Internal Audit Programs

advertisement

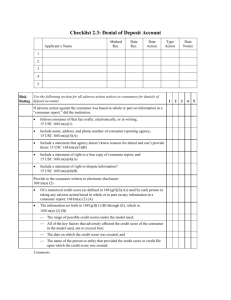

Fair Credit Reporting Act Compliance Audit As a user of consumer reports, the bank must comply with certain responsibilities of users of reports set forth in the Fair Credit Reporting Act (FCRA) (15 USC 1681). The Consumer Financial Protection Bureau (CFPB) is generally authorized to issue regulations as necessary or appropriate to administer and carry out the purposes and objectives of the FCRA. However, they do not have rulemaking authority for FCRA sections 615(e) ("Red Flag Guidelines and Regulations Required") and 628 ("Disposal of Records"). Therefore, the CFPB's Regulation V (12 CFR 1022) does not include parallel provisions to the other federal agencies' rules on the disposal of consumer information; the rules on identity theft red flags and corresponding interagency guidelines on identity theft detection, prevention, and mitigation; and the rules on the duties of card issuers regarding changes of address. To ensure compliance, actual procedures should be checked against any formal or informal procedures, and interviews should be conducted with the personnel responsible for compliance to ensure adequate knowledge of regulatory requirements. Please see the Identity Theft Red Flags and Address Discrepancies Compliance Audit and the Marketing Compliance Audit for a review of requirements for identity theft prevention and affiliate marketing opt-out rules. The following checklist should be modified to fit the specifics of your institution. FAIR CREDIT REPORTING ACT Yes, No N/A 1. Does the bank have procedures in place to ensure that consumer reports are only obtained for reasons outlined in the regulation? (15 USC 1681b, 15 USC 1681d) 2. When adverse action is based on a credit bureau report, does the institution disclose the following requirements of 15 USC 1681m: • The name, street address, and telephone number of the consumer reporting agency (including a toll-free telephone number, if it is a nationwide consumer reporting agency) that provided the report? • A statement that the consumer reporting agency did not make the adverse decision and is not able to explain why the decision was made? Work Paper Reference Comments • A statement setting forth the consumer's right to obtain a free disclosure of the consumer's file from the consumer reporting agency if the consumer requests the report within 60 days? • A statement setting forth the consumer's right to dispute directly with the consumer reporting agency the accuracy or completeness of any information provided by the consumer reporting agency? • If the action is based on a credit score, does the notice contain the following information about the score: — The current credit score of the consumer or the most recent credit score of the consumer that was previously calculated by the credit reporting agency for a purpose related to the extension of credit? — The range of possible credit scores under the model used? — All of the key factors that adversely affected the credit score of the consumer in the model used, except that the total number must not exceed four (4)*? — The date on which the credit score was created? — The name of the person or entity that provided the credit score or credit file upon which the credit score was created? * If a key factor that adversely affects the credit score of a consumer consists of the number of inquiries made with respect to a consumer report, that factor must be included in the disclosure even if there are four other factors. So in this case, the maximum number of key factors may be five (5). 3. Does the institution provide a notice to all parties to a loan that adverse information may be reported to the credit bureau (15 USC 1681s-2(a) of the Fair and Accurate Credit Transactions Act (FACT ACT) (15 USC 1681s, 12 CFR 1022))? 4. Does the institution provide the required disclosure to the consumer if the institution takes adverse action concerning credit, wholly or partly based on information contained in a consumer report, even if the information is not derogatory? 5. When adverse action is based on other outside information, does the institution disclose the consumer’s right to know the nature of the information? (15 USC 1681m(b)) 6. Does the institution have procedures in place to provide the nature of the other outside information on request? (15 USC 1681m(b)) 7. Are these disclosures made to the comaker, guarantor, or surety to whom the information relates? (Note: Although Regulation B (12 CFR 1002) requires that notice be given only to the primary applicant, the FCRA requires that notice be given to all parties to the credit if they are denied based on information in the consumer report or a third-party report.) 8. If the institution engages in “prescreening,” does each consumer whose name is on the prescreened list receive an offer of credit? 9. Does the institution provide both the long and short notice to each consumer as required by 12 CFR 1022.54? 10. Is the institution a consumer reporting agency as defined in 12 CFR 1022.3(f) (15 USC 1681a(f)) and if so, does it comply with the requirements imposed by the act? 11. Does the institution disclose to affiliates information beyond its transactions and experiences with consumers? (12 CFR 1022.3(d), 15 USC 1681a(d)) 12. If so, does the bank offer consumers an opportunity to opt out of the sharing agreement? (12 CFR 1022.3(d), 15 USC 1681a(d)) 13. Does the institution report credit history to a credit bureau? (15 USC 1681s-2) 14. If so, does the institution have procedures in place to ensure that it provides information that: • Reflects the terms of and liability for the account or other relationship • Reflects the consumer's performance and other conduct with respect to the account or other relationship • Identifies the appropriate consumer (12 CFR 1022, Appendix E) 15. Are the policies and procedures for reporting accurate information appropriate to the nature, size, complexity, and scope of the bank's activities? Note: In establishing these procedures, management must consider, as appropriate, agency guidance. 16. Does the bank have procedures in place to respond to disputes about the accuracy of information from consumers as required by the regulation within 30 days of the request? 17. Does the bank have procedures in place to respond to disputes about the accuracy of information from a credit reporting agency within 30 days of the request? 18. Does the institution disclose its disclosure of information to affiliates in its privacy policy as well as in the initial disclosures when a consumer opens an account? 19. Does the institution request credit bureau reports as a requirement for employment? (15 USC 1681d) 20. If so, does the institution properly notify applicants of this requirement in writing? (15 USC 1681d) 21. Before employment is declined based on information from a consumer reporting agency, does the institution send an adverse action notice and provide a copy of the report and their consumer rights to the applicant? (15 USC 1681d) 22. Does the institution have procedures in place to properly dispose of consumer information from a credit reporting agency? (15 USC 1681w) 23. Does the institution have procedures in place to provide the negative information notice to a consumer? (15 USC 1681s-2) Note: Model forms are available in Appendix B of 12 CFR 1022. 24. Does the institution have adequate procedures and internal controls in place if a consumer/customer claims a bank account has been used in an identity theft scheme? (15 USC 1681m, 15 USC 1681g(e), and 15 USC 1681c-1(h)(2)(B)) 25. Does the institution have procedures in place to ensure that delinquent credit as a result of identity theft is not reported to the credit reporting agency? (15 USC 1681s-2) 26. Does the institution have procedures in place to ensure that electronic receipts will not have more than five digits of the consumer’s account number? (15 USC 1681c(g)) 27. Does the institution have procedures in place to avoid collecting or using medical information in violation of 12 CFR 1022.30? 28. Does the bank not issue a replacement card on a debit or credit card if they have received an address change in the preceding 30 days unless they have taken reasonable steps to verify the address as outlined in the regulation? 29. Does the bank have procedures in place to ensure that they are reporting accurate information to consumer reporting agencies, taking into consideration the guidance offered by the agencies? Note: Accurate information means information that correctly: • Reflects the terms of and liability for the account or other relationship; • Reflects the consumer's performance and other conduct with respect to the account or other relationship; and • Identifies the appropriate consumer. 30. If the bank receives a direct dispute from a consumer, does it have procedures in place to: • Conduct a reasonable investigation with respect to the disputed information? • Review all relevant information provided by the consumer with the dispute notice? • Complete its investigation of the dispute and report the results of the investigation to the consumer within 30 days from the date on which it received the notice of the dispute from the consumer? • If the investigation finds that the information reported was inaccurate, promptly notify each consumer reporting agency to which it provided inaccurate information of that determination and provide to the consumer reporting agency any correction to that information that is necessary to make the information accurate? 31. If the bank determines that the dispute is frivolous, does it respond to the consumer within five business days? 32. Does the bank have policies and procedures in place to send appropriate risk-based pricing notices, as required by 12 CFR 1022.70? 33. If the bank uses the credit score proxy method for determining to whom to send the notice, is the method it uses to determine and recalculate the cutoff score accurate according to the requirements in 12 CFR 1022.72? 34. If the bank uses the tiered rate method for determining to whom to send the notice, are they correctly identifying the consumers who should get the notice as required by 12 CFR 1022.72? 35. If the bank determines who should get the notice by a direct comparison method, does it select a sample of the comparison and determine if their method seems reasonable? 36. Does the bank use the appropriate model form for the notice? Note: Appendix H of Regulation V (12 CFR 1022) contains all model forms, including the credit score disclosure required when a credit score is used as a basis for risk pricing. 37. Does the bank select a sample of notices provided and compares them to the requirements in the regulation and the model forms? (12 CFR 1022.73) 38. Does the bank send a separate notice to each consumer on a loan if: • They live at separate addresses? • The notice includes a credit score disclosure? 39. Does the bank send a notice for each loan transaction even if the consumer has received a notice for a previous transaction? (12 CFR 1022.75) 40. If the bank is the first creditor in a multi-creditor transaction, such as a secondary market mortgage transaction, does it send a risk-based notice, if appropriate? (12 CFR 1022.75) 41. If the bank chooses to provide a credit score disclosure instead of a risk-based disclosure, does it send the notice as soon as practical after it has received the credit score from the consumer reporting agency?