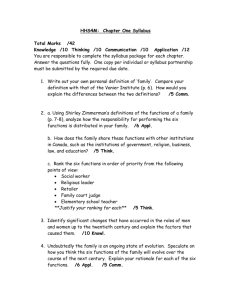

Analysis for General Managers Professors Paul A. Argenti, Sydney

advertisement

Analysis for General Managers Professors Paul A. Argenti, Sydney Finkelstein This minicourse focuses on general management—what it is, what it means for people and organizations, why it's important, and how it affects the identification of key problems and opportunities that help define whether companies will be winners or losers. The module has three primary goals: to introduce the notion of a general management perspective, to foster understanding of the general manager's job, and to develop analytical skills for effective problem solving and opportunity identification. Click here for the syllabus Capital Markets Professors Richard J. Rogalski, Kent L. Womack Managers in any corporate function should understand the pricing of stocks and bonds. This course examines the complex interrelationships among equity and fixed income markets. Topics include the cost of money (interest rates) in bond markets; how stocks and bonds should be priced and why prices are sometimes not realized because of institutional factors or market inefficiencies; the optimal construction of portfolios of investments, emphasizing the trade-off between risk and return in great detail; and the pricing and uses of derivative assets such as futures and options and how they may be used to control financial risk in corporations. Click here for the syllabus Corporate Finance Professors Diego Garcia, Rafael LaPorta This course discusses basic principles of corporate finance and provides practical tools for financial decisions and valuation. The course consists of five sections. The first, Capital Budgeting Decisions, shows optimal project acceptance criteria consistent with the objective of maximizing the market value of the firm. The second section, Estimating the Cost of Capital, extends the analysis from the Capital Markets course to the practice of estimating a project's expected return. The third section, Valuation Techniques, develops several valuation methods used in practice, including WACC, APV, multiples, and real options. Part four, Capital Structure and Dividend Policies, involves a discussion of how capital structure and dividend decisions affect firm value and survey industry practice. Part five of the course, Investment Banking, develops key principles and practices for raising capital, mergers and acquisitions, and modern restructuring techniques. Click here for the syllabus Decision Science Professors Jeffrey D. Camm, Stephen G. Powell This course introduces the basic concepts of model building and encourages students to take an analytic view of decision making. The electronic spreadsheet is used as the principal device for building models, and the course covers the concepts of effective spreadsheet design and use. With that background, students acquire knowledge about specific management science techniques, such as optimization and simulation, and the student builds spreadsheet models to identify choices, formalize trade-offs, specify constraints, perform sensitivity analyses, and analyze the impact of uncertainty. Click here for the syllabus Field Study in American Business This course is open to students who wish to experience a more focused, goal-oriented summer internship. The lectures/discussions, contrasting American business organization with alternative business systems, take place in the spring term of the first year. After their summer internship, students submit a research report. Click here for the syllabus Financial Measurement, Analysis, and Reporting Professors Robert A. Howell, Phillip C. Stocken This course develops the basic concepts and procedures underlying corporate financial statements and introduces tools for analyzing profitability and risk. We explore the impact of the alternatives available within generally accepted accounting principles on financial statements, especially in terms of management's financial reporting strategy. Click here for the syllabus Global and Competitive Strategy Professors Constance E. Helfat, Margaret A. Peteraf This course is concerned with the formulation of business strategy and its implementation. Strategy is concerned with answering two central questions: 1) what businesses should we participate in? and 2) how should we compete? Managing the enterprise in a way that facilitates arriving at and implementing the best answers to these questions is referred to as strategic management. In this course, students learn concepts and frameworks that are useful for analyzing and formulating business strategies. Students also develop skills for identifying managerial issues, finding alternative ways to deal with those issues, and evaluating alternative plans of action. Finally, students learn specific analytical techniques for diagnosing the competitive position of a business, evaluating business strategies, and identifying and analyzing specific business options. Click here for the syllabus Global Economics for Managers Professors Andrew B. Bernard, Matthew J. Slaughter Global Economics for Managers will expand your knowledge of economics in two directions. First, expansion of the scope of inquiry covers the economics of the nation in a global economy. This portion of the course will cover international economics and macroeconomics. The focus of study will be on the larger economic forces that shape production, trade flows, capital flows, interest rates, exchange rates, and other variables that create the global economic landscape. The second direction is international microeconomics which will apply the tools of microeconomics and international economics to illustrate how globalization influences performance, strategy, and policy within firms. The ultimate objective is to help students develop a framework for analyzing both opportunities and risks in a global economic environment. Click here for the syllabus Leading Organizations Professors Ella L. Bell, William F. Joyce, Robert K. Kazanjian, Judith B. White The basic premise of this course is that effective leaders create conditions that enable organization members to be maximally effective in their roles and that lead them to act in the organization's best interests. The purpose of this course is to develop students' effectiveness as leaders by (1) introducing them to frameworks that are useful for diagnosing problems involving human behavior and (2) helping them learn how to exercise leadership to solve those problems—from managing the motivation and performance of individuals and teams to leading at the executive level. Click here for the syllabus Management Communication Professors Paul A. Argenti, Mary M. Munter This minicourse gives students the opportunity to improve their ability to communicate effectively as managers. Students examine and practice the communication strategies and skills that are essential for success in business. More specifically, the three course goals are to improve (1) understanding of and ability to apply communication strategy; (2) managerial writing ability; and (3) managerial speaking ability. Click here for the syllabus Managerial Economics This course applies the ideas and methodology of economics to analysis of the firm, key decisions within the firm, and the industry. Topics covered include costs, pricing, competition, economic efficiency, and industry equilibrium and change. Particular attention is paid to behavior of the firm and industries when uncertainty and transaction costs exist. The course combines lectures/discussions of principles with cases covering both current and classic firm and industry dilemmas. Issues of public policy, especially regarding antitrust issues, are also covered. Click here for the syllabus Marketing Professors Kevin L. Keller, Koen H. Pauwels This course introduces students to the role of marketing within business firms. Through assigned readings, lectures, case studies, and the MARKSTRAT simulation game, students apply analytical concepts and techniques developed from economics, psychology, statistics, and finance to the definition and analysis of marketing decision problems. Specific topics include buyer behavior, market segmentation, targeting, positioning, marketing research, product policy, pricing, distribution channels, and advertising. Click here for the syllabus Operations Management Professors Joseph M. Hall, M. Eric Johnson, David F. Pyke Operations management is the systematic direction and control of the processes that transform inputs into finished goods or services. This course provides an introduction to the concepts and analytic methods that are useful in understanding the management of a firm's operations. The level of analysis varies considerably, from operations strategy to daily control of production processes, order fulfillment, and inventory. Click here for the syllabus Statistics for Managers Professors Joseph M. Hall, Praveen K. Kopalle This course provides an in-depth introduction to statistics as applied to managerial problems. The emphasis is on conceptual understanding as well as conducting statistical analyses. Students will learn both the limitations and potential of statistics and how to interpret results. They will also gain hands-on experience using Excel as well as more comprehensive packages such as SPSS. Topics include descriptive statistics (central tendency, dispersion, skewness, and covariance), continuous distributions (especially the normal), confidence intervals for means and proportions, and regression analysis (model evaluation, coefficient evaluation and interpretation, prediction intervals, multicollinearity, omitted variables bias, indicator variables, and model building). Application areas include finance (for example, portfolio construction), operations (such as quality control), and marketing (for example, promotion and advertising response). Click here for the syllabus Strategic Analysis of Technology Systems Professors Andrew A. King, Alva H. Taylor This course develops students' understanding of how firms use technology to position themselves strategically, from the perspective of a director of business development. We begin with an understanding of how firms develop technical know-how that is difficult to imitate. Then we examine how technological systems evolve, with particular emphasis on the emergence of standards, and will then turn to understanding networks, such as the Internet. We explore how network externalities affect competitive equilibria and examine how organizations interact in networks and position themselves within networks. Finally, we build frameworks for understanding how evolving information technologies are changing the competitive landscape and examine how firms use information technology to differentiate themselves from competitors. Click here for the syllabus Advanced Competitive Strategy Professor Richard A. DAveni This course is designed to analyze the strategic lessons learned from the fields of military science, political science, international relations, and history, especially of the history of world empires from Ancient Rome to the British and even modern America. Applying these lessons to business, this course examines when and where to use guerilla versus traditional war fighting strategies, defensive versus offensive strategic postures, brinkmanship versus cooperative strategies, and revolutionary versus counterrevolutionary strategies. Part of the course is devoted to the use of portfolio strategy as a competitive weapon to create mutual assured destruction, to shift the balance of market power between competitors, and to create the conditions for profitability and stability by guiding the evolution of industry structure. To apply these concepts to business, the course develops visual tools such as price-quality analysis, stronghold analysis, know-how and smart-bombing analysis, as well as competitive pressure mapping and sphere-of-influence analysis. The course is designed to provide an alternative to traditional economic and strategic planning frameworks, sometimes presenting a contradictory viewpoint. Click here for the syllabus Advanced Corporate Finance Professor B Espen Eckbo This course covers current research topics in corporate finance and investment banking. The objective is to develop both critical thinking and a good understanding of key empirical regularities. Some of the hypotheses considered are controversial. For example, do corporate insiders successfully time the market when offering to sell or repurchase securities? Can issuers avoid leaving substantial "money on the table" in IPOs? We distinguish between "inside" and "outside" equity, and use this dichotomy to explain the striking disappearance of equity rights offerings. We discuss empirical evidence addressing the long-standing issue of whether firms' capital structure choices reflect tradeoffs between tax benefits and distress costs, or concerns with asymmetric information about the firm's asset in place (as in the "pecking order"). We investigate managerial investment incentives during periods of financial distress and actions taken in response to hostile takeovers. Finally, we discuss the controversy over executive compensation policies. The course requires active student participation based on a substantial number of academic readings, a midterm project, and a term project. Click here for the syllabus Advanced Entrepreneurship Professors Gregg Fairbrothers, Philip J. Ferneau This course is integrative and experiential in nature, drawing from a broad range of business basics. Its main focus will be in-depth exposure to the process of starting and scaling an enterprise from an idea and business plan into a company. The course will cover: 1) developing a startup idea in technology, research, a small business, or a nonprofit; 2) crafting a promising execution strategy and validating market potential; 3) developing a credible business plan and delivering effective presentations, for investors if startup capital is required, or in an alternative context if bootstrapped; 4) building a team of employees, partners, and investors; 5) managing growth while effectively executing product development; 6) and marketing, sales, and operations. The class will expose students to what entrepreneurship takes in a startup context, and how integrative, entrepreneurial execution can be successfully utilized in a variety of career and work contexts. Students will formulate a plan to take an idea into execution, present and articulate elements of this plan in multiple sessions, and defend it against challenge and criticism. There will be a special effort to integrate concrete, operational, and execution-related information, to define key areas an entrepreneur should be aware of, to expose students to a variety of successful entrepreneurs, and to provide a framework of "toolkit" resources relevant to startup execution. The class will be structured to accommodate both students with a pre-existing plan and those wishing to develop of an idea. Click here for the syllabus Advanced Financial Accounting Professor Clyde P. Stickney Advanced Financial Accounting is designed to prepare you to interpret and analyze financial statements effectively. The course explores in greater depth financial reporting topics introduced in the first-year core course in financial accounting and also examines additional topic not covered in that course. The viewpoint is that of the user of financial statements. However, we develop sufficient understanding of the concepts and recording procedures to enable you to interpret various disclosures in an informed manner. We discuss each financial reporting issue in terms on its effect on assessments of a firm s profitability and risk. This course is designed primarily for students who expect to be intensive users of financial statements as part of their professional responsibilities. Click here for the syllabus Advanced Management Communication Professor Mary M. Munter This course focuses on managerial presentations in a variety of management settings: explanatory (such as technical presentations), persuasive (such as sales presentations), and interactive (such as meetings and brainstorming sessions). Students deliver a series of presentations and facilitate a series of collaborative role plays, receiving extensive individual feedback on each of them from the instructor, peers, video playback, and self-analysis. This feedback covers their communication strategy (speaker style and credibility, audience analysis and motivation, and rhetorical structure) and their communication skills (delivery, organization, and visual aids). Click here for the syllabus Advanced Presentation Skills Professor Mary M. Munter This course will improve students' ability to speak effectively in various managerial situations, including speaking impromptu, explaining extremely difficult subject matter, and persuading people on a volatile issue. Students will: 1) build on and improve the subtleties of delivery, structure, and visual aids in much greater detail than we did in the first-year Management Communication course; and 2) enhance their ability to give feedback and to analyze their own strengths and weaknesses. Click here for the syllabus Advanced Topics in Strategic Management: Business Development Professor Constance E. Helfat This course extends the range of material covered in strategy courses. Many of the topics deal with business development. The course addresses several sorts of questions in business development, such as: Which markets should we enter? Do we have the capabilities to enter? If not, can we develop these capabilities, and how? How do we acquire and manage the necessary knowledge? Should we exit some markets and when? To answer these questions, the course covers market entry strategies, dynamic capabilities for change, knowledge management, strategic alliances, and market exit. Class sessions will include case analyses, student discussion, and lectures. Strong student involvement during the class sessions will be an integral part of the course. Click here for the syllabus Applications of Optimization Professor Kenneth R. Baker Building on the optimization coverage in the core Decision Science course, this course provides advanced tools that are useful in many industries and functions. After reviewing and extending the formulation and interpretation of linear programming models, the course introduces data envelopment analysis, a sophisticated approach for evaluating the efficiency of similar businesses or business units. The course touches briefly on the solution of nonlinear optimization models and then covers formulation and solution of integer programs, with emphasis on marketing and logistics applications. The coverage then moves on to heuristic programming and the use of evolutionary algorithms to solve problems that do not fit easily into the traditional optimization frameworks. Click here for the syllabus Applications of Simulation Professor Stephen G. Powell This course extends and deepens the coverage of Monte Carlo simulation in the core Decision Science course. It begins with an overview of simulation in spreadsheet models using Crystal BallSM, covering such issues as choosing probability models, analyzing simulation outputs, and optimization of simulation models. Applications in finance, economics, marketing, and operations are examined in depth. The course then moves on to discreteevent and continuous simulation using Extend+. This tool allows us to model applications in manufacturing and service operations, marketing, and strategy. A course project allows students to apply simulation techniques to a realistic problem of their own choosing. Click here for the syllabus Breakout Strategy Professor Thomas C. Lawton This course focuses on the challenges facing existing or aspiring business leaders who want to take a company from a subordinate to a dominant market position. The central notion of the elective is that of breakout: the strategic process by which enterprises come from nowhere to become, in the space of a few years, a formidable competitor in their chosen markets. In some cases, new companies like AirAsia and eBay achieve breakout. In many other cases, established companies such as Adidas or Starbucks breakout from existing secondary or spatially limited positions to create or conquer new markets at home and abroad. In this elective, we identify four types of breakout company and the five essential practices that underpin their market success. We illustrate how the most successful strategies are often the simplest, so long as they adhere to the five realistic and comprehensible practices that are at the heart of winning strategies: creating workable vision by understanding and responding to stakeholder expectations, facing customers with a value proposition that is clear and covers all the important bases, aligning what you do with what the customer really wants, balancing the hard and soft sides of business to deliver on your promises and liberating and fully harnessing the energies of a top management team. Taken together, these practices constitute the breakout strategy cycle. Overall, the course is an invaluable source of tools, techniques and inspiration for ambitious entrepreneurs and aspirational managers. For existing strategic leaders, it will prove to be a source of ideas that should bring immediate practical benefits. Click here for the syllabus Business Development and Innovation Professor Alva H. Taylor This course provides a strategic framework for managing innovation in business. The emphasis is on conceptual models that clarify the interactions between patterns of technological and market change, competition, and internal firm capabilities. The analytical tools in this course are critical for development of an innovation strategy. They can provide the basis for insightful strategic thinking when deciding which technologies to invest in, and how to use and develop capabilities to exploit innovative activities for competitive advantage. As part of the course, students have the opportunity to follow a company or industry of interest. The course is appropriate for 1) anyone interested in managing a business with significant technology content or where innovation is a necessity for competition, 2) those interested in new business ventures and consulting, and 3) investment analysts, brand managers, and operations managers dealing with issues regarding innovation. Click here for the syllabus Business Law Professor John T. Broderick Jr Business Law is designed to provide students with practical knowledge of legal issues and principles that often arise in the business environment. The course will also arm students with the ability to spot potential legal problems and minimize their risk to a business. The range of course topics include: jurisdiction, contract law, employment law, ADR, sexual harassment, employment privacy issues, copyright and trade secrets, business torts, forms of business organizations, duties of officers and directors, corporate criminal law, corporate governance, and securities regulations. The class has a hands-on, interactive atmosphere, and several topics are led by distinguished speakers who have attained top positions in their fields and acquired extensive specialized knowledge and experience. Click here for the syllabus Competition and Public Policy Professor Victor O. Stango The array of competitive tactics employed by companies is constantly expanding, and these tactics often face scrutiny from antitrust authorities. In this course, we will study the variety of ways in which firms compete through price, production, and entry and exit in markets. We analyze firms' motivations (both pro-competitive and anti-competitive) for these strategies, how these strategies are implemented, when they are likely to be effective, and how they are viewed by U.S. antitrust laws. The material will be structured around discussion of well-known antitrust cases, ranging from classic cases in monopolization to the most recent cases in high-tech markets. Central to the course is the Competitive Strategy Game, a simulated interaction among up to eight companies competing in one or more of four possible markets. The game permits application of many of the concepts studied in the course. Click here for the syllabus Consulting: Dimensions of Change Agency Professor Ella L. Bell The purpose of this course is to learn how to work with change on the personal and professional level. Students will plan and implement change at the individual and organizational levels. On the personal level, students select an individual change project on any goal they desire. On the group level, students work in small, selfselected change teams to complete a change project outside of class. This course is experiential, using lectures, self-reflection, group processing, and readings. Click here for the syllabus Consumer Behavior Professor Gad Saad Managers cannot plan marketing strategy without making assumptions about how and why consumers buy. This course aims at making these assumptions more realistic, based on recent research on the psychology and sociology of consumption. Topics include the behavioral science bases of market segmentation, product positioning, pricing, and advertising evaluation. The course prepares students to ask the right questions of consumers in order to develop marketing strategies that are responsive to consumer needs. Click here for the syllabus Corporate Communication Professor Paul A. Argenti This minicourse focuses on the changing environment for business and the corporate communication function. Building on the first-year curriculum, it covers, in greater detail, the changing environment for business (as viewed through literature and film), media relations, financial communications, corporate advertising, reputation management, and crisis communication. Students also work on written and oral communications skills through case analyses, experiential exercises, and presentations. Click here for the syllabus Corporate Restructuring Professor Karin S. Thorburn This course provides an understanding of a variety of financial restructuring techniques. The objectives are to understand how different restructuring approaches can increase firm value, to recognize characteristics of firms that are potential candidates for various restructurings, and to build a framework for analyzing corporate restructuring transactions, primarily through corporate valuation techniques. Students get a basic understanding of corporate governance, including managerial incentives and agency problems. Topics include divestitures, spinoffs, equity carveouts, tracking stock, rollups, leveraged recapitalizations, leveraged buyouts, private workouts, prepackaged bankruptcy filings, vulture funds, and restructuring of bankrupt firms. Click here for the syllabus Corporate Social Responsibility Professor David E. Collins This course examines the responsibilities of business corporations and corporate executives to shareholders and other constituencies as they are manifested in the day-to day issues faced by senior managements. It begins by exploring the rationale behind the proposition that business has a responsibility to society beyond that of wealth creation. It then emphasizes values-based decision making and challenges participants to explore and apply their own values to issues such as: responsibility for shareholders' profit vs. responsibilities for the interests of other stakeholders; efficiency vs. community - or the conflict between profit making and employee welfare; responsibility to the consumer-quarterly profit vs. quality product; responding to the demands of shareholder activists, the media, and politicians on the attack, and the challenges of the international market place. Further, the course will examine and discuss the content and value of codes, credos, and other normative standards that have been advanced as models of responsible corporate behavior. It will close with a discussion of what leadership demands in the global market of the 21st century. Click here for the syllabus Corporate Valuation Professor Oyvind Norli Students will have an opportunity to estimate cash flows and discount rates in order to establish values for projects and firms. In addition to traditional discounted cash flow (DCF) analysis, the course explores alternative valuation methods, such as real option valuation and comparable company analysis. The contribution of corporate financial decisions regarding capital structure, cash distribution policies, and performance evaluation schemes to value creation and destruction are also investigated. The course will use a mixture of lectures, cases, projects, and guest speakers. Prerequisite: Corporate Finance or its equivalent. Click here for the syllabus Countries and Companies in the International Economy Professors Andrew B. Bernard, Matthew J. Slaughter This course focuses on countries, firms, and the interactions between them in the arenas of international trade, investment, and finance. The first half of the course focuses on the economic analysis of countries. Case studies provide a quick tour of the opportunities and challenges faced by nations at various stages of development. The objective is to understand the country analysis required to analyze the global expansion options of a business. The second half of this course focuses on the causes and consequences of exchange-rate fluctuations and country risk. Cases and a simulation exercise are used to study the following topics in a variety of global industries: corporate operating decisions on pricing, output, and investment; corporate valuation; cross-border financing; and corporate hedging policies. Click here for the syllabus Database Marketing Professor Scott A. Neslin This course introduces the concepts and methods of database marketing in hands-on assignments that show how specific methods pay off in terms of increased profitability. Students use real-world applications and databases as they learn about topics such as the lifetime value of the customer, scoring current customer files based on market potential, direct marketing process, next-product-to-buy, and market-basket analysis. Click here for the syllabus Debt Markets Professor Joel M. Vanden In the past decade, new markets have evolved for a variety of bonds, mortgage-related securities, assetbacked securities, and so on. More recent financial innovations have been associated with these debt securities. This course provides an in-depth analysis of important concepts and applications related to debt markets. Topics include an analysis of debt instruments, trading and pricing strategies, the term structure of interest rates, the yield curve, volatility, default risk, futures, options, swaps and interest-rate derivatives, mortgagebacked securities, risk and bond portfolio management, and international bond markets. Click here for the syllabus Designing Organizations: The Implications of Structures, Control Systems, and Rewards Professor William F. Joyce This course covers (1) designing basic operating structures; (2) designing complex operating structures appropriate for conditions of high complexity, uncertainty, and interdependence; and (3) managing the implementation of strategic change. The purposes of the course are to develop an integrated approach to organization design and to help students think logically and clearly about problems of organization and strategic change. The course uses lectures, cases, and an organization design simulation that involves role-playing. Click here for the syllabus Doing Business in Asia Professors David C. Kang, Joseph A. Massey This course introduces the distinctive institutions and characteristics of the business systems of the three most important Asian economies—Japan, Korea, and China—and explores their differences from one another and from classical Western models of capitalism. In addition to class sessions on key aspects of these Asian business systems and on their business negotiation styles, the course includes an optional trip to these countries over spring break for field visits to plants, corporate boardrooms, and government and financial institutions. Click here for the syllabus Doing Business in Southeast and Central Asia Professors David C. Kang, John B. Owens Doing Business in Southeast and Central Asia This course is designed to introduce students to the cultural, legal, and business environments in Southeast and Central Asia. The course will focus on the practical issues that a foreigner will encounter in conducting business in international venues, focusing on managing in a developing or transition economy in a third world country, and combining the academic research and skills with the experience and wisdom of management practitioners. In particular, we will emphasize the acquisition of skills required to manage in third world, emerging and transition economies. The DBSEA course will focus on two aspects. One is to provide specific knowledge about the business systems in Southeast and Central Asia. However, just as importantly, understanding and dealing with these issues clearly works best when there is a specific context for the general point: for instance, how to deal with the many facets of pressure, corruption, and influence in a foreign environment; how to deal with the problems of having one central headquarters and yet operations around the region; and issues of dealing with and understanding myriad of different ways that business is both organization and exercised. The goal is to use Southeast and Central Asia as a springboard for more generalized lessons. In addition, we will invite selected guest speakers who can provide an inside perspective on doing business in these regions. This course is designed to be both distinctive from, and a complement to, the course "Doing Business in Asia," which covers Japan, Korea, and China. Click here for the syllabus Entrepreneurship in the Social Sector 1 There has been a worldwide explosion of entrepreneurial activities by organizations whose primary focus is on improving the health, education, and well-being of individuals and communities. Most of this activity has been undertaken by nongovernmental organizations (NGOs) or nonprofit organizations, which in the United States generate revenues greater than the gross domestic product of Brazil, Russia or Australia. In recent years, some entrepreneurs working in the social sector have chosen to incorporate as for profit organizations rather than nonprofit organizations. Both models will be considered in this course though the vast majority of cases will be about nonprofit organizations like Habitat for Humanity and City Year. This course will focus on the tools and skills required to launch or grow a successful enterprise in the social sector. Because of the nature of the funding in this sector, all but the largest organizations rely on an entrepreneurial style of management. During this course students will meet outstanding social entrepreneurs who have succeeded in creating sustainable enterprises that combat important social problems. Click here for the syllabus Entrepreneurship in the Social Sector 2 This minicourse is a continuation of Entrepreneurship in the Social Sector I. It enables students to deepen their knowledge of this sector. Teams of students work on projects sponsored by nonprofit organizations. In addition to an intellectually challenging project, students enjoy the opportunity to help a worthy organization. Click here for the syllabus Ethics in Action In this brief mini-course, we will have the opportunity to consider the ethical challenges that arise across the spectrum of business activity. Several faculty members from diverse disciplines will lead discussions of ethical issues in cases involving their particular areas of expertise. We will look at several specific ethical issues faced by businesses in the current environment both in the US and in the global marketplace, where different local practices and cultural norms seem to muddy the ethical water. Our purpose in this course is to acquire some practical business skills: the ability to identify the ethical dimensions of business problems, the ability to make practical, reasoned decisions when faced with ethical dilemmas, and the ability to justify those decisions in language that is both clear and persuasive. Click here for the syllabus Field Study in International Business Professor John B. Owens Students in this course conduct a three-week on-site consulting project for a major company in a developing country. This is an excellent option for students who want an international experience but do not want to sacrifice time at Tuck. The project work is completed between the end of the first-year summer internship and the beginning of the second-year winter term. Click here for the syllabus Field Study in Private Equity Professor Philip J. Ferneau This course provides hands-on experience working with private equity practitioners and growth ventures so students can learn to plan, manage, and invest in the contexts in which they operate. Graduates lacking such experience are at a disadvantage in getting jobs at private equity firms and are less prepared to succeed when presented with private equity or growth venture opportunities. Unlike independent study, in which student teams report only to their faculty sponsors, this course requires teams to present their work to their classmates, so all may learn from each other. More specific learning objectives will depend on each project's topic. Click here for the syllabus Financial Reporting and Statement Analysis Professor Amy P. Hutton This course provides a framework for using financial statement data in many business analysis and valuation settings. It begins with an introduction and the development of a framework for business analysis and valuation. The four key components of this framework are (1) business strategy analysis, (2) accounting analysis, (3) financial analysis, and (4) prospective analysis. The course is designed for students entering careers in general management who are interested in taking an additional accounting class. Click here for the syllabus Financial Statement Interpretation and Analysis Professor Amy P. Hutton This course develops the necessary concepts and skills to interpret and analyze financial statements in a variety of settings, including credit decisions, prediction of financial distress, industry competitive analysis, and valuation. The course is designed primarily for students who will be intensive users of financial statements as part of their professional responsibilities. Students taking this course are advised to take Advanced Financial Accounting. Students taking Financial Reporting and Statement Analysis may not take this course. Click here for the syllabus Futures and Options Markets Professor Joel M. Vanden This course examines options, futures, swaps, and other derivative securities that are pervasive in business and finance. The theoretical foundations for valuing derivative securities are developed and their role in financial engineering and hedging risk is studied. Through a variety of cases, simulations, and projects, students learn to price and use these securities in several market and corporate practical applications. Click here for the syllabus Global Strategy and Implementation Professor Richard A. DAveni This course is designed to analyze some of the basic issues related to the formulation and implementation of global strategies. Part of the course is devoted to global strategy formulation issues such as the elements of global strategy, global growth strategy, foreign entry strategy, local tailoring versus global economies of scale, cross-border mergers and acquisitions, and location optimization and global value chain configuration. The remainder of the course is devoted to global implementation issues, including transnational versus multidomestic structures, global alliances, global knowledge transfer, and developing a global mindset among people, processes, and systems. Click here for the syllabus Growing an Entrepreneurial Business Click here for the syllabus Implementing Strategy: Management Control Systems Professor Vijay Govindarajan Management control systems are a major way to implement strategy through performance measurement, strategic planning systems, transfer pricing systems, reward systems, and so on. This minicourse uses case studies to (1) introduce and discuss the key issues for several of the most important management control systems in use in businesses, (2) illustrate and emphasize the need for a good "fit" between a particular control system and the firm's strategy, and (3) emphasize the necessity for overall compatibility among the sets of control systems in use. Click here for the syllabus International Corporate Finance Professor Rafael LaPorta This course examines two fundamental decisions of multinational firms - the investment decision and the financing decision. Topics discussed in the course include: valuation of foreign investments, global debt and equity financing, cross-border mergers and acquisitions, financial distress and restructurings, foreign exchange risk management, comparisons of corporate governance practices around the world, and project finance. In contrast, we will not have time to focus on foreign exchange rate systems, currency and banking crises, foreign exchange futures, options, and swaps. The course mostly benefits students interested in pursuing careers in investment banking, or in managing/advising international corporations. Click here for the syllabus International Corporate Governance Professor B Espen Eckbo In the course we discuss how the value of financial contracts depends on a country's legal system and its corporate governance practices. Greater investor protection lowers the cost of capital and results in greater financial development and economic growth. Thus, countries around the world are searching for a set of governance practices, rules, and regulations that will promote private sector development. In Europe, Asia, and Latin-America, much of the governance debate focuses on protecting small investors from the actions of large, controlling shareholders. In the U.S., the debate focuses in particular on the failure of many boards to protect outside investors from powerful corporate managers. The course keys into this debate, covering areas such as asset tunneling in corporate pyramidal structures, hostile takeovers and the failure of the market for corporate control, executive compensation policies, and recent regulatory developments to increase corporate transparency and the value of the shareholder vote. Students research selected geographical areas and debate to what extent the increasing international capital flows causes governance systems to converge towards a global standard. Click here for the syllabus Introduction to Entrepreneurship Professor Gregg Fairbrothers This course is designed to provide basic education in commercialization of technology, entrepreneurship, and the starting of new business ventures. The course will address fundamentals in major areas of conceptualizing and launching a successful new business, including: concept development, market and competitive assessment, business plan development, team building, financing and investor presentations, and execution. Students will be exposed to the startup process in detail. The course will combine lectures and visiting speakers, workshop sessions, and readings. Throughout the term, participants will develop an executive summary of a business idea, which they will present to a panel of potential investors at the conclusion of the course. Click here for the syllabus Investments Professor Kenneth R. French This course examines financial theory and empirical evidence that is useful when making investment decisions. The topics covered include portfolio theory, equilibrium models of security prices (including the capital asset pricing model and the arbitrage pricing theory), the empirical behavior of security prices, market efficiency, performance evaluation, venture capital, and behavioral finance. The course: (1) provides an understanding of the equilibrium pricing relationships in asset markets, as these relationships form the foundation for financial decision making and management; (2) develops a specific set of analytical tools that can be used to solve investment problems; (3) improves students' understanding of financial institutions and markets; and (4) helps students develop a way of thinking about and framing investment decisions. Click here for the syllabus Leadership Out of the Box Professor Ella L. Bell Exceeding performance expectations is not enough in today's business climate if an executive is to succeed. Executives must find ways for developing their employees in order to get the very best productivity. Wise leaders recognize that people are a source of corporate wealth. A potent leader co-creates with his or her people to push the company ahead of the competition. But before a leader can assume this role and responsibility, they must be willing to engage in their own developmental journey. In this course, we take leadership out of the box by studying the lives of extraordinary leaders while engaging in our own selfexploration. Our intent is to appreciate the strengths and frailties all leaders possess, and to understand the learning edges we all experience. This course creates the space to study, reflect on and discuss principles of leadership, such as self-awareness, identity, faith, vision, courage, passion, mindfulness, and commitment. By studying the lives of others, we learn how the context shapes the experiences and choices of leaders over the course of their lives. We also recognize the power of the historical moment that enables certain men and women to come to the forefront at critical times. Click here for the syllabus Management of Service Operations Professor Joseph M. Hall This course develops a business process view of service delivery and focuses on the analysis and design of processes to achieve organizational goals. The notion of services is broadly construed to include both “pure” services, such as banking and health care, and the service components of manufacturing, such as after-sales support and product design. Course content will include a mix of case discussions and lectures. Click here for the syllabus Managerial Accounting Professor Richard C. Sansing This course uses the concepts of opportunity cost and organizational architecture as a conceptual framework for the study of managerial accounting. Opportunity cost is the conceptual foundation underlying decision-making; organizational architecture is the conceptual foundation underlying the use of accounting as part of the firm's control mechanism. We examine these issues using both a textbook and case discussions. The major topics include cost behavior; accounting costs versus opportunity costs; divisional performance measures; transfer pricing; budgeting; cost allocation; activity-based costing; and cost variance analysis. Click here for the syllabus Managerial Applications of Game Theory Professor Robert G. Hansen A strategic situation exists when the outcome for one party depends critically on the action taken by another. Making optimal decisions in strategic situations requires considering what other parties will do and what they believe you may do. Game theory offers a set of analytical tools designed to aid decision making in strategic situations. This minicourse covers the essentials of game theory, with explicit focus on managerially relevant applications. Click here for the syllabus Managerial Decision Making Professor Kent L. Womack The course Managerial Decision Making differs from most MBA courses in that instead of proceeding normatively (i.e. how people and managers ought to make decisions), it focuses on providing descriptive insights of how people and hence managers actually do process information and make decisions, often inaccurately. That is, it studies the judgment and decision-making heuristics and biases that are profoundly wired in the human mind. In a fast-changing corporate world, managers are constently faced with making risky decisions under tremendous uncertainly. This course, while developing a sharper probabilistic and Bayesian mindset in students, sheds light on why inferior managerial decisions are repeatedly made in various contexts budgeting, project finance, and marketing etc. and offers prescriptive insights. Though built on a rigorous academic literature, the teaching method of this course is interactive and intuitive. Throughout the course, we will conduct short surveys to help students examine their own judgment and decision making heuristics and biases. Click here for the syllabus Managing Strategic Business Relationships Professor Leonard Greenhalgh This minicourse focuses on how to manage strategic business relationships. Managers in today's organizations must negotiate, use power, and resolve conflicts to manage across the organizations' boundaries. The course explores relationships with value chain partners, competitors, parent organizations and subsidiaries, different functional units, bosses, subordinates, and unions. Students participate in simulated situations, with guided self-appraisal and analysis of videotaped performance, to develop an effective approach for dealing with people and groups. The course focuses on the individual student and helps to develop an understanding of personality predispositions, strengths and weaknesses, and ethical constraints and obligations. Click here for the syllabus Market-Focused Strategy Professor Kusum L. Ailawadi This course will add to the conceptual frameworks introduced in the first-year marketing course. The course is designed in three modules: managing markets, managing products and segments, and managing customers. The first module provides the frameworks and skills needed to assess markets and make integrated product positioning, pricing, advertising, promotion, and distribution decisions in the selected markets. It highlights the importance of combining creativity and analytics in going to market. The second module focuses on the factors that firms must consider as they expand their product line and tap new segments for sustained growth. It emphasizes the strategic choice of new products and segments, and the importance of making holistic marketing mix decisions that take into consideration the impact on existing products and segments. The third module follows the evolution of marketing towards selecting and satisfying customers. The focus here is on strategically selecting which customers the firm wants to serve or not serve, and evaluating marketing decisions by their impact on customer equity (their ability to acquire and retain profitable customers). Cases will be used from a variety of industries, companies, and decision contexts, and will be supplemented with readings, short lectures, and presentations by visiting executives. Click here for the syllabus Marketing Communications Professor Georgios A. Bakamitsos This course takes an analytical approach to the study of marketing communications of business firms and other types of institutions. It focuses on the process and the challenges involved in developing effective communication strategies for organizations. Contemporary and classic case studies are used to illustrate the key issues in developing effective advertising and serve as a basis for the discussion of the topics covered in class. The major objectives of this course are to (1) identify the role of advertising as it relates to other marketing functions and other promotional activities; (2) provide an understanding of the advertising industry and the environment in which it operates; (3) develop analytical skills useful in planning and evaluating advertising campaigns; and (4) provide students with a forum for presenting and defending their recommendations and for critically examining and discussing the recommendations of others. Click here for the syllabus Marketing Research Professor Tridib Mazumdar This course is designed to give students an appreciation of the scope of marketing research and the nature of marketing research techniques. The goal of the course is to make students knowledgeable users of marketing research information. The first part of the course considers the acquisition of data. Research design, sampling procedures, and questionnaire design are discussed in the context of both traditional and online market research. The second part of the course introduces students to multivariate data analysis techniques, including cross-tabulations, factor analysis, discriminant analysis, and conjoint analysis. The course uses readings, case studies, and hands-on business projects. Click here for the syllabus Medical Care and the Corporation Professor Michael Zubkoff The course is intended to (1) illustrate the applicability of management concepts and techniques to the healthcare industry, (2) enhance the ability of managers to serve as hospital trustees, and (3) demonstrate how corporate managers can exercise judgment and control over expenditures for healthcare benefits while protecting the health of the employees. The characteristics and components of the healthcare system and their interactions and determinants are analyzed. The history of corporate and governmental intervention in healthcare are reviewed. The importance of understanding the medical market dynamics and the options for data-driven strategies for market reform are stressed. Case examples highlight the use of new analytic techniques for understanding and managing medical markets. A project is an important part of the course. Click here for the syllabus Negotiations Professor Jeff A. Weiss This course is designed for students who seek to learn how to become effective negotiators in managerial settings. The course is largely experiential, which means that students learn the theory, concepts, and models underlying good practice inductively they learn by doing and then reflecting on their effectiveness. As a result, perfect attendance, promptness, and adequate preparation are course requirements. Simulated negotiations span the range of situations managers will encounter. Click here for the syllabus Organizational Culture Professor Zeynep Aksehirli Despite its profound effect on our every move in any organization we belong to, organizational culture continues to be an elusive concept for managers. This course aims to introduce organizational culture concepts and gives you some first hand experience in understanding the cultural values of an organization. After arming you with tools and frameworks that can be used to identify and evaluate key cultural values of an organization, it will also equip you with some tools and techniques about changing the corporate culture to increase satisfaction and performance. At a personal level, these insights in organizational culture will help you find your fit for your future job and connect with your company's culture. This will be a hands-on course. We will have several lectures and in-class experiential exercises that will give you the necessary background. However, your main learning will be through the course project, where you will go into an organization with the intention of deciphering its explicit and implicit cultural values. You will also get a chance to compare the cultures of several organizations through your colleagues' projects and cases we will cover in class. Click here for the syllabus Private Equity Finance Professors Colin C. Blaydon, Fred E. Wainwright The purpose of this course is to examine the financial perspective on decisions in entrepreneurial settings. While focusing on financial decisions, the course is integrative in looking at entrepreneurial financial decisions from the perspectives of the business opportunity, the goals of the participants, and the context, as well as looking at the "deal" and the resources employed. The course also offers a close examination of the investor's role and the expanding institutional environment of private equity financing. Click here for the syllabus Professional Decision Modeling Professor Peter J. Regan This minicourse applies decision science (simulation, optimization, and decision analysis) in the context of a case drawn from professional decision consulting. The case challenge is to value an asset in the context of a spin-off negotiation. Students receive case information in weekly installments and work in teams to design and build spreadsheet models as a means of making recommendations on questions posed by client management. Students present results and modeling approaches in class. CheckThisOut! sessions introduce spreadsheet modeling techniques of general interest with examples that students work through on their laptops. Excel, Crystal Ball, and Solver are used. A course website supports a weekly discussion forum and step-by-step guide to spreadsheet techniques demonstrated in class. Click here for the syllabus Real Estate Professor John H. Vogel Jr The real estate course is designed to provide an overview of the real estate industry and the basic analytic techniques for investing in this $17 trillion asset class. Real estate knowledge is also important to managers because they must make decisions about where to locate facilities and how to structure leases. Students will find that this course takes a practical, hands-on, problem-solving approach. Cases are used in every class because they reflect the project oriented nature of this industry. It is a general management course that blends quantitative and qualitative analysis. The course also emphasizes the entrepreneurial management style and risk analysis techniques used by successful investors and developers. One of the highlights of this course is the opportunity to interact with industry leaders who expose students to the latest techniques and trends. Click here for the syllabus Real Estate Mini The real estate mini-course is designed to provide an overview of the real estate industry and provide basic tools for analyzing real estate investments. It also touches on critical management issues like leasing. It is a general management course that blends quantitative and qualitative analysis. Cases are used in every class because they reflect the project oriented nature of the real estate industry. Students often ask about the difference between the mini-course and the full course. The full course allows us to look at a broader range of cases, build stronger skills, get first hand experience with an actual development in Hanover and meet industry leaders. The mini- course tries to cover the basics that every manager and investor should know. Click here for the syllabus Sales Promotion Professor Scott A. Neslin The objective of this seminar is to develop an in-depth understanding of the theories, functions, and workings of sales promotion. Topics include (1) economic and behavioral theories of sales promotion, (2) how sales promotion affects sales, (3) potential strategic and tactical objectives of sales promotion, (4) the sales promotion planning process, and (5) quantitative evaluation of sales promotion. The course blends theory and practice and is intended for students whose careers will require them to be deeply involved with sales promotion decisions, either as line managers or as consultants. Click here for the syllabus Selling and Sales Leadership Professor Eli Jones Today's business-to-business selling environment is very complex due to globalization, a rapid infusion of technologies, and more competition. This course covers professional selling from the perspective of business development in major accounts under hypercompetitive business conditions. It is targeted toward those who are interested in the strategies and activities associated with key account management; i.e. the process of formulating selling strategies, implementing, and evaluating a sales program. Communication, selling, and negotiating techniques will be included. Click here for the syllabus Seminar in Strategy: Managing Corporate Entrepreneurship Professor Christopher R. Trimble To stay on top, corporations must learn to continuously create, grow, and profit from completely new ways of doing business. They must simultaneously pursue both excellence in their existing business and creativity in generating new businesses. This minicourse will take two perspectives. The first is that of the CEO of a corporation. How can a CEO build a corporation that can balance managing the present with creating the future? How is such an organization structured? What policies need be put in place? The second is that of the CEO of a new venture within a larger corporation. How is the relationship between the new venture and the parent best managed? What tensions naturally arise? How may they be overcome? Click here for the syllabus Services Marketing Professor Gail A. Taylor Services are becoming the dominant economic driver in the U.S. economy, and are critical for gaining competitive advantage in companies from all industrial sectors. Superior service quality drives the competitive advantage of leading companies, such as Charles Schwab, Ritz-Carlton Hotels, and FedEx. Even for companies not considered traditional service companies, services represent primary growth and profitability strategies into the 21st century. In this discussion-based course students learn critical skills and gain knowledge needed to implement quality service and service strategies for competitive advantage across industries. Frameworks for customer-focused management, and how to increase customer satisfaction and retention through service marketing strategies will be presented. Students will learn to map services, understand customer expectations, and develop effective relationship marketing strategies. The course places an emphasis on the total organization and how effective marketing and customer focus must be coordinated across multiple functions. Click here for the syllabus Social Capital Professor Zeynep Aksehirli Social Capital can be defined as the degree to which an organization or community collaborates and cooperates (through such mechanisms as networks, shared trust, norms and values) to achieve mutual benefits. The objectives of this course are to introduce you to social capital, to enable you to identify and evaluate key elements that enhance value of an individual's social network, and to familiarize you with some tools and techniques for managing organizational social capital and the value derived from it. We will examine different types and combinations of social relations, network structures of these relations, and institutional environments that impact them. This course will be a combination of lectures and case based class discussions. I will also ask you to bring in and discuss your own personal experiences as well as the experiences at your previous or current organizations. Click here for the syllabus Strategic Brand Management Professor Susan M. Fournier One of the most valuable assets that firms have is the brand names associated with their products or services. This course addresses important branding decisions faced by an organization in terms of how to build, measure, and manage brand equity. Its basic objectives are to (1) provide an understanding of the important issues in planning and evaluating brand strategies, and (2) provide the appropriate concepts and techniques to improve the long-term profitability of brand strategies. The course consists of lectures, case discussions, guest speakers, and a brand audit project. Click here for the syllabus Strategic Responses to Market Failure Professor Andrew A. King Market failure limits the welfare of nations, but it can be an opportunity for firms to increase their profits. This class explores some of the strategies that firms can use to profit from market failure. We will explore both unilateral and collective strategies and identify when each can be used. The class emphasizes asymmetric information and property rights problems. We will consider how firms can credibly communicate information, and how they can resolve common property issues. We will explore cases where these actions provided sustained advantage and investigate the implication of these examples for corporate and national development. Because market failure is traditionally the provenance of governments and institutions, we will consider the history and function of some examples. We will investigate how for-profit firms acted to change or augment them. Click here for the syllabus Structuring Mergers and Acquisitions This course deals with issues related to corporate mergers and acquisitions (M&A). Students will develop skills necessary to design a deal or form an opinion about a proposed deal. Focus will be placed on method of payment, deal structure, bidding strategies, merger negotiations, and defensive tactics. The legal and regulatory framework for corporate takeovers will be covered, including anti-trust and fiduciary duties of the board of directors, as well as issues particular to cross-border deals and what it takes to make an acquisition successful. The course uses a mix of case assignments, providing ample opportunity to practice valuation skills, and visitors will give their own perspective on the art of the takeover. Students will present their analysis of an M&A transaction to visiting investment bankers (mid-term) as well as write a pitch book as a final term paper. Click here for the syllabus Supply Chain Management and Information Technology Professor M. Eric Johnson This course focuses on managing material and information outside the factory walls, including aspects of product design and configuration, forecasting, inventory planning for both material and finished goods, global sourcing decisions, distribution system design, channel management, logistics, and facility location. We will explore marketing distribution strategies, including order fulfillment for e-retailers and the impact of electronic commerce on both distribution and back-end supply chain processes. Click here for the syllabus Taxation and Business Policy Professor Richard C. Sansing The objective of this course is to help students develop an understanding of the key underlying concepts that pervade the many specific provisions of the tax law and how income tax considerations interact with non-tax considerations in a series of business decisions. Topics discussed include compensation planning, the organization form decision, taxation of earnings of domestic and foreign affiliates, corporate distributions, mergers and acquisitions, and corporate spinoffs. Click here for the syllabus Tools for Improving Manufacturing This minicourse examines the use of manufacturing and operations as competitive weapons. In this class, we formulate a framework for developing and implementing a manufacturing strategy. The main goal is to provide students with simple, powerful approaches for improving operations, particularly at smaller companies. The objectives are to equip future general managers, consultants, and manufacturing managers with the perspectives and skills to effectively use manufacturing as a competitive weapon; to develop a framework for the strategic management of manufacturing; and to develop facility with simple technical tools and frameworks which apply directly to operational decisions and can be useful in adding value to manufacturing firms. Click here for the syllabus Top Management Teams Professor Sydney Finkelstein This minicourse examines the effects of senior executives on company strategy, performance, and vitality. How can we better understand, predict, and improve organizational outcomes by paying greater attention to top management capabilities and behaviors? Course topics include: executive selection and succession, executive compensation, top management team composition and dynamics, and board-management relations. Though the course is relevant for students who wish to strengthen their managerial talents, it is not a skills-based "leadership" course; rather, it is intended to improve the student's ability to diagnose, critically evaluate, and enhance executive capabilities in a firm. Click here for the syllabus