chapter 7 - Holy Family University

advertisement

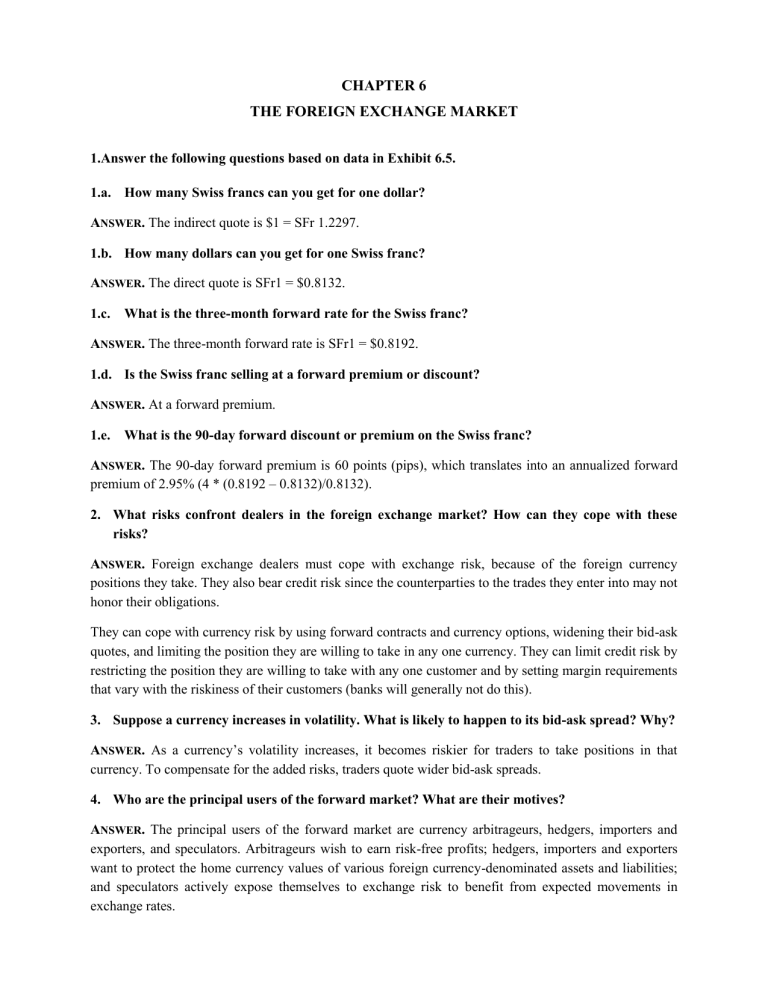

CHAPTER 6 THE FOREIGN EXCHANGE MARKET 1.Answer the following questions based on data in Exhibit 6.5. 1.a. How many Swiss francs can you get for one dollar? ANSWER. The indirect quote is $1 = SFr 1.2297. 1.b. How many dollars can you get for one Swiss franc? ANSWER. The direct quote is SFr1 = $0.8132. 1.c. What is the three-month forward rate for the Swiss franc? ANSWER. The three-month forward rate is SFr1 = $0.8192. 1.d. Is the Swiss franc selling at a forward premium or discount? ANSWER. At a forward premium. 1.e. What is the 90-day forward discount or premium on the Swiss franc? ANSWER. The 90-day forward premium is 60 points (pips), which translates into an annualized forward premium of 2.95% (4 * (0.8192 – 0.8132)/0.8132). 2. What risks confront dealers in the foreign exchange market? How can they cope with these risks? ANSWER. Foreign exchange dealers must cope with exchange risk, because of the foreign currency positions they take. They also bear credit risk since the counterparties to the trades they enter into may not honor their obligations. They can cope with currency risk by using forward contracts and currency options, widening their bid-ask quotes, and limiting the position they are willing to take in any one currency. They can limit credit risk by restricting the position they are willing to take with any one customer and by setting margin requirements that vary with the riskiness of their customers (banks will generally not do this). 3. Suppose a currency increases in volatility. What is likely to happen to its bid-ask spread? Why? ANSWER. As a currency’s volatility increases, it becomes riskier for traders to take positions in that currency. To compensate for the added risks, traders quote wider bid-ask spreads. 4. Who are the principal users of the forward market? What are their motives? ANSWER. The principal users of the forward market are currency arbitrageurs, hedgers, importers and exporters, and speculators. Arbitrageurs wish to earn risk-free profits; hedgers, importers and exporters want to protect the home currency values of various foreign currency-denominated assets and liabilities; and speculators actively expose themselves to exchange risk to benefit from expected movements in exchange rates. 5. How does a company pay for the foreign exchange services of a commercial bank? ANSWER. Companies compensate banks for foreign exchange services through the bid-ask spread. The bank will buy foreign exchange at the bid rate (low) and sell at the ask rate (high). CHAPTER 6 PROBLEMS 1. The $: € exchange rate is €1 = $1.35, and the €/SFr exchange rate is SFr 1 = €0.61. What is the SFr/$ exchange rate? ANSWER. SFr1 = €0.61 * 1.35 = $0.8235. 2. Suppose the direct quote for sterling in New York is 1.9880-5. 2.a. How much would £500,000 cost in New York? ANSWER. To buy £500,000 would cost £500,000 * 1.9885 = $99,425. 2.b. What is the direct quote for dollars in London? ANSWER. The direct quote for the dollar in London is just the reciprocal of the direct quote for the pound in New York or 1/1.9880 - 1/1.9885 = 0.5029-0.5030. 3. Using the data in Exhibit 6.5, calculate the 30-day, 90-day, and 180-day forward discounts for the Canadian dollar. ANSWER. Here are the relevant rates for the Canadian dollar: Spot: C$1 = $0.9207 30-day forward: C$1 = $0.9216 90-day forward: C$1 = $0.9231 180-day forward: C$1 = $0.9250 The 30-day forward discount is: [($0.9216 - $0.9207)/$0.9207] * 12 = 1.17% The 90-day forward discount is: [($0.9231 - $0.9207)/$0.9207] * 4 = 1.04% The 180-day forward discount is: [($0.9250 - $0.9207)/$0.9207] * 2 = 0.86% In this case, the forward discounts at these maturities are relatively small, indicating that Canadian and U.S. interest rates are close to each other. 4. An investor wishes to buy euros spot (at $1.3480) and sell euros forward for 180 days (at $1.3526). 4.a. What is the swap rate on euros? ANSWER. A premium of 46 points. 4.b. What is the premium on 180-day euros? ANSWER. The 180-day premium is (1.3526 - 1.3480)/1.3480 * 2 = 0.68%. 5. Suppose Credit Suisse quotes spot and 90-day forward rates of $0.7957-60 and 8-13, respectively. 5.a. What are the outright 90-day forward rates that Credit Suisse is quoting? ANSWER. The outright forwards are: bid rate = $0.7965 (0.7957 + 0.0008) and ask rate = $0.7973 (0.7960) 5.b. What is the forward discount or premium associated with buying 90-day Swiss francs? ANSWER. The annualized forward premium = [(0.7973 - 0.7960)/0.7960] * 4 = 0.65%. 5.c. Compute the percentage bid-ask spreads on spot and forward Swiss francs. ANSWER. The bid-ask spread is calculated as follows: Percent spread = Ask price - Bid price x 100 Ask price Substituting in the numbers yields a spot bid-ask spread of (0.7960 - 0.7957)/0.7960 = 0.04%. The corresponding forward bid-ask spread is (0.7973 - 0.7965)/0.7973 = 0.10%. 6. Suppose Dow Chemical receives quotes of $0.008242-45 for the yen and $0.03023-27 for the Taiwan dollar (NT$). 6.a. How many U.S. dollars will Dow Chemical receive from the sale of ¥50 million? ANSWER. Dow must sell yen at the bid rate, meaning it will receive $412,100 (50,000,000 * 0.008242). 6.b. What is the U.S. dollar cost to Dow Chemical of buying ¥1 billion? ANSWER. Dow must buy at the ask rate, meaning it will cost Dow $8,245,000 (1,000,000,000 * 0.008245) to buy ¥1 billion. 6.c. How many NT$ will Dow Chemical receive for U.S.$500,000? ANSWER. Dow must sell at the bid rate for U.S. dollars (which is the reciprocal of the ask rate for NT$, or 1/0.03027), meaning it will receive from this sale of U.S. dollars NT$16,518,005 (500,000/0.03027). 6.d. How many yen will Dow Chemical receive for NT$200 million? ANSWER. To buy yen, Dow must first sell the NT$200 million for U.S. dollars at the bid rate and then use these dollars to buy yen at the ask rate. The net result from these transactions is ¥733,292,905 (200,000,000 * 0.03023/0.008245). 6.e. What is the yen cost to Dow Chemical of buying NT$80 million? ANSWER. Dow must sell the yen for dollars at the bid rate and then buy NT$ at the ask rate with the U.S. dollars. The net yen cost to Dow from carrying out these transactions is ¥293,812,182 (80,000,000 * 0.03027/0.008242) 8. As a foreign exchange trader at Sumitomo Bank, one of your customers would like a yen quote on Australian dollars. Current market rates are: Spot 30-day ¥121.37-85/U.S.$1 15-13 A$1.1878-98/U.S.$1 20-26 8.a. What bid and ask yen cross rates would you quote on spot Australian dollars? ANSWER. By means of triangular arbitrage, we can calculate the market quotes for the Australian dollar in terms of yen as ¥102.00-58/A$1 These prices can be found as follows. For the yen bid price for the Australian dollar, we need to first sell Australian dollars for U.S. dollars and then sell the U.S. dollars for yen. It costs A$1.1898 to buy U.S.$1. With U.S.$1 we can buy ¥121.37. Hence, A$1.1898 = ¥121.37, or A$1 = ¥102.00. This is the yen bid price for the Australian dollar. The yen ask price for the Australian dollar can be found by first selling yen for U.S. dollars and then using the U.S. dollars to buy Australian dollars. Given the quotes above, it costs ¥121.85 to buy U.S.$1, which can be sold for A$1.1878. Hence, A$1.1878 = ¥121.85, or A$1 = ¥102.58. This is the yen ask price for the Australian dollar. ADDITIONAL CHAPTER 6 PROBLEMS 1. Suppose the quote on pounds is $1.624-31. 1.a. If you converted $10,000 to pounds and then back to dollars, how many dollars would you end up with? ANSWER. For $10,000, you would buy pounds at the price of $1.631, giving you £6,131.21 ($10,000/1.631) and resell them at the bid price of $1.624. The latter transaction would yield $9,957.08, resulting in a round-trip cost of $42.92. 1.b. Suppose you could buy pounds at the bid rate and sell them at the ask rate. How many dollars would you have to transact in order to earn $1,000 on a round-trip transaction (buying pounds for dollars and then selling the pounds for dollars)? ANSWER. For every pound you could buy at the bid and sell at the ask, you would earn the spread of $0.007. To earn $1,000, you would have to transact £142,857.14 ($1,000/$0.0007). At the current bid rate of $1.624, this is equivalent to $232,000 (142,857.14 * $1.624). 3. The spot and 90-day forward rates for the pound are $1.1376 and $1.1350, respectively. What is the forward premium or discount on the pound? ANSWER. The forward premium (discount) on the British pound is [(f1 - e0)/e0] * (360/n) = [(1.1350 - 1.1376)/1.1376] * 4 = -0.91% which is a forward discount of 0.91%. 4. Suppose the spot quote on the euro is $0.9302-18, and the spot quote on the Swiss franc is $0.6180-90. 4.a. Compute the percentage bid-ask spreads on the euro and franc. ANSWER. The percentage bid-ask spreads on the euro and franc are calculated as follows: Euro bid-ask spread = (0.9318 - 0.9302)/0.9318 = 0.17% SFr bid-ask spread = (0.6190 - 0.6180)/0.6190 = 0.16% 4.b. What is the direct spot quote for the franc in Frankfurt? ANSWER. To sell one franc for euros, first sell the franc for $0.6180 and then convert $0.6180 into euros at the ask rate of $0.9318. Thus the bid rate for the franc is 0.6180/0.9318 = €0.6632. Similarly, to acquire one franc, sell euros for dollars and then sell dollars for francs. Specifically, it costs $0.6190 to buy €1. Because €1 can be converted into $0.9302, it takes €0.6190/0.9302 = €0.6654 to buy $0.6190. Thus the ask rate for francs is €0.6654. The bid-ask quote on the franc in Frankfurt is therefore €0.6632-54.