Steel Industry Update/154

March 2001

Locker Associates, 225 Broadway, NY NY 10007 Tel: 212-962-2980

Fax: 212-608-3077

Important Notice to Subscribers: Due to rising printing and distribution costs, as well as the time sensitive

nature of our material, the next issue of Steel Industry Update (#155) will be distributed by email only. Therefore it

is imperative that you contact us at lockerassociates@yahoo.com with your email address -- otherwise you will not

receive the next issue. For those subscribers who do not have an email address, we will fax the Update provided

you supply your fax number by calling us at 212-962-2980.

In today’s global economy, markets can rapidly

change direction. While current steel pricing and

production conditions are among the worst in recent memory there is some hope that things

could start to improve by mid-2001. In fact, Peter

Marcus of World Steel Dynamics is now predicting that the “death spiral” of steel prices has hit

rock bottom and that there is a positive shift underway in U.S. and global steel markets.

Marcus recently wrote that 2001 could be a mirror image of 2000. The first half of 2000 saw

strong pricing and increased shipments for U.S.

steel producers while the second half witnessed a

dramatic downturn. On the global front, in the

first three quarters of 2000 world steel production

surged. Approximately 854 million metric tonnes

of steel were produced on an annual basis during

this period, which represents a 15% increase

over the annual rate during the first quarter of

1999. While global consumption rose an estimated 4.7% over this same period, it was clearly

not enough to offset the massive growth in production. Moreover, during the second half of

2000 steel buyers started liquidating inventories,

compounding the supply-demand imbalance and

driving prices to the floor.

However, despite projections for an adverse

start, 2001 already shows some signs of improvement. For the world market, there are three

main reasons for a more positive outlook: (1) anticipated lower global steel production, (2) stable

steel demand, and (3) the end of inventory liquidations by steel users. For the U.S., this world

outlook is coupled with favorable predictions on a

substantial drop in imports, especially HR band.

Inside This Issue......

Fourth Quarter Results ..............................

Trade Crisis ................................................

Prices and Shipments ................................

Raw Materials ............................................

Labor/Management ....................................

Capacity/Technology .................................

Worthy of Note ...........................................

1

2

4

5

5

7

7

With supply and demand becoming more balanced by mid-year, world and domestic steel

prices will slowly but surely move up.

Where are prices headed? According to World

Steel Dynamics, world export prices for slab may

rise as much as $45 per metric tonne by the third

quarter, up from $160 in December, and hotrolled band could rise to $275 per tonne from

$175 over the same period (F.O.B. the port of

export). Cold rolled and galvanized are also

forecasted to rise from their lows of $290 and

$360 per tonne to $380 and $475 per tonne respectively by the third quarter of this year. Of

course, a lot depends on what happens to the

rest of the economy, especially major steel consuming industries like auto, construction and

heavy equipment. But assuming end-use markets hold up, a slow and painful recovery is in the

works.

FOURTH QUARTER RESULTS

Performance during the fourth quarter of 2000 reflected the depression battering the North American steel industry. Weaker prices led to dramati-

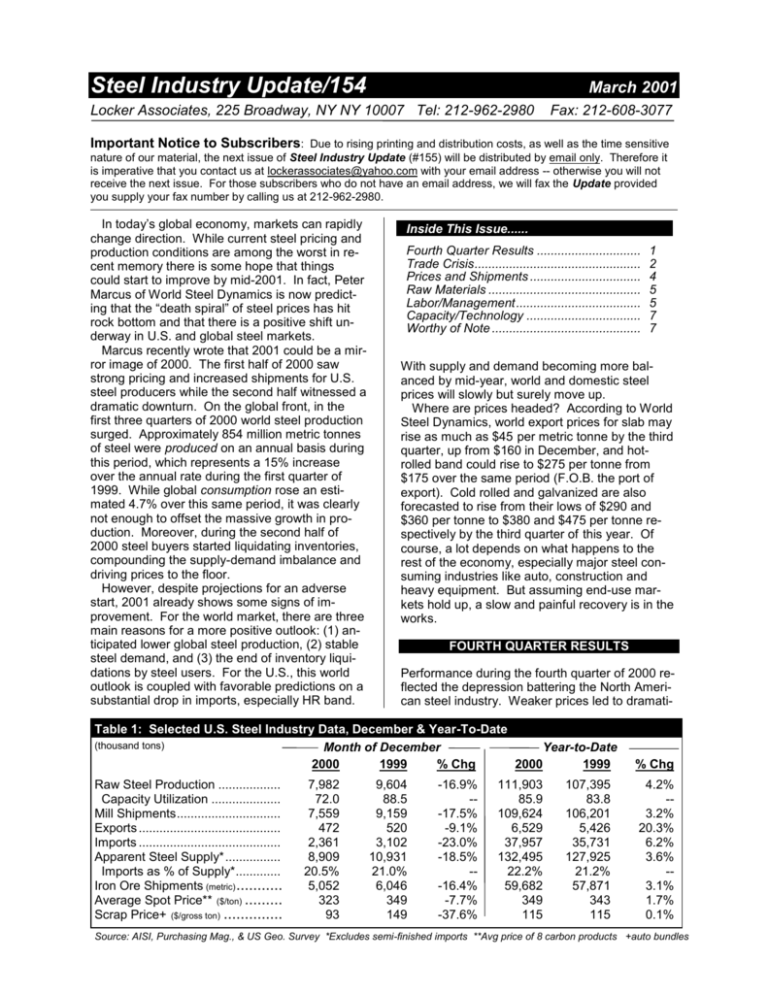

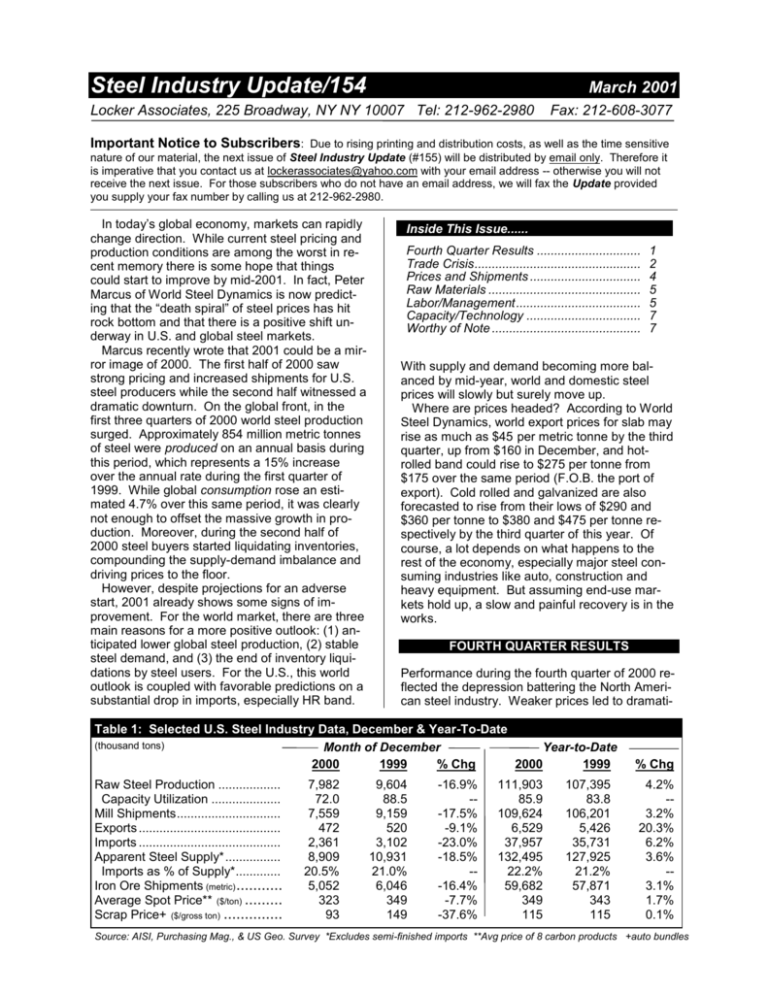

Table 1: Selected U.S. Steel Industry Data, December & Year-To-Date

(thousand tons)

Month of December

Year-to-Date

2000

1999

% Chg

2000

1999

% Chg

Raw Steel Production ..................

Capacity Utilization ....................

Mill Shipments ..............................

Exports .........................................

Imports .........................................

Apparent Steel Supply* ................

Imports as % of Supply*.............

Iron Ore Shipments (metric) ...........

Average Spot Price** ($/ton) .........

Scrap Price+ ($/gross ton) ..............

4.2%

-3.2%

20.3%

6.2%

3.6%

-3.1%

1.7%

0.1%

7,982

72.0

7,559

472

2,361

8,909

20.5%

5,052

323

93

9,604

88.5

9,159

520

3,102

10,931

21.0%

6,046

349

149

-16.9%

--17.5%

-9.1%

-23.0%

-18.5%

--16.4%

-7.7%

-37.6%

111,903

85.9

109,624

6,529

37,957

132,495

22.2%

59,682

349

115

107,395

83.8

106,201

5,426

35,731

127,925

21.2%

57,871

343

115

Source: AISI, Purchasing Mag., & US Geo. Survey *Excludes semi-finished imports **Avg price of 8 carbon products +auto bundles

Steel Industry Update/154

cally reduced shipments and falling sales for all

companies tracked by Locker Associates, with

U.S. integrated mills suffering the most dramatic

downturn.

The six U.S. integrated producers realized operating loses of $389 million for the fourth quarter

compared with gains of $28 million over the same

period last year (see Table 2). (Unfortunately,

both LTV and Wheeling-Pitt had to be excluded

from our review do to late reporting.) Shipments

for U.S. integrated mills declined 12%, dropping

from 9.7 million tons to 8.6 million tons, while

sales went down 10%. In addition, with production volume falling, average costs per ton rose

almost 12%. With all these negative trends, every U.S. integrated mill lost money except AK Steel

-- but even their profits fell nearly 50%. (Note: US

Steel’s numbers now include their Kosice mill in

the Slovak Republic.)

Previously faring better than most U.S. integrated producers, the three Canadian integrated

mills reported fourth quarter losses as well as falling shipments and sales across the board. Only

Dofasco reported a positive operating income.

While Canadian shipments dropped only half as

much as the U.S., they reported a more dramatic

downturn in sales of 13% and nearly an 8% drop

in prices.

While the six U.S. minimills in Table 2 also

showed significant signs of slippage, all but two

(Birmingham Steel and Co-Steel) managed to

generate a positive operating income for the

fourth quarter. Operating costs for the minimills

remained fairly constant despite a nearly 10%

drop in sales and a 6% reduction in shipments.

Average prices fell nearly 3.5% but producers

were still able to hold their ground. Excluding Ipsco, which includes major fabricating operations,

all six minimills reported a decline in shipments

for the fourth quarter.

TRADE CRISIS

Imports Reached Record Levels in 2000: Figures released by the Census Department showed

steel imports in 2000 at 38 million net tons, up 2.2

million net tons, or 6%, from 1999. Semifinished

imports topped 9 million tons, a new all-time record. The biggest increases were in HR sheets,

OCTG, and heavy structural shapes, while the

largest decreases were in CR sheets and hotdipped galvanized sheets and strip. The countries registering the biggest increases in shipments to the U.S. were Ukraine, China, and India,

while Japan, Korea, and Mexico registered the

greatest declines.

Preliminary figures for January showed steel

imports at 2.24 million net tons, virtually the same

as the 2.23 million the month before, but down

830,000 tons, or 27%, from the 3.07 million net

ton figure for January of last year. Semifinised

products went down 62% from January 2000,

while finished products were off 12%. HR sheet

dropped 34% from last year, but CR was up a

whopping 56%. Plate, wire rode and HR bar all

went down, while heavy structurals, rebar and

OCTG products went up (AMM 2/1, 2/12, 2/26; U.S.

Customs Service).

AK Leads Charge Against Bailouts: In the face

of calls for action to protect domestic steel from

the rising tide of bankruptcies and layoffs, AK

Steel has emerged as the leading force opposing

such moves. In January, citing “philosophical differences” with the American Iron and Steel Institute and a majority of its members, it withdrew

from that organization. AK had opposed AISI actions supporting trade cases against the dumping

of foreign imports and had registered its disagreement with the law sponsored by Sen. Robert

Byrd (D.-W.Va.) that provides federal aid to troubled steel mills. Last month, it came out in opposition to the plan of Ohio Republican Gov. Bob

Taft to grant $110 million to aid troubled companies in the state. The Taft plan would provide

$30 million for ailing steelmakers to expand or restructure operations, $60 million in tax-exempt

bonding authority to finance pollution control

equipment, $15 million to help upgrade employee

skills, and $5 million for infrastructure improvement and new equipment.

AK, on the other hand, has touted its role as a

model of success for the industry. Recently, Rep.

John Boehner (R.-Ohio) sent a letter to President

Bush urging him to tour the company’s Middletown facility to see “a profitable and efficient

steel producer” that has operated “without any

government intervention.” Its government

“hands-off” policy has received partial support

from the Steel Manufacturers Association, representing most of the major minimills. A statement

from SMA’s Board of Directors last month, while

backing further relief actions by the government

to stem low-cost imports, opposed “any bailout of

non-competitive facilities and reduction of their

legacy costs.” Its “survival of the fittest” position

(government’s support of troubled companies “violates the laws of evolution,” in the words of one

Steel Industry Update (ISSN 1063-4339) published 10 times/year by Locker Associates, Inc. Subscriptions $395/yr; $725/two yrs; Multiple copy

discounts available. Checks payable to Locker Associates in U.S. dollars drawn on a U.S. bank. Copyright © 2001 by Locker Associates Inc. All rights

reserved. Reproduction in any form forbidden w/o permission. Some material in this Update is excerpted from American Metal Market (AMM), which is

available by subscription by calling 800-247-8080. Locker Associates, 225 Bdwy, # 2625, NY NY 10007. E-Mail: lockerassociates@yahoo.com

-2-

Steel Industry Update/154

Table 2: Performance of Major North American Steel Producers, 4Q00 & 4Q99

U.S Integrated

AK Steel ...........

Bethlehem ........

National ............

Rouge Steel .....

USSteel ............

Weirton.............

U.S. Totals .......

Shipments

Sales

Oper Income

Sales/Ton

(thousand tons)

($ millions)

($ millions)

($ per ton)

4Q00

1,595

1,877

1,434

566

2,632

471

8,575

4Q00

$46

(116)

(76)

(71)

(122)

(50)

$(389)

4Q99

$94

(35)

3

(44)

48

(39)

$28

4Q00

$649

482

454

408

459

446

$495

4Q99

$683

482

466

417

418

436

$485

4Q00

$29

(62)

(53)

(125)

(46)

(106)

$(45)

4Q99

$59

(16)

2

(60)

17

(59)

$3

Canadian Integrated (C$=US$.66)

Algoma .............

437

495

$228

$266

Dofasco ............

1,121

1,109

759

801

Stelco ...............

1,106

1,225

612

771

Canada Totals .

2,664

2,829 C$1,599 C$1,838

$(11)

20

(62)

C$(52)

$9

105

30

C$144

$521

677

553

C$600

$537

722

629

C$650

$(24)

18

(56)

C$(20)

$18

95

24

C$51

$(6)

(1)

18

120

2

15

$147

$3

17

31

147

6

27

$232

$264

293

414

409

402

333

$372

$279

304

447

417

453

345

$386

$(10)

(2)

32

49

4

32

$29

$5

25

61

56

15

54

$43

607

673

515

2,619

413

510

5,337

4Q00

$1,035

905

652

231

1,208

210

$4,241

($ per ton)

4Q99

$1,092

1,058

786

306

1,198

290

$4,728

N.A. Minimills (US$)

Birmingham ......

562

Co-Steel ...........

574

Ipsco* ...............

560

Nucor* ..............

2,471

Oregon .............

381

Steel Dynamics

457

N.A Mini Totals

5,004

4Q99

1,599

2,196

1,686

734

2,865

665

9,745

Oper Inc/Ton

$149

168

232

1,010

153

152

$1,864

$170

204

231

1,092

187

176

$2,059

Source: Company documents. Note: Steel Segment, except Ipsco & Nucor. Includes profit-sharing; excludes non-recurring charges.

AK backer) is in direct contradiction to the position of the United Steelworkers of America, which

is calling for a $10 billion loan guarantee program

and a 2% surcharge on all steel consumed to pay

for legacy costs like retiree insurance benefits.

And straddling these positions, the American Iron

and Steel Institute, representing most of the

country’s integrated producers, in a statement

last month that reflected the industry split, strongly supported immediate quota restrictions and

other restraints on foreign imports, but avoided

entirely the issue of government bailouts for

struggling facilities (AMM 2/12, 2/13, 2/19, Yahoo Mail

gency round of multilateral steel negotiations with

the World Trade Organization and non-WTO trading partners to restrain imports. A few weeks letter, the Senator, in a handwritten letter he delivered personally to Vice President Cheney, repeated his request for an emergency national

steel summit.

While supporting Rockefeller’s call for a national summit, Tom Danjczek, president of the Steel

Manufacturers Association, representing minimills

in the U.S., expressed caution that such a confab

should not be a cover for a government bailout of

the industry. “If this could support the industrywide call for trade limitations, we would be very

encouraged,” he said. So far, however, the Bush

administration has not responded to either of

Rockefeller’s initiatives.

2/23, AK Press Release 2/15).

Nucor also came forward last month with their

position on bailouts. Bob Jones, the company’s

director of marketing, told a steel conference that

the industry needed to be consolidated and that

some obsolete facilities should be closed. He

was critical of the $1 billion loan guarantee program under the measure passed by Congress

last year and sponsored by Sen. Robert Byrd (D.W.Va.), “Nucor is not supportive of bailout loans

and guarantees,” said Johns (AMM 2/21).

Meanwhile, several trade bills were introduced

into Congress in February. Rep. Ralph Regula

(R.-Ohio), former chairman of the Congressional

Steel Caucus, reintroduced his bill to make it easier to reach a positive injury finding under Section

201 of the Trade Act of 1974. The bill would

amend the section to hold that imports shall be

considered a serious injury or threat of injury “if a

causal link is established between imports and injury to domestic industry.” At present, imports

have to be a “substantial” cause of injury, a barrier that has often prevented the domestic industry

from gaining import restrictions. Regula’s bill was

introduced in the last Congress but never came

to a vote (AMM 2/1, 2/12, 2/26).

Rockefeller Pushes 201 Action: West Virginia

Sen. Jay Rockefeller (D.) has continued to prod

the new Bush administration to undertake some

measures to help the industry. A Jan. 29 letter

from Rockefeller urged the President to immediately call for a 201 review by the U.S. International Trade Commission, convene an Emergency National Summit on Steel, and begin an emer-3-

Steel Industry Update/154

More Casualties File for Bankruptcy: Three

more steel mills joined the growing casualty list

last month. On Feb. 7, GS Industries filed for

Chapter 11 bankruptcy and immediately announced that it was permanently shutting down

its wire rod operation in Kansas City, Mo. The

company was formed six years ago with the merger of GS Technologies of Kansas City and

Georgetown Industries of Charlotte, NC. The

company blamed weaker demand for wire rod in

the face of higher electricity and gas costs, and

claimed that the tide of imports last year played

only a small part in its problems. GS was one of

eight U.S. wire producers and two unions that

filed an action against imports under Section 201

in 1998. The move finally led President Clinton to

impose a three-year tariff quota on most wire rod

imports a year later, but at a level that most in the

industry regarded as too high and with a tariff

level they felt was too low to be effective.

Early last month, CSC asked the bankruptcy

court for permission to shut down its Warren,

Ohio, mill if a buyer could not be found. The

company, which manufactures specialty steel

bars, filed for Chapter 11 bankruptcy Jan. 12. Its

debts at the time registered $259 million against

$219 million in assets. Randy Lachowski, CSC’s

president and CEO, said that the company did

not have enough cash to continue even on a limited operational basis after the court-approved

budget expired Feb. 9 (AMM 2/2).

Finally, Qualitech, which had already emerged

from one bout with Chapter 11 two years ago,

decided to close its SBQ mill in Pittsboro, Ind., rather than seek another round with the bankruptcy

courts. Qualitech’s president, Robert D. Bosar,

said that an investment bank would be retained to

find a customer for the $350 million minimill,

which employed only 125 of its original 325 workers. A second Qualitech plant, built to produce

iron carbide in Corpus Christi, Tex., has not been

able to find a buyer and will reportedly be bulldozed and sold for scrap (AMM 2/7, 2/8, 2/12).

1.8%, carbon tubing was higher by 1.5%, and

carbon bars were up by 1.3% (AMM 2/9).

PRICES AND SHIPMENTS

Sheet: Mixed signals emerged from sheet producers last month, though the news was generally positive. Amid signs that the HR market may

be recovering both integrated and minimill producers announced sizeable price increases. Anticipating a strengthening market, Ispat in late

January attempted a price rise on HR sheet of

$40/ton, and CR and galvanized of $30/ton, all

beginning with March 1 shipments. The move

was joined by US Steel, Bethlehem, LTV, Stelco

and Wheeling-Pittsburgh. However, in a move

clearly undercutting its rivals, Nucor a week later,

announced a price hike of only $20/ton for HR

alone, effective with April 1 shipments. By the

end of February, buyer resistance on the West

Coast seemed to forestall any immediate hikes in

that region. The word there was that increases

may be in the offing later, but not now. Prices for

HR sheet in February were around $220/ton with

CR and coated sheet at about $330/ton and

$350/ton respectively (AMM 1/29, 2/6, 2/26).

Stainless Plate: Prices for stainless coiled plate

have dropped since the beginning of the year by

5.1%, according to plate dealers. The decline,

they say is primarily due to the sharp increase in

prices that came during the first ten months of

last year -- up 23%. During January and February of this year, coiled plate grade 316 and 316L

both fell to $1825/ton, from levels of $1950 for

grade 316, a drop of 6.4%, and $1935 for grade

316L, a decline of 5.6%. Grade 304 coiled plate

went from $1320 to $1270/ton, down 3.8%, and

grade 304L dropped from $1395 to $1340/ton, a

dip of 3.9%. Uncoiled plate also slid, but not so

sharply. Grade 316 uncoiled went from $2240 at

the end of last year to $2180/ton, down 2.7%,

grade 316L was off by 1.8% from $2220 to

$2180/ton, grade 304 declined from $1740 to

$1720/ton, down 1.l%, and grade 309 went from

$3500 to $3435/ton, off by 1.9% (AMM 1/29).

Service Centers Report Inventories Melting: A

possible pickup in the industry was reported last

month; inventories at steel service centers were

dropping steadily, indicating they may be ready to

place new orders. In December, inventories

reached the lowest levels for the entire year, registering the fourth consecutive monthly decline.

Service centers shipped 29.6 million tons of steel

last year, just a bit more than the 29.4 million tons

shipped in 1999 and just a bit short of the record

of 29.8 million tons in 1998. Greatest gains were

in alloy products, increasing by 10.4% over 1999.

Stainless steel shipments from service centers in

2000 were up by 3%, carbon plate increased by

Wire Rod: Government sources at the beginning

of February confirmed that all future imports of

wire rod for the 12 months that ended Feb. 28

would be subject to a 10% tariff since import quota levels had been filled. Under Section 201,

three-year quota restrictions were placed on wire

rod imports beginning March 1, 2000, limiting

them to 1.58 million tons the first year, and an increase of 2% each year in the second and third

years. Some importers were reported to be holding their goods in storage for the month of Febru-4-

Steel Industry Update/154

fining it as just “a working group” to explore the

possibilities, SMA President Thomas Danjczek

said the committee would consist of six or seven

members of the organization. He also acknowledged that there could be some significant legal

issues in launching such a venture under the

auspices of a trade association. However, SMA

is interested, he said, in exploring opportunities

for reducing production costs to its members

ary, for the next quota year beginning March 1, to

avoid paying the surcharge. Customs sources

said that they had collected $1.76 million in overquota tariff payments this year. Later in February, several U.S. and Canadian wire rod producers were attempting to gain $25 to $35/ton price

increases. Rocky Mountain and GS Industries

were seeking increases of $25 while Ivaco/Quebec was attempting to get increases of as

high as $35/ton, depending upon grade. Current

prices of wire rod are between $270 and

$280/ton, down from about $300/ton last April

and about $80 to $90 less than what they would

be in a stronger market, according to manufacturers. Increases are necessary, they say, to

counter higher energy costs and to restore pricing

up to more reasonable levels (AMM 2/7, 2/26).

(AMM 2/8, 2/13).

Iron Ore Deal Could Reshape Market: The recent agreement under which Australia’s BHP, the

world’s third largest producer of iron ore, would

buy control of Brazil’s second biggest producer,

the Caemi group, has stirred up a great deal of

speculation that it is only the first step in a giant

deal that could change the face of the ore market.

Analysts say that the deal could also involve the

world’s No. 1 ore producer, CVRD of Brazil. Under the agreement, BHP is paying $332 million

for a 60% share of voting stock in Caemi, a slightly higher bid than the offer from CVRD. However,

Mitsui of Japan, which owns 40% of the voting

shares, has 60 days to exercise its right to purchase Caemi on the same terms as the winning

bidder. CVRD reportedly has an agreement with

Mitsui providing that, if it lost in the bidding for the

company, Mitsui would invoke its option, buy the

60% share of Caemi, and then divide the company equally between itself, BHP, and CVRD. But,

no one had any official comment on the speculation, or on whether such an agreement even existed (AMM 2/15).

Carbon Plate: Bethlehem hiked its price of carbon plate products by $10/ton on all orders

scheduled for shipment after Feb. 11. At the

same time, it rescinded its energy surcharge of

$8/ton that it had imposed Feb. 4 on most of its

steel products. The price increase on carbon

plate followed similar moves by several producers, including Geneva Steel, US Steel and Ipsco.

Both Bethlehem and US Steel also announced

their intention to try for an additional $15/ton on

heated plate products, making the total increase

for that product $25/ton. A Bethlehem spokesman said that increased demand from the construction, shipbuilding, bridge, energy equipment,

and machinery sectors of the economy had resulted in a higher level of orders in recent weeks.

Before the price increases, carbon plate prices

had fallen off about $40/ton over a six-month period and were at about $260/ton. Coiled plate is

selling for about $240/ton (AMM 2/8, 2/9).

LABOR/MANAGEMENT

USWA and Oregon Steel Battle On: The running dispute between the United Steelworkers of

America and Oregon Steel flared up again last

month as two western transit systems decided on

company bids to supply their rails. The battle has

run for several years since Oregon, in defiance of

federal labor laws, refused to reinstate many

workers who had been on strike against the company. Among other products, Oregon supplies

rails for metropolitan transit systems.

Early in February, the Tri-County Metropolitan

District of Oregon (Tri-Met), which is expanding

the Portland city transit system, rejected a bid

from Oregon Steel to supply 2,300 tons of rail

and awarded the contract instead to rail supplied

by Pennsylvania Steel Technologies (PSI), a unit

of Bethlehem Steel. The USWA had lobbied

heavily against Oregon Steel and in favor of PSI.

Oregon Steel has filed a protest with Tri-Met.

However, a few weeks later, a similar USWA lobbying effort with the Santa Clara (Cal.) Valley

RAW MATERIALS

Scrap Prices Expected to Fall Still Further:

With the exception of November and December,

scrap prices have been on a year-long slide and

dealers early last month still did not see the light

at the end of the tunnel. Auto bundles at the beginning of February fell by $20/long ton and were

back to $86.50, less than $1 higher than its low

point in October. The decline was the second

largest one-month drop in the past decade. The

weakening economy and the fall in auto sales, as

well as the increasing number of steel companies

either in or near Chapter 11 fueled the continuing

downturn.

At the same time, the Steel Manufacturers Association is setting up a committee to evaluate

the possible introduction of a cooperative scrap

purchasing venture for its minimill members. De-5-

Steel Industry Update/154

Transportation Authority was unsuccessful as

Oregon received the nod to furnish 1,904 tons of

standard rail and 1,080 tons of premium rail for

the VTA system.

The award to PSI of the Portland contract was

made, despite Oregon Steel’s lower bidding

price, because PSI offered “more certainty and

less risk,” according to a Tri-Met spokesperson.

“On-time delivery of rail is critical to the overall

project schedule,” she said, citing a cost of

$210,000 for every month the rail delivery is late.

An Oregon Steel spokesperson disputed TriMet’s claim, saying that Tri-Met had never had a

delivery problem with its rails in the past.

In another development, Oregon Steel, in an

out-of-court settlement with the Colorado Department of Public Health and Environment,

agreed to pay a $600,000 fine for violations of the

state’s environmental regulations on smoke and

particles from steelmaking operations. In addition, the company will pay $400,000 to fund environmental projects in the Pueblo community and

has agreed to invest $15 mil to upgrade its steel

furnace and associated emission control system

steel unit in the nine months proceeding last June

30. Many have blamed the decline in Corus

sales on the weakness of the euro against the

pound sterling since 80% of the company’s exports go to the European continent. A national

steel strike has not occurred in Britain in 20 years

(AMM 1/31, 2/2, 2/5, 2/12, 2/19).

(AMM 1/29, 2/21; Oregon Steel Press Release 2/6, 2/15).

Sharp Union Response to Corus Restructuring, Layoffs: Union leaders and representatives

of the Corus Group, the new Anglo-Dutch conglomerate, reported that their two-hour London

meeting in mid-February was “constructive”. The

meeting came after two months of company activity that included the dismissal of two of its top executives and the announcement, after much secrecy and rumors, that the company was cutting

back sharply and laying off thousands of British

steelworkers. After the meeting, a spokesperson

for the Iron and Steel Trades Confederation reported that it presented its package and the company said it would “give it consideration and get

back to us in a month’s time.”

The crisis came to a head after Corus acknowledged that it was closing a number of mills and

cutting the jobs of 6,050 workers. Previously,

rumors of the cutbacks had spurred talk of a national steel strike and other possible labor actions. The union even made a bid for the Llanwern Works in Wales by putting together a consortium to buy the plant, a move that was rejected by Corus. At the Scunthorpe plant, the union

voted overwhelmingly for industrial action short of

a strike in response to a hundred “redundancies”

or layoffs announced a few months ago. The action could include a ban on overtime and a “work

to rule,” or doing no more than what is called for

in the union contract.

The Anglo-Dutch company reported an operating loss equivalent to $433 million in its carbon

-6-

AK Hits Contract Worker for Talking to Picketers: An employee of Superior Building Services, an outside contractor that provides cleaning services for AK Steel, stopped one day to talk

to a locked-out member of United Steelworkers of

America who was picketing at the plant gates in

Mansfield, Ohio. The conversation proved to be

a costly one for him. The next day, he got a call

from his employer that AK no longer wanted him

to work there.

That charge is the substance of a complaint issued by the National Labor Relations Board

against AK in a case to be heard by an NLRB

administrative law judge May 8. It accuses the

company of acting against the contractor employee because he was sympathetic to the USWA and because AK wants to discourage employees from talking with picketers. To date, the

company has not commented on the case.

On another front in the AK-USWA conflict, the

NLRB rejected a union appeal of its decision issued last July that the company acted illegally in

locking out its workers in Sept. 1999, just after it

acquired the Mansfield plant from Armco. The

lockout occurred just hours before the union contract expired and while negotiations were in progress on a new one. The NLRB ruled that there

was “insufficient evidence” to warrant a ruling that

AK had violated the law (AMM 1/31, 2/15).

Burns Harbor Fire Kills Workers: Bethlehem

Steel strongly denied last month that its own negligence was responsible for the two deaths and

five injuries in a Feb. 2 fire at its Burns Harbor,

Ind., mill. The company was responding to

charges leveled by Paul Gipson, president of

USWA Local 6786, that cutbacks in the safety

program at the plant led to the fire that killed Daniel Kado, 54, a millwright, and Mike Davis, 41, an

outside contractor. The company said that an investigation into the cause of the fire was under

way (AMM 2/7).

TXI-Chaparral: No Comment on Layoffs: TXIChaparral would neither confirm nor deny in midFebruary that it had laid off some 200 workers as

part of a company-wide cost-reduction program.

Industry sources had disclosed that the 200 were

being let go, but the company merely said that it

was doing everything it could to become “as effi-

Steel Industry Update/154

cient as we possibly can in today’s environment.”

TXI-Chaparral produces rebar, SBQ, structural

beams, channels and spring flats.

be closed. It was critical of the $1 billion loan

guarantee program under the measure passed by

Congress last year sponsored by Sen. Robert

Byrd (D.-W.Va.) “Nucor is not supportive of

bailout loans and guarantees,” said the company’s director of marketing, Bob Johns (AMM 2/21).

Co-Steel Advertises for Replacement Workers: Co-Steel Lasco of Ontario, Canada, which

locked out its workers just before Christmas, has

now begun advertising for replacement workers.

The locked-out workers, represented by USWA

Local 6571, had worked for 10 months without a

contract while negotiations were taking place.

The lockout is seen by Co-Steel Lasco workers

as a move to pressure the union into accepting its

terms, which entail a number of major concessions and “givebacks” on the part of employees.

The minimill, employing 500 workers, has an annual capacity of about a million tons. It turns out

long products like beams, rebar, angles, rounds,

squares, channels, special flats and grader

blades.

CAPACITY/TECHNOLOGY

Usinor, Arbed Merger Could Create Global Colossus: The preliminary steps jointly taken last

month between Europe’s two largest steel manufacturers -- Arbed of Luxembourg and France’s

Usinor -- along with Spain’s Acereda, to create a

mega-merger of the steel giants has the potential

of changing the face of the world steel market. In

a memorandum of understanding issued Feb. 19,

the three laid down their intention to form the

world’s largest steel group, employing 110,000

workers and producing 46 million metric tons of

crude steel annually. Its sales, based on last

year’s figures would total 30 billion euros, or

$27.6 billion, a year -- 15 billion euros in flat carbon steel, 5 million euros in stainless steel, 4 million euros in long products, and 6 billion euros in

processing, trading and distribution. Rumors of

the merger talks had been floating around since

last summer when Usinor and Thyssen Krupp of

Germany were said to have held merger discussions. Although it was expected that other European steel companies would react with some

trepidation to the merger, thus far there seems to

be only relief at the prospect. Thyssen Krupp

said it felt strengthened by the step and “favors

any move toward consolidation and restructuring

of the European steel market” which, it felt, would

lead to better balance and capacity utilization.

Salzgitter, Germany’s second largest steel producer, said that it didn’t feel the merger would

have a significant effect on the German market

(AMM 2/19).

In the U.S., Nucor last month told a steel conference that the steel industry needed to be consolidated and that some obsolete facilities should

SDI’s New Structural Mill Finally Gets Permit:

Steel Dynamics, after a year of record sales and

profits, is moving ahead with its intent to build a

new structural mill in Whitley County, Ind. The

company said last month that the Indiana Department of Environmental Management had reissued the air permit for the mill eight months after the U.S. Environmental Appeals Board had

remanded several outstanding issues to the state

agency. The company said that the issues had

now been resolved. Construction of the mill was

to begin last month and will take about 12 to 14

months to complete. SDI also said that it had

completed the repairs to its Iron Dynamics facility,

idled since the middle of last year. The plant has

been plagued by technical problems for several

years. Nearly two years ago, the liquid pig iron

operation opened with much fanfare, but was

forced to close after only five weeks of operation

when a refractory break-out occurred in the submerged arc furnace. The break-out was caused

by the use of the wrong type of brick in the furnace lining. The error caused months of disruption while a new wall, lined with copper, was designed and installed (AMM 1/31; New Steel 12/99).

Nucor Pushes Plans for New Rail Facility: Nucor is pushing ahead vigorously on a new joint

venture with Germany’s Voest-Alpine to build a

new North America rail mill at a site yet to be determined. The rails would be turned out in 320foot lengths, sharply reducing the number of

welds now needed on the standard 80-foot

lengths, thus reducing the most vulnerable spots

on the rails. Industry analysts predict that the

market for rails could grow to 1.2 or 1.3 million

tons a year in the next few years as railroads

seek to replace older lines becoming obsolete.

While the amount of track mileage in the U.S. has

remained fairly consistent at about 170,000 miles,

there has been a substantial increase in the

amount of freight tonnage hauled over the rails,

causing acceleration in wear. “Most of the market is in replacement trade,” said Pennsylvania

Steel Technologies Vice President Kirk Gibson

(AMM 2/8).

WORTHY OF NOTE

New Execs Tapped in Struggle to Turn Birmingham Around: In an effort to reverse the

-7-

Steel Industry Update/154

downturn at Birmingham Steel, its chairman and

CEO, John Correnti, has recruited a number of

his former colleagues at Nucor, where he was also CEO before he and a group of investors

gained control of Birmingham in 1999. The latest

recruit is Christopher Hiller, who joins Birmingham as vice president and general manager of its

plant in Cartersville, Ga. He previously served in

the same capacity at Nucor’s Norfolk, Neb., facility. Correnti is struggling to turn around the operations of a company that showed a net loss of

$119 million for its fiscal quarter ending Dec. 31,

compared with a net loss of $20 million for the

same period a year earlier. Hiller will take over a

structural products mill that is trying to upgrade

the production of medium structural shapes and

billets. It has a capacity of about 900,000 tons of

raw steel a year, a rolling capacity of about

750,000 and employs 125 workers.

Earlier in February, it was announced that Birmingham has pushed back by two months the

closing date for the sale of its SBQ operations in

Cleveland, Ohio and Memphis, Tenn., to North

American Metals, a new company. Birmingham

has been anxious to divest itself of its SBQ operations for some time and negotiated the sale to

North American last September. The final closing

has been delayed, however, by the difficulty

North American has had in putting together financing for the deal. Originally scheduled for late

November, then postponed to January 31, the

closing has now been rescheduled for March 23

(AMM 2/2, 2/23).

tence after pleading guilty in the case, was one of

the witnesses against Mitsubishi (AMM 2/14).

NKK, National Steel, Plan Closer Ties: Two

companies, one based in Tokyo, the other in

Pittsburgh, are planning a leaner, trimmed-down

operation and closer ties between them, according to announcements last month. Under NKK’s

new business plan, it would sell its Tokyo headquarters building and dissolve its holding company for North American operations, NKK USA

Corp., which is deeply in the red. The building

sale is expected to improve its profit to 98 billion

yen ($852.2 million) and its cash flow to 260 billion yen ($2.26 billion) and reduce its debt to 1.25

trillion yen ($10.87 billion). National said it would

take more vigorous cost-cutting measures, including further downsizing of its work force. It was also reportedly contemplating the closing of its No.

6 galvanizing line in its Granite City, Ill., division.

Employing about 9,000 workers, about 370 of

whom are currently on layoff, it planned to cut

back overtime by about 70% and make deeper

cuts in both hourly and salaried workers. Under

the new cooperative setup between them, NKK

will operate two divisions in North America -- one

for the steel business that would include National

and DNN Galvanizing and a second one for engineering and other activities (AMM 2/15).

Enron Uses Commodity Trading for Steel Ecommerce: E-commerce for steel companies

selling their products just hasn’t really gotten off

the ground, but Enron Corp. is now trying a different approach. The Houston-based commodities and energy trader is beginning to trade steel

like a commodity, purchasing it for forward delivery, some as far ahead as five years out, and

making its profits from hedging. The company

said it had begun trading contracts on its web site

(www.enrononline.com) for 7 gauge, 10 gauge,

and 12 gauge HR steel in 48 and 60-inch widths

for delivery as far off as September. So far, the

only shipping destination is Chicago, but other

destinations to be added include Detroit, Houston, Cleveland and Los Angeles. It is currently

buying 10 gauge, 48-inch width HR for $215/ton

and selling it for April delivery in Chicago at $225

Mitsubishi Guilty in Graphite Cartel Case: Japan’s Mitsubishi, the only company to hold out

against pleading guilty or otherwise admitting

culpability in an international cartel scheme to fix

the price of graphite electrodes, was found guilty

Feb. 12 by a federal jury in Philadelphia. No date

was set by U.S. District Judge Marvin Katz for the

amount of the fines that will be imposed on the

company.

A number of companies -- UCAR, SGL Carbon,

Carbide/Graphite Group, Tokai Carbon (a U.S.

subsidiary of Showa Denko) and SEC Corp. were

all implicated in the price-fixing scheme. UCAR

paid a $110 million criminal fine, the largest in the

history of anti-trust enforcement. In response to

a civil suit, it also agreed to pay $80 million in

damages to companies for harm done through illegal price-fixing. In 1999, after reaching a $40.6

million settlement with its shareholders arising

from the case, UCAR then turned around and

sued Mitsubishi for inducing its participation in the

cartel. UCAR’s former chairman, Robert Krass,

who is now completing a 17-month prison sen-

(AMM 2/19).

NOTES ON STEEL TRACK EXHIBITS

Performance data is from monthly AISI sources. Spot Prices (except

OCTG) are from Purchasing Magazine and are FOB Midwest, with no

extras. Hot rolled sheet, 48 inch, temper rolled, ASTM 569; Cold

Rolled Sheet, 48 inch, AISI 366; HD Galvanized Sheet, 120 inch AISI

525, G90; Coiled Plate, A36, 1/2x96x240 inch; Cold Finished Bar,

SBQ 1018; Wide-Flange Beam, A36, W8, 18 lbs; Wire Rod, low carbon; Rebar, carbon, no. 6. OCTG spot prices are from Pipe Logix, FOB

Houston for J55 8REUE Seamless Tube.

-8-

Steel Industry Update/154

Table 3: Selected Canadian Steel Industry Data, November & Year-To-Date

(thousand tons)

Month of November

Year-to-Date

Locker Associates

Steel Track: Performance

2000

1999

% Chg

2000

1999

% Chg

Raw Steel Production1,441

Mill Shipments

..............................

10.2

Exports

.........................................

415

2000

9.8

Imports .........................................1999 773

9.4

Apparent

Steel Supply ................. 1,759

9.0

Imports

as % of Supply ..............

41.7

Utilization

-0.9%Capacity

15,350

15,212

-5.3%

5,186

4,812

-10.5%

8,242

6,093

2000

-6.4%

18,406

16,493

1999 36.9

-44.8

1,454

100%

438

95%

864

1,880

90%

46.0

m

i

l

n

e

t

0.9%

7.8%

35.3%

11.6%

--

t

o

8.6 CSPA 2/26/01

Source:

n

85%

s

8.2

80%

7.8

75%

7.4

7.0

2000

1999

70%

J

9.8

F

9.2

M

10.0

A

9.8

M

10.1

J

9.6

J

9.4

A

9.2

S

8.8

O

8.0

N

8.1

D

8.0

8.5

7.8

8.9

8.6

8.9

8.4

8.6

9.0

8.7

9.6

9.4

9.6

2000

1999

J

90%

F

89%

M

91%

A

92%

M

91%

J

90%

J

85%

A

84%

S

83%

O

81%

N

75%

D

72%

77%

80%

82%

82%

82%

80%

79%

83%

82%

88%

89%

89%

Locker Associates Steel Track: Spot Prices

Flat-Rolled Prices

Other Product Prices

560

$ 540

520

p

e 500

r

CF Bar (SBQ)

480

t 460

o

n

CR Sheet

440

420

400

380

360

340

Plate

320

300

Beam

280

260

Wire Rod

HR Sheet

220

240

89 90 91 92 93 94 95 96 97 98 99 J

F M A M

J

J

A

S O N D

J

F

89 90 91 92 93 94 95 96 97 98 99 J

F M A M

2000

J

J

A

S O N D

2000

Spot Prices for Selected Steel Products, February & Year-To-Date

($ per net ton)

2001

Hot Rolled Sheet......................

220

Cold Rolled Sheet....................

330

HD Galvanized Sheet................

350

Coiled Plate............................... 240

Cold-Finished Bar (SBQ)..........

435

Wide-Flange Beams.................

300

Wire Rod/Low Carbon..............

290

Rebar........................................ 280

Average Spot Price+.................

306

OCTG Seamless Tube...........

1027

Scrap Price ($/gross ton)*.........

87

Sources: Purchasing Magazine, Pipe Logix

Month of February

2000

%Chg

330

-33.3%

440

-25.0%

430

-18.6%

320

-25.0%

460

-5.4%

300

0.0%

300

-3.3%

325

-13.8%

363

-15.8%

924

11.1%

137

-36.5%

+ Composite price of 8 carbon products

Steel Update/154

-9-

2001

223

335

345

240

433

300

290

280

306

1026

97

*auto bundles

Year-to-Date

2000

325

435

430

310

460

300

300

320

360

916

145

%Chg

-31.5%

-23.0%

-19.8%

-22.6%

-6.0%

0.0%

-3.3%

-12.5%

-15.1%

12.0%

-33.1%

J

F

Steel Industry Update/154

Subscribers to the Steel Industry Update Include...

Acme Metals

Algoma Steel

Bank Boston

Bank of America

Bear Stearns

Bethlehem Steel

British Steel

Capital Resource Partners

Chase Securities

Cleveland Cliffs

CIBC Wood Gundy

Donaldson Lufkin Jenrette

First Ontario Fund

Ford Motor

Garantia Banking

Greenway Partners

Gulf States Steel

Industrial Bank of Japan

Ispat Inland Steel

Ipsco Steel

KPMG Peat Marwick

Lehman Brothers

LTV

Mellon Bank

Metal Strategies

National Steel

North Star Steel

Nucor

Oglebay Norton

Plaza Investment Managers

Prudential Securities

Rockwell Automation

Santander Investment Securities

Scotia McLeod

Showa Denko

Stelco

US Steel

Warburg Dillon Read

WCI Steel

Wheeling-Pittsburgh

Worthington

---------------------------------------------------------------------Please enter my subscription to Locker Associates’ Steel Industry Update:

[ ] One year (10 issues): $395

[ ] Payment enclosed

[ ] Bill me

[ ] Two Years (20 issues): $725 (Save $65)

I prefer to receive the Update by: [ ] Mail (hard copy) [ ] Email

Note: Subscribers outside North America must add $15/year for air-mail postage. Make checks payable to

Locker Associates; payment must be in U.S. dollars drawn on a U.S. bank. Multiple copy discount available.

Name:

Title:

Company:

Address:

City:

State:

Phone #:

Fax #:

Zip:

Country:

Email

Return to: Locker Assoc. 225 Broadway, #2625, NY, NY 10007 Ph-212-962-2980; Fax-212-608-3077

email: lockerassociates@yahoo.com

website: www.lockerassociates.com

- 10 -