The Rise of a Trade Association - Harvard Negotiation Law Review

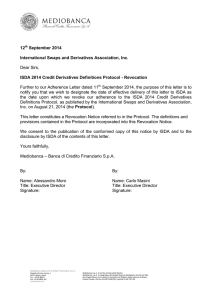

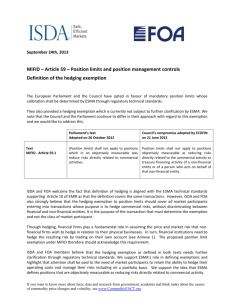

advertisement