Problem Set 1 Solution Key

1

Public Finance

Problem Set 2 Solution Key

ECN 131

Prof. Farshid Mojaver

4

. Consider the case of a single mother with two children, who is trying to decide how many hours to work each month. Suppose, due to constraints such as child care, she is limited to working a maximum of 40 hours per week, for a total labor supply endowment of 160 hours per month. This mother has no other source of labor income, and if she works, would receive a wage of $6 for each hour worked.

Assume that the mother’s utility function is defined over money (C) and leisure (L), and takes the following form:

U = 3 log C + 5 log L a) Solve for the mother’s optimal choice of labor supply. How much money does the mother have for consumption? b) Suppose the state government introduces a welfare program for single mothers (similar in nature to TANF). Under this new program, a mother with no labor income would receive $120 per month from the government (i.e. $120 is the benefit guarantee ). However, if the mother chooses to work, this benefit amount is reduced by 20% of her labor income (i.e. the benefit reduction rate is 20%). i.

Intuitively, how might you expect labor supply to differ under this program than if no welfare program existed? Should the mother work more or less if welfare is provided, or is the answer uncertain? Demonstrate graphically what happens to the budget set that this mother faces due ii.

to the introduction of welfare (labeling the number of hours at which she stops receiving any benefits from the government).

Now, solve for the optimal choice of labor supply. How many hours of work will the mother now provide? What is her total labor income? What is her total income (including the welfare benefit)? How has labor supply changed from in (a), and how has total income changed? Is the woman better off? c) Now, let’s apply these theoretical results. Consider a state that has an established welfare regime as in (b). The Governor of the state is concerned that too many single mothers are out of the labor force. To remedy this, he is trying to decide between implementing one of three different welfare i.

ii.

iii.

iv.

policy reforms:

1) lowering the benefit amount, but keeping the benefit reduction rate the same

2) keeping the benefit amount the same, but lowering the benefit reduction rate

3) lowering the benefit amount the same amount as (1) and lowering the benefit reduction rate the same as (2)

Theoretically, how should each proposal affect the labor supply of unemployed single mothers, and why?

How should each proposal affect the labor supply of welfare mothers who are working?

Which proposal do you expect to result in the largest number of workers who were previously not receiving benefits to now start receiving welfare benefits?

Based on these conclusions, which proposal would you suggest the Governor implement?

Why? a) L = leisure

C = 6(wage) × hours of work = 6(160–L) = 960–6L

U = 3 log C + 5 log L = 3 log(960–6L) + 5 logL

U/

L = 0

(–18)/(960–6L) + 5/L = 0

–18L + 4800 – 30L = 0

4800 = 48L

100 = L

So leisure = 100

hours of work = 60

C = 6 × 60 = 360

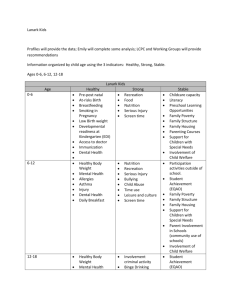

2 b i) LS(Labor supply) effects depend on individual’s previous choice of labor (i.e., whether they’ll face the new budget constraint caused by the welfare program or not). If they’re working a lot, there’s likely no effect. If they’re working a little, there might be a LS effect (probably negative).

New BC meets old where C new = C old at same L

C new = 120 + 6 × .8(160–L)

C old

C

= 6 × (160–L) new = C old

120 = 6 × .2(160–L)

120 = 192 – 1.2L

60 = L

C

960

Slope = – w = – 6

600

Slope = – w × (1–BRR)

= – 6 × .8 = – 4.8

120

G = 120

60 160 L b ii) Assuming that the mother is on the lower (new) portion of the budget constraint, then C = [ G – W(160–L)(.BRR)] + W(160–L) = 120 + .8 × 6(160–L) = 888 – 4.8L

U = 3 log(888 – 4.8L) + 5 log L

U/

L = 0

(–14.4)/(888 – 4.8L) + 5/L = 0

38.4 L = 4440

L = 115.625, C = 333

Labor income = 6 × (160 – 115.625) = 266.25.

Benefit = G – (0.BRR)W(160–L) = 120 – 0.2*266.25 = $66.25

Total Income = $66.25 + 266.25 = $332.5

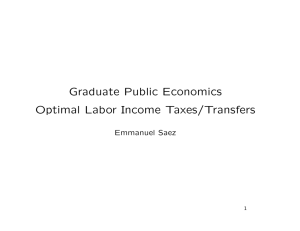

The woman MUST be better off (you don’t even need to do a utility calculation for this), because for any amount of work, she has at least as much income as before the program, so her utility is at least as great as before (if she did not change her work behavior) or greater than before (if she did change her behavior). c) The following pictures represent the reforms:

3

C C w(1-BRR 0 ) BRR 0

Baseline

G 0

L

① G ↓

G 1

L

C C

BRR 1

BRR 1

G 0

G 1

②

BRR ↓

L

③

G ↓ BRR ↓

L

i) All proposals should induce some unemployed women to enter the LF(Labor force).

①

quite clearly makes it more painful to remain unemployed.

②

increases the returns to work (essentially an increase in the effective wage). Normally, this would have apposing income & substitution effects, but since the woman isn’t working, there is no income effect associated with the case in the effective wage. Graphically, some women will have indifference curves that hit the corner of the BC in the baseline, but are tangent to the BC with positive hours of work in

②

.

③

is a mix of

①

and

②

, so LS also increases for some women. ii)

①

represents a negative income shock, should encourage LS.

②

only represents a change in the effective wage. Hence, there are apposing income & substitution effects: Income effect: for a given L, wage and income are higher, so use some wealth to purchase leisure and reduce hours of work. Substitution effect: returns to work increase, so increase hours of works. Since these effects are apposing, total effects are ambiguous.

③

is also ambiguous since

②

is ambiguous (although technically it depends on the magnitude of the change in G and BRR) iii) Proposal

②

(because its “breakeven level” – where the new BC meets the old BC – is furthest to the left). iv) Anything reasonable here will do; depends how much you care about encouraging LS of the unemployed & those who work little vs. discouraging LS for those who work a fair bit.

Empirical Economics part 1

1.

According to a recent Op-Ed piece by Joshua Foer in the New York Times (2/14/06), “A study conducted during the 1980's found that men who kiss their wives before leaving for work live longer, get into fewer car accidents, and have a higher income than married men who don't.” Since reading this news, I have made a point of kissing my wife before work every morning in order to (1) prolong my life, (2) avoid

4 car accidents, and (3) raise my income. Briefly explain (for one of these goals) why my logic is likely mistaken.

The study does not appear to establish any causation between wife-kissing and any of the three measured “benefits.” Even though there is apparently correlation between wife-kissing and health/ safety/income, this doesn’t mean one causes the other. For example: avoiding car accidents. Suppose there is a third variable that can’t be measured, a tendency to be late. And men who tend to be late are often too much in a hurry to kiss their wives before work, and they are also more likely to get into a car accident (because they are rushing). Thus the hidden “tendency to be late” variable causes non-kissing and accidents. Nonkissing does not have any causal relationship to car accidents.

2.

A paper published in a medical journal found that children who said they dieted gained more weight over a period of time than did children who said they did not diet. The authors concluded that dieting may lead to binge eating and therefore cause weight gain, a conclusion that was widely reported in the press.

Can you think of any alternative explanations?

Ans) Although dieting may cause binge eating that in turn leads to increased weight gain, dieting may not be the only explanation. For example, it could be that the children who diet are the ones most prone to gaining weight. Consequently, dieting may not cause weight gain.

3.

You are hired by the government to evaluate the impact of a policy change that effects one group of individuals but not another. Suppose that before the policy change, members of a group affected by the policy averaged $17,000 in earnings and members of a group unaffected by the policy averaged $16,400.

After the policy change, members of the affected group averaged $18,200 in earnings while members of the unaffected group averaged $17,700 in earnings. a) How can you estimate the impact of the policy change? What is the name for this type of estimation? b) What are the assumptions you have to make for this to be a valid estimate of the impact of the policy?

Ans) a) After the policy change, both affected and unaffected group’s average earnings are increased by $1,200 and $ 1,300 respectively. If we can assume that both group’s other economic situations are the same, so we can ignore all the other factors nevertheless their average earning levels are somewhat different, then we can estimate that the new policy has the impact of decreasing the earnings by $100. This is an example of Qusai-

Experiments. b) For the above estimating, we need to assume that the both group’s economic situations are exactly same only except they were implemented the new policy or not. If we can not guarantee the above assumption, i.e., if we can not ignore all the other factors which can affect their income changes, then the estimation may be contaminated one, so we can not be confident of the estimation.

4.

Your state introduced a tax cut in the year 1999.You are interested in seeing whether this tax cut has led to increases in personal consumption within the state. You observe the following information:

5 a) Your friend argues that the best estimate of the effect of the tax cut is an increase in consumption of 30 units, but you think that the true effect is smaller, because consumption was trending upward prior to the tax cut. What do you think is a better estimate? b) Suppose that you find information on a neighboring state that did not change its tax policy during this time period. You observe the following information in that state:

Given this information, what is your best estimate of the effect of the tax cut on consumption? What assumptions are required for that to be the right estimate of the effect of the tax cut? Explain.

Ans) a) Prior to the tax cut, there was a steady increase in consumption of 10 units every two years. If that trend had continued, and there had not been a tax cut, you might have predicted that consumption in 2000 would be 330. The actual consumption was 350, so an argument could be made that the additional increase of 20 units can be attributed to the tax cut, over and above the general trend. b) This new information suggests that growth in consumption would have been greater than the past trend indicates even if there had been no tax cut. The difference in the “control” state—the state that did not change its tax policy—is 20 units, or approximately 7% ([300 – 280] ÷ 280).

The difference in the treatment state is (350 – 320) ÷ 320 = 9.4%.

The difference in the difference is only 2.4%, but this is a good estimate of the effect of the policy only if the states are roughly comparable in other ways. The estimate assumes that economic impacts were similar in each state (perhaps because they are neighboring and so have similar industries, urbanization, demographics, etc.) and that no other policies that might affect consumption were instituted in either state during that same period.

5.

Researchers often use panel data (multiple of observations over time of the same people) to conduct regression analysis. With these data, researchers are able to compare the same person over time in assessing the impacts of policies on individual behavior. How could this provide an improvement over crosssectional analysis of the type described in the text?

Ans) Panel data sets allow researchers to control for attributes of a person that do not change over time. For example, it is particularly hard to obtain data about attitudes, preferences for leisure, familial or cultural values, and the like, but these traits are likely to be fairly stable in adults. Therefore a researcher can control for these unobservable, or immeasurable, influences on behavior by using panel data. In effect, the researcher can hold the person’s underlying preferences and attitudes constant while observing their responses to policy over time.