How do I decide which payment method to use

advertisement

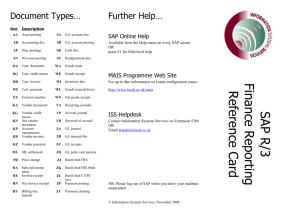

Which payment method to use? 1. Payments to recognised organisations that will be used more than once. When the University is to trade with a supplier more than once, the supplier must have a vendor master record set up on SAP. Schools, institutes and support services must use SAP to: issue a purchase order; input the goods received; and process the invoice. To create a Vendor Master record, complete the application to create a Master Record form on the web and return to procurement; http://www.ncl.ac.uk/internal/purchasing-services/sap/documents/vendorform.doc 2. One off payments to recognised organisations If a cheque needs to be raised to a Recognised Organisation for a one off payment to an organisation that will not be used again such as an attendance at a conference then a UK Payment Request Form (FI008) should be completed. This form CANNOT be used for payments to individuals and the payment should not exceed £2,000. A recognised organisation can be defined as a named organisation that is not an individual. Joe Bloggs and Sons would be acceptable whereas Joe Bloggs would not. In the case where the value exceeds £2,000, the payment will need to be co-signed by the Assistant Director of Finance (Income & Expenditure). The completed request form, plus supporting documentation (which is to be attached to the reverse of the form) should be sent to your Finance Faculty Support Team. http://www.ncl.ac.uk/internal/finance/sap/documents/FI008A.pdf This form should be used on those occasions when an invoice is not available but a payment is required, in sterling, within the UK. It should be clear that the vendor will not be used again and does not already exist on SAP. If the Vendor already exists on SAP then please refer to 1 above. If the request is urgent then once the invoice has been entered on the system please contact finance on payments@ncl.ac.uk to request that this be treated as such. All documentation needs to be on the system and finance contacted by 10.00 a.m. daily for a sterling cheque to be produced the same day. BACS payment are produced every Wednesday and input can take place up until 10.00 am Cheques will no longer be sent out in the internal mail, if you want to collect a cheque before it is sent out, please put a note on the Payment Form, and Cashiers will contact you when it is ready to collect from Finance Reception. Please note that Purchasing Services have agreements set up for most categories of goods and services, and these vendors should be used in all instances, i.e. with catering, vendors which are not on the approved list should not be used for health and safety purposes. For a list of all agreements please see the Purchasing website (link below) contact Dave Anderson with any queries you may have (x 5360) http://www.ncl.ac.uk/internal/purchasing-services/agreements/index1.php 3. Fees and Associated Expenses Forms (FI004) This form can be used for Non Employees (Employees should claim back any expenses through the e-expenses system) Non Employees – this form should be used for work which is of an irregular basis. If the work forms a regular pattern, for example, 3 x 1 hour lectures per month for 6 months, then a contract should be organised with your HR Officer and again this form should not be used. Tax and National Insurance will be deducted from all payments. http://www.ncl.ac.uk/internal/finance/sap/FI004.rtf 4. Procedure for Paying Self Employed Individuals Payments to individuals and not recognised organisations should be done via the Vendor route in ALL circumstances if tax and NI are thought not to be applicable. The One Off Payment/Daily Cheque method should not be used. An invoice should be received from the individual and the following forms completed. 1) Application to create a Master Record http://www.ncl.ac.uk/internal/purchasing-services/sap/documents/vendorform.doc 2) Employment Status Chart http://www.ncl.ac.uk/internal/purchasingservices/sap/faq/documents/EmploymentStatus.doc The forms should then be sent to the Procurement Office, if there is any doubt concerning self employed status the forms will then be sent on to Finance who will make the final decision . Please attach all relevant documentation to the completed forms. 5. Request for Prizes to Students (TF001) A UK Payment Request Form should be completed, documentation attached and authorisation obtained. The request should be sent directly to the Finance Income Section marked for the attention of James Fox. Please note that the Endowment Accounts are now held at School Level so they do not need to come to the Faculty for Authorisation before being sent to James Fox. Please remember to put the Student’s bank details on the form, as cheques will only be raised where authorised by Craig Oliver, Head of Payments. http://www.ncl.ac.uk/internal/finance/documents/TF001.pdf 6. Procedures for Payment for Teaching and Demonstrating Duties The Inland Revenue has insisted that the University pay all full time and part time postgraduate student demonstrators through the payroll system. All postgraduate demonstrators must therefore be issued with appointments by the Human Resources section. It is not appropriate to use this mechanism to remunerate staff holding full-time or part-time contracts of employment with the University. You are referred to the statement of Good Practice in Provision for Doctors Students which was approved by Senate at its meeting on 6th July 2004. Section 11 of this document which refers specifically to Teaching and Demonstrating opportunities, is particularly relevant. 7. Ex Gratia/Ad Hoc Payments Staff incurring additional responsibilities by undertaking extra work of the same grade for a continuous period exceeding four weeks may, at the University's discretion, on the recommendation of the Head of School and with the authorisation of the Provost, be granted an ex gratia/ad hoc payment. If an ex gratia/ad-hoc payment is to be made to an employee then this should be organised via your HR officer. 8. Foreign Currency Payments Payment of invoices received from overseas suppliers, or individuals abroad may need to be made in Foreign Currency. Some of these payments are made to suppliers on a regular or occasional basis, whilst others are 'one off' payments to organisations or individuals with which we will only trade once. One off Foreign Payments: Send the invoice and completed foreign payment request form and invoice backing slip to Jan Hunter, Treasury Section of the Finance Department and she will input the request into SAP. Specify whether a draft, bank transfer or cheque is required State where the draft or cheque is to be sent, i.e. directly to the beneficiary (in which case clear address details are required) or returned to the department. If a bank transfer is required, it is essential that the beneficiary's bank details are clearly stated on the foreign payment request form Finance will order or prepare the drafts, foreign cheques or bank transfers and issue as requested. Regular Foreign Payments: If regular or occasional payments are issued to foreign suppliers, such suppliers should be set up on SAP in the same manner as UK. Once the vendor has been set up on SAP: Issue a purchase order and process the invoice as for a UK invoice, but making sure you select the appropriate foreign currency on the system. Take a photocopy of the foreign payment invoice, which should include all relevant references (for example, invoice number) so that the beneficiary can easily identify the payment. In addition, it is important to write onto the copy invoice the SAP document number. Send the copy invoice to James Fox in Cashiers, so that he can ensure that the relevant identifiers are included with the foreign payment. Forward the original foreign payment invoice to Finance, together with UK invoices, for filing. ALL foreign currency payments are issued by the Treasury Section of the Finance Department, the completed form should to be forwarded for the attention James Fox. http://www.ncl.ac.uk/internal/finance/sap/FI008B.pdf General Points to Note When you are filling in these forms, remember you must complete all fields and state clearly: Payee Address to send Payment to Value of Payment Payment Method (Cheque / Bank Transfer – Bank Details) Authorisation GL Code Cost Centre / WBS Element Reason for Payment Vat Code If these Fields are incomplete, payment may be held and the form returned to you for completion.