Rochester Rehabilitation Center

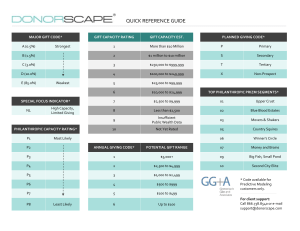

advertisement