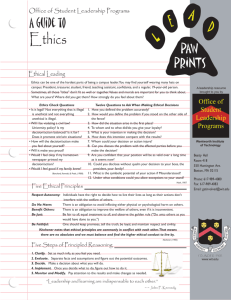

ethics - Continuing Education Insurance School of Florida, Inc.

advertisement