UNITED FIRE & CASUALTY v. CEDARS SINAI MEDICAL CENTER

advertisement

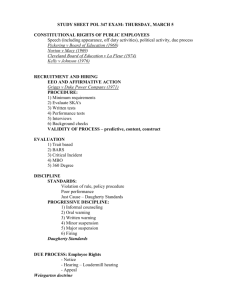

BEFORE THE IOWA WORKERS’ COMPENSATION COMMISSIONER ______________________________________________________________________ : UNITED FIRE & CASUALTY, : File No. 5048485 : Insurer, : Petitioner, : MEDICAL FEE : vs. : DISPUTE DECISION : CEDARS SINAI MEDICAL CENTER, : : Provider, : : and : : SEQUETOR, INC., : : Vendor, : Respondents. : Head Note Nos.: 2501, 2906 ______________________________________________________________________ STATEMENT OF THE CASE United Fire & Casualty (UFC), insurer, petitioner, filed a contested case proceeding seeking resolution of a medical fee dispute between Cedars Sinai Medical Center (provider) and Sequetor, Inc. (vendor), both as respondents, under rule 876 IAC 10.3 and rule 876 IAC 4.46. Under Iowa Code section 85.26(4), a claim for benefits is normally only maintained by an injured employee, the employee’s dependents, or a legal representative. Iowa Code section 85.27(3) grants an exception to that requirement. This section allows a healthcare provider, or an insurer, to maintain an action to determine if charges are reasonable, and if the informal dispute resolution procedure is followed under rule 876 IAC 10.3(3). The administrative record in this file indicates that respondent and petitioner have complied with the requirements of 876 IAC 10.3. The administrative record suggests a good faith effort to reach a resolution of the dispute has failed. Insurer, as petitioner, has instituted a contested case proceeding under rule 876 IAC 4.46. The record in this case consists of petitioner’s Exhibits A-L and respondents’ Exhibits 1, 2, 5, and 6, previously filed as rebuttal addendums. UNITED FIRE & CASUALTY V. CEDARS SINAI MEDICAL CENTER Page 2 The undersigned added an additional exhibit to the record, Exhibit AA, under rule 876 IAC 4.46(3). Exhibit AA is a copy of an e-mail from a medical fee dispute reviewer, Alex Kauffman, correcting a number regarding his review. The e-mail was sent to both counsel for the petitioner and to the vendor in this matter, on February 14, 2014. Exhibit AA is referenced in Respondent’s brief at page two, first paragraph. Exhibit AA has been added to the record for clarity in the chronology of this matter. As both parties received this e-mail, and the record is added for the purposes of clarifying facts in the record, the addition of Exhibit AA is not prejudicial to either party. In a ruling on a motion to strike the addendums, filed September 16, 2014, addendum numbers 3 and 4 were struck from the record. Addendum numbers 1, 2, 5, and 6 were not struck and shall, for the purposes of this decision, be referred to as Exhibits 1, 2, 5, and 6. By order filed by the acting workers’ compensation commissioner, this decision is designated file agency action. Any appeal of this decision would be a petition for judicial review under Iowa Code section 17A.19. ISSUES 1. Are the charges, recommended by the reviewer, unreasonable. 2. Is the acceptance of petitioner’s payment an accord and satisfaction. 3. Does Sequetor, vendor, have standing in this matter. In the brief in support of the contested case proceedings, petitioner also raised the issue that vendor, Sequetor, was engaged in the unauthorized practice of law. (Respondent’s brief pages 4-6) Following the filing of the petition, defendants retained legal counsel licensed to practice in Iowa. As a result, the contention that the vendor is engaged in the unauthorized practice of law is not an issue in this case and will not be discussed in this decision. FINDINGS OF FACT On March 19, 2010, Cody Mills (Mills) fell approximately 25 feet from scaffolding while working for Alan Stevens Associates, Inc. The record indicates Mills landed on his head. (Exhibit K; Exhibit L, page 29) Mills was transported to Cedars Sinai Medical Center in Los Angeles, California. Cedars Sinai is a designated level one trauma center. (Ex. C) Mills was initially assessed as having a left frontal hematoma. (Ex. K; Ex. L, p. 29) On March 19, 2010 Mills underwent an emergency craniotomy, and an epidural drain placement. Mills was also assessed as having a complete fracture of the anterolateral orbital complex. Mills was transferred to the Neurosurgical Intensive Care Unit at Cedars Sinai. (Ex. K; Ex. L, pp. 41-42, 79) UNITED FIRE & CASUALTY V. CEDARS SINAI MEDICAL CENTER Page 3 On March 20, 2010 Mills underwent a second emergency procedure including a right frontal craniotomy, evacuation of a right-sided hematoma, and the placement of a ventricular drain to monitor intracranial pressure. (Ex. K; Ex. L, pp. 13-14) Mills returned to the neurological intensive care unit, where he stayed until April of 2010. On March 24, 2010 Mills underwent a tracheotomy and placement of a feeding tube. (Ex. K; Ex. L, pp. 63-66) On April 9, 2010 Mills had an external ventricular drain and an inferior vena cava filter placed. (Ex. K; Ex. 1; Ex. L) On April 26, 2010 Mills had a ventricular shunt placed. (Ex. K; Ex. L) On May 10, 2010 Mills had a right occipital ventriculoperitoneal shunt placed. (Ex. K; Ex. L, p. 419) On June 1, 2010 Mills underwent a cranioplasty on the left. (Ex. K; Ex. L, p. 505) On June 4, 2010 a ventriculoperitoneal shunt was replaced. (Ex. K; Ex. L, p. 543) On June 9, 2010 the shunt was removed and an external ventricular drain was placed. (Ex. K; Ex. L, p. 543) On June 28, 2010 Mills had another ventriculoperitoneal shunt placed. (Ex. L, p. 681; Ex. 1) On July 7, 2010 Mills underwent a thoracocentesis to remove fluid. (Ex. L, p. 665; Ex. 1) On July 8, 2010 Mills had a chest tube placed. (Ex. L, p. 646; Ex. 1) On July 20, 2010 Mills had a ventriculoperitoneal shunt placed in the abdomen. (Ex. L, p. 609; Ex. 1) Mills was discharged from Cedars Sinai on July 28, 2010 after spending 131 days at the facility inpatient. In total, Mills underwent approximately 23 surgical procedures. Records indicate he underwent a number of diagnostic tests including, but not limited to multiple x-rays, CT scans, EEGs, and echocardiograms. (Ex. L) Mills was discharged from Cedars Sinai on July 20, 2010. He was assessed at that time, as having ventriculitis (inflammation of the ventricles in the brain), intraventricular hemorrhage, hydrocephalus, pulmonary embolism, postoperative right frontal epidural hematoma, a massive left frontal epidural hemorrhage, a complex anterior skull fracture, a maxillary and orbital fracture, and a thalamic storm. According to the record, a thalamic storm is excessive and uncontrollable activities of the sympathetic nervous system leading to increased heart rate, restlessness, increased respiratory rate, and fever. Thalamic storms are usually associated with brain injuries. (Ex. K; Ex. L, p. 29-30) UNITED FIRE & CASUALTY V. CEDARS SINAI MEDICAL CENTER Page 4 The bill for Mills’ hospitalization at Cedars Sinai was $5,314,001.96. (Ex. G, p. 4) The bill was submitted to UFC for payment. UFC submitted the bill to Alpha Review, a bill reviewing agency. In a review that appears to be dated September 28, 2010, Alpha determined the reimbursable amount owed totaled $939,455.04. (Ex. G, pp. 1-4; Ex. 6) Notes on the review indicate that charges were priced in accordance to the First Health Contract. Notes on the review also indicate that “. . . all reductions are in accordance with the medical fee schedule as per the rules and regulations authorized by California Labor Code Section 4603.5 and 5307.1.” (Ex. G, p. 4) A check for $939,455.03 was paid by UFC to Cedars Sinai dated October 11, 2010. (Ex. 6) A second review was performed by Alpha. This review appears to have been performed in late October 2011. The second review allowed for an additional $740.78 to be paid. (Ex. H) Notes at the end of this review indicate “. . . unless otherwise noted, all bill review reductions are due to charges exceeding amounts that would appear reasonable for the provider’s geographic region.” (Ex. H, p. 6) A second check, dated November 2, 2011, was paid to Cedars Sinai for $740.78. (Ex. 6) In a report dated May 13, 2013 Mindy Daugherty, RN, gave her opinions of the billing associated with the Mills’ claim. Ms. Daugherty indicated, in the report, she has been a nurse for over 20 years and has 10 years’ experience in the accuracy of medical bills and the reasonableness of charges. Nurse Daugherty indicates that as many as 43 states have medical fee schedules to standardize the costs associated with workers’ compensation medical claims. (Ex. K) Ms. Daugherty noted that there are two types of fee schedules used regarding workers’ compensation claims. They are the relative value scale (RVS) and the usual customary and reasonable scale (UCR). The RVS schedule is based on what fees “should” cost. Ms. Daugherty indicates the most common RVS schedule is the Medicare payment system. The UCR schedule is based upon what medical providers “typically” charge for medical services. (Ex. K, p. 3) Ms. Daugherty indicated that the Medicare payment schedule for inpatient services is based upon the MS-DRG system (DRG standing for diagnostic related groups). She indicated that if a patient contracts a hospital-acquired condition, the payment received under Medicare is lessened in an effort to encourage hospitals to provide quality healthcare. (Ex. K, pp. 4-5) Ms. Daugherty indicated that the Official Medical Fee Schedule (OMFS) for California workers’ compensation cases is issued by the DWC administrative director and can be found in Title 8 of the California Code of Regulation. Ms. Daugherty indicated that the OMFS system is based upon the Medicare DRG system. (Ex. K, p. 5) Ms. Daugherty indicated that the Mills’ charges would be assessed under the MS-DRG system, as the highest severity rating of major complications given the nature of Mills’ condition. (Ex. K, p. 6) She opined that under the MS-DRG system, Cedars Sinai UNITED FIRE & CASUALTY V. CEDARS SINAI MEDICAL CENTER Page 5 would have received $846,370.44 if the claims had been paid by Medicare. (Ex. K, pp. 5-7) She also suggests that Mills’ stay as an inpatient was likely extended due to alleged hospital acquired conditions (e.g. pneumonia and infections). She opined that because Medicare would analyze these conditions as hospital related, charges associated with pneumonia or other infections, would have received a lower Medicare payment. (Ex. K, pp. 5-6) Ms. Daugherty opined that because the OMFS for California is based upon the MS-DRG system, the reimbursement Cedars Sinai received from UFC would have been reasonable under California and Iowa law. (Ex. K, p. 6) The petitioner and respondents were unable to agree to full payment of the Mills’ bills. The parties chose to pursue resolution of the matter under rule 876 IAC 10.3. Alex Kauffman was ultimately selected as the bill reviewer by the Iowa workers’ compensation commissioner under the procedures of 876 IAC 10.3. Once Mr. Kauffman was chosen as the bill reviewer, counsel for UFC wrote to Mr. Kauffman in a letter dated December 17, 2013. The letter indicates Mr. Kauffman was given an itemization of charges and medical records for his review. UFC counsel also provided Mr. Kauffman with the Alpha Review documentation, Ms. Daugherty’s report, and a document entitled “Collector’s Notes.” (Ex. F) In a report dated February 10, 2014, Mr. Kauffman gave his opinions regarding the charges associated with the Mills’ claims. Mr. Kauffman indicated that for the Mills’ charges, he reviewed CMS billing forms, medical records, hospital charges, bill reviews performed by Alpha Review, and the report from Ms. Daugherty. (Ex. C) Ms. Kauffman indicated that he has been performing bill review and analyzing bills since 1999 for both insurance companies and providers in California. He indicated he is familiar with the California administrative code regarding workers’ compensation fees and has been appointed by California workers’ compensation judges to conduct independent bill reviews. (Ex. C) Mr. Kauffman indicated petitioner paid the provider, based on a DRG analysis representing an average length of stay of 31.6 days. Mills was inpatient for 131 days. He also noted that the fee schedule used by UFC was unreasonable, as it did not take into consideration Mills’ trauma designation, and the intense inpatient care required by Mills. (Ex. C, p. 5) Mr. Kauffman opined the claims should have been paid under CCR 9789.22(i)(1) using a per diem method. This would have resulted in a total payment of $3,894,576.10. Using the per diem method Mr. Kauffman opined that the insurer should pay $2,955,121.10 ($3,894,576.10 - $939,455.03 already paid). Mr. Kauffman also opined that another way to review the bills at issue is that the provider should have been paid at 90 percent of billed charges as per a report UNITED FIRE & CASUALTY V. CEDARS SINAI MEDICAL CENTER Page 6 sponsored by the RAND Corporation. This would have resulted in billed charges of $4,782,601.70, leaving the amount owed by the insurer to be $3,843,146.70 ($4,782,601 less $939,455.10). (Ex. C, p. 7) The RAND report, referenced at Exhibit C, page 7, is a report titled “An Update on Services Provided Under California’s Workers’ Compensation Program”, authored by Barbara O. Wynn, and sponsored by the RAND corporation. The report makes findings and recommendations regarding hospital services provided under the California Workers’ Compensation system. (Ex. A, pp. 6-9, 15-17) Mr. Kauffman averaged all three methods of payment together to reach an average due of $2,579,240.90, less amounts paid, plus interest. (Ex. C; Ex. AA) In subsequent correspondence Mr. Kauffman corrected an error and noted that the amount owed by defendant insurer should be $2,266,089.20. (Ex. AA; Respondent’s brief, p. 2) CONCLUSIONS OF LAW The first issue to be determined is if the additional charges, opined as due by Mr. Kauffman, are unreasonable. Petitioner in this matter has the burden of proof to show that the recommended charges are unreasonable under 876 IAC 4.46(1) and (4). As detailed above, Mills had a life-threatening injury after falling 25 feet from scaffolding. He underwent over 20 surgical procedures. It is true, as Ms. Daugherty indicates in her report, that some of the surgical procedures were minor and were performed at bedside. It is also true that a number of the 23 surgical procedures were not minor procedures. These surgeries include three craniotomies (Ex. L, pp. 13-14; 41-42; 505), insertion of a feeding tube (Ex. L, p. 63), a tracheotomy (Ex. L, p. 65) and the placement of a number of shunts in the skull. (Ex. L, pp. 419, 543, 681, 609) Mills spent 131 days inpatient at Cedars Sinai. Two experts have opined regarding the reasonableness of charges. Ms. Daugherty, the petitioner’s expert, opined that the charges for Cedars Sinai are excessive, and the amount paid by UFC was reasonable. Mr. Kauffman averaged three different analyses of the bills at issue and opined that UFC still owed Cedars Sinai $2,266,089.20, less amounts paid plus interest. (Ex. C; Ex. AA; Respondent’s brief p. 2) Mr. Kauffman’s report has the advantage, in that he was able to review Nurse Daugherty’s evaluation prior to issuing his report. Nurse Daugherty did not review, and could not opine, regarding Mr. Kauffman’s opinions. Mr. Kauffman’s report indicates he routinely evaluates claims using OMFS standards in California for both providers and insurance. Mr. Kauffman is certified, under California law, to review medical bills. Nurse Daugherty does not indicate she UNITED FIRE & CASUALTY V. CEDARS SINAI MEDICAL CENTER Page 7 has any experience in reviewing California medical claims. Nurse Daugherty does not indicate that she is certified under California insurance law. (Ex. C, p. 3) Mr. Kauffman opines the insurer used a fee schedule based on an average length of stay for patients of 31.6 days. Mr. Mills was inpatient at Cedars Sinai for 131 days. Nurse Daugherty does not discuss this discrepancy. (Ex. C, p. 4) Nurse Daugherty refers to the OMFS (the fee schedule for California). However, her report indicates that she did not base her opinions on the OMFS, but instead relied on Medicare regulations to reach her conclusions. (Ex. K, pp. 5-6) Mr. Kauffman specifically referred to regulations in California regarding his opinions. All three of the analyses used specifically refer to California workers’ compensation law. (Ex. C, pp. 67) Mr. Kauffman was supplied with input from both the insurer and the provider and used that information in arriving at his opinions regarding the reasonableness of the Mills’ charges. (Ex. C; Ex. F) Nurse Daugherty’s opinions were based on information provided only by the insurer. (Ex. K) Mr. Kauffman was able to review Nurse Daugherty’s opinions. His report indicates he has far more experience in evaluating California workers’ compensation medical claims than does Nurse Daugherty. Mr. Kauffman relied on California law to reach his opinions. Nurse Daugherty relied on Medicare regulations. Mr. Kauffman opined the insurer based the payment and claims, in part, on a fee schedule based on an average length of inpatient stay of 31.6 days. Mills was inpatient for 131 days. Nurse Daugherty did not address this discrepancy. Mr. Kauffman had input from both the insurer and provider. Nurse Daugherty only had information from the insurer. For these reasons, and others as detailed above, it is found that the opinions of Mr. Kauffman are more convincing than the opinions of Nurse Daugherty regarding the reasonableness of charges. An additional aspect in this case is the amount of time Mills was in Cedars Sinai and the lack of involvement during his stay on the behalf of the insurer. Under Iowa law, the employer has the right to choose the provider of care except where the employer has denied liability. Iowa Code section 85.27. Under Iowa law, an employer must pay for all medical treatment they authorize and direct. Van Dyke v. Vermeer Manufacturing, File No. 5012087 (App. Decision June 23, 2006). As noted above, Mills was inpatient at Cedars Sinai for 131 days. There is nothing in the record suggesting the petitioner/insurer attempted to direct or monitor care in this case. Given the time spent by Mills at Cedars Sinai, and the fact that defendant insurer did not attempt to monitor charges in this matter, defendant insurer should not now claim that charges are excessive and ultimately pay less than one-fifth of the amounts charged. Given the duration of time Mills spent inpatient at Cedars Sinai, defendant insurer has some obligation to monitor the care at issue in this case. UNITED FIRE & CASUALTY V. CEDARS SINAI MEDICAL CENTER Page 8 Mills was hospitalized for 131 days in this matter. He received over 20 surgical procedures. The review of Mr. Kauffman is found to be more convincing than that of Ms. Daugherty. Given this record, petitioner UFC has failed to carry its burden of proof that the charges sought by respondents are unreasonable. The next issue to be determined is if acceptance of payment by respondent resulted in an accord and satisfaction for all charges. Rule 876 IAC 4.46(3) states, in relevant part: “. . . the issues of the contested case proceedings shall be limited to the dispute considered in rule . . .” 876 IAC 10.3. Accord and satisfaction was not at issue in the underlying fee dispute in this matter between the parties under 876 IAC 10.3. For this reason, accord and satisfaction is not an issue that can be determined in this contested case proceeding. Assuming for argument sake that petitioner can still bring the issue of accord and satisfaction in this contested case proceeding, an accord and satisfaction has not occurred in this matter. Iowa Code section 554.3311(4) states: A claim is discharged if the person against whom the claim is assessed proves that within a reasonable time before the collection of the instrument was initiated, the claimant, or an agent of the claimant . . . knew that the instrument was tendered in full satisfaction of the claim. There is no indication in the record that Sequetor or Cedars Sinai knew that the check for $939,455.03 was tendered in full satisfaction of the bills at issue. Nothing on the check found at Exhibit G indicates that the check was tendered to be full satisfaction of the medical bills at issue. For this reason, there was no accord and satisfaction under Iowa Code section 554.3311. The final issue to be determined is whether Sequetor, has standing to be involved as a party in this matter. As noted above, rule 876 IAC 4.46(3) indicates that the issues of the contested case proceeding are limited to the disputes considered in the rule 876 IAC 10.3 proceeding. Standing was not at issue in the underlying fee dispute between the parties under rule 876 IAC 10.3. For this reason, standing is not an issue to be determined in this contested case proceeding. Assuming for argument sake that standing can still be raised as an issue in this contested case proceeding, Sequetor is a party that has standing in this matter. The record indicates that Cedars Sinai hired Sequetor as its agent in resolving the outstanding workers’ compensation payment issues in this case. (Ex. 5) Sequetor is working as a vendor or agent of Cedars Sinai. There is no prejudice shown by allowing Sequetor to be a party in this proceeding. For these reasons, Sequetor has standing to be involved in this proceeding. UNITED FIRE & CASUALTY V. CEDARS SINAI MEDICAL CENTER Page 9 ORDER THEREFORE IT IS ORDERED: That petitioner, United Fire & Casualty, shall pay provider and vendor, together referred to as respondent, two-million two-hundred sixty-six thousand eighty-nine and 20/100 dollars ($2,266,089.20), less amounts previously paid. Signed and filed this ___________ day of December, 2014. JAMES F. CHRISTENSON DEPUTY WORKERS’ COMPENSATION COMMISSIONER Copies To: Sasha Monthei Attorney at Law PO Box 36 Cedar Rapids, IA 52406 smonthei@scheldruplaw.com Jane V. Lorentzen Attorney at Law 2700 Grand Ave., Ste. 111 Des Moines, IA 50312 jlorentzen@hhlawpc.com JFC/sam