Chapter 5 Inventory Management Review Questions It has been

advertisement

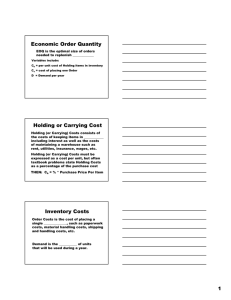

Chapter 5 Inventory Management Review Questions 1. It has been stated that, as a rule of thumb, ‘‘the best inventory is no inventory.’’ Discuss this heuristic. Answer: Inventory is an idle asset. Sitting around it produces nothing, and it costs to keep it. We say it is non-value-adding. Thus, with less inventory kept in storage, there is less waste and lower cost. This may be relatively valid in manufacturing, but it is unlikely to be true in retailing. In retailing, inventory serves additional purposes, such as attracting customers to displays. The heuristic contradicts an old marketing adage, “You can’t sell from an empty wagon.” This heuristic must be applied to the right situation to be valid. Just in case we have some readers who aren’t familiar with the meaning of heuristic, consider it to be a pragmatic set of guidelines (for understanding a situation). Pragmatic is an important adjective because it emphasizes rules based on experience rather than theory (i.e., a rule of thumb). 2. How does this rule of thumb apply to gasoline? Is gasoline an order point policy (OPP) commodity? Answer: While it does cost to keep gasoline in some form of storage, gasoline is not an “idle asset.” A traditional automobile will not run without gasoline, and it is not possible to know the exact amount of gasoline that will be needed to operate the automobile for the next day or two. If an extra supply of gasoline is maintained in the garage, then it is possible that this inventory is superfluous and even dangerous. Of course, this is not the case if hurricanes occur regularly. Gasoline is an OPP commodity with characteristics of a perpetual inventory system. Drivers are able to monitor their inventory of gasoline with fuel gauges. They will purchase additional fuel whenever the inventory falls to the “reorder point” (perhaps when a warning light comes on). However, there is no set economic order quantity; drivers either purchase what they can afford at that time or fill up their tanks. This discussion becomes even more involved when talking about hybrid engines which require some gasoline to charge the batteries. Then, depending upon how that car is used (highway or local) refueling can be very infrequent. Residue buildup can occur when fuel tanks are left barely filled for long periods of time. 3. For a toothpaste manufacturer, how is the decision made concerning how many caps should be ordered? Could it be a different number than the number of tubes that are ordered at one time? Answer: Over time, the number of caps should be about the same as the number of tubes. But caps and tubes may come from different suppliers, or they may be made by processes having significantly different economic run sizes. There is no reason for the order quantities to be related. Here is an example: caps are ordered monthly, 52,000 at a time; tubes are 1 ordered weekly, 12,000 at a time. Over the year, the same quantity (624,000) of each (caps and tubes) is used. 4. How often should an order size be updated? Answer: Order sizes should be updated on a regular basis, such as in an annual review, even if there is no obvious problem. This prevents policies from becoming outdated. Order sizes should also be reviewed on an event basis, such as a change in supplier, and on an exception basis, such as when interest rates, prices, or demand levels are no longer in the same range for which the order size calculations were valid. Technological changes in manufacture and alterations of delivery conditions may also affect order size. Since many of the above changes are occurring with greater frequency, an annual review may be too long a period to wait. 5. What method should be used to determine the order quantity for a raw material that is used continuously within a flow shop? Answer: Flow shops use material on a regular and predictable basis; they tend to use the same material for months or years. EOQ may be an appropriate model for flow shops if sometimes they work overtime or consume variable amounts of the materials in line with other parameters. 6. What method should be used to determine the order quantity for a raw material that is used continuously within an intermittent flow shop? Answer: Intermittent flow shops fall between job shops and flow shops in their volumes of output and in their continuity. Job shop outputs are not as uniform as flow shop outputs. It would be foolish to use EOQ to schedule the arrival of raw materials for which there is no job to use them. Job shops are more likely to order materials and parts on a per-job basis, so that when a job is done, there are no leftovers. On the other hand, if the intermittent flow shop has a high degree of regularity, running (say) 3 days a week, then it is possible to use EOQ order policies. Finally, the intermittent flow shop (as epitomized by the EPQ model) should forecast needs when the periods between runs are irregular. 7. Who are the people that are responsible for placing orders? Answer: Purchasing agents and buyers place orders with external organizations. Production schedulers requisition raw materials and parts in support of planned output. These may include internal requests from other production departments as well as external request that are funneled through purchasing agents. There are also orders to ship goods. Such orders might come from warehouse managers, production schedulers, and marketing managers. 2 8. Benetton is a well-known manufacturer and retailer of clothing all over the world. The Benetton factories are tied in with retailers so that demand information is relatively immediate and complete concerning what is selling and what is not. How does this information affect lot-size planning? Answer: Lot-size planning is based in part on estimates of demand. As demand increases, so does the lot size. Benetton’s wide variety of products includes many which may be seasonal or faddish; they may be more concerned with timeliness in the production of demanded items than with production quantities. The more timely data, coupled with a faddish industry, suggest that manufacturing schedulers use a relatively short order horizon. It should be adaptable to changes on short notice. Wherever 24/7 electronically generated order data is used, ordering costs are reduced; smaller batch sizes are required; money is saved and better timeliness is achieved. 9. Salespeople use handheld telecommunications devices to communicate inventory status to the warehouse in a major toy company. Why is this system needed and what does it affect? Answer: The immediacy of the data reduces lead times, and therefore decreases variability that must be dealt with. The electronic system speeds replacement (fill-in) sales, which may prevent lost sales from stock-outs at the retail level. In the systems view, the organization suffers if any part of this supply chain cannot execute the plan. Quality, demanded goods cannot be sold if they are in the warehouse and meanwhile the retailer is out of stock. Unless the toy is a classic with enduring demand, lost sales at retail translate into inventory that will never leave the warehouse. 10. What is carrying cost composed of and what is the range of values that will be found for this cost under varying conditions? Answer: The major elements of carrying cost are opportunity costs for alternative uses of funds (9 to 15 percent), theft (up to 6 percent), obsolescence (0 to 5 percent—but increasing every year), deterioration (1 to 3 percent), and handling (1 to 2 percent) Minor elements in carrying cost are taxes, storage, insurance, and miscellaneous (up to 0.25 percent each). Interest rates have been almost negligible in the past few years, and company profits have been volatile, so there might be reason to decrease the value assumed for opportunity costs. 11. What is the logic for a buyer to accept a discount offer? Answer: Discounts save money but increase the number of units acquired. The reduction of annual total purchase costs is represented by (c - c )*D. Acquisition cost savings are shown 3 by the equation for a variety of price breaks. The purchase price reduction frequently more than offsets the increase in the carrying costs of greater stock levels. Usually, ordering costs also decrease since more is being bought at one time because of the discount price. People are accused of buying what they don’t need because of discounts. That should not occur for business people who have excellent models for deciding when to accept a discount. 12. What is the logic for a seller to offer a discount? Answer: The offered discount encourages fewer but larger orders, which is cost-efficient from the supplier’s point of view. The supplier has its own set-up and carrying-cost factors, which undoubtedly favor large orders. The discount offered to a customer is a way of moving the customer’s purchase quantity closer to the optimum for the supplier’s production and supply chain system. 13. Why is there an ordering cost and of what is it composed? Answer: There is an ordering cost because the making and placing of an order uses scarce resources. In the inventory policy model this cost is a fixed amount per order (regardless of the size of the order). Ordering cost is the cost of labor (clerical and managerial, including approvals), space, equipment, and materials used in making and placing an order. Costs that are appropriate for inclusion in the ordering cost are those costs that are variable—with the frequency of ordering (i.e., those that are not fixed costs of the purchasing department). 14. What is the difference between an ordering cost and a setup cost? Answer: An ordering cost is the cost of making and placing an order with an external supplier; a set-up cost is the cost of making and placing an order for self-supply (i.e., producing the item internally). 15. When is it likely that an ordering cost will be larger than a setup cost? Answer: Ordering costs are likely to exceed set-up costs when set-up costs have been dramatically reduced by use of good methods engineering techniques. There are also reductions of setup costs due to group technology and flexible manufacturing processes. Both can show numerous examples of reduced setup costs. Ordering costs, on the other hand, are seldom scrutinized using efficiency improvement techniques. That presents an obvious opportunity to find savings in operations that are taking place consistently and everywhere. 4 16. When is it likely that a setup cost will be larger than an ordering cost? Answer: Setup costs are often process changeover costs which include lost output and product wasted in set-up and testing. These costs can be considerable. Ordering costs are likely to be less than set-up costs if the vendor-customer link uses EDI (electronic data interchange), or the Internet. Trust arrangements between certified vendors and customers can result in pre-agreed upon delivery schedules (e.g., vendor releasing). 17. Relate the number of orders placed and the order quantity. Answer: The number of orders placed n (per time period) times the order quantity Q equals the demand (per time period). That is: Q n = D. 18. Why are order point policies (OPP) called by that name? Answer: Order Point Policies (OPP) are so named because the event that triggers a replenishment order is when the inventory level reaches the “reorder point.” The name is assigned because the reorder point is the constant element—the timing between orders is variable. 19. Why are total variable cost equations written for OPP models instead of total cost equations? Answer: Total cost equations include carrying cost, ordering or set-up cost, and acquisition cost. In OPP models there is no quantity discount to consider, so that c D is a constant. Any cost that is a constant regardless of the decision reached is not relevant to the decision. Therefore, OPP models can safely remove acquisition cost from the data used for decisions. This leaves total variable cost (TVC) equations, which are the sum of carrying costs and ordering or set-up costs. Both of the latter costs vary with order quantity. 20. When discounts are being considered, total cost equations must be used instead of total variable cost equations. Why is this so? Answer: When discounts are being considered, the acquisition cost c D is no longer constant. Different order quantity decisions will lead to different values for c D. The discount prices are denoted as c’< c, c”< c’, etc. Since the acquisition cost is not constant, it must be included in the discount decision. In fact, if acquisition cost were not included in the order quantity determination, the discount would never be taken, since any deviation from EOQ raises the sum of carrying costs and ordering costs. 5 21. Differentiate between EOQ and EPQ models. Answer: EOQ assumes instantaneous delivery of all of the units ordered for the product. Whereas, EPQ assumes that the ordered product arrives in a smooth manner over a period of time (for example, so many units arrive per hour or per day). This smooth arrival rate, coupled with some usage rate, means that some items are used directly and never enter inventory. This reduces the average inventory on which carrying costs are calculated. This lower carrying cost leads to a larger lot size for ELS than for a comparable EOQ model. These two patterns of arrivals for stock are usually associated with vendors for EOQ and self-supply for EPQ. 22. When is lead-time variability a problem and what can be done about it? Answer: Variable lead times (LT) compound the probabilistic nature of variable demand. They add an extra source of uncertainty. Variable LT complicate the process of controlling stock-outs and calculating buffer stocks. Variable lead time can be dealt with by better partnership relations with suppliers, use of more reliable shipping firms, and expediting. If variability cannot be reduced, then extra safety stock needs to be carried. Variability in any form adds extra costs to the system’s management. 23. How can lead-time variability be modeled? Answer: Variable lead time and variable demand taken together constitute a joint distribution of two variables. This can be modeled with equations but the formulations are difficult. It is possible to sum the variances of the two distributions in an effort to estimate the amount of variability that these two sources of variation contribute. A simulation can be created with the joint distributions—and that approach holds a lot of promise in understanding and coping with the larger degree of variability. It is often useful to employ simplifying assumptions such as a “worst case” lead time. Then there are those who use the ostrich management technique (ignore LT distributions). 24. What is a two-bin system? When is it applicable? Answer: The “two-bin” system is a simple version of OPP modeling. Two “bins” are used to hold an item of merchandise. Bin-One is filled to the reorder point. Bin-Two has the rest of the inventory. Orders are filled from Bin-Two first. When it is emptied, a replenishment order is generated. The reorder point has been reached. This system is easy to understand and to implement; it generates little paperwork. It works well on small, low-value items such as nuts and bolts, and liquids. 25. Describe a perpetual inventory system. 6 Answer: A perpetual inventory system continuously records withdrawals. Often, perpetual inventory is associated with order point policies, where an order for a fixed amount is placed whenever inventory falls to the reorder point. Continuous monitoring and awareness of the level of inventory is essential for the concept of reorder points to be effective. 26. Under what circumstances is a perpetual inventory system preferred? Answer: Perpetual inventory is preferred when inventory position is important enough to be known at all times. This is when the value of knowing inventory position outweighs the added cost of monitoring and checking. When the costs of operating the system are very high, we may not select the perpetual inventory model (see Review Question 27). Perpetual models are used for high-value items, items critical to operations, or items that are timesensitive (short shelf lives, for example). Also, as computer systems have become less expensive and more powerful, the cost of using the perpetual system has decreased to the point where it is preferred overall except for C-type items. 27. Describe a periodic inventory system. Answer: In a periodic inventory system, an item’s inventory position is checked at fixed time intervals—the “period” of the policy’s name. The time interval between orders is fixed, but the amount of the order is variable. This happens because the amount in stock will differ at each periodic inspection—the result of variation in demand. The size of the order is the difference between stock on hand and the calculated target inventory. This system requires keeping track of stock withdrawals but only needing to subtract withdrawals on the day as specified by the period (e.g., every other Monday, check stock on paper towels for the spa). 28. When is a periodic inventory system preferred? Answer: A periodic inventory system is preferred for low-value items (C-type) or items not critical to operations. Periodic is preferred for manual inventory systems because it requires less record-keeping and paperwork. Small business owners may not have the time or money to use perpetual systems. Periodic inventory may be preferred when multiple products need to be ordered together—the fixed time interval coordinates that activity. Periodic inventory may be required to coordinate production changeovers, or may be necessitated by a supplier who accepts orders only on certain days or where deliveries are scheduled only on specific days. Periodic inventory systems have become less popular as point-of-sale systems and 7 other computerized transaction systems have made perpetual inventory much less expensive to use. 29. How can a quantity discount model be used by a buyer and supplier to negotiate a price break point schedule that benefits both of them? Answer: Quantity discounts may benefit both parties. Customers save more on acquisition costs than they pay extra for inventory carrying and ordering costs. Suppliers save more on fewer set-ups than they give up on sales revenues (which are the result of the customer’s acquisitions). The quantity discount model is based on an analysis of total costs. Discounts are offered voluntarily by suppliers, and taken (or rejected) voluntarily by customers. Both parties can calculate the impact of any proposed discount schedule on their total costs, and will know how advantageous (or not!) that discount might be. This is the basis for negotiating a mutually advantageous discount. 30. Why is it that multiple price break points for many discount levels can be examined in the same fashion as one price break point for a single discount? Answer: There is no logical distinction between two price levels and more than two. Each price level generates an inventory cost curve. But for any specified quantity, only one price level is feasible, as determined by the schedule that relates discounts to quantities purchased. The optimal decision is reached by finding the point of lowest total cost on these feasible sections of the cost curves. It does not matter (except for more complex arithmetic) whether there are two (or more) feasible segments. It is essential, however, to know that the lowest possible total cost has been selected by the acceptance of any discount offered. If the amount ordered is very large, it behooves the buyer to examine the costs of obsolescence, spoilage, etc. 31. Is the two-bin inventory system perpetual or periodic? Answer: The two-bin model is not periodic because there is no inspection at any fixed time interval. It is an order point model in that the emptying of one bin (a quantity event, not a time event) triggers replenishment. Perpetual inventory is a type of order point model. The two-bin model is labeled a perpetual model, but there is no need for continuous recording of inventory position; in fact, it is a near-paperless inventory model. 32. Distinguish between inventory problems under certainty, risk, and uncertainty. Answer: Certainty problems have known demands and lead times. Supplier contracts are an example. There is no need to employ probability distributions. Risk problems have variable 8 demands and/or lead times—for which probability distributions must be established. Uncertainty problems have no probability distributions available. One must assume the nature of the uncertainty. For example, a uniform distribution states that all possibilities are equally likely. Risk and uncertainty add sources of variation to a situation and therefore add to cost. The basic EOQ and EPQ models are models of certainty—there are no probabilistic factors to consider. Order point models and periodic review models are models of risk—the normal distribution is used in the calculation of buffer stock or target inventory. An example of uncertainty would be the Christmas tree problem with no available probabilities for demand. Such a problem would be solved by decision table tools (without calculating expected values). For example, it is possible to minimize regret. 9 Problems Problem 1 1. Water testing at the Central Park reservoir requires a chemical reagent that costs $500 per gallon. Use is constant at 1/3 gallon per week. Carrying cost rate is considered to be 12 percent per year, and the cost of an order is $125. What is the optimal order quantity for the reagent? Answer 8.50 EOQ Model Yearly Demand (D) Order Cost/Order (S) Inv Cost/unit/year (i) Item Cost (C) 17.33 $125.00 12.00% $500.00 =52*(1/3) Inv Cost/unit/year (H) $60.00 =0.12*500 EOQ 8.50 EOQ = Total Cost (TC) TC = (D/Q)*S + (Q/2)*H + D*C $9,176.57 10 Problem 2 2. Continuing with the information about the Central Park reservoir given in Problem 1, the city could make this reagent at the rate of 1/8 gallon per day, at a cost of $300 per gallon. The setup cost is $150. Use a 7-day week. Compare using the EOQ and the EPQ systems. What course of action do you recommend? Answer 15.28 EPQ Model Yearly Demand (D) Setup Cost/Order (S) Inv Cost/unit/year (i) Item Cost (C) Inv Cost/unit/year (H) 17.33 $150.00 12.00% $300.00 $36.00 Production Rate per day (p) 0.125 Demand Rate per Day (d) EPQ 0.048 15.28 =52*(1/3) =0.12*300 EPQ = Total Cost (TC) $5,540.42 TC = (D/Q)*S + (Q/2)*H*(1-d/p) + D*C Answer: Comparing with total cost in problem 1, there is a saving of $3,636.15 ($9,176.57 - $5,540.42). 11 Problem 3 3. Water testing at the Delaware reservoir requires a chemical reagent that costs $400 per gallon. Use is constant at 1/3 gallon per week. Carrying cost rate is considered to be 10 percent per year, and the cost of an order is $100. What is the optimal order quantity for the reagent? Answer 9.31 EOQ Model Yearly Demand (D) Order Cost/Order (S) Inv Cost/unit/year (i) Item Cost (C) Inv Cost/unit/year (H) EOQ 17.33 $100.00 10.00% $400.00 $40.00 9.31 Total Cost (TC) TC = (D/Q)*S + (Q/2)*H + D*C $7,305.71 12 =52*(1/3) =0.12*500 EOQ = Problem 4 4. Continuing with the information about the Delaware reservoir given in Problem 3, the town could make this reagent at the rate of 1/4 gallon per day, at a cost of $500 per gallon. The setup cost is $125. Use a 7-day week. Compare using the EOQ and the EPQ systems. What course of action do you recommend? Answer 10.35 EPQ Model Yearly Demand (D) Setup Cost/Order (S) Inv Cost/unit/year (i) Item Cost (C) Inv Cost/unit/year (H) 17.33 $125.00 10.00% $500.00 $50.00 Production Rate per day (p) 0.25 Demand Rate per Day (d) EPQ 0.048 10.35 Total Cost (TC) TC = (D/Q)*S + (Q/2)*H*(1-d/p) + D*C =52*(1/3) =0.10*500 EPQ = $9,085.47 Answer: Comparing with total cost in problem 3, there is a saving of $1,779.76 ($9,085.47 - $7,305.71) if purchased from outside. 13 Note: See Excel file SMCh05 for calculations of problems 5, 6 and 7. Problem 5 5. The Drug Store carries Deodorant R, which has an expected demand of 15,000 jars per year (or 60 jars per day with 250 days per year). Lead time from the distributor is three days. It has been determined that demand in any 3-day period exceeds 200 jars only once out of every 100 3day periods. This outage level (of 1 in 100 LT periods) is considered acceptable by P/OM and their marketing colleagues. The economic order quantity (EOQ) has been derived as 2,820 jars. Set up the perpetual inventory system (EOQ with stock-outs ). Solution: Order 2,820 jars when the inventory level hits 200 jars which is the chosen reorder point (ROP). This ROP provides the acceptable outage level of one occurrence in a hundred, i.e., 0.01. Next, we note that the 200 units of the designated ROP are composed of: first, the sum of the expected demand in any 3-day lead time period which is 180 units, and second, 20 units of Buffer Stock (BS). In summary, we have estimated BS = 20 units with the chosen ROP = 200 units and this yields the acceptable outage rate of 1/100 LT periods. We have determined BS = zσ = 20. Refer to the z-table where the lookup value for the tail of 0.01 provides the z-value of 2.325. From this we find that the implied value of σ is 20/2.325 =8.602. The variance σ2 = 74 and sigma for a day is equal to the square root of 74 which equals 4.97. This gives all necessary information to set up the perpetual inventory system (see sections 5.10.1 and 5.10.2). Problem 6 6. Use the information given in Problem 5, plus the fact that it has been determined that demand in any 50-day period exceeds 4,000 jars only once out of every 100 50-day periods. This outage level (of 1 in 100 LT periods) is considered acceptable by P/OM and their marketing colleagues. Set up the periodic inventory system. (EOQ with stock-outs.) Solution: The optimal review interval is that period of time required to use up the EOQ stock level. Since the demand of 15,000 units/year is 15,000/250 = 60 units/day, there are 2,820/60 = 47 days between reviews. The lead time for replenishment is 3 days. With the periodic model, the time from placing an order to its arrival is 47 + 3 = 50 days. This includes the periodic time interval of 47 days between reorders. The chance of demand being greater than 4,000 over this 50-day period is (a satisfactory) one percent. The M-level for the periodic model is set at 4000. See Figure 5.12 where the M-level is shown as the horizontal line on the chart. Demand in the reorder period is 2820 units and demand in the lead time period is 180 units. Then, we calculate 4000 – 2820 – 180 = 1000 units which is a reasonable estimate for buffer stock (BS). Note: M is set by adding EOQ + D(LT) + BS. Thus, 14 when the reorder quantity at the periodic review time is the same as the EOQ, it is because all the units of inventory except BS have been depleted. Also, we have determined BS = zσ = 1000. With z = 2.325 as in Problem 5, σ = 1000/2.325 = 430.11. See the spreadsheet SMCh05. Problems 6 estimates the standard deviation for M = 4000 units at 430 units. This does not seem out of line. Also quite reasonable for the periodic model is the high daily sigma of demand. It is 60.83. The periodic system requires large buffer stocks to protect against out-of-stocks caused by demand variability over the long period of 50 days between replenishments. Problem 7 7 Compare the results derived in Problems 5 and 6. What do you recommend doing? Explain how you have taken into account all of the important differentiating characteristics of perpetual and periodic inventory systems. (EOQ with stock-outs.) Solution: The perpetual system must protect against outages for the short period of time that is the lead time—not the period between reviews. Since the perpetual is less wasteful than the periodic system, why ever use the periodic. First, when the delivery system is geared to periodicity, (i.e., the ship leaves on the first of each month) the perpetual cannot be used. Second, before computers, computations were costly. Many people would have been involved in maintaining an accurate perpetual total. Therefore, for C-type and even B-type items, the periodic system was a less expensive way to go. Comparing Problems 5 and 6, note how much smaller the perpetual buffer stock size is than the periodic buffer size (20 to 1,000). The comparison is 50:1. Perpetual needs smaller amounts of storage space, there is less damage and pilferage, there are lower amounts of cash tied up in holding costs. In general, opportunity cost savings of the perpetual are evident, and the system’s managers enjoy much smaller inventory fluctuations. The spreadsheet shows that sigma for the periodic system is more than twelve times greater than for the perpetual. Problem 8 8. Consider the recommendation made in Problem 5, taking into account the fact that The Drug Store must combine orders for Deodorant R with other items in order to have sufficient volume to qualify for the distributor’s shipping without charge. With this constraint, what are your recommendations? Solution: If orders must be combined to save on shipping charges, then a periodic inventory system is indicated. The shipping costs dominate the decision when they are larger than the savings obtained by using the optimal order quantity of the perpetual inventory model instead of the 15 optimal order interval of the periodic inventory model. Thus, various items, including Deodorant R, will be ordered every (say) 30 or 40 days. The optimal period of 47 days for Deodorant R has to be altered to fit other items as well. Using judicious consideration, a compromise period must be determined. On the other hand, using a systems approach, it is necessary to investigate other methods of shipping including UPS and FedEx (with special arrangements) and the USPS which has been making all kinds of special deals with Amazon, Wal-Mart and other large retailers. Problem 9 9. The information required to solve an EOQ inventory problem is as follows: demand per year (D) = 5,000, ordering cost per order (S) = $ 10.00, Cost of the item (C) = $10 per unit, and inventory carrying cost per unit per year (H) = 16% of the cost of the item (C). What is the optimal order quantity? (EOQ model) Answer 250.00 EOQ Model Yearly Demand (D) Order Cost/Order (S) Inv Cost/unit/year (i) Item Cost (C) Inv Cost/unit/year (H) 5000.00 $10.00 16.00% $10.00 $1.60 EOQ 250.00 =0.16*10 EOQ = Total Cost (TC) TC = (D/Q)*S + (Q/2)*H + D*C $50,400.00 16 Problem 10 10. Using the information in Problem 9, instead of buying from a supplier the decision is to make the item in the company’s factory. The new equipment is able to produce 30 units per day. Cost per item is now $6.00. The set up cost is $ 150.00 per set up. What is the optimal run size (EPQ)? Working Days per Years Answer EPQ Model Yearly Demand (D) Setup Cost/Order (S) Inv Cost/unit/year (i) Item Cost (C) Inv Cost/unit/year (H) Production Rate per day (p) Demand Rate per Day (d) EPQ Total Cost (TC) TC = (D/Q)*S + (Q/2)*H*(1-d/p) + D*C 250 2165.06 5000.00 $150.00 16.00% $6.00 $0.96 Assumed =0.16*6 30 20.000 2165.06 EPQ = $30,692.82 Run Time (Cycle Time) Maximum Inventory Level 72.17 721.69 =EPQ/d =2165/30 Imax = Q*(1- d/p) Average Inventory 360.84 (Imax)/2 The optimal run size with self-supply is more than 8 times the optimal order quantity (EOQ = 250). 17 Problem 11 11. Using the information in Problems 9 and 10, which is better: make or buy? Answer Make Comparing with total cost in problems 9 and 10, there is a saving of $19,707.18 ($50,400 - $30,692.82) if the item is made in house. Problem 12 12. Using the information in Problems 9—11, what factors that are not part of the mathematical model might shift the decision? Solution: Additional factors not in these equations that might shift the decision from make to buy include: unexpectedly large training costs to develop the necessary skills, low capacity problems that make it impossible to match supply and demand, finding new suppliers that can produce items at lower costs than previously thought possible, and production difficulties encountered that were not anticipated. 18 Problem 13 13. The following quantity discount schedule has been offered for the situation described in Problem 9. Should either of these discounts be accepted? $ 10.00 for Q ≤ 299 $ 9.00 for 300 ≤ Q ≤ 499 $ 8.00 for Q ≥ 500 Data from problem 9. The information required to solve an EOQ inventory problem is as follows: demand per year (D) = 5,000, ordering cost per order (S) = $ 10.00, Cost of the item (C) = $10 per unit, and inventory carrying cost per unit per year (H) = 16% of the cost of the item (C). What is the optimal order quantity? (EOQ model) EOQ with Price = $ 8.00 Yearly Demand (D) 5000.00 Order Cost/Order (S) $10.00 Inv Cost/unit/year (i) 16.00% Item Cost (C) $8.00 Inv Cost/unit/year (H) $1.28 =0.16*8 EOQ 279.51 This EOQ (279.51)<500. Therefore, EOQ = it is not feasible. Best Quantity for price ($ 8.00) = 500 Total Cost at Q = 500 $40,420.00 TC = (D/Q)*S + (Q/2)*H + D*C EOQ with Price = $ 9.00 Yearly Demand (D) 5000.00 Order Cost/Order (S) $10.00 Inv Cost/unit/year (i) 16.00% Item Cost (C) $9.00 Inv Cost/unit/year (H) $1.44 =0.16*9 EOQ 263.52 This EOQ (263.52)<300. Therefore, EOQ = it is not feasible. Best Quantity for price ($ 9.00) = 300 Total Cost at Q = 300 $45,382.67 TC = (D/Q)*S + (Q/2)*H + D*C EOQ with Price = $ 10.00 Yearly Demand (D) 5000.00 Order Cost/Order (S) $10.00 Inv Cost/unit/year (i) 16.00% Item Cost (C) $10.00 Inv Cost/unit/year (H) $1.60 EOQ 250.00 =0.16*10 EOQ = Total Cost (TC) $50,400.00 TC = (D/Q)*S + (Q/2)*H + D*C Answer: Q = 500 is the best quantity because it minimizes the total cost. 19 Problem 14 14. The quantity discount schedule offered in Problem 13 prompted a competitor to offer the following discount schedule. Should any of these discounts be accepted? $ 10.00 for Q ≤ 250 $ 9.00 for 251 ≤ Q ≤ 599 $ 7.00 for Q ≥ 600 Data from problem 9. Demand per year (D) = 5,000, ordering cost per order (S) = $ 10.00, Cost of the item (C) = $10 per unit, and inventory carrying cost per unit per year (H) = 16% of the cost of the item (C). What is the optimal order quantity? (EOQ model) EOQ with Price = $ 7.00 Yearly Demand (D) 5000.00 Order Cost/Order (S) $10.00 Inv. Cost/unit/year (i) 16.00% Item Cost (C) $7.00 Inv. Cost/unit/year (H) $1.12 =0.16*7 EOQ 298.81 This EOQ (298.81) < 600. Therefore, it EOQ = is not feasible. Best Quantity for price ($ 7.00) = 600 Total Cost at Q = 600 $35,419.33 TC = (D/Q)*S + (Q/2)*H + D*C EOQ with Price = $ 9.00 Yearly Demand (D) 5000.00 Order Cost/Order (S) $10.00 Inv. Cost/unit/year (i) 16.00% Item Cost (C) $9.00 Inv. Cost/unit/year (H) $1.44 =0.16*9 EOQ 263.52 This EOQ is feasible. EOQ = Total Cost (TC) $45,379.47 TC = (D/Q)*S + (Q/2)*H + D*C Answer: Q = 600 is the best quantity because it minimizes the total cost. Note: In this problem there is no need to calculate EOQ at $ 10.00 since a feasible quantity has been found at a price of $ 9.00. 20 Problem 15 15. Compare the answers to Problems 13 and 14 and discuss these results, making appropriate recommendations. Solution: In the previous two problems, unit costs dictate the decision. In Problem 14, buying in lots of 600 from the competitor for C = $7 has a total unit cost of $35,000. That is considerably less than the $50,000 at C = $10 or even $45,000 at C = $9. The competitor in Problem 14 beats the competitor in Problem 13 by $5,000 ($40,420.00 - 35,419.33). See the total cost calculations in Problems 13 and 14. 21 Problem 16 16. Murphy’s is famous for their coffee blend. The company buys and roasts the beans and then packs the coffee in foil bags. It buys the beans periodically in quantities of 120,000 pounds and assumes this to be the optimal order quantity. This year it has been paying $2.40 per pound on a fairly constant basis. The company ships 1,200,000 1-pound bags of its blended coffee per year to its distributors. This is equivalent to shipping 24,000 1-pound foil bags in each of 50 weeks of the year. This can be considered to be constant and continuous demand over time. What carrying cost in percent per year is implied (or imputed) by this policy if an order costs $100 on the average? Discuss the results In this problem, find the value of inventory carrying coast per unit per year (H), given D, S and EOQ. The value of H will be = 2DS(Q^2) Q= Yearly Demand (D) Order Cost/Order (S) Item Cost (C) Order Quantity (Q) 1200000.00 $100.00 $2.40 120000.00 Inventory Carrying Cost per Unit per year $0.02 Inventory Carrying Cost as a % of Item Cost 0.7% = H/C Answer: The implied carrying cost is 0.7% which is rather low. The model does not consider fluctuations in coffee market prices, which may determine Murphy’s real buying pattern during the year. If the price of coffee could be cut in half, the carrying cost would double to 1.4 percent. Even so, the percentages are too low. It is apparent that Murphy’s is not following an optimal ordering policy. 22 Problem 17 17. Using the information in Problem 16, suggest a better ordering policy. To answer this question a more reasonable inventory carrying cost is to be assumed and then the total cost will be compared for the current policy (order size = 120,000) and economic order quantity. Inv. Cost/unit/year (i) Yearly Demand (D) Order Cost/Order (S) Inv. Cost/unit/year (i) Item Cost (C) Inv. Cost/unit/year (H) 12% Calculations for the EOQ 1200000.00 $100.00 12.00% $2.40 $0.29 EOQ Assumed =.12*2.4 28867.51 EOQ = Total Cost (TC) TC = (D/Q)*S + (Q/2)*H + D*C $2,888,313.84 Calculations for the Current Policy Yearly Demand (D) 1200000.00 Order Cost/Order (S) $100.00 Inv Cost/unit/year (i) 12.00% Item Cost (C) $2.40 Inv Cost/unit/year (H) $0.29 Order Size (Q) 0.288 120000.00 EOQ = Total Cost (TC) TC = (D/Q)*S + (Q/2)*H + D*C $2,898,280.00 Answer: The current policy with a total cost of $ 2,898,280.00 is more expensive as compared with EOQ policy with a total cost of $ 2,888,313.84. Note: The two policies can be compared for various values of the inventory carrying cost just by changing the assumed value of (i) in the above spreadsheet. 23 Problem 18 18. The manager of the greeting card production department has been buying two rolls of acetate at a time. They cost $200 each. Card production requires 10 rolls per year. Ordering cost is estimated to be $4 per order. What carrying cost rate is imputed? Is it reasonable? In this problem, find the value of inventory carrying coast per unit per year (H), given D, S and EOQ (Q). The value of H will be = 2DS(Q^2) Q= Yearly Demand (D) Order Cost/Order (S) Item Cost (C) Order Quantity (Q) 10.00 $4.00 $200.00 2.00 Inventory Carrying Cost per Unit per year $20.00 Inventory Carrying Cost as a % of Item Cost 10.0% = H/C Answer: The implied carrying cost is 10% which is reasonable. 24 Problem 19 19. Using the information in Problem 18, if the cost of rolls of acetate increases to $250 each, what happens to the imputed carrying cost rate? Is this reasonable? In this problem, find the value of inventory carrying coast per unit per year (H), given D, S and EOQ (Q). The value of H will be = 2DS(Q^2) Q= Yearly Demand (D) 10.00 Order Cost/Order (S) $4.00 Item Cost (C) $250.00 Order Quantity (Q) 2.00 Inventory Carrying Cost per Unit per year $20.00 Inventory Carrying Cost as a % of Item Cost 8.0% = H/C Answer: A carrying rate of 8 percent is imputed, which is reasonable. If the real economic conditions with respect to interest rates and the company’s ability to use funds are known, then the imputations can be better corroborated. Problem 20 20. In an inventory control system, the annual demand is 12,000 units; the ordering cost is $30 per order and the inventory holding cost is $ 3.00 per unit per year. The order quantity is 1000 units and the cost per unit of the item is $150? What is the total cost (TC) per year? TC includes the inventory holding cost, ordering cost and the cost of the item. EOQ Model Yearly Demand (D) Order Cost/Order (S) Item Cost (C) Inv Cost/unit/year (H) 12000.00 $30.00 $150.00 $3.00 25 EOQ Total Cost (TC) TC = (D/Q)*S + (Q/2)*H + D*C 1000.00 $1,801,860.00 26 Problem 21 21. A company is planning for its financing needs. What is the total cost (TC) per year given an annual demand of 12,000 units, setup cost of $32 per order, a holding cost per unit per year of $4, an order quantity of 400 units, and a cost per unit of inventory of $150? TC includes the yearly set up cost, inventory holding cost and the item cost. EOQ Model Yearly Demand (D) Order Cost/Order (S) Item Cost (C) Inv Cost/unit/year (H) EOQ (Q) Total Cost (TC) TC = (D/Q)*S + (Q/2)*H + D*C 12000.00 $32.00 $150.00 $4.00 400.00 $1,801,760.00 27 Problem 22 22. If annual demand is 50,000 units, the ordering cost is $25 per order and the holding cost is $5 per unit per year, what is the optimal order quantity? Answer 707.11 EOQ Model Yearly Demand (D) Order Cost/Order (S) 50000.00 $25.00 Inv Cost/unit/year (H) $5.00 EOQ 707.11 EOQ = Problem 23 23. A company is using the Economic Order Quantity (EOQ) model to manage its inventories. Suppose its annual demand doubles, while the ordering cost per order and inventory holding cost per unit per year do not change. What will happen to the EOQ? Answer: EOQ = If the annual demand doubles, then increase D to “2D” in the above equation. New EOQ = 1.41 * Old EOQ. The number 1.41 is square root of 2. The students can test it by using numerical numbers. 28 Problem 24 24. Find the economic production quantity for the following problem. Also Identify the storage capacity required. Annual Demand = 50,000 units; Setup Cost = 25; Inventory Holding Cost = 5 per unit per year. Production rate = 500 units per day; number of working days = 250. Working Days per Years Answer 250 912.87 Storage Capacity 547.72 Assumed EPQ Max. Inv. Level EPQ Model Yearly Demand (D) Setup Cost/Order (S) Inv Cost/unit/year (H) 50000.00 $25.00 $5.00 Production Rate per day (p) 500 Demand Rate per Day (d) EPQ Maximum Inventory Level Note: Storage capacity is equal to the maximum inventory level. 200 912.87 547.72 =EPQ*(1(d/p)) Maximum Inventory Level 29 EPQ = Problem 25 25. Consider the following data answer the next four questions. A plant operates 5 days a week, 52 weeks a year and can produce at 60 units per day. o The setup cost for production run is $ 450.00. o The cost of holding inventory is $ 5.00 per unit per year. o The annual demand for this product is 5,000 units. a. What is the Economic Production Quantity (EPQ)? 1150.88 Working Days per Years EPQ Model Yearly Demand (D) Setup Cost/Order (S) Inv Cost/unit/year (H) Production Rate per day (p) Demand Rate per Day (d) EPQ 260 5 days/52 Weeks 5000.00 $450.00 $5.00 60 19.231 1150.88 EPQ = b. What is the total annual cost of inventory and set up if the batch size (Q) is 800 units? Batch Size (Q) 800 Maximum Inventory Level 543.59 Imax = Q*(1- d/p) Average Inventory Annual Inventory Cost Number of Set-ups Annual Set-up Cost Total Annual Inventory and Set-up Cost 271.79 (Imax )/2 $1,358.97 6.25 $2,812.50 H*(Imax )/2 D/Q (D/Q)*S $4,171.47 c. What is the number of set ups per year if the lot ize (Q) is 1500 units? Lot (batch) Size 1500 Number of Set-ups 3.33 = 5000/1500 d. What is the maximum inventory level if the batch size (Q) is 600? Batch Size 600 Maximum Inventory Level 407.69 Imax = Q*(1- d/p) 30 31