What is GST – a revision

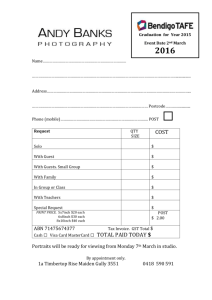

advertisement

What is GST – a revision

Although most of you would have heard and read by now a significant amount of information

about GST it will not be wasted to begin with a brief revision. In order to place your

organisation within the context of the GST system in general, it will be beneficial to provide a

broad overview of the principles underlying the legislation and it will also help at the outset to

revisit some of the terminology of the legislation.

The GST is a tax of 10% on most supplies of goods and services in Australia from 1 July

2000. The GST legislation revolves around taxable supplies and is calculated on the basis of

the consideration received for taxable supplies made by registered suppliers. The GST will be

included in the price of supplies made from 1 July 2000. Registered suppliers will calculate

the GST as 1/10th of the value of the supply. Recipients will be able to work out the GST

included in the price by working out 1/11th of the price paid. A registered recipient will be able

to claim

an input tax credit for the GST paid by it as part of the price of the supply. It is too simplistic

(but nevertheless a useful reminder) to note that if money changes hands, there may be a

taxable supply and, consequently a GST liability for the supplier. (We will see shortly,

however, that not only transactions which involve payments of money attract GST).

A 'taxable' supply must be:

a supply. Including the obvious - supplies of goods, services, information, interests in

property - and the not so obvious - such as financial supplies (like credit) and an entry

into or release from an obligation.

for consideration. The obvious form of consideration is a payment but, as noted

above, consideration can include an act done in connection with a supply of anything

(in other words, the consideration need not be an amount of money).

the supply must be made in the course of an enterprise. An 'enterprise' is an activity

or series of activities done in the form of a business or an adventure or concern in the

nature of trade but includes an activity or series of activities done on a regular or

continuous basis in the form of granting of a lease of property. It is particularly

relevant here that an enterprise specifically includes an activity or series of activities

done by a charitable institution. For the purposes of the GST legislation, an

organisation may be charitable if it is conducted on a non-profit basis and is

established for a community benefit including the promotion of culture or the provision

of community facilities, like museums. An enterprise will not include some activities so far as is particularly relevant, private recreational pursuits or hobbies or activities

by individuals without a reasonable expectation of profit or gain (apart from trustees

of charitable funds).

the supply must be connected with Australia.

The supplier is registered (or required to be).

Non – Profit Organisations and the GST

A non-profit organisation is required to be registered if its annual turnover is $100,000 or

more. In determining relevant annual turnover for this purpose, you would consider the value

of taxable supplies (excluding GST) made, or likely to be made, in the 12 months ending at

the end of the current month and for the current month and the next 11 months. If your annual

turnover for the last 12 months has been below $100,000 and is not likely to exceed that in

the next 12 months, the organisation will not be required to register; also if annual turnover is

not likely to exceed $100,000 in the next 12 months, although it may have done so in the last

12 months, the organisation will not be required to register. Unconditional donations or gifts

are not included in the calculation of the organisation's annual turnover for this purpose.

Although the organisation may not be required to register on these turnover tests, it may still

choose to do so. These turnover tests should be reviewed regularly to ensure the

organisation's status has not altered.

Is your organisation required (or entitled to be registered for

GST)?

The outline of the mechanics of the GST legislation above demonstrates that your

organisation may be making:

supplies connected with Australia;

for consideration;

in the course of an enterprise, and therefore should apply the annual turnover test to

determine whether it is required to be registered to ensure compliance with the GST

legislation. The organisation will need an Australian Business Number (or ABN) to be

part of the GST regime, whether it is required to be part of the regime or chooses to

be.

The entity that must or may be registered for GST purposes (and therefore must have an

ABN) can include an individual, a body corporate, an unincorporated association or a body of

persons.

There is specific Australian Business Number legislation which describes the entities entitled

to an ABN.

Most organisations represented here will qualify for an ABN under that legislation as they

carry on an enterprise and are:

incorporated under the State incorporations legislation; or

unincorporated associations - a group of people with a common purpose (usually set

out in a constitution) of providing a benefit to the community rather than to its

members.

There may be groups of people here that fall into a grey area. For example a group of

individuals working on the restoration of an item of historical interest in their spare time; also a

local history group which is merely a group of individuals interested in gathering and

discussing matters relevant to local history.

Neither group has a formalised management structure or constitution but it is conceivable that

both apply for and obtain grants or subsidies (where applications are not limited to more

formally organised groups). It is likely that neither group will be entitled to an ABN and will not

be able to participate in the GST regime because they do not carry on an 'enterprise'. They do

not qualify as a charity or a non-profit organisation and may be considered to be merely

involved in a recreational pursuit or hobby or an activity without a reasonable expectation of

profit or gain. If however their activities take on some 'business' flavour however , for

example, display of work for a fee at community events, or research work paid for by

interested parties, or producing publications for sale, the question of whether they are

carrying on an enterprise is more difficult to answer. Each particular case would need to be

considered on its merits.

The Australian Tax Office ('ATO') will not provide a private ruling on whether an enterprise is

being carried on for the purpose of the granting of an ABN but the ATO may be able to

provide general advice in relation to this matter.

An organisation can obtain an ABN even if it does not register for GST purposes. There are

two relevant practical reasons for doing so which are unrelated to GST. An organisation will

need an ABN:

to apply for endorsement as a deductible gift recipient or an income tax exempt

charity. An organisation's current status for either of these purposes will cease to be

effective on 1 July 2000 under the current system.

to prevent an entity to whom you supply goods or services from withholding tax at the

top marginal rate from payments due. As we will see shortly in relation to GST, a

grant to your organisation to be used for a particular purpose is consideration for the

supply of a service or entry into an obligation by your organisation. In that case, in the

absence of an ABN, the grantor may have to withhold the tax from the grant.

In order to be registered for GST purposes from 1 July 2000 application for an ABN must be

made before 31 May 2000. In order to obtain endorsement as a deductible gift recipient or

income tax exempt charity from 1 July 2000 application for an ABN should be lodged as early

as possible.

If you don't already have one, an application for an ABN and guides to its completion are

available by contacting the ATO.

What are the consequences of Registration?

Once registered for GST purposes:

it is the organisation's obligation to cancel the registration if it ceases to carry on an

enterprise;

if the organisation has elected to be registered, it must remain registered for 12

months;

the organisation must remit GST to the government from the consideration received

for all taxable supplies it makes;

the organisation is entitled to claim input tax credits for GST included in the price of

purchases made for the purpose of making taxable supplies;

the organisation must account for GST payable and input tax credits claimed by

lodging a business activity statement within 21 days after the end of each tax period;

tax periods may be quarterly or monthly and for some entities the tax periods are

compulsory. The booklet produced by the ATO in relation to non-profit organisations

current at 3 March 2000 indicates that the government will allow non-profit entities to

choose quarterly tax periods.

Issues related to the consequences of registration for GST

1. Attributing GST and input tax credits to tax periods

Depending on whether an organisation uses a cash or accruals basis of accounting, the rules

for attributing GST and input tax credits to particular tax periods vary. An entity can choose a

cash basis of accounting if it is a charity or a gift deductible entity or its annual turnover is $1

million or less. In that case GST is not payable until payment for a taxable supply is actually

received and no input tax credits will be claimable until the supply is paid for. Accounting on a

non-cash basis would mean that GST must be accounted for in the earlier of the tax period in

which an invoice is issued or the tax period in which any of the consideration is received.

Similarly with a claim for input tax credits.

While commercial organisations may be able to use an accruals accounting basis to a cash

flow advantage, the burden of the GST liability arising before receiving payment for a taxable

supply may be too much for some non-profit organisations. The pros and cons of the optimum

basis of accounting will depend on the particular income/costs base within which your

organisation operates.

2. Tax Invoices/Adjustment Notes

No input tax credits are claimable without a tax invoice in the approved form which will be

provided by the supplier (unless the GST exclusive value of the supply is less than $50,

although some form of documentary evidence should be held to support all claims for input

tax credits). An organisation registered for GST purposes will therefore be required to issue

tax invoices within 28 days of a request being made for one by a recipient (and this a

statutory requirement of the GST legislation) and will be keen to collect them. Only those

registered for GST purposes can issue tax invoices so that organisations registered for GST

purposes will probably prefer to deal with a registered supplier.

There are differing requirements for tax invoices for supplies under $1,000 and those for

$1,000 or more. The booklet published by the ATO for non-profit organisations contains

examples of both.

In addition, if GST has already been accounted for and input tax credits claimed and the

consideration changes for some reason or a bad debt arises, an adjustment will be required

on the relevant business activity statement and an adjustment note will be required if

additional input tax credits are to be claimed (unless the supply is for less than $50).

3. GST free supplies

Not all supplies made by an organisation registered for GST purposes will be subject to GST,

although most will be. It is simpler to identify relevant GST free supplies. They will include, for

organisations that qualify as charities, non commercial supplies. Any supply made for

consideration of less than 50% of the GST inclusive market value or less than 75% of the cost

of the supply falls within this category. For example (subject to some flexibility in registration

which is referred to below), if homemade produce is sold at a fundraising stall for less than

half of its market value, the sales will be GST free; supplies of research work or historical

information from the museum's information banks or a newsletter for less than 75% of the

cost of such supplies will be GST free. In addition, raffle tickets will be GST free, sales of

donated second-hand goods like excess museum stock (provided the items are sold without

altering their original character) will be GST free. In the latter case repairs would not be

considered as a relevant alteration.

food

It is relevant to note that some food is GST free by virtue of its status under the regulations to

the GST legislation but it is unlikely that food sold at a fundraising store or a cafeteria would

qualify for this GST free status. A list of relevant food is set out in the regulations to the GST

legislation.

donations/gifts, subsidies/grants and sponsorships

Remembering the wide definition of supply discussed earlier, we will now consider the way in

which donations/gifts, subsidies/grants and sponsorships are treated for GST purposes. A

simple rule of thumb is that if a benefit flows to the giver, the organisation will be liable for

GST as supplier of a service to the giver. So that if a donation or gift has no 'strings' attached,

the organisation will not be liable for GST. Similarly with grants, subsidies and sponsorships.

However, where, as is the case more often than not, the donation is to be used for a particular

purpose, the sponsorship is in return for some form or acknowledgement or there are

reporting requirements attached to the grant, the organisation will be required to remit GST as

1/11th of the value of the donation, sponsorship or grant. The giver will be entitled to a

corresponding input tax credit. It is possible that a mere requirement to issue a receipt for a

donation will affect its GST free status for this purpose. The ATO's booklet dealing with GST

and non-profit organisations points out that the effect of this should be revenue neutral for the

giver and the organisation. This is so where the giver is registered for GST purposes and the

gift is in cash - the giver should increase the GST exclusive value of the gift or donation by

1/10th and claim the input tax credit to which it is entitled and the organisation should pay

1/11th of the donation to the ATO. In fact the booklet indicates that grants by Commonwealth

Departments will be grossed up by 10%. However, difficulties may arise where:

the giver is not registered for GST purposes (eg. the individual benefactor who

requires that the gift be used in a particular way is unlikely to be happy to increase

the gift by 10% to maintain the value of it to the organisation and as a result the value

of the gift to the organisation is eroded by the GST payable on it.)

the gift is in kind - the organisation will then be using its cash reserves to fund the

GST liability.

Similar problems arise where, say, the local paper provides free advertising of the museum's

activities/services in return for free research for its regular local history supplement or, to take

one of the ATO's more general examples, a sponsor provides goods and services in return for

other goods and services. As the ATO points out, where the supplies by each registered

entity are of equal value no GST will be payable by either entity because the value of the

supply is the same as the value of the acquisition. What if however the sponsor is not

registered for GST purposes? No corresponding input tax credits will be available to the

organisation for the acquisition from that sponsor. There may also be room for debate as to

the equal market value of the supplies by each entity - presumably the willingness of each

entity to 'swap' supplies indicates their equal market value, however, there may be

circumstances where there is arguably an unequal market value of the supply so that the GST

liabilities do not simply cancel each other out. It may be worth agreeing with the other party an

equal value for each supply for this reason.

In both cases the ATO has indicated in its booklet of non-profit organisations that although the

effect to the parties (and government) is revenue natural, both parties should still return the

GST payable on the taxable supply and claim the corresponding input tax credits.

membership fees

Membership fees are generally paid for services or goods of some sort such as a newsletter

or a right to use the museum's facilities for research. The ATO booklet related to GST and

non-profit organisations recognises that membership 'bestows rights to members even where

nothing tangible is supplied'. If this is the case, the fees will be subject to GST. Membership

fees paid since 2 December 1998 in respect of periods from 1 July 2000 will be subject to

GST even if the fee has not been increased for GST when it was levied. Organisations in this

situation should consider whether their constitution entitles them to levy additional fees to

cover the liability and whether the members will wear this additional cost. The risk of

disgruntling valuable members may be too great but the funds of the organisation intended for

the furtherance of the organisation's purposes will be depleted as a result of the GST liability

which has not been anticipated in levying the membership fees.

other supplies

Admission prices, full priced research services and photo production services will be other

common examples of supplies which a museum may make which will be subject to GST from

1 July 2000. The price of such supplies will need to be reset to take this liability into account if

net revenues are to be maintained.

4. Flexible registration requirements

Non-profit organisations will be entitled to treat independent units of their operation as

separate entities for GST purposes subject to the unit having separate accounting records

and being separately identifiable. This will extend to fundraising activities like a fete or a stall.

This unit will then have the annual turnover threshold separately applied to it. Where the

turnover of the unit is less than $100,000 it will not have to register for GST purposes thus

reducing compliance costs for such an activity and enabling the supplies made in respect of

that unit to be made free of GST. Of course, there would also be no entitlement to claim input

tax credits for GST in the price of acquisitions made in respect of the activity. Each unit being

treated as a separate entity for GST purposes must be recorded.

5. Liability for GST

Where an unincorporated association or body of persons has GST obligations the liability is

imposed on each member of the committee of management by the taxation administration

legislation. Any one of the members may discharge the liability. This is a result of the fact that

such a body has no separate legal status apart from its members. An incorporated body will

be the liable entity.

6. GST and the price of acquisitions

Not all acquisitions by your organisation will include GST - some of them will be GST free or

input taxed. For example where property is owned, general rates and water sewerage and

drainage supplies will be GST free. Financial services will be input taxed so that no GST will

be included in the cost.

Most other acquisitions by your organisation will be affected by GST (gas, electricity, security,

insurance premiums, rent) after 1 July 2000.

Acquisitions from an unregistered supplier should not be affected by GST - if dealing with

unregistered suppliers your organisation should monitor their charges post 1 July 2000 as no

input tax credits will be claimable in respect of such acquisitions and it is possible that such

prices may tend to creep upwards in line with similar services by registered suppliers. In the

latter case, input tax credits will be claimable by your organisation for the GST component in

the price on receipt of the appropriate tax invoice.

Transition to GST – long term contracts

By virtue of the transitional provisions associated with the GST legislation some supplies

under long term contracts (like leases) which were entered before 8 July 1999 (when the GST

legislation became law) will be GST free until 1 July 2005 or the first review opportunity after 8

July 1999. There are a couple of qualifications to this basic rule and the definition of review

opportunity is not a simple one. Suffice it to say that such contracts spanning the 1 July 2000

introduction date for GST should be examined to determine their GST status. Wages are GST

free as are some education courses. Government registration fees will generally be GST free.

7. Pricing Decisions

The Australian Competition and Consumer Commission will vigorously monitor prices in a

post GST environment to ensure that organisations pass onto consumers any cost savings

arising from the New Tax System. If your organisation benefits from the removal of wholesale

sales tax, for example, this benefit must be reflected in post 1 July 2000 pricing decisions.

There are guidelines issued on 9 March 2000 which set out the principles pursuant to which

repricing should be carried out.

To Register or not for GST purposes?

Where your organisation is not required to register for GST purposes, if it remains

unregistered:

no GST will be payable on supplies but no input tax credits will be claimable in

respect of the acquisitions made which include GST (that is, you are spared some of

the problems outlined in relation to donations/sponsorships but your costs may

increase where GST is included in prices and the removal of other indirect taxes does

not cause a price fall).

the reporting/accounting requirements will not apply to your organisation.

You will need to analyse your costs/income base and likely compliance costs to determine the

best position for your organisation in the circumstances. Of course, where the threshold

annual turnover test is satisfied, there will be no choice as to whether to register.

You should not confuse this decision with that to apply for an ABN which has separate

significance as outlined above.

What Now?

You may have heard the following an acronym for GST - GST Started Today! It may be

daunting, even scary, but it won't go away!

Your organisation must begin now to come to grips with what GST will mean for it - there may

be frustrations in the process because not all answers are out there yet. As we approach 1

July 2000 things will become clearer.

First apply for an ABN now.

Then consider registration for GST purposes.

Once the decision has been made to register:

check with suppliers that they are GST ready;

analyse supplies and acquisitions for GST implications;

review record keeping and other administrative requirements to comply with the GST

system;

train your volunteers and staff.

Registered or not, you will also need to review existing contracts spanning 1 July 2000 for

their GST implications and consider claims by your suppliers for increased costs as a result of

GST.

Where to find further information

I have not been able to cover all issues/details in this presentation but hopefully I have

succeeded in highlighting the various matters you will need to consider in implementing the

GST. Your organisation will have specific queries and will need to find out more once you

have had a chance to digest this information and once you consider in detail your

organisation's circumstances. The following resources may help:

1. Australia Qld’s website (http://www.maq.org.au) has a specific GST subject area

which includes links to the ATO. It may also shortly include a question and answer

facility if this is seen as beneficial to members.

2. publications - industry specific booklets (there is one related to charities and nonprofit organisations) and fact sheets, rulings and the legislation itself are all available

to you in hard copy or by accessing the various ATO websites through

www.taxreform.ato.gov.au. The tax reform information line on 132 478 can also help

to arrange delivery of hard copy material.

3. may be organised by your State organisation the details of which will be available

once the planning is completed.

4. professionals - lawyers, accountants, financial advisers - you may even have some

on your membership list!

5. ATO e-mail query facility replyin5@ato.gov.auis a service which aims to answer your

queries in five working days.

You should also note that the registration for GST purposes will produce a $200 certificate (to

be used with specific registered suppliers) to assist in offsetting GST implementation costs.

Conclusion

I will close with a repetition of my earlier advice to 'Get Started Today'.

© Copyright Minter Ellison - March 2000