Insurance Issues - ANU Law Students' Society

advertisement

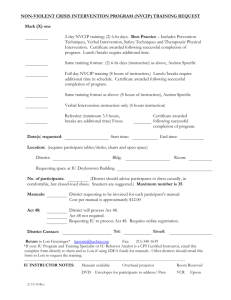

How to Use this Script: These Sample Exam Answers are based on problems done in the past two years. Since these answers were written the law may have changed and/or the subject may have changed. Additionally, the student may have made some mistakes in their answer, despite their good mark. Therefore DO NOT use this script by copying or simplifying part of it directly for use in your exam or to supplement your summary. If you do so YOUR MARK WILL PROBABLY END UP BEING WORSE! The LSS is providing this script to give you an idea as to the depth of analysis required in exams and examples of possible structures and hence to provide direction for your own learning. Please do not use them for any other purposes - otherwise you are putting your academic future at risk. Commercial Law, Semester 1 2003, Questions 1 and 2, Score 82 Question 1 Insurance Issues Lois wants to recover her losses due to vandalism from her insurer. She has a contract for property insurance, not falling into any of the exceptions in s 9 of the Insurance Contracts Act 1984 (ICA). Common law and ICA therefore applicable. First thing to note is that policy only for $30,000, losses amount to $50,000. Lois can only recover up to the amount on her policy ($30,000). The remaining $20,000 will be a dead loss unless she is able to sue the vandal or Hal. If Lois can successfully recover the $30,000 under insurance contract, her insurer might also want to sue either Hal or the vandal. General rule is that insurer would be able to do so due to doctrine of subrogation (see Castellain v Preston) – insurer acquires Lois’s ‘rights and remedies’ in respect of the loss. But note insurer cannot recover from Hal because is an employee of the insured: s 66, see Boral Resources. This is subject to Hal’s negligence amount to ‘serious or wilful misconduct’. Can Lois recover from insurer Insurer might try to deny indemnity on basis that Lois did not have an ‘insurable interest’ – property damaged owned by Antiques As New P/L (AAN), but contract in Lois’s own name – see Macura. However Lois can rely on ss 16 and 17 of ICA. She will be able to show ‘economic or pecuniary loss’ on grounds that as sole shareholder, the value of her shares has dropped as a result of the vandalism. She might also rely on her charge to this effect. Insurer might also try to avoid the contract or limit liability based on the warranty. It is likely that application of the contra proferentes rule to the first sentence of the warranty (owner of stock in trade) will result in it being construed as a statement of present fact rather than a future undertaking: Huddleston. It is a true statement on this construction, because Lois owned property personally when contract entered into. Lois is in better position than insured in Huddleston, because first sentence of warranty not even expressed in future tense. The second part of the warranty (‘remain responsible for stock in trade’) may constitute a continuing warranty subject to s 54 of the ICA. First question is whether Lois actually breached it. Once again, contra proferentes suggests that it will be read down to give effect to the commercial purpose of the contract: see Albion, Legal General v Eather. Lois will argue that commercial purpose of policy is to cover for exactly this type of loss (amongst other things) ie negligence of employee, vandalism. May argue as in Albion, that only in breach if deliberately courts a risk. Might need more evidence of extent to which employee was unsupervised, but in general likely that court will find it would be too onerous to require employers to supervise employees after hours, contrary to commercial purpose of the contract. If, however, Lois is in breach of the warranty s 54 requires consideration of whether her failure to be responsible for safety and security of stock ‘reasonably capable’ of causing or contributing to her loss (s 54(1) and (2)). In event breach is found, likely insurer would be able to avoid liability under s 54(2). Securities Issues Whether Reese and Francis will be able to access stock and equipment directly in order to satisfy their respective debts depends on a series of priority contests, governed by registration regime in Corporations Act. Lois’ Interest Lois has a registered floating charge, however she has not put in notice under s 279(3) of the Corporations Act 2001. She will therefore be deemed to have consented to losing priority to subsequent registered fixed charges created after her charge crystallises (s 279(2)). Rees’s Interest Reese also has a registered floating charge, however he appears to have given the prescribed notice under s 279(3). Francis’ Interest Francis has a registered fixed charge over equipment, but a floating charge over the stock ie) a typical fixed and floating charge over the whole undertaking. Priority All 3 charges are registered, priority therefore prima facie depends on time of registration (s 280(1)). Lois takes priority, except in respect of Francis’ fixed charge. A crucial question, however, is when the floating charges crystallised. There do not appear to have been any dealing outside the ordinary course of business (see Fire Nymph) and although Lois appears close to insolvency (and is in arrears with her debtors) there is unlikely to be cessation of business for the purposes of implicit crystallisation, see Woodroffes. It appears therefore that none of the floating charges will have crystallised. The question is whether Reese and Francis are then simply able to ‘call in’ their charges. This will depend on construction of charge document, and intention of parties and time charge created: Whitton. If the creditors can simply call on their charges, Lois will need to assert her priority, based on being the first registered. She will be able to assert priority against Riese, but not against Francis’ fixed charge over the equipment (s 279(2)). Question 2 Is receiver entitled to sell any of the stock? The $30,000 worth of stock supplied by Malcolm. Malcolm has an ‘all money’s’ retention of title clause in relation to the stock. Such a clause is not a charge (Armour, applied in Australia in Chattis). Hence there can be no argument that it is void against liquidator because unregistered. The $5000 of stock in its original state is unlikely to be available for liquidation. Issue is whether the restoration of the other $25,000 supplied by Malcolm has taken it outside the terms of his retention of title clause. Depends on application of doctrine of specification. Crucial question is whether the derived product is ‘reducible to the original materials’: Assoc Alloys per Bryson J. It appears that where only restoration is restiching of upholstery, it would be physically possible to return items to original state: this would be more problematic where furniture has been rebuilt. However Bryson J noted that question does not turn on physics alone – must consider ‘economic perspective’. Facts indicate that significant capital (upwards of $20,000) needed for this type of restoration work. We also know that Lois has ‘quite a flair’ for restoration. Bryson J cautioned against deciding that goods not specified where significant capital and skill is involved (no way to account for it in divvying proceeds). However these facts do not involve subcontracting, and are not on scale and complexity of processing in Alloys. Conclusion Malcolm may not be able to access much of the furniture. Specification is a ‘question of fact’. Each item will need to be separately considered. Customers’ Goods The customers’ goods have not been paid for and are in Lois’s (or her company’s) possession. Liquidator may be able to prevent their return until they are paid for (and thereby increase money available for creditors) by asserting a particular possessory lien: Bevan v Waters. Will need to show that the goods have been improved, or value has been added to them: Southern Livestock. Where they have merely been stored, no lien available. One problem may be customers arguing that goods merely maintained, not improved: see Patton. Mere stitching may only maintain furniture in current state. With this reservation liquidator may resist return until debt owing on each good (not general debt) is paid: Dinmore. If customers don’t collect, may dispose according to legislation: see Uncollected Goods Act. Cash Assets Malcolm has created a trust over proceeds of sale of his goods. This is not a charge: Assoc Alloys. However the trust is only valuable where Malcolm can separate and identify proceeds of sale of furniture supplied by him from other proceeds. Facts indicate no separate account. Malcolm may not be able to claim. Restoration Equipment Whether Malcolm has taken title (and go equipment not available for distribution) depends on whether property has passed to Malcolm. Property cannot pass in unascertained goods: SOGA ACT, 1954, s 21. Malcolm and Lois only agreed to sell $20,000 worth of equipment, they did not specify which $20,000 worth subject to sale. Malcolm will argue that there was only ever $20,000 of equipment – therefore property passed when contract made because goods were specific. Outcome depends on whether there is more than $20,000 of equipment.