Name - Reeths-Puffer Schools

advertisement

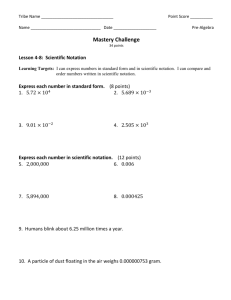

Name__________________________ Hour______________________ CREDIT CARD TEST 3 1.) Dan D. Lyons made $570 in purchases on his credit card in November, and made no payments on his November statement. One month later he receives his December statement. If his credit card company charges $14.07 in interest, what is his interest rate? 2.) Ginger Vitus has a previous balance of $300. If she made a $75 payment, purchased $120 worth of stuff and her new balance is $400, what is the amount of the interest? . 3.) Gladys C. Hugh made $740 in purchases on her card in June. She does not make any payments on her June statement. If her credit card company charged her $19.55 in interest, what is her interest rate? 4.) Dr. Payne shows a previous balance of $1300. He has interest charges totaling $68.50. He made a payment of $905, and his new balance is $910.00. How much did he make in new purchases? 5.) Hy Lowe was charged $190 in interest on his credit at a rate of 31.5%. What is the balance on his card? 6.) A.) Jim Shorts shows a previous balance of $1090 on his Master . . . . Card. He has interest charges totaling $124. He made a payment of $620, and purchased a bunch of unnecessary junk totaling $500. Calculate his new balance. B.) Jim’s minimum monthly payment is 5% of his closing balance or $40 whichever is greatest. Using his new balance of ____________ calculate his minimum monthly payment. 7.) Calculating credit Card statements Bank: Providian Sapphire Rewards Card APR: 47.9% Balance: $6,440 Calculation Method: Average Daily Balance Stats: Name: Ima Broke 35 years old Ph.D in Spendology Car loans, home equity loan, massive student loans Using credit card to pay for her car payment, utility bills, and morning latte. Currently studying how many swipes a credit card can take before it is unrecognizable. Goal: Calculate credit card bill for this next month Balance carried over from last month $6,440 Electric Cereal Box Opener, $90 on the 6th. Rims for car (Ford Escort), $370 on the 14th. Big screen TV, $1500 charge on the 20th. Burger King, $15 on the 25th Paying for your trip to Burger King for the next 39 years . . . Priceless Average Daily Balance: Total Balance: Daily Periodic Rate: Interest/Finance Charge: New Balance: Total Payment (4%): Principal Payment: Day Month Geometric Mean 8.) Joe Kerr is invested in Fisher Fund Triple a (a mutual fund that invests in global stocks) that has had the following annual returns: 2006 2007 2008 2009 9.5% 16.5% -1.4% 19.9% What is Joe’s annualized return rate? 9.) Joy Rider is invested in Edward Jones QAS (a mutual fund that invests in high growth potential companies) that has had the following annual returns: 2003 2004 2005 2006 2007 2008 20.60% 18.9% -2.7% 13.9% -.50% 8.7% What is the Joy’s annualized return rate? 10.) Laura Lynn Hardy is invested in CC3 Municipal Bond Fund (a mutual fund that invests in city bonds) that has had the following annual returns: a. b. c. d. -10.2% 19.6% 10.04% -.10% What is Laura’s annualized return rate? Show work: Calculate how much she will have if she started with $2000 (actual percentage) Calculate how much she will have by using the annualized rate. 11.) Explain in detail what happens when you try to close a credit card account. 12.) If you carry over a balance from month to month on a credit card you are known as a ________________________. 13.) If you pay off your balance every month you are known as a ___________________________. 14.) __________________ is the most marketed product in the world. 15.) Define “Kiddie Branding” as it pertains to credit cards. 16.) What is an “Universal Default”? 17.) Name two products that Visa sells. 18.) Why do people spend more when they pay with plastic? I=PRT 19.) If the principal balance on a credit card is $309 and the rate is 21.9%, how much interest will be charged in one month? 20.) If the interest charged for one month is $15.50, and the rate is 19%, what is the principal balance? 21.) If the interest charged for one month is 9.31, and the principal is $442, what is the rate that is being charged? Scientific Notation 22.) Write 4,678,567,000 in scientific notation 23.) Write .00000002 in scientific notation. 24.) Write 8,708 in “e” notation. 25.) Write .09 in “e” notation 26.) Write 3 X 107 in standard form. 27.) Write 5.875 X 10-2 in standard form. Extra Credit 1.) If you have the following returns, what is the annualized return? 1999 105% 2000 137% 2001 185% 28.) Credit Card Tricks _____________________: A fee charged to your account for not using it. It Kinda takes away the incentive to only use a credit card, “for emergencies only”. _____________________: A fee assessed to your account if you pay off the balance early. _____________________: Tempting you with low rates like 3.9%, 1.99%, or even 0% _________________________: This contains legal info like: Annual fee if applicable, other APRs (balance transfer, cash advances, default APRs), grace period, finance calculation method, and other transaction fees (balance transfers, late payments, exceeding credit limit fee, cash advances). _____________________: Sending you a notification that you are qualified to receive a very low rate only to find out after sending in the application that your rate is much higher because your FICO score is not quite good enough. ______________________: Instead of using a month to find your average daily balance they use two months. Note: It seems good at first but in the long run you are paying much more because you don’t get credit for making a payment. 28.) List three things debt collectors (whether from credit card companies or debt agencies) do that breaks federal law. 29.) What is the most marketed product in the world? 30.) What interest rates can credit card companies charge? 31.) If someone has a credit card balance of $2000 and defaults the balance will balloon to $8000 due to increased interest and fees galore. The credit card company will win whether that person pays or not. Explain. 32.) Every time a debit card or credit card is used the issuing bank gets a commission. What is the name for this commission? 33.) What can merchants in Michigan and 39 other states do with regards to the “commission” from question 32? 34.) Name three aspects of the Credit Card Act of 2009. Extra Credit Type Question Joe Gettensmart (age 18) , who eats fast food EVERYDAY, decides to eat healthy and saves up a mere $26 per week which he deposits into a Roth account at the end of each month. How much will he have when he is 48? 58?