CSA-Axis-Bank

advertisement

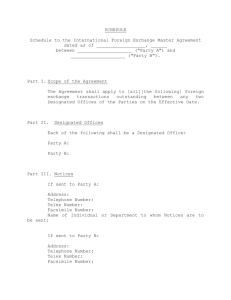

Credit Support Annex under ISDA framework vis-à-vis Legal and Regulatory Scenario in India Credit Support Agreement & Credit Support Annex Netting and Close-Out Netting Provisions under ISDA Master Agreement Whether Close-out Netting enforceable in India Legal Position in India Regulatory Scenario on CSA Perspective of ISDA ISDA Master + Schedule Derivative Transactions Need for Margin / Credit Support (Cash / Securities) - Collateral ISDA Master Agreement + Schedule Credit Support Deed (CSD) under English Laws Credit Support Annex (CSA) under English Laws CSD – Security Agreement CSA – Direct Transfer (CSA does not create a Charge or Security Interest) Features of CSA: Nature of Collaterals Amount How determined Periodicity Its an Annex i.e exchange of Collateral is a “Transaction” under ISDA Agreement No separate governing law and jurisdiction, as it shall be governed by the law agreed under ISDA Agreement Payment Netting (7 5 = 2) combining offsetting cash flow obligations between two parties on a given day in a given currency into a single net payable or receivable; payment netting is essentially the same as set-off Closing Out Netting a process involving termination of obligations under a contract with a defaulting party and subsequent combining of positive and negative replacement values into a single net payable or receivable. Basic elements of Close-out Netting : a. Early Termination, b. Valuation of the Terminated Transactions c. Settlement and Set off Whether close-out netting under ISDA is enforceable in India ? a. Companies b. Private Banks c. Foreign Banks (Indian Branch) d. PSBs / SBI Close-out Netting : Whether there is any specific legislation in India which permits the same ? Is there any “direct” High Court or Supreme Court Judgement in India which recognises this concept for derivatives or other transactions/ entities and overruling the application of law of liquidation ? (other than Judgements from which attempt can be been made to draw a distant corollary to enable one to form such view ?) RBI circulars on Netting : 2011 RBI Circular on Prudential Norms for OffBalance Sheet Exposures of banks states – “law is not unambiguously clear” 2012 Master RBI Circular on Prudential Guidelines on Capital Adequacy – “No Netting exposure for regulatory capital purposes is not permitted” Margining is required to be on gross and not on net exposures Basel Requirement on netting : Basel III permits regulatory capital netting, if regulator is satisfied that written and reasoned legal opinion in said jurisdiction permits close-out netting. Discussion-Divergent Views In view of the different laws and statutes under which various companies, banks and financial institutions are incorporated/ set up in India, do the present legislations read as a whole, have place for a consolidated all pervading “Netting-Act” ? CCP has to be qualified one i.e. compliant with Committee on Payment and Settlement Systems (CPSS)- International Organisation of Securities Commission (IOSCO)’s Principles for Financial Market Infrastructures (FMI Principles) (FMI Principles have to be adopted by a Country for implementation. ) If CCP is not Qualified, 20% - 150 %, risk weight for trade exposure may apply THANK YOU