as in Ploof v. Putnam. 7 The plaintiff, caught in a storm, attempted to moor his boat at the defendant's dock. An employee of the defendant shoved the boat away, and it was later wrecked by the storm. The plaintiff sued for the loss and won. The value of being able to trespass on the defendant's property during the storm was great, the cost to the defendant of preventing the wreck was small, and negotiations for landing fights were, in th e ci rc u m stances, infeasible. But the plaintiff would probably have been liable to the defendant for any damage caused by his boat. 8 Such liability is appropriate to assure that the rescue is really cost-justified, to encourage dock owners to cooperate with boats in distress, to get the right amount of investment in docks (see §6.9 infra), and, in short, to 7. 81 Vt. 471, 71 A. 188 (1908). 8. Vincent v. Lake Erie Transp. Co., 109 Minn. 456, 124 N.W. 221 (1910). Strict Liability 177 simulate the market transaction that would have occurred had transaction costs not been prohibitive. (Should the owner of the dock be awarded a fee as well, for the use of his dock? Cf. §4.14 supra.) But in cases of public necessity, as where the fire department pulls down a house to make a firebreak, compensation is not required. / This illustrates a common technique of common law regulation, that of encouraging the provision of external benefits (saving the rest of the city from the fire) / by allowing costs (the cost to the person whose house is pulled down) to be externalized, o The defendant in Ploofv. Putnam might not have been adjudged negligent had there been no effort to shove off the plaintiff's boat but the pier simply was in bad repair and collapsed when the plaintiff attempted to moor his boat. The probability of a boat's being in distress in the vicinity of the pier may have been so slight that, under the Hand Formula, proper maintenance of the pier would not have been a cost-justified precaution. But at the moment when the plaintiff's boat attempted to land, the probability of a serious accident was high, the expected accident loss great, and the cost of avoidance small. So viewed, Ploof v. Putnam is a special application / of the last clear chance doctrine. A man is using the railroad track as a path. Since he is a trespasser, the railroad has no duty to keep a careful lookout for him (see §3.5 supra). But if the crew happens to see him (and realizes he is oblivious to the train's approach), it must blow the train's whistle and take any other feasible pre- / cautions to avoid running him down. Even though the accident might have been prevented at low cost if the trespasser had simply stayed off the track, at the moment when the train is bearing down upon him it is the engineer who can avoid an accident at least cost, and this cost is substantially less than the expected accident cost. Alternatively, the case may be viewed as one where, although the cost to the victim of preventing the accident is lower than the accident cost, the cost to the injurer of preventing the accident is even lower. It might be thought that, were there no doctrine of last clear chance, there would ,/ be fewer trespassers (why?)and maybe, therefore, fewer accidents than with the doctrine. But this ignores the probabilistic character of taking care. To stray across ~ the center line in a two-way highway is negligent, but everyone does it occasionally because it would be too costly to adopt a driving strategy that reduced the probability of straying to (or very close to) zero. Some careful people will occasionally find themselves trespassers, which implies that we do not want to reduce the probability of trespassing to zero. And therefore the fact that the last clear chance doctrine slightly reduces the incentive not to trespass is not a decisive objection to it. 9. During the great London fire of 1666, the mayor refused to order houses taken down in the path of the fire to form a firebreak, asking, "Who will pay for the damage?" Richard A. Posner, Tort Law: Cases and Economic Materials 187 (1982). Incidentally, why might the cost to the owners of the houses /i be a good deal less than the pre-fire market value?