For Immediate Release Contact: Jeanie Clapp 10/20/2011 916/366

advertisement

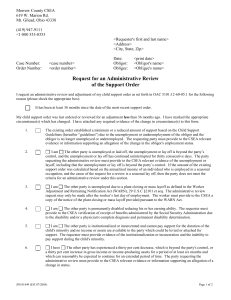

California Society of Enrolled Agents 3200 Ramos Circle Sacramento, CA 95827-2513 Tel: 916-366-6646 Fax: 916-366-6674 www.csea.org For Immediate Release 10/20/2011 Contact: Jeanie Clapp 916/366-6646 or jclapp@csea.org Franchise Tax Board Urged to Delay Implementation of Tax Form Changes Sacramento, CA – In an attempt to increase compliance with tax laws and provide instruction to taxpayers, the Franchise Tax Board (FTB) announced in September its plans to update the Schedule CA (540) form to collect more detailed information regarding real estate tax deductions. The proposed new form would require taxpayers to include parcel numbers, addresses, the total amount paid in real estate taxes and the allowable tax deduction. While the proposal is potentially helpful for taxpayers and tax return preparers, the California Society of Enrolled Agents (CSEA), a nonprofit organization dedicated to serving Enrolled Agents (EAs), sees significant flaws in launching this program without thorough examination. EAs are licensed by the federal government to prepare tax returns, assist with tax planning and represent taxpayers before the Internal Revenue Service. The question with no clear answer is this: What constitutes allowable real estate tax deductions? According to the FTB’s form, a taxpayer can deduct the portion that is based on the assessed value of the property but cannot deduct the amounts paid for local benefits, such as Mello Roos taxes. However, Internal Revenue Service (IRS) documentation suggests that Mello Roos and other California assessments may be deductible. “Despite its good intentions, the California FTB is attempting to clarify the property tax deduction, which is determined by federal law and regulated by the IRS,” says Jean Nelsen, EA, President of CSEA. “Until the IRS ends many years of confusion and controversy by providing clarity on which items on a property tax bill can be deducted, it is premature for the state to make that determination.” Furthermore, property tax bills differ in appearance from county to county and some do not clearly delineate between the deductible and non-deductible portions. Taxpayers will likely direct questions to county assessor offices, already working with very limited resources. This could easily stretch staffs beyond their capacities to respond. Answers also may vary from county to county, which will further cloud the issue. CSEA strongly supports effective tax administration and efforts to assist taxpayers in complying. However, until negative consequences of FTB’s proposal are analyzed and mitigated, CSEA believes implementation should be delayed. Premature implementation of a compliance initiative will do far greater harm than good in achieving its desired goals. Visit www.CSEA.org or call (800) 777-2732 for additional information. ### About CSEA CSEA is a nonprofit 501(c)(6) organization with more than 4,200 active Members. It is a professional association dedicated to serving EAs in California and abroad, enabling them to grow, prosper, and lead as The Tax Professionals while serving taxpayers in a dynamic, rapidly changing environment with integrity and trust.