Steel Industry Update/149

August/September 2000

Locker Associates, 225 Broadway, NY NY 10007 Tel: 212-962-2980

Despite the rosy shipment forecasts we presented

in the July Update, very dark clouds are now enveloping the North American steel industry. Imports are soaring, prices are plummeting -- especially sheet tags, inventories continue to climb,

stock prices are stuck at all-time lows and the first

shutdown and layoff announcements have been issued. This could be a painful fall and winter if the

economy continues to falter, especially the auto

and construction markets.

The tepid numbers generated in the second

quarter for integrated mills (see Table 2) could

worsen due to falling prices. HR sheet spot offerings have quickly slipped below $300/ton (down

from $340 in April) while CR prices are touching

$400/ton (down from $440). Gulf States shut its

plant this summer, Wheeling-Pitt has just announced its laying off 29 hourly workers due to a

decline in sales and LTV announced the closure of

its Minnesota iron ore mines. Most importantly, the

Clinton administration continues to largely ignore

the rising flood of low-priced imports.

On the more positive side, Europe, most of Asia

and Latin America continue to grow. Unlike the

early 1980's, the integrated mills have strengthened their balance sheets, dramatically reducing

their debt and pension bills. And scrap and pig iron

prices have edged up on the world market in the

last six weeks. If the world and U.S. economy can

maintain strong growth, then it's conceivable we

could witness a steel shortage that drives up prices

to new highs. In other words, we are at a crucial

crossroad. Over the next three months, if the negative volume and price trends accelerate, the steel

industry could take a real hit. But if demand recovers and prices rise, the downturn will be averted.

Stay tuned.

Fax: 212-608-3077

Inside This Issue......

Second Quarter Results ............................

Prices and Shipments ................................

End-Use Markets .......................................

Trade ..........................................................

Labor/Management ....................................

Raw Materials ............................................

Worthy of Note ...........................................

1

2

4

4

5

7

7

SECOND QUARTER RESULTS

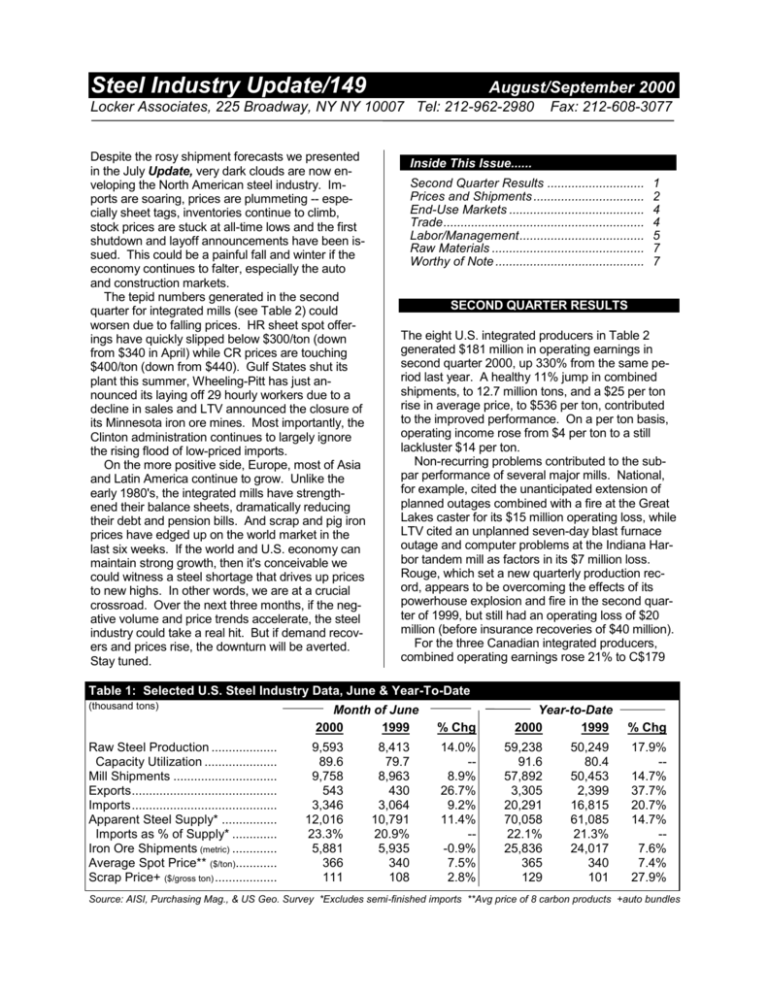

The eight U.S. integrated producers in Table 2

generated $181 million in operating earnings in

second quarter 2000, up 330% from the same period last year. A healthy 11% jump in combined

shipments, to 12.7 million tons, and a $25 per ton

rise in average price, to $536 per ton, contributed

to the improved performance. On a per ton basis,

operating income rose from $4 per ton to a still

lackluster $14 per ton.

Non-recurring problems contributed to the subpar performance of several major mills. National,

for example, cited the unanticipated extension of

planned outages combined with a fire at the Great

Lakes caster for its $15 million operating loss, while

LTV cited an unplanned seven-day blast furnace

outage and computer problems at the Indiana Harbor tandem mill as factors in its $7 million loss.

Rouge, which set a new quarterly production record, appears to be overcoming the effects of its

powerhouse explosion and fire in the second quarter of 1999, but still had an operating loss of $20

million (before insurance recoveries of $40 million).

For the three Canadian integrated producers,

combined operating earnings rose 21% to C$179

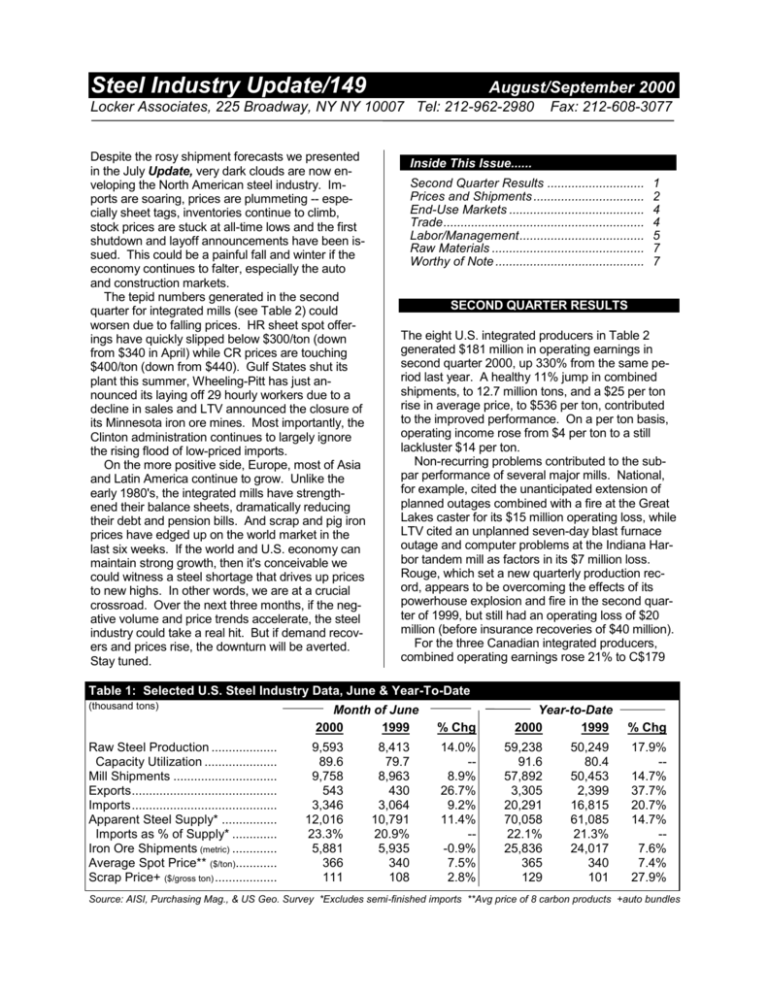

Table 1: Selected U.S. Steel Industry Data, June & Year-To-Date

(thousand tons)

Raw Steel Production ...................

Capacity Utilization .....................

Mill Shipments ..............................

Exports ..........................................

Imports ..........................................

Apparent Steel Supply* ................

Imports as % of Supply* .............

Iron Ore Shipments (metric) .............

Average Spot Price** ($/ton)............

Scrap Price+ ($/gross ton) ..................

Month of June

2000

1999

9,593

89.6

9,758

543

3,346

12,016

23.3%

5,881

366

111

8,413

79.7

8,963

430

3,064

10,791

20.9%

5,935

340

108

% Chg

14.0%

-8.9%

26.7%

9.2%

11.4%

--0.9%

7.5%

2.8%

Year-to-Date

2000

1999

59,238

91.6

57,892

3,305

20,291

70,058

22.1%

25,836

365

129

50,249

80.4

50,453

2,399

16,815

61,085

21.3%

24,017

340

101

% Chg

17.9%

-14.7%

37.7%

20.7%

14.7%

-7.6%

7.4%

27.9%

Source: AISI, Purchasing Mag., & US Geo. Survey *Excludes semi-finished imports **Avg price of 8 carbon products +auto bundles

Steel Industry Update/149

million (US$121 mil) despite a modest 1% decline

in shipments. Stronger profits were the result of

higher average price, up C$32 per ton price to

C$667 per ton (US$451 per ton), which more than

offset a C$21 per ton rise in average operating

cost. Algoma -- which set new production records

on its DSPC in both May and June -- posted operating earnings of $C45 per ton (US$30), a marked

improvement compared to a C$27 per ton loss in

second quarter 1999.

The six North American minimills in Table 2 also

enjoyed stronger earnings. Combined operating

income rose 33% to $207 million thanks to both a

6% rise in shipments and $22 per ton rise in average price to $390 per ton. Operating income per

ton increased to $36, up $7 per ton from the same

period last year.

All six minimills were profitable, but there was

significant variation among the group. Oregon

earned a paltry $1 per ton, while Steel Dynamics

earned $74 per ton, making it the most profitable

mill in North America on a per ton basis.

creased by 2.1% over May and were up by

21.6% over June of 1999. Figures released by

Pipe Logix, a consulting and information services

firm for the industry, showed a 3.2% jump in carbon ERW casing in June, from $647 to $668/ton

and another 1.5% hike in July to $678/ton. Carbon seamless casing moved up from $807 to

$817/ton in June and to $821/ton in July, a gain

of 1.2% and 0.5% respectively. Alloy ERW casing, at $785/ton in May, increased by 2.5% to

$805/ton in June, and 1.2% to $815/ton in July,

and alloy seamless casing went up 1%, from

$879 to 888/ton in June and 0.9% more to

$896/ton in July. Tubing also showed similar increases, with carbon seamless up 2.8% in June

and 1.1% in July, from $969 to $996 and

$1,007/ton respectively, carbon ERW ahead

1.5% and 1.3%, from $846 to $859 and $870/ton,

alloy seamless increasing 2.1% and 0.6%, from

$1,128 to $1,152/ton in June and $1,159/ton in

July, and alloy ERW up 2.3% in June and 0.6% in

July, from $1,016 to $1,039 and $1,045/ton respectively. Even as prices continued to move

ahead, spokesmen for the industry expressed

cautious hope that the highly attractive U.S. market does not result in a new surge of cut-rate imports from abroad, which could change the picture considerably (AMM 7/5, 8/1).

PRICES AND SHIPMENTS

OCTG: The unabated rise in energy prices sent

OCTG prices still higher this summer as oil drilling continued to increase. In August, U.S. Steel

led with a tag hike of $40/ton on high-strength alloy casing effective Sept. 1. In June, prices in-

Sheet: With both the U.S. economy and steel

Table 2: Performance of Major North American Steel Producers, 2Q00 & 2Q99

Shipments

Sales

Oper Income

Sales/Ton

(thousand tons)

($ millions)

($ millions)

($ per ton)

U.S Integrated

2Q00

2Q99

2Q00

2Q99

AK Steel ...........

1,710

1,736

1,226

1,114

Bethlehem ........

2,239

2,109

1,059

985

LTV Steel .........

2,273

1,987

1,279

1,014

National............

1,631

1,471

772

707

Rouge Steel .....

638

372

276

173

USSteel............

2,904

2,548

1,585

1,303

Weirton ............

653

606

293

267

WHX (W-P)* ....

615

568

294

256

U.S. Totals .......

12,663

11,397

$6,785

$5,819

Canadian Integrated (C$=US$.68)

Algoma.............

530

571

305

296

Dofasco............

1,128

1,141

842

784

Stelco ...............

1,267

1,245

804

798

Canada Totals ..

2,925

2,957 C$1,951 C$1,878

N.A. Minimills (US$)

Birmingham ......

734

Co-Steel ...........

750

Ipsco* ...............

559

Nucor* ..............

2,836

Oregon .............

417

Steel Dynamics

503

N.A Mini Totals

5,798

831

728

421

2,571

405

506

5,463

213

244

237

1,214

162

191

$2,260

258

212

185

997

189

167

$2,008

Oper Inc/Ton

($ per ton)

2Q00

116

25

(7)

(15)

(20)

68

12

2

$181

2Q99

89

(26)

(7)

3

(62)

43

0

2

$42

2Q00

717

473

563

474

433

546

449

478

$536

2Q99

641

467

510

481

466

511

441

451

$511

2Q00

68

11

(3)

(9)

(31)

23

19

3

$14

2Q99

51

(12)

(4)

2

(166)

17

0

3

$4

24

100

55

C$179

(15)

112

52

C$148

575

746

635

C$667

518

687

641

C$635

45

89

43

C$61

(27)

98

42

C$50

3

16

23

128

1

37

$207

7

8

23

79

10

28

$156

290

325

423

428

388

379

$390

310

291

439

388

467

329

$368

4

21

41

45

1

74

$36

9

12

55

31

25

55

$29

Source: Company documents. Note: Steel Segment, except Ipsco & Nucor. Includes profit-sharing; excludes non-recurring charges.

-2-

Steel Industry Update/149

Table 3: U.S. Annual Product Spot Prices: Actual and Forecast

Actual

1999

($/ton)

Hot rolled sheet..........

Cold rolled sheet.........

HD galvanized sheet...

Coiled mill plate..........

Cold-finished bars......

Wide-flange beams....

Reinforced bars #6.....

Wire rod/low carbon...

Carbon Avg Price.....

Stainless 304 sheet...

Stainless 316 sheet...

Forecast

2001

2000

2002

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

283

303

327

335

331

330

328

326

324

323

321 318

397

403

437

437

432

430

427

425

423

421

419 415

423

467

430

440

435

433

430

428

426

424

421 418

300

300

323

330

326

325

323

321

319

318

316 314

460

460

460

467

462

460

457

455

452

450

448 444

270

287

307

313

310

308

306

305

303

302

300 297

310

307

322

327

324

322

320

318

316

315

313 311

295

315

300

300

297

295

293

292

290

289

287 285

342

355

363

369

365

363

361

359

357

355

353 350

1,555 1,750 1,750 1,958 1,936 1,927 1,915 1,906 1,894 1,887 1,875 1,860

1,792 1,821 2,200 2,300 2,275 2,263 2,250 2,238 2,225 2,216 2,203 2,185

Sources: Purchasing Magazine, Buying Strategy Forecast (7/24/00)

industry showing signs of a slowdown in the last

couple of months, flat-rolled sheet declined in

August with HR at about $290/ton, down some

$50-$60 from May and CR off about $70/ton to

about $380. Prices have been affected by typical

summer slowdowns and by the fact that service

centers are reportedly working off the higher inventory levels they built up late last year. Another factor is a bit of a slowdown -- though not a

major one -- in construction activity (AMM 7/17).

regional price policy and its attempts to gain a

larger share of the merchant bar market. AISI

figures reveal that imports of carbon structural

shapes went up by 30.4% this May over May of

last year, from 146,542 tons to 191,032 tons, although total imports of 709,789 tons in the first

five months were off this year by 2.2% compared

with the first five months last year (AMM 7/24).

Slab: After a rise of about $19/metric tonne earlier in the year, slab prices were falling off this

summer and the trend appears to be accelerating. California Steel Industries, the largest domestic slab buyer, was reported to be paying

$10/metric ton less in the third quarter, or about

$220 f.o.b., and prices were expected to be still

lower in the last quarter of this year. California

has also resumed buying slab from Cia Siderurgica de Tubarao (CST), the Brazilian company that

was formerly CSI’s biggest supplier. California

had stopped buying its slabs from CST earlier this

year when its prices were about $10/metric ton

higher than competitive suppliers. Although purchases have begun again, it is reported unlikely

that the Brazilian firm will regain its predominant

position with CSI.

Meanwhile, another Brazilian steelmaker, Cia

Siderurgica Paulista (Cosipa) is ready to start up

a new mill Oct. 1 to increase its raw steel output

to 4.5 million metric tons a year, up from 2.7 million metric tons. The third largest Brazilian steel

producer plans to turn out 900,000 metric tons of

slab annually, most of it for export, even as CST,

the country’s biggest slab exporter, will be reducing its shipments abroad (AMM 7/31, 8/3, 8/16).

Merchant Bar: Nucor’s recent aggressive pricing

stance in merchant bar is causing increasing

concern in the market, according to a July report.

In mid-July, the company announced that it was

cutting its tags on merchant bars and structural

shapes. Birmingham, North Star, SMI, and Auburn Steel quickly followed with cuts of their own.

Mills are now reportedly introducing a “foreignfighter” price, which has been devised to fight

against low-priced imports, and this is the price

merchant bar buyers were now paying. Basically,

it means that if a small buyer can purchase at the

foreign-fighter price, he will pay the same price as

the large buyer, since it is not likely that manufacturers will discount below this price. Some industry sources expressed doubt that the “foreignfighter” prices would last.

In mid-summer, a Midwestern buyer was reporting that 2 inch by 2 inch by 1/4 inch angles,

selling for $330/ton, were being discounted to

$316/ton. The foreign-fighter price for the product is $281. Industry and service center sources

said that a key factor behind Nucor’s cuts were its

Steel Industry Update (ISSN 1063-4339) published 10 times/year by Locker Associates, Inc. Subscriptions $395/yr; $725/two yrs; Multiple copy discounts available. Checks payable to Locker Associates in U.S. dollars drawn on a U.S. bank. Copyright © 2000 by Locker Associates Inc. All rights

reserved. Reproduction in any form forbidden w/o permission. Some material in this Update is excerpted from American Metal Market (AMM), which is

available by subscription by calling 800-247-8080. Locker Associates, 225 Bdwy, # 2625, NY NY 10007. E-Mail: lockerassociates@yahoo.com

-3-

Steel Industry Update/149

END-USE MARKETS

last year. Holding that the reduced-price imports

had caused, or threatened to cause, injury to domestic industry, the 4-2 commission decision levied anti-dumping duties of up to 95.29% on four

Japanese companies -- Nippon, Kawasaki, NKK,

and Toyo Kohan -- and 32.52% on “all others.” In

two years, from 1997 to 1999, imports of tin mill

goods had jumped by 74.4%, from 199,583 to

348,000 tons. The Japanese, who have been

handed a number of adverse anti-dumping decisions by the ITC this year, were particularly upset

by this one, which involved only one U.S. tin mill

manufacturer, Weirton Steel, and two unions, after other domestic mills declined to join. During

the hearings, they introduced testimony from four

U.S. can manufacturers that Weirton’s poor ontime delivery performance rather than lower import prices were the reason for their decision to

purchase Japanese tin mill products last year.

Weirton, whose tin mill goods account for about

40% of its income and 22% of the domestic market, should now find it easier to obtain a loan

guarantee from a federal steel loan program.

The AISI hailed the ITC decision and repeated its

call for stronger and more-strictly enforced trade

laws (AMM 7/6, 8/4).

Steel Still King in Automaking: The outlook for

development of new lightweight steel for use in

car manufacturing looked rosier in July with the

issuance of a government report that neither

aluminum nor composite materials will be able to

be priced cheaply enough in the near future to rival steel costs in most major vehicles. The report

by the National Research Council urges the Partnership for a New Generation of Vehicles to

closely follow the development of the new lightweight steel by the Ultra Light Steel Auto Body

consortium. The consortium, created by the

American Iron and Steel Institute, has been developing the ultra-light, high-strength steel for the

next generation of cars to meet the competition

from lighter weight but higher priced metals.

”We’re encouraged that the National Research

Council recognized the contributions and potential that we have been able to demonstrate for the

next generation of vehicles,” said David Jeanes,

AISI senior VP of market development.

Later in the month, reports indicated that steel

products in some of its newer and higher forms

will be used in a significantly larger number of vehicles for 2001. Ford also announced that it intended to use new laminated steel door panels in

its 2001 Ranger trucks. The laminated panels cut

down vibrations and noise in the vehicles. About

350,000 Ford Ranger trucks are sold each year

(AMM 7/12, 7/14, 7/27).

Series of ITC Judgments Buoy U.S. mills: A

series of U.S. International Trade Commission

anti-dumping rulings in July has given a new lift to

a number of U.S. steel producers. In one case,

involving large diameter pipe from Mexico, the

commission held, by a unanimous 6-0 vote, that

imports of carbon seamless standard pipe and

pressure pipe caused or threatened injury to domestic producers. It also held, by a 5-1 vote that

imports of alloy seamless pipe did the same. In

addition, four commissioners found injury to the

domestic industry from small diameter carbon

and alloy pipe from Romania and the Czech Republic. In the critical circumstances portion of the

decision, four of the commissioners held that

such circumstances were not present during the

period of the investigation, so that duties will be

imposed from the date of the preliminary antidumping margins, or Aug. 23, rather than 90 days

before that. The ruling will result in duty margins

of 19.65% on imports from Mexico, 32.26% to

39.93% for the Czech Republic, and 11.08% to

19.11% for Romania.

Injury, or the threat of injury, to the U.S. market

was also found in the imports of structural steel

beams from S. Korea. The unanimous ITC holding will see final anti-dumping and subsidy rate

margins applied to Inchon Iron & Steel (25.51%

and 0.15%), Kangwon (49.73% and 3.88%), and

all others (37.72% and 3.87%) (AMM 7/14).

Freight Car Sales Derailed in Second Quarter:

It looks like someone has pulled the emergency

brake on railway freight cars. During the second

quarter of this year, sales orders plummeted by

20.4% from the first quarter, with deliveries the

lowest in nearly three years. Although second

quarter orders for 11,595 cars was still 73.9%

higher than the 6,658 cars ordered in the second

quarter of 1999, it was considerably off the

14,551 orders placed in the first quarter of this

year. American Railway Car Institute President

Robert A. Matthews, however, predicted a turnaround toward higher sales again “as railroads

continue to recover from recent merger-related

problems and fuel prices remain high.” The more

the railroads are used, he said, the more need

there will be for new freight cars (AMM 7/27).

TRADE

ITC Hits Japanese Tin Mill Imports: An antidumping ruling August 2 by the U.S. International

Trade Commission struck sharply at the imports

of Japanese tin-and chromium-coated steel sheet

-4-

Steel Industry Update/149

U.S. Trade Study Gets Mixed Reviews: The

long-awaited government report on the recent crisis in steel imports was issued July 26 to a variety

of reviews, mostly lukewarm, on its formula for

preventing future disasters. While most praised

the study as a well-documented, fact-filled description of the import problem, they noted that it

was quite short on any conspicuous new

measures that would prevent future occurrences.

Others noted that, at least it laid to rest the denials from some sources that there was a real problem from abroad, or that domestic industry was

the source of the blame. The United Steelworkers of America called the study “the result of a

massive grassroots effort by our union and others,” and said that it looked to Congress for legislative action “to put teeth into the report’s findings.” Others, like the American Iron and Steel

Institute, welcomed the report but said that it is

“less than what is needed to address the global

steel structural problems and to achieve the Steel

Action Program’s stated goal of ‘zero tolerance of

unfair trade.’” Most of the remedies against future dumping surges recommended in the 235page study were those already in the hopper, according to some industry and congressional

sources. They included:

Rebar Cases Get Mixed ITC Verdict: In another

action this summer, the ITC dismissed cases of

anti-dumping against producers of rebar in four

countries, even as it voted to carry on the investigation into charges of injury by imports from eight

others. The 5-1 preliminary injury vote held that

imports from Russia, Venezuela and Austria were

negligible and that imports from Japan did not

cause or threaten injury to the U.S. rebar industry. It did, however, decide to proceed with the

probe of imports from China, Korea, Indonesia,

Poland, Ukraine, Belarus, Latvia, and Moldava.

A final vote on these countries is expected next

spring.

Allegations of critical circumstances were filed

Aug 21 by the Rebar Trade Action Coalition, representing eight U.S. rebar mills. They charged

that last December producers in several of these

countries, believing that anti-dumping cases

would be filed imminently, engaged in “a massive

increase in dumped imports.” An attorney representing the industry said that “importers should

be put on notice that we are requesting the U.S.

government to impose duties as rapidly as the

law allows in order to address the harm caused

by these import surges.” If critical circumstances

are upheld, rebar producers in these countries

would be subject to retroactive duties on goods

coming into the country up to 90 days before the

preliminary determination of anti-dumping duties,

now scheduled for Dec. 5 (AMM 8/14, 8/15, 8/16, 8/23).

● A system of early warnings through the expedited issuance of steel import statistics a

month early and closer coverage of raw steel

production, consumption, capacity utilization,

import penetration, average weekly overtime

hours and other employment data.

LABOR/MANAGEMENT

AK’s “Safety” and “Citizenship” Citations

Leave Lots of Heads Shaking: The National

Safety Council’s selection of AK Chairman and

CEO Richard Wardrop for its first Green Cross for

Safety Medallion has left lots of people scratching

their heads in disbelief. The company was cited

for turning around a poor safety record into one

with a very low rate of plant accidents. The NSC

also cited Wardrop for his “corporate citizenship.”

Blasting the award almost as soon as it was announced, the United Steelworkers of America

said that it called into question the very integrity

and credibility of the NSC. It pointed to the fact

that AK and its contractor, Motorized Assisted

Deliveries, have been assessed for over $50,000

in fines by OSHA just this summer for numerous

health and safety violations at its Mansfield plant.

In one violation that resulted in a $44,000 fine

against MAD, an employee’s clothing caught fire

when he was not given, nor required to wear, protective equipment to guard against burns. The

union also charged that the company’s intimidating practices inside the plant had prevented

workers from reporting accidents and safety viola-

● Expediting investigations of dumping, antiduty actions, and critical-circumstance findings

to speed up relief for industries and communities affected by the actions.

● Making sure the U.S. trade laws, while consistent with WTO regulations, are strengthened

to increase the ability to litigate dumping abuses.

● Conducting negotiations and bi-lateral discussions with Japan, Russia, Brazil and South

Korea to correct structural problems in the industry and broadening the discussions to include extensive monitoring.

● Seeking a moratorium on lending by multilateral development banks for enterprises that

significantly increase overseas steel production

capability.

● Energizing the international steel policy

agenda through meetings attended by highlevel government officials (AMM 7/27, 7/28, 7/31).

-5-

Steel Industry Update/149

tions, and that many of the violations were being

committed by contractors working at the AK

plants so that they are not reported as being the

responsibility of AK.

But the clearest irony in the “corporate citizenship” citation is the development, reported in the

July Update, that AK was cited twice in June for

polluting the waters of two towns in Ohio and

Pennsylvania. The company was ordered by the

EPA to supply and pay for supplementary drinking water for an entire town after it found that nitrate waste from AK’s Butler steel mill, dumped

into a local river, had permeated the town’s water

supply. The waste dumping has resulted in a nitrate level 10 times above the national standard

which could cause serious illness and death in infants under six months of age. The EPA order

carried a penalty of $15,000 a day for noncompliance. AK is appealing the order.

In another legal action, the U.S. Justice Department also filed a lawsuit in June charging AK

with polluting the air and water at its Middletown,

Ohio, plant for seven years by repeatedly dumping pollutants, including heavy metals, nitrogen

ammonia, cyanide, and PCBs, into a local river.

The Justice Department acted after investigations

by the U.S. EPA and the Ohio attorney general’s

office. A spokesperson for the state attorney

general’s office also announced its intention to

file a lawsuit on behalf of the state EPA. The

federal suit is seeking the maximum penalties of

$25,000 a day for each day of violation before

January 31, 1997 and $27,500 for each day

since. The state suit will reportedly ask for fines

of $25,000 a day for clean air violations and

$10,000 a day for clean water and hazardous

waste violations.

AK is currently involved in a bitter labor dispute

with USWA at its Mansfield, Ohio, plant after it

locked out the workers there more than a year

ago. The “corporate citizenship” citation is also

paradoxical in light of the comment by an AK

spokesman earlier this year on the fact that the

company’s action has been deeply resented by

the Mansfield community. “I see no evidence anyone is jumping on the AK bandwagon saying,

‘You’re doing the right thing,” he said, but the

company is responsible to its stockholders, not to

the community’s feelings. And when 10 members

of Ohio’s Congressional delegation sought a

meeting with Wardrop, to discuss the situation

they were turned down. The lawmakers then

"branded AK’s conduct “an embarrassment to the

state of Ohio and harmful to both the company

and the city of Mansfield.”

was not guilty of unfair labor practices in its lockout of the Mansfield workers, declaring the lockout a “legitimate economic weapon.” It also dismissed a USWA charge that the company had

unlawfully engaged in surveillance of union members and of the union hall in Mansfield, holding

that AK’s concerns about its security justified its

actions. The union promptly announced that it

would appeal the decision with the NLRB general

counsel in Washington. The decision did hold

that if a settlement was not reached with the union, the company should be held in violation of

the National Labor Relations Act by trying to

pressure employees into accepting its contract

last August when it prematurely distributed a version of it to union members.

All of this AK-USWA conflict did not prevent the

company and USWA Local 1865 at the Ashland

plant from reaching a tentative agreement on a

new five-year pact containing a $2-an-hour wage

increase over the life of the contract (AMM 7/12,

7/18, 8/3, 9/4; USWA Local 169 Strike Bulletins: Our Struggle

for Justice 8/2, 8/17; Yahoo Finance Newswire 8/1).

Rouge & UAW Sign Pact: After rejecting a contract negotiated by their leaders in July, members

of UAW Local 600 approved a new four-year

agreement with Rouge Steel a month later. The

new contract includes a 3-cent-an-hour base pay

increase in each of its four years in addition to inflation pay raises tied to the Consumer Price Index. It also includes a $1,000 lump-sum payment

to all workers completing their 90-day probationary periods, and an additional $100 lump-sum

payment to all workers, including those still on

probation. There is also a lump-sum payment for

retirees and their surviving spouses and a pension increase of $4-a-month for every year of service for all future retirees. It also adds several

health care benefits for employees. The contract,

by avoiding a possible strike, was particularly important for Rouge, still recovering from serious financial problems caused by the fatal explosion

and fire at its plant last February (AMM 7/12, 8/14).

Rocky Mountain Hit with Half-a-Million in

OSHA Fines: Citing 107 violations of health and

workplace standards, OSHA has proposed penalties against Rocky Mountain Steel to the tune of

$487,000. The violations include 22 repeat citations after a comprehensive inspection of the

company’s Pueblo, Colo., mill following the death

of a worker there in February. It was the second

accident-related death at the plant in a year. Assistant U.S. Secretary of Labor Charles N. Jeffress declared in Washington in August that even

after being repeatedly cited for violations, the

company “has continued to disregard employee

NLRB Hands Down AK Decision: In another

AK development, an NLRB ruling said that AK

-6-

Steel Industry Update/149

safety.” Since 1972, he said, 31 out of 42 inspections had resulted in citations. Just three years

ago, the mill was fined $1.1 million by OSHA -- a

sum later negotiated down to $400,000 -- and

$111,500 in penalties. The OSHA decision was

welcomed by USWA, which has been involved in

a labor dispute with the steelmaker since Rocky

Mountain’s parent company, Oregon Steel, in violation of current labor law, refused to rehire workers that had struck the plant three years ago.

In a development related to the labor dispute,

both sides claimed a victory in a recent NLRB ruling that found USWA guilty of about 80 violations,

but the Board refused to impose any sanctions or

fines, or command the union to apologize, as the

company had sought. The judge also rejected

Oregon Steel’s demand that the union be decertified and the union noted that the NLRB had found

the company guilty of “massive violations of federal labor law” making it liable for restitution of

back pay that could come to as much as $120

million (AMM 8/10, 8/24; Oregon Steel Press Release 8/8).

not only costs less to set up and run but provides

a melt with substantially reduced residuals.

However, the liquid pig iron works has been

plagued by problems almost from the time it

opened in the spring of 1999. After operating

successfully for about five weeks, it was forced to

shut down. The whole highly advanced technological process came grinding to a halt when a refractory break-out occurred in the submerged-arc

furnace. The company acknowledged at the time

that the breakout was caused by the use of the

wrong type of brick lining in the of the submerged-arc furnace. It reopened shortly afterward, but problems still persisted. The plant will

now undergo equipment retrofits and is not expected to resume production until the end of next

year (AMM 7/20).

WORTHY OF NOTE

Guaranteed Loans Go to Four U.S. Mills:

Wheeling-Pittsburgh, Northwestern Steel & Wire,

Geneva Steel, and GS Technologies have been

approved for $365 million in loan guarantees by

the U.S. Government. The loans were guaranteed under the authority of the 1999 Emergency

Steel Loan Guarantee Act, passed by Congress

last year to help steel companies in the wake of

the foreign dumping crisis. As approved by the

Emergency Steel Loan Guarantee Board, Northwestern got $170 million, Geneva received $110

million, GS was approved for $50 million, and

Wheeling-Pitt received $35 million. Other applications still being considered are those from

Weirton, Gulf States, and Acme Steel. For Geneva and Acme, the loan will help the companies,

now in Chapter 11 bankruptcy, to become solvent

again. Northwestern will use the loan to fund

some major projects, like the construction of a

new structural mill. Citicorp USA is the lending

institution for Wheeling-Pitt, Geneva and GS

Technologies, while Bankers Trust will fund the

Northwestern loan (AMM 7/5).

RAW MATERIALS

Whither the Scrap Market?: After a summer of

mixed signals and contradictory predictions, industry analysts could only express puzzlement at

the direction of the scrap market and a reluctance

to make any predictions for the future. The end of

July saw a very slight upturn in the auto bundles

market as prices inched up a little over $1 to

$108.50/metric ton. In the first six months of this

year, bundles lost nearly 30% of their value as

they tumbled from a high of over $150 last December. But no one was willing to say if he

thought it was the beginning of a real turnaround

or just a plateau before scrap went into a new

tailspin. At the beginning of the summer, falling

ferrous scrap prices of $2 to $5/gross ton in many

of the major scrap markets had produced a

gloomy outlook among observers. But two weeks

later, some were expressing cautious optimism

that ferrous scrap exports, suffering from an extreme case of the blahs for months, may show

some upward swing. They pointed to the slowing

pace of scrap shipments from Russia and

Ukraine into Asian steel markets as a good sign

for future U.S. exports. However, as of the beginning of this month, everyone seemed to agree

that the jury was still out (AMM 7/12, 7/25, 7/31, 8/7).

Acominas to Spend $133 Million: Acos de Minas Gerais (Acominas), Brazil’s biggest bloom

and billet maker, launched a program of new investments in July to upgrade quality and increase

output in its plant in Minas Gerais state. The investment program will total $133 million. The improvements, which are expected to raise its steel

production from 2.5 million to 2.7 million metric

tons, include a one-million-metric-ton-a-year continuous billet caster (already in operation), a ladle

furnace, installation of a pulverized coal injection

system in one blast furnace and the upgrading of

its sinter feed plant.

Acominas plans to use $63 million of the

SDI Suspends Pig Iron Facility: Steel Dynamics, over the summer, suspended the production

of liquid pig iron at its Butler, Ind. mill. The pig

iron facility was operated by its subsidiary, Iron

Dynamics. Liquid pig iron, used in the plant melt

shop, is a substitute for scrap, and the process

-7-

Steel Industry Update/149

Table 4: Selected Canadian Steel Industry Data, May & Year-To-Date

(thousand tons)

2000

Mill Shipments ............................. 1,458

Exports ......................................... 552

Imports ......................................... 839

Apparent Steel Supply ................. 1,745

Imports as % of Supply .............. 48.1

Month of May

1999

1,363

457

528

1,434

36.8

% Chg

2000

7.0%

20.8%

58.9%

21.7%

7,139

2,496

3,831

8,474

45.2

Year-to-Date

1999

6,887

2,239

2,288

6,937

33.0

% Chg

3.7%

11.5%

67.4%

22.2%

Source: CSPA 8/25/00

amount to renovate a sections rolling mill it

bought from Germany in 1988 but never installed

for lack of financing. The mill, with a capacity to

turn out 450,000 metric tons of 6-inch by 24-inch

sections a year, should be installed in the next

year or two. The $133 million investments actually are only the first phase of a $500 million expansion that Acominas eventually expects will

produce 3.5 million tons of steel annually. The

company, which now exports about 60% of its

production to Southeast Asia and North America,

plans to increase shipments to these markets after its expansion.

In a related development, the Gerdau Group,

Brazil’s largest steel manufacturer and owner of

36.6% of Acominas stock, is currently negotiating

to buy 17.2% more. The acquisition would give it

a better than 50% stake in Acominas and would

make it one of the world’s largest and most profitable steel companies. The purchase price of the

stock was said to range between $150 million

and $250 million (AMM 7/7, 7/11, 8/9).

of 749-223. Company officials had said, at that

point, that obtaining a positive vote on the labor

agreement was the key as to whether it would

continue operations. However, the die seemed to

be cast a month earlier, in July, when Gulf States

was not on the list of those approved for loans by

the Emergency Steel Loan Guarantee Board. It

had applied for a credit of $130 million, with 85%

guaranteed by the federal government, and had

let it be known that it would shut down if it did not

receive the loan (AMM 7/11, 8/2, 8/9, 8/11).

Kawasaki to Build Rail Cars in Nebraska: Kawasaki Heavy Industries revealed plans in late

August that it would build a plant to manufacture

railway cars in Lincoln, Nebraska. The plant

would be built on the site of its subsidiary, Kawasaki Motor Manufacturing, which now produces

motorcycles, jet skis, parts for construction machinery and industrial robots. Its present railway

car manufacturing is done at its Kobe, Japan, facility. The company said it was investing about 5

billion yen ($47 million) to build the Lincoln mill,

which would produce 200 rail cars annually, starting in April 2002.

Several weeks before this announcement, it

was also revealed that Kawasaki is currently in

talks with France’s giant steelmaker, Usinor, in an

effort to get a global cooperation agreement to

supply steel sheet to automakers. Earlier reports

in the European press speculated that Germany’s

Thyssen Krupp Steel may have floated merger offers to Usinor but high officials at Thyssen dismissed the reports. Officials of both Thyssen

Krupp and Usinor acknowledged, however, that

talks had been held some months ago on the

possible formation of alliances in the cobalt and

nickel markets, but nothing further has been

made public. Thyssen Krupp now has a 40%

share of the European stainless market, prompting fears of the possible formation of a large European cartel.

Actually, of all the large basic industries, steel

is among the least heavily concentrated. Compared with the tire industry, for example, in which

the top five producers turn out 70% of production,

the auto industry where the top five make 57% of

Steel Union Blasts Gulf States Shutdown: In

the wake of the bankruptcy shutdown of Gulf

States Steel last month, the United Steelworkers

of America reacted strongly to a report that the

company’s bankruptcy filings included cuts to

health-care benefits, long-term disability payments, and the elimination of all benefits for the

surviving spouses of retirees. The proposals,

said USWA District 9 Director Homer Wilson,

“were not even part of the company’s negotiations with us.” He charged that Gulf States was

attempting to scapegoat the union for the company’s closing. "Gulf States executives,” he said,

“are trying to build a bankruptcy case on the

backs of the workers and their families, when our

members have already made significant sacrifices in contract negotiations to keep the company

from going under.” Management, he said, had

made no similar effort to reduce benefits for itself,

but rather had plans to pay its executives bonuses if the company had worked its way out of

bankruptcy.

Earlier, the union’s Local 2176 membership

had rejected a Gulf States contract offer by a vote

-8-

Steel Industry Update/149

all cars, or aluminum in which the top five manufacture 44% of the world’s output, only 14% of all

raw steel is produced by the world’s top five

steelmakers (AMM 7/11, 8/25).

Family Health Center, will be developed and run

by CHD Meridian Healthcare of Nashville, Tenn.

It would minister to 45,000 patient visits a year

along with a full-service pharmacy. Construction

of a new center is now underway with the opening planned for January 1, 2001 (AMM 8/25).

Companies Join to Provide Better Health

Coverage: Three of the biggest steelmakers in

the country have combined -- no, not to fix prices

or drive out competition, but to provide better

health care for their employees. U.S. Steel, Bethlehem and National have formed an equal partnership to build a health center in Chesterton,

Pa., to provide health care for employees, retirees, and families of the three companies who live

in the vicinity. The new facility, called The Steel

NOTES ON STEEL TRACK EXHIBITS

Performance data is from monthly AISI sources. Spot Prices (except

OCTG) are from Purchasing Magazine and are FOB Midwest, with no

extras. Hot rolled sheet, 48 inch, temper rolled, ASTM 569; Cold

Rolled Sheet, 48 inch, AISI 366; HD Galvanized Sheet, 120 inch AISI

525, G90; Coiled Plate, A36, 1/2x96x240 inch; Cold Finished Bar,

SBQ 1018; Wide-Flange Beam, A36, W8, 18 lbs; Wire Rod, low carbon; Rebar, carbon, no. 6. OCTG spot prices are from Pipe Logix,

FOB Houston for J55 8REUE Seamless Tube.

“As management and technical consultants, E&E has been a subscriber to Steel Industry Update

for many years. This concise compendium of key industry data is one of the most valued reference

sources in our library.”

Joel Hoffner

President, E&E Corporation

“The Update is timely, comprehensive and provides us with accurate information critical for understanding what is going on in the steel industry. It is widely read by my colleagues.”

A. Cole Tremain

V.P. Industrial Relations, LTV Steel

“The monthly price, product, and market data keeps our negotiators well informed. We find the data very useful for our Steelworker locals. The Update serves as a guide for navigating through the

North American steel industry and is read throughout Canada.”

Leo Gerard

Secretary Treasurer , United Steelworkers of America

---------------------------------------------------------------------Please enter my subscription to Locker Associates’ Steel Industry Update:

One year (10 issues): $395

Payment enclosed

Bill me

Two Years (20 issues): $725 (Save $65)

I prefer to receive the Update by: Mail (Hard Copy)

Email

Note: Subscribers outside North America must add $15/year for air-mail postage. Make checks payable to

Locker Associates; payment must be in U.S. dollars drawn on a U.S. bank. Multiple copy discount available.

Name:

Title:

Company:

Address:

City:

Phone #:

State:

Zip:

Country:

Fax #:__________________Email:____________________

Return to: Locker Assoc. 225 Broadway, #2625, NY, NY 10007 Ph-212-962-2980; Fx-212-608-3077

email: lcokerassociates@yahoo.com

-9-

Steel Industry Update/149

- 10

-