Account Mapping - Core-CT

advertisement

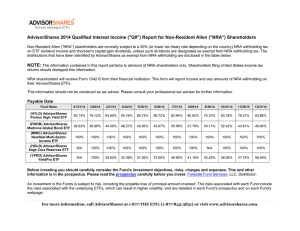

Account Mapping Document Last Updated: September 2015 Overview: The State of Connecticut will use an Account Mapping process within the Core-CT PeopleSoft HRMS system to map certain earnings, deductions, and taxes to expenditure accounts as defined by the requirements gathering of the Core-CT Financials team. Due to the fixed criteria defined by the State of Connecticut for distributing its payroll expenditures, the Account Mapping process will allow for a standard and less complex payroll distribution process that will be easily understandable and maintainable now and in future years. Funding sources for all payroll expenditures will be made up of chartfield combinations, which will then be stored in the Core-CT HRMS system as account codes. One component of the account code is the Account chartfield. Core-CT HRMS has been configured to have each position tied to at least one account code, which will be used to fund any payroll expenditures associated with that position. Every account code that will be used in the HRMS system will have a default value defined for the Account chartfield. This configuration of the account codes will ultimately reduce the burden Agencies will have to bear when choosing the proper funding source for each position, as it can be assumed that the Core-CT HRMS system will always map the correct account to the assigned account code based on the Account Mapping rules that will be discussed in this document. This document will detail the Account Mapping process for earnings, deductions, and taxes. As accounts are added or deleted from the overall account structure, updates will need to be made to the configuration to properly reflect the State of Connecticut’s business needs for payroll expenditure distribution. Earnings: Earnings paid by the State of Connecticut will be distributed to an account code / funding source as designated by their position unless the account code is overridden in the payroll process. Since an employee’s earnings can constitute a variety of different payment types, the State wishes to track each payroll expense independently of each other by automatically assigning them to a distinct account through the Account Mapping process. See Appendix 2 for a complete listing of deduction codes that map to a specific account. The Account Mapping process will be based on the following logic: Page 1 of 7 Account Mapping Document Last Updated: September 2015 1. In the first step, the mapping process will evaluate whether the earn code that was reported has been configured to map directly to an account. If it has been configured, then the account it is mapped to will be used to overwrite the default account in the employee’s account code combination when payroll expenditures are distributed for those earnings. If it has not been configured, then the process will proceed to step 2. 50160 - Longevity Payments 50170 - Overtime Payments Does the Earn Code map directly to an account? Yes 50180 - Differential Payments 50190 - Accumulated Leave 50210 - Meal Allowance 50710 - Employee Allow & Reportable Payments 50720 - Employee Non-Reportable Payments 50730 - Fees Paid To Employees 50740 - Interest Penalty - Payroll Awards 50750 - Education & Training For Employees No 50760 - Tuition Reimbursement 50780 - Employee Travel In-State Travel 50790 - Employee Travel Out-State Travel 50800 - Employee Travel Mileage Reimbursement 2. If their JobCode has been configured, the appropriate account is selected, which will apply to all earnings for the employee. If it has not been configured, then the process will proceed to step 3. 3. If an employee is classified with an Employee Class that has been configured, then the corresponding account will be mapped to all earnings. Else, the mapping process will proceed to Step 4 *See Appendix 2 for a complete listing of earn codes and their corresponding accounts. 50200 - Graduate Assistants Does the Job Code map directly to an account? Yes 50220 - Cooperative Ed (Co-op) Students * JobCode = '2552V1' No * JobCode = '2552VR' 50120 - Salaries & Wages - Temporary * Employee Class = 'Judicial Temporary' Does the Employee Class map directly to an account? * Employee Class = 'Legislative Temporary' Yes 5. Finally, if the earnings paid to an employee have not been mapped to an account, this final step will map the earnings based on whether the employee is full or part time. 50140 - Salaries & Wages - Student Labor * Employee Class = 'Student Laborer' Is the employee Regular or Temporary? Temporary 50120 - Salaries & Wages - Temporary Regular 50110 - Salaries & Wages - Full Time Is the employee Full / Part Time? *Note: All earnings will be mapped to an account. Page 2 of 7 50130 - Salaries & Wages - Contractual * Employee Class = 'Contractor - No Benefits' No 4. If an employee is classified as Temporary, then all earnings will be mapped to the corresponding account. Else, the mapping process will proceed to Step 5. *See Appendix 2 for a complete listing of jobcodes and their corresponding accounts. Full Time Part Time 50150 - Salaries & Wages - Part Time Account Mapping Document Last Updated: September 2015 Deductions: Fringe benefits provided by the State of Connecticut will be distributed to the same account code / funding source as an employee’s earnings unless otherwise overridden in the payroll process. As a way to differentiate each class of deduction from other deductions and from earning payments, the Account Mapping functionality will again be utilized. See Appendix 3 for a complete listing of deduction codes that map to a specific account. Group Life Insurance – Account 50410 Medical / Dental Insurance – Account 50420 Unemployment Compensation – Account 50430 Retirement – Account 50470 o SERS – Account 50471 o ARP – Account 50472 o Teacher’s Retirement System – Account 50473 o Judges & Comp Commissioners – Account 50474 o Other Statutory – Account 50475 Employee Death Benefits – Account 50500 Buy Back Option – Account 50510 Taxes: Taxes will follow the same process of mapping an account to the account code / funding source as the earnings and deduction mapping. Only employer paid taxes will be included in the distribution of funds. Social Security – Account 50440 o FICA / OASDI (ER) – Account 50441 o FICA / MED (ER) – Account 50442 Page 3 of 7 Account Mapping Document Last Updated: September 2015 Appendix 1 - Distribution properties of a regular employee’s check. Regular Employee with the following account code / funding source: Account Code Account Deptid Project_Id Fund Program SID / Budget_Ref Class DCP3950011000100100000001 50600 DCP39500 11000 00000 10010 2003 *Note: The Account Code for this employee is the default funding source for their position. It does not contain all chartfields available for configuration. Employee’s Paycheck Earnings: Regular Pay (REG) – 80 hours @ $10/hour = $800.00 Overtime Pay (OT1) – 10 hours @ $15/hour = $150.00 Longevity Pay (LNG) – Flat Amount = $100.00 Differential Pay (SD1) – 10 hours @ $.50/hour = $5.00 Total Gross Pay = $1155.00 Taxes: Federal Withholding State Withholding FICA / OASDI (EE) FICA / OASDI (ER) FICA / MED (EE) FICA / MED (ER) Total Taxes = $146.62 = $51.98 = $71.61 = $71.61 = $16.75 = $16.75 = $286.96 Deductions: Medical (ANTM01 – EE) Medical (ANTM01 – ER) Dental (CIGDEN – EE) Dental (CIGDEN – ER) Life (LIFBAS – ER) Savings Bond (SAVBND) Total Deductions = $15.00 = $100.00 = $10.00 = $50.00 = $5.00 = $100.00 = $125.00 Net Pay = $743.04 *Numbers are not based on true tax calculations. Distribution: Default After After After After After After After After After Payment / Deduction / Tax Monetary Amount Regular Overtime Longevity Differential Medical Dental Life FICA/OASDI(ER) FICA/MED (ER) $800.00 $150.00 $100.00 $ 5.00 $100.00 $ 50.00 $ 5.00 $ 71.61 $ 16.75 Page 4 of 7 Account Code Account Deptid DCP3950011000100100000001 DCP3950011000100100000001 DCP3950011000100100000001 DCP3950011000100100000001 DCP3950011000100100000001 DCP3950011000100100000001 DCP3950011000100100000001 DCP3950011000100100000001 DCP3950011000100100000001 DCP3950011000100100000001 50600 50110 50170 50160 50180 50420 50420 50410 50441 50442 DCP39500 DCP39500 DCP39500 DCP39500 DCP39500 DCP39500 DCP39500 DCP39500 DCP39500 DCP39500 Project Id Fund Program 11000 11000 11000 11000 11000 11000 11000 11000 11000 11000 00000 00000 00000 00000 00000 00000 00000 00000 00000 00000 SID / Class 10010 10010 10010 10010 10010 10010 10010 10010 10010 10010 Budget Ref 2003 2003 2003 2003 2003 2003 2003 2003 2003 2003 Account Mapping Document Last Updated: September 2015 Appendix 2 Job Codes Account 50200 50200 50200 50200 50200 50200 50200 50200 50200 50200 50200 Setid UNIVS UNIVS UNIVS UNIVS UNIVS UNIVS UNIVS UNIVS UNIVS UNIVS UNIVS JobCode 4185V1 4185VR 045C1 2178C1 2178C2 2178C3 2178C4 2178C5 2178CE 2178V1 2178M1 Description GraduateAssistant GraduateAssistant CCEducAsst CCEducAsst CCEducAsst CCEducAsst CCEducAsst CCEducAsst CCEducAsst CCEducAsst CCEducAsst 50170 50170 50170 50170 50170 50170 50170 50170 50180 50180 50180 50180 50180 50180 50180 50180 Y07 Y08 Z02 Z07 Z08 HOP HPR HPA CD2 CD3 CD4 CD5 CD6 DCV DF1 DF2 OT Dbl NRA Inc Code 19 OT 1 1/2 NRA Inc Code 19 OT Straight NRA Inc Code 50 OT Dbl NRA Inc Code 50 OT 1 1/2 NRA Inc Code 50 Holiday Paid Holiday Premium Holiday Premium Paid Additionl Certificate Diff. Level 2 .50 Certificate Diff. Level 3 .70 Certificate Diff. Level 4 .90 Certificate Diff. Levl 5 1.30 Certificate Diff. Levl 6 1.60 Skill Diff. Driver Crash Vhcl Pay Differential Freezer .60x Pay Differentl Freezr .60 1.5 Earn Codes Account 50140 50140 50150 50160 50160 50160 50160 50160 50160 50160 50160 50160 50170 50170 50170 50170 50170 50170 50170 50170 50170 50170 50170 50170 50170 50170 50170 50170 50170 50170 50170 50170 50170 50170 50170 50170 50170 50170 50170 50170 50170 50170 50170 50170 50170 Earn Code Description SL1 Student Labor Reg Pay Sub FICA SL2 Student Labor Reg Pay No FICA SUB SDE Inhouse Substitute Pay LNA Longevity Adjustment LNG Longevity T03 Longevity NRA Inc Code 12 U03 Longevity NRA Inc Code 15 V03 Longevity NRA Inc Code 16 W03 Longevity NRA Inc Code 17 X03 Longevity NRA Inc Code 18 Y03 Longevity NRA Inc Code 19 Z03 Longevity NRA Inc Code 50 OFO Time and a Half OT FLSA OT1 Time and a Half OT OT2 Double Time OT Amounts OT3 Time and a Half OT Amounts OT4 Straight Time OT Amounts OT5 Time and a Qtr OT OTA OT Adjustment OTD Double Time OT OTH Half Time OT OTP Time and a Half OT HCP OTS Straight Time OT QFL Q104 FLSA Overtime QHZ Q StraightTime OT and HazDuty QOF Q FLSA Overtime QOH Q 1.5 Overtime and Haz Duty QOT Q 1.5 Overtime QST Q Straight Time OT T02 OT Straight NRA Inc Code 12 T07 OT Dbl NRA Inc Code 12 T08 OT 1 1/2 NRA Inc Code 12 U02 OT Straight NRA Inc Code 15 U07 OT Dbl NRA Inc Code 15 U08 OT 1 1/2 NRA Inc Code 15 V02 OT Straight NRA Inc Code 16 V07 OT Dbl NRA Inc Code 16 V08 OT 1 1/2 NRA Inc Code 16 W02 OT Straight NRA Inc Code 17 W07 OT Dbl NRA Inc Code 17 W08 OT 1 1/2 NRA Inc Code 17 X02 OT Straight NRA Inc Code 18 X07 OT Dbl NRA Inc Code 18 X08 OT 1 1/2 NRA Inc Code 18 Y02 OT Straight NRA Inc Code 19 Page 5 of 7 Account 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 50180 Earn Code Description DI1 Pay Differential Inmate .60 1x DI2 Pay Differentl Inmate .60 1.5 DOF Duty Officer 10% F11 Shift Diff .49 1x FLSA F12 Shift Diff .49 1.5 FLSA F21 Shift Diff .65 1x FLSA F22 Shiff Diff .65 1.5 FLSA F31 Shift Diff .75 1x FLSA F32 Shift Diff. 75 1.5 FLSA F41 Shift Diff 2.00 Tmp Night FLSA F51 1199 Shift Diff 1 x FLSA F52 1199 Shift Diff 1.5 x FLSA HD1 Hazardous Duty .50 1x HD2 Hazardous Duty .50 1.5 HD3 Hazardous Duty .55 1x HD4 Hazardous Duty .55 1.5 HD5 Hazardous Duty .45 1x HDA Hazardous Duty Amount HDP Hazardous Duty 25% HDS Hazardous Duty Saw .40 K9H K9 Daily Home Care 10.41 LDF Lane Differential .25 N11 Shift Diff .49 1x No FLSA N21 Shift Diff .65 1x No FLSA N31 Shift Diff .75 1x No FLSA N41 1199 Shift Diff 1 x No FLSA OC1 On Call/Standby 1.00 OC2 On Call/Standby 1.50 OC3 On Call/Standby 3.00 OCA On Call/Standby Amount OCF On Call/Standby Fire/Crash .70 PD1 Pay Differential .55 PD2 Pay Differential .60 SD1 Shift Diff I SD2 Shift Diff 2 Time and a Half SD3 Shift Diff 3 SDA Skill Differential Amount SE2 Selective Duty Shift Diff SE3 Selective Duty Shift Weekend SIR Snow & Ice Removal 1.40 SKP Skill Premium Amount Account Mapping Document Last Updated: September 2015 50180 50180 50180 50180 50190 50190 50190 50190 50190 50190 50210 50210 50210 50210 50210 50210 50210 50210 50210 50210 50210 50210 50210 50710 50710 SPF WD1 WD2 WD3 DT2 DT4 PPH RSP VPA VPH EXP ML0 ML1 ML2 ML3 ML4 ML5 ML6 ML7 ML8 ML9 MLA MLP ATT AUT Page 6 of 7 Skill Premium FireFighter .75 Week End Differential .40 Week End Differential .50 1199 Week End Differential Year of Death Sick Year After Death Sick Personal Leave Payout Hours Retirement Sick Pay Vacation Payout Amounts Vacation Payout Hours Lodge/Meal Expense Meal - DOC 6.00 Meal - DPS 8.75 Meal - DPS 13.21 Meal - DPS 15.45 Meal - DPS 18.78 Meal - DOC 7.00 Meal - HCP 8.75 Meal - HCP 13.21 Meal - HCP 15.45 Meal - HCP 18.78 Meal Allowance Meal - HCP Attendance Award Auto Usage Fee 50710 50710 50710 50710 50710 50710 50710 50710 50710 50710 50710 50710 50710 50710 50710 50710 50720 50730 50730 50740 50760 50780 50790 50800 CER CHI CLN COM GRA HOM INO KEN LTE MIL RER SHU TRP UNF UNT UNV NRL PDJ CTR INT TU1 NRI NRO NRM Certification Fee Child Care Clothing/Cleaning Commutation Pay Grant Home/Office Innovation Award Kennel Allowance Legislative Travel Exp Reportable Mileage Reportable Reimbursements Safety Shoe Res Troopers Uniform Union Tuition and Training Unvouchered Expense Non Reportable Reimbursement - LEG Per Diem Payment Judicial Court Transcribers Interest Arb Award Tuition Reim - No Tax Non Rpt Reimburse In State Non Rpt Reimburse Out of State Non Reportable Mileage Account Mapping Document Last Updated: September 2015 Appendix 3 Deduction Codes Account 50410 50410 50420 50420 50420 50420 50420 50420 50420 50420 50420 50420 50420 50420 50420 50420 50420 50420 50420 50420 50420 50420 50420 50420 50420 Dedcd Ded_Class LIFBAS N LIFSUP N ANDPD1 T ANDPD2 T ANDPM1 T ANDPM2 T ANDPM3 T ANDPM4 T ANDPM5 T ANQDD1 N ANQDD2 N ANQDM1 N ANQDM2 N ANQDM3 N ANQDM4 N ANQDM5 N ANTD01 N ANTD02 N ANTM01 N ANTM02 N ANTM03 N ANTM04 N ANTM05 N CCDPM1 T CCDPM2 T * N – Nontaxable Deduction * T – Taxable Deduction Page 7 of 7 Description Life Ins. - Basic Life Ins. - Supplemental Anthem Dental A & C Anthem Dental A, B & C Anthem State BlueCare POS Anthem State BlueCare POE Anthem State BlueCare POE Plus Anthem State Preferred Anthem Out of Area Anthem Dental A & C Anthem Dental A, B & C Anthem State BlueCare POS Anthem State BlueCare POE Anthem State BlueCare POE Plus Anthem State Preferred Anthem Out of Area Anthem Dental A & C Anthem Dental A, B & C Anthem State BlueCare POS Anthem State BlueCare POE Anthem State BlueCare POE Plus Anthem State Preferred Anthem Out of Area ConnectiCare POS ConnectiCare POE Account 50420 50420 50420 50420 50420 50420 50420 50420 50420 50420 50420 50420 50420 50420 50420 50420 50420 50420 50420 50430 50471 50471 50471 50472 50473 50474 Dedcd Ded_Class CCDPM3 T CCQDM1 N CCQDM2 N CCQDM3 N CIGDEN N CIGDPD T CIGQDD N CTCM01 N CTCM02 N CTCM03 N HNDPM1 T HNDPM2 T HNDPM3 T HNQDM1 N HNQDM2 N HNQDM3 N HNTM01 N HNTM02 N HNTM03 N UNCER N RHAZER N RSERER N RSUCON N RALTER N RTRER N RJUDER N Description ConnectiCare HMO PC ConnectiCare POS ConnectiCare POE ConnectiCare HMO PC CIGNA Dental CIGNA Dental CIGNA Dental ConnectiCare POS ConnectiCare POE ConnectiCare HMO PC Health Net Charter POS Health Net Charter HMO Health Net Passport HMO Health Net Charter POS Health Net Charter HMO Health Net Passport HMO Health Net Charter POS Health Net Charter HMO Health Net Passport HMO Employer Unemployment Comp Employer SERS Hazardous Duty Employer SERS Ret Employee Employer UCONN Retirement Employer Alternate Retirement Employer Teachers Retirement Employer Judges Retirement