capsim - be solution

advertisement

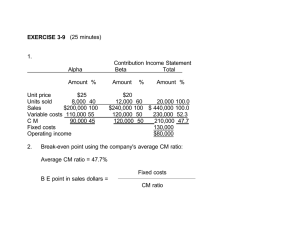

Name: _______Solution _______________ Class Period: 11:30 1:00 Acct 2220 Zeigler: Capsim Individual H/W#4 (10 pts total) - Spring 2015 Use Round 0 Fasttrack & Your Annual Report for this Break-Even Analysis Overview: The goal of this individual assignment is to apply Cost-Volume-Profit (CVP) analysis from our study earlier this term. This assignment focuses on Break-Even analysis, in both units and sales dollars, and the Margin of Safety. Required: (2 pts each for questions 1, 2, 3) Using the Production Report (see Round Zero Fasttrack), *and* your company’s “Annual Report”, answer the questions below relating to break-even analysis of your one original product. Prepare a Contribution Margin (CM) Template, as discussed in class earlier this term, to confirm your answer (see reverse for guidance). When preparing your analysis, consider the following four practical limitations: a) Use only unit “material cost” and “labor cost” from the Fasttrack Production Report for your variable costs. Next, refer to your Annual Report income statement to find your fixed costs for the year. These fixed costs are shown as “Period” Costs. When reviewing your Annual Report, you will see “Inventory Carrying Cost” expense shown as a variable cost. Ignore these costs. Why? Because CVP analysis assumes all production is sold (Chp 3). Note: In the simulation, a 12% inventory carrying cost results when excess inventories remain each year (i.e. when production exceeds sales). This expense relates to inventory holding costs such as warehousing, insurance, etc. Again, disregard these carry costs in this analysis. b) Ignore “Income Taxes”. Why? Because zero profit, means zero income taxes. c) Ignore “Profit Sharing”. Why? Because no profit generally means no profit-sharing among employees. d) Ignore “Interest expense”. Why? Because interest expense is a function of debt vs. equity choices by mgmt. NOTE: For questions 1& 2 below, use the hints provided and determine breakeven in units and dollars. Next, use the reverse page OR the Excel file posted on our class website to confirm your answer. If you enter the information properly in Excel, the result will confirm both sales dollars and units to break-even (Note: Some rounding will occur). _____ 1) Using the “Equation Method” (Sales – VC – FC = 0), what would be the Break-Even point, for your one original product, in Units? You must show your equation method work below to earn credit. a) between 100,000 and 200,000 units b) between 200,000 and 300,000 units c) between 300,000 and 400,000 units d) between 400,000 and 500,000 units Equation Method support: Sales ($34x) – VC (16.17X material cost + $10.11X labor cost) - $960,000 depr - $2,637,000 period FC = 0 $34X - $26.28X - $3,597,000 = 0 7.72X = $3,597,000 X = 465,933 UNITS TO BREAK-EVEN (this is quite a bit below the current sales level of 1,200,000 units!) _____ 2) Using the “Equation Method”, (Sales – VC – FC = 0) what would be the Break-Even Point, for your one original product, in Sales Dollars? You must show your equation method work below to earn credit. a) between $30,000,000 and $40,000,000 in sales dollars b) between $20,000,000 and $30,000,000 in sales dollars c) between $15,000,000 and $20,000,000 in sales dollars d) between $10,000,000 and $15,000,000 in sales dollars Equation Method support: S - ~.773S - $3,597,000 = 0 .227S = $3,597,000 S = $15,845,815 in SALES DOLLARS TO BREAK-EVEN (far below the current $40,800,000 in sales!) _____ 3) Using the above answers, what is the approximate “Margin of Safety” here? In other words, how much “sales cushion” exists between total Round Zero sales and the B/E point you determined above? Show work below. a) between $40,000,000 and $50,000,000 (IN SALES DOLLARS) b) between $30,000,000 and $40,000,000 (IN SALES DOLLARS) c) between 600,000 and 800,000 (IN UNITS) d) between 400,000 and 600,000 (IN UNITS) Computational Support: Current Sales – Break-Even Sales = Margin of Safety UNITS: (Current sales is 1.2mm units – B/E Sales of ~465,933 units (above) = MOS of ~ 734,067 UNITS SALES DOLLARS: Current sales of $40,800,000 – B/E Sales of $~$15,845,815 = ~ $24,954,185 MOS in Sales 4) Four (4) points for a correct hand-written analysis (OR via an attached/stapled Excel Printout): Acct 2220 Zeigler: Capsim Break-Even Assignment H/W#4: Using Practice Round 0 Fasttrack & Your Company Annual Report Procedure: Use this template to confirm Break-Even for your one original product AFTER you have completed your (page 1) analysis using the "Equation Method" (i.e. S - VC - FC = 0) Be sure to confirm all formulas Enter Your Company: _________ Contribution Margin Template Units: 465,933 INPUT CELLS IN YELLOW Unit Sales revenue $34.00 % 100% $ Total 15,841,722 Less: Variable costs Labor Cost Material Cost Disregard "Carry Cost" ($10.11) ($16.17) xx -30% -48% xx $ $ $ (4,710,583) (7,534,137) - $7.72 22.7% $ 3,597,003 Contribution Margin Less: Fixed (Period) costs Depreciation All other S,G & A Costs x x Pre-Tax Profit (i.e. Break-Even Proof) ($960,000) ($2,637,000) $0 Attach this completed printout (showing confirmation of break even) to your assignment and turn in on the due date.