Management of Risks in Projects and Processes of SME's

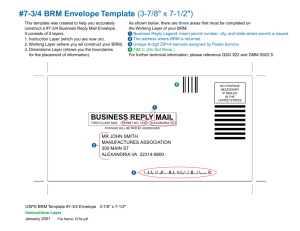

advertisement

STEINBEIS TRANSFER CENTER A D V A N C E D R I S K T E C H N O L O G I E S - R-T E C H RISKMAN Subproject on MoRiS: MANAGEMENT OF RISKS IN PROJECTS AND PROCESSES of SME’s Scope and Objectives Rationale Project and Business Risks, especially when not properly managed, appear as a problem in many different areas nowadays: financing, engineering, environment, etc. (annual losses of EU citizens and SME’s in this area are estimated at €10,000 million/year, tendency steep rising!). Furthermore, for many modern companies with high level of business process optimization (e.g. high-tech companies) these risks are the most important area where significant savings can be achieved. Benefit and applications Large companies like banks and insurances, and big consultants working for them, have recognized the problem and implemented the corresponding solutions under the form of Business Risk Management (BRM) solutions. These solutions (incl. methods, tolls, etc.) developed for large companies are usually too expensive, too complex and/or too resource consuming, to be used on a broader scale by companies not specialized in risk, as well as by small and medium enterprises. Examples: When investing in a new R&D project, when introducing new technology, when extending your business area or product palette … General approach, activities and integration The solution solution to be developed for SME’s shoud be based on: innovative, but recognized BRM (Business Risk Management) methodology used also by large companies, use of intelligent and other state-of-the-art methods and software tools, and reliable and adaptable forms of implementation at the client’s site. The proposed project should include tasks like should include steps like: Task 1. Understanding company’s business Task 2. Establishing BRM goals and its objectives Task 3. Assessing specific risks Task 4. Developing BRM strategies Task 5. Designing of the new or re-examining and customizing of existing Information System for DecisionMaking, incl. the risk control system Task 6. Designing of the risk control system Task 7. Implementation of the risk control system Task 8. Monitoring of BRM Performance Task 9. Implementation of corrective measures, manage residual risks Task 10. Continuous improvement of BRM For the above steps, relevant data should be acquired, stored in a database and analyzed, leading to successful integration of BRM with client’s ERP (Enterprise Resource Planning), his business process and asset management. Expertise needed to achieve the objectives The „large company“ approaches offer usually one standard (sophisticated) set of methods/tools for virtually all situations – often with overkilling as the de facto result. We offer flexible and adaptable solutions, which can be gradually refined or re-sized whenever needed. They allow to acquire & manage all risk/relevant data STEINBEIS TRANSFER CENTER ADVANCED RISK TECHNOLOGIES - R-TECH -2- model the risks (both qualitative and quantitative ways) quantify risk (e.g. by extracting knowledge from data) optimize risk management strategy and corrective measures, using advanced quantitative rating/scoring methods. The tools are based on application and combination of: advanced methods for uncertainty modeling and data analysis, like fuzzy, neuronal networks, casebased reasoning… advanced database tools, allowing connection to different database systems decision optimization tools combining Bayesian and fuzzy technologies, using Analytical Hierarchy Process (AHP) data mining tools Change of laws regulating the high level expertise from different core business application areas Introduction of the New competitor The risk is treated as a “logical sum” of probability of new ERP system from Asia appears occurrence and severity of consequences. Typical results of introduction of BRM are satisfying legal requirements (e.g. Increase of loan Market risk: KonTraG in Germany), interest rates introduction of a improving overall business practice and Fraud in new product achieving savings on e.g. losses prevented construction area or reduced insurance costs. Typical deliverables are risk management system implemented, database providing overview of all risk/relevant factors and risk ranking and prioritization maps identifying critical activities. The form of the proposed solution spans from small, ad-hoc consulting actions for on-going activities and pilot-projects, to taking over of complete projects for introduction or up-grading of BRM from introductory seminars to full-scale on-the-job training Additional data about partners and costs. The project will be performed with 3-5 dedicated partners (SME and industry), ideally: one SME for “intelligent methods” and software one business consultant (incl. rating methods) one or more SME’s for testing and implementation of the method. and in cooperation with other partners in RISKMAN. The subproject would involve a foreseen effort of ca. 4,5 MEURO and last 3 years. Contact STC Advanced Risk Technologies - R-Tech Dachswaldweg 55, 70569 Stuttgart, Germany tel: +49-711-6770635 / +49-172-6359190; fax: +49-711–6770606 e-mail: jovanovic@iname.com and stz592@stw.de, www: www.stz-rtech.de and www.risktechnologies.com