Document

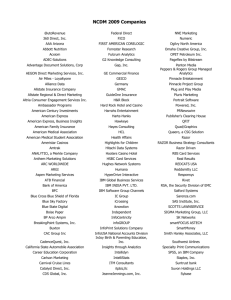

advertisement

LIMITED LIABILITY COMPANY (LLC) A Limited Liability Company (LLC) is a business structure allowed by state statute. LLCs are popular because, similar to a corporation, owners have limited personal liability for the debts and actions of the LLC. Other features of LLCs are more like a partnership, providing management flexibility and the benefit of pass-through taxation. Owners of an LLC are called members. Since most states do not restrict ownership, members may include individuals, corporations, other LLCs and foreign entities. There is no maximum number of members. Most states also permit “single member” LLCs, those having only one owner. A few types of businesses generally cannot be LLCs, such as banks and insurance companies. Check your state’s requirements and the federal tax regulations for further information. There are special rules for foreign LLCs. Classifications The Federal Government does not recognize an LLC as a classification for federal tax purposes. An LLC business entity must file as a corporation, partnership or sole proprietorship tax return. An LLC that is not automatically classified as a corporation can file Form 8832 to elect their business entity classification. A business with at least 2 members can choose to be classified as an association taxable as a corporation or a partnership, and a business entity with a single member can choose to be classified as either an association taxable as a corporation or disregarded as an entity separate from its owner, a “disregarded entity.” Form 8832 is also filed to change the LLC’s classification. Effective Date of Election The election to be taxed as the new entity will be in effect on the date the LLC enters on line 8 of Form 8832. However, if the LLC does not enter a date, the election will be in effect as of the form’s filing date. The election cannot take place more than 75 days prior to the date that the LLC files Form 8832 and the LLC cannot make the election effective for a date that is more than 12 months after it files Form 8832. However, if the election is the “initial classification election,” and not a request to change the entity classification, there is relief available for a late election (more than 75 days before the filing of the Form 8832). Forming a Limited Liability Company (LLC) In an LLC, owners have limited personal liability for the debts and actions of LLC, similar to a corporation. The benefits of pass-through taxation and flexibility, much like a partnership, make LLCs an attractive business structure. Each state may use different regulations, and you should check with your state if you are interested in starting a Limited Liability Company. Banks, insurance companies, and non-profit organizations generally cannot be LLCs. Your state may have other restrictions. Electing an Entity Classification Because the Federal Government does not recognize LLCs for federal taxation purposes, each LLC is classified differently depending on the LLCs structure. In some cases, the company can request how they would like to file the return. LLCs can only be classified as a corporation, partnership or sole proprietorship. Form 8832 is needed to classify your LLC. SINGLE MEMBER LIMITED LIABILITY COMPANIES Over the years, there has been confusion regarding Single Member Limited Liability Companies in general and specifically, how they can report and pay employment taxes. An LLC is an entity created by state statute. The IRS uses tax entity classification, which allows the LLC to be taxed as a corporation, partnership, or sole proprietor, depending on elections made by the LLC and the number of members. An LLC is always classified under federal law as one of these types of taxable entities. A multi-member LLC can be either a partnership or a corporation, including an S corporation. To be treated as a corporation, an LLC has to file Form 8832, Entity Classification Election (PDF), and elect to be taxed as a corporation. A multi-member LLC that does not so elect will be classified under federal law as a partnership. A single member LLC (SMLLC) can be either a corporation or a single member “disregarded entity”. Again, to be treated under federal law as a corporation, the SMLLC has to file Form 8832 and elect to be classified as a corporation. An SMLLC that does not elect to be a corporation will be classified by the existing federal guidance as a “disregarded entity” which is taxed as a sole proprietor for income tax purposes. Employment tax and certain excise tax requirements for an SMLLC that is a disregarded entity have changed over the past few years. In August, 2007, final regulations (T.D. 9356) (PDF) were issued requiring disregarded single member LLCs to be treated as the taxpayer for certain excise taxes accruing on or after January 1, 2008 and employment taxes accruing on or after January 1, 2009. SMLLC’s will continue to be disregarded for other federal tax purposes. For employment taxes, prior to the regulation changes, the single member owner of a disregarded SMLLC was responsible for reporting and paying employment taxes. Before January 1, 2009 the single member owner could file using either the name and EIN assigned to the SMLLC, or the name and EIN of the single member owner. Even if the pre-January 1, 2009 employment tax obligations were reported using the disregarded SMLLC's name and employer identification number, the single member owner retains ultimate responsibility for collecting, reporting and paying over employment taxes for those periods. As of January 1, 2009, Notice 99-6 is obsolete and the SMLLC will be responsible for collecting, reporting and paying over employment tax and excise tax obligations using the name and EIN assigned to the LLC. An LLC applies for an EIN by filing Form SS-4, Application for Employer Identification Number, and completing lines 8 a, b, and c. An SMLLC that is a disregarded entity that does not have employees and does not have an excise tax liability does not need an EIN. It should use the name and TIN of the single member owner for federal tax purposes. However, if a SMLLC, whose taxable income and loss will be reported by the single member owner, nevertheless needs an EIN to open a bank account or if state tax law requires the SMLLC to have a federal EIN, then the SMLLC can apply for and obtain an EIN. Filing Federal Tax Forms If the LLC is a sole proprietor for federal tax purposes, the entity should file either: Form 1040 Schedule C, Profit or Loss from Business (Sole Proprietorship) (PDF) Form 1040 Schedule E, Supplemental Income or Loss (PDF) Form 1040 Schedule F, Profit or Loss from Farming (PDF) Form 1040 Schedule J, Income Averaging for Farmers and Fisherman (PDF) If the business has net income over $400, it may be required to file Schedule SE, Self-Employment Tax (PDF). LLC FILING AS A CORPORATION OR PARTNERSHIP The LLC structure is not recognized by federal law and therefore their filing status is determined by the Entity Classification Rules. Form 8832 is used for this purpose. Pursuant to the entity classification rules, LLCs with multiple owners that do not elect to be taxed as a corporation are taxed as a partnership. Classification The Entity Classification rules classify certain LLC business entities as Corporations: A business entity formed under a Federal or State statute or under a statute of a federally recognized Indian tribe if the statute describes or refers to the entity as incorporated or as a corporation, body corporate, or body politic. An Association under Regulations section 301.7701-3. A business entity formed under a Federal or State statute if the statute describes or refers to the entity as a joint stock association. A state chartered business entity conducting banking activities if any of its deposits are assured by the FDIC. A business entity wholly owned by a state of political subdivision thereof, or a business entity wholly owned by a foreign government or other entity described in Regulations section 1.892.2-T. A business entity taxable as a corporation under a provision of the code other than section 7701.(a)(3). Certain foreign entities (see Form 8832 instructions). Insurance Company An LLC that is not automatically classified as a corporation can file Form 8832 to elect their business entity classification. A business with at least 2 members can choose to be classified as an association taxable as a corporation or a partnership, and a business entity with a single member can choose to be classified as either an association taxable as a corporation or disregarded as an entity separate from its owner, a “disregarded entity.” The Form 8832 is also filed to change the LLC’s classification. Filing If the LLC is a partnership, it should file a Form 1065, U.S. Return of Partnership Income. Each owner should show their pro-rata share of partnership income (reduced by any tax the partnership paid on the income), credits and deductions on Schedule K-1 (1065), Partner’s Share of Income, Deductions, Credits, etc. If the LLC is a corporation, it should file a Form 1120, U.S. Corporation Income Tax Return. The 1120 is the corporate income tax return, and there are no flow-through items to a 1040 from a corporate return. However, if the LLC filed as an S Corporation, it should file a Form 1120S, U.S. Income Tax Return for an S Corporation and each owner reports their pro-rata share of corporate income, credits and deductions on Schedule K-1 (Form 1120). For additional information on the kinds of tax returns to file, how to handle employment taxes and possible pitfalls, refer to Publication 3402 Tax Issues for Limited Liability Companies., Possible Repercussions Limited Liability Companies may face these issues. Form 8832 If an LLC does not File Form 8832, it will be classified, for Federal tax purposes under the default rules. The default rules provide that if the LLC has at least two members and is not required to be classified as a corporation, it will automatically default as a partnership, and be required to file a partnership return. An LLC that has only a single member and is not required to be classified as a corporation will automatically default to the classification of disregarded entity. The disregarded entity files as a sole proprietorship and completes the appropriate schedules as part of the single owners Form 1040. Common Errors There are two common areas where unintentional errors may occur. If you convert an existing business, such as a corporation, into an LLC there may be tax implications. The conversion may result in taxable gains Employment tax wage bases may be affected Special rules apply when your LLC has an operating loss: The amount of loss you can deduct may be limited because of your limited liability for LLC debts. Passive Activity Loss limitation may restrict the amount of loss you can deduct. Where to look for help: Tax Assistance by telephone: 1-800-829-1040 Order forms by telephone: 1-800-829-3676 Publication 15 Employer’s Tax Guide Publication 334 Tax Guide for Small Business Publication 541 Partnerships Publication 542 Corporations Publication 1635 Understanding Your EIN (PDF) Form 8832 Entity Classification Election Where to File Tax Returns - Addresses Listed by Return Type In order to determine where to file your return, identify the form number for which you need the information and follow the numerical or alpha-numerical links below to your specific Where to File information. Examples for a return beginning with a number: To find Form 3520, Annual Return to Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts, choose the number 3; for Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return, choose the number 7. Example for a return beginning with an alpha character: To find Form SS-4, Application for Employer Identification Number, choose the alpha S. Find forms that begin with: Numbers 1 2 3 4 5 7 8 9 Alpha's C S W Note: Some addresses may not match a particular instruction booklet or publication. This is due to changes being made after the publication was printed. This site will reflect the most current Where to File Addresses for use during Calendar Year 2011. Forms for Limited Liability Companies (LLC) FORM USE THIS FORM TO - Schedule C (Form 1040) – Profit or Loss from Business (PDF) Generally, when an LLC has only one member, the fact that it is an LLC is ignored or “disregarded” for the purpose of filing a federal tax return. Remember, this is only a mechanism for tax purposes. It does not change the fact that the business is legally a Limited Liability Company. If the only member of the LLC is an individual, the LLC income and expenses are reported on Form 1040, Schedule C, E, or F. Schedule E (Form 1040) Supplemental Income and Loss (PDF) Generally, when an LLC has only one member, the fact that it is an LLC is ignored or “disregarded” for the purpose of filing a federal tax return. Remember, this is only a mechanism for tax purposes. It does not change the fact that the business is legally a Limited Liability Company. If the only member of the LLC is an individual, the LLC income and expenses are reported on Form 1040, Schedule C, E, or F. Schedule F (Form 1040) – Profit or Loss from Farming (PDF) Generally, when an LLC has only one member, the fact that it is an LLC is ignored or “disregarded” for the purpose of filing a federal tax return. Remember, this is only a mechanism for tax purposes. It does not change the fact that the business is legally a Limited Liability Company. If the only member of the LLC is an individual, the LLC income and expenses are reported on Form 1040, Schedule C, E, or F. Schedule SE (Form 1040) – Self-Employment Tax (PDF) LLCs filing Schedule C or F Members of LLCs filing Schedule C or F are subject to selfemployment taxes on earnings. LLCs filing Partnership Returns Generally, members of LLCs filing Partnership Returns pay self-employment tax on their share of partnership earnings. Use Schedule SE (Form 1040) to figure the tax due on net earnings from self-employment. W-2 and W-3 - Wage and Tax Statement; and Transmittal of Wage and Tax Statements (PDF) Employees of all LLCs are subject to withholding tax. Report wages, tips, and other compensation, and withheld income, social security, and Medicare taxes for employees. Form W-2G - Certain Gambling Winnings (PDF) Report gambling winnings from horse racing, dog racing, jai alai, lotteries, keno, bingo, slot machines, sweepstakes, wagering pools, etc. Form 940 - Employer's Annual Federal Unemployment (FUTA) Tax Return (PDF) Report and pay FUTA tax if the company either: Paid wages of $1,500 or more in any calendar quarter during the calendar year (or the preceding calendar year), or Had one or more employees working for the company for at least some part of a day in any 20 different weeks during the calendar year (or the preceding calendar year). Form 941 - Employer's Quarterly Federal Tax Return (PDF) If you are an employer, you must file a quarterly Form 941 to report: Wages you have paid, Tips your employees have received, Federal income tax you withheld, Both employer’s and employee’s share of social security and Medicare taxes, and Advance earned income tax credit (EIC) payments. After you file your first Form 941, you must file a return each quarter even if you have no taxes to report. Form 943 - Employer's Quarterly Federal Tax Return for Farm Employees (PDF) Form 944 - Employer’s Annual Federal Tax Return (PDF) This form was designed so the smallest employers (those whose annual liability for Social Security, Medicare, and withheld federal income taxes is $1,000 or less) will file and pay these taxes only once a year instead of every quarter. The IRS will notify those employers who will qualify to file Form 944 in February of each year. Form 1040 – U.S. Individual Income Tax Return (PDF) See 1040 Instructions Form 1065 – U.S. Return of Partnership Income (PDF) Most LLCs with more than one member file a partnership return, Form 1065. If you would rather file as a corporation, Form 8832 must be submitted. You don’t need to file a Form 8832 if you want to file as a partnership. Form 1096 - Annual Summary and Transmittal of U.S. Information Returns (PDF) Transmit paper Forms 1099, 1098, 5498, and W-2G to the IRS. 1099-A, B, C, CAP, DIV, INT, LTC, MISC, OID, PATR, R, S and, SA (PDF) Important: Every corporation must file Forms 1099-MISC if, in the course of its trade or business, it makes payments of rents, commissions, or other fixed or determinable income (see section 6041) totaling $600 or more to any one person during the calendar year. Also use these returns to report amounts received as a nominee for another person. For more details, see the General Instructions for Forms 1099, 1098, 5498, and W2G (PDF) Report the following: Acquisitions or abandonments of secured property; Proceeds from broker and barter exchange transactions; Cancellation of debts; Changes in corporate control and capital structure; Dividends and distributions; Interest payments; Payments of long-term care and accelerated death benefits; Miscellaneous income payments to certain fishing boat crew members, to providers of health and medical services, of rent or royalties, of nonemployee compensation, etc.; Original issue discount; Taxable distributions received from cooperatives; Distributions from pensions, annuities, retirement or profitsharing plans, IRAs, insurance contracts, etc.; Proceeds from real estate transactions; and Distributions from an HSA, Archer MSA, or Medicare Advantage MSA. Form 1120 U.S. Corporation Income Tax Return (PDF) Generally, when an LLC has only one member, the fact that it is an LLC is ignored or “disregarded” for the purpose of filing a federal tax return. Remember, this is only a mechanism for tax purposes. It does not change the fact that the business is legally a Limited Liability Company. If the only member of the LLC is a corporation, the LLC income and expenses are reported on the corporation’s return, usually Form 1120 or Form 1120S Form 1120-S U.S. Income Tax Return for an S Corporation (PDF) Generally, when an LLC has only one member, the fact that it is an LLC is ignored or “disregarded” for the purpose of filing a federal tax return. Remember, this is only a mechanism for tax purposes. It does not change the fact that the business is legally a Limited Liability Company. If the only member of the LLC is a corporation, the LLC income and expenses are reported on the corporation’s return, usually Form 1120 or Form 1120S Form 8832 – Entity Classification Election (PDF) If you prefer to file as a corporation instead of a “disregarded entity” Form 8832 must be submitted. Otherwise, you don’t need to file Form 8832.

![Your_Solutions_LLC_-_New_Business3[1]](http://s2.studylib.net/store/data/005544494_1-444a738d95c4d66d28ef7ef4e25c86f0-300x300.png)