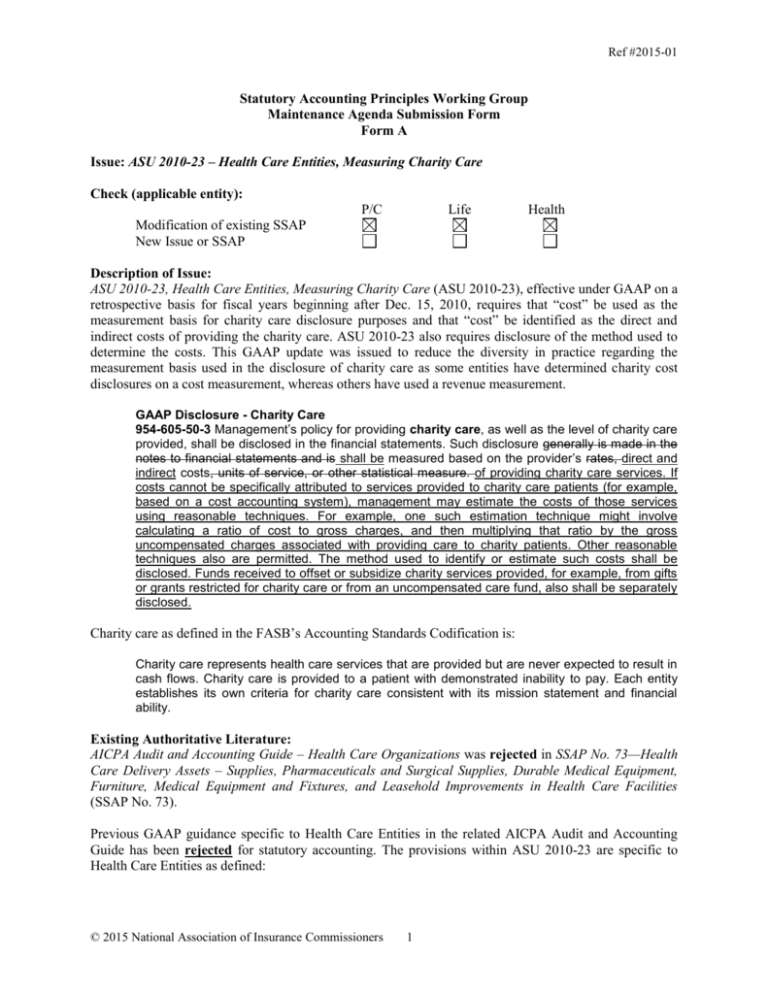

Issue: ASU 2010-23 – Health Care Entities, Measuring Charity Care

advertisement

Ref #2015-01 Statutory Accounting Principles Working Group Maintenance Agenda Submission Form Form A Issue: ASU 2010-23 – Health Care Entities, Measuring Charity Care Check (applicable entity): P/C Life Health Modification of existing SSAP New Issue or SSAP Description of Issue: ASU 2010-23, Health Care Entities, Measuring Charity Care (ASU 2010-23), effective under GAAP on a retrospective basis for fiscal years beginning after Dec. 15, 2010, requires that “cost” be used as the measurement basis for charity care disclosure purposes and that “cost” be identified as the direct and indirect costs of providing the charity care. ASU 2010-23 also requires disclosure of the method used to determine the costs. This GAAP update was issued to reduce the diversity in practice regarding the measurement basis used in the disclosure of charity care as some entities have determined charity cost disclosures on a cost measurement, whereas others have used a revenue measurement. GAAP Disclosure - Charity Care 954-605-50-3 Management’s policy for providing charity care, as well as the level of charity care provided, shall be disclosed in the financial statements. Such disclosure generally is made in the notes to financial statements and is shall be measured based on the provider’s rates, direct and indirect costs, units of service, or other statistical measure. of providing charity care services. If costs cannot be specifically attributed to services provided to charity care patients (for example, based on a cost accounting system), management may estimate the costs of those services using reasonable techniques. For example, one such estimation technique might involve calculating a ratio of cost to gross charges, and then multiplying that ratio by the gross uncompensated charges associated with providing care to charity patients. Other reasonable techniques also are permitted. The method used to identify or estimate such costs shall be disclosed. Funds received to offset or subsidize charity services provided, for example, from gifts or grants restricted for charity care or from an uncompensated care fund, also shall be separately disclosed. Charity care as defined in the FASB’s Accounting Standards Codification is: Charity care represents health care services that are provided but are never expected to result in cash flows. Charity care is provided to a patient with demonstrated inability to pay. Each entity establishes its own criteria for charity care consistent with its mission statement and financial ability. Existing Authoritative Literature: AICPA Audit and Accounting Guide – Health Care Organizations was rejected in SSAP No. 73—Health Care Delivery Assets – Supplies, Pharmaceuticals and Surgical Supplies, Durable Medical Equipment, Furniture, Medical Equipment and Fixtures, and Leasehold Improvements in Health Care Facilities (SSAP No. 73). Previous GAAP guidance specific to Health Care Entities in the related AICPA Audit and Accounting Guide has been rejected for statutory accounting. The provisions within ASU 2010-23 are specific to Health Care Entities as defined: © 2015 National Association of Insurance Commissioners 1 Ref #2015-01 Pursuant to ASC 954, the Health Care Entities topic applies to health care entities, which are the following types of entities: a) Entities whose principal operations consist of providing or agreeing to provide health care services and that derive all or almost all of their revenues from the sale of goods or services, and b) Entities whose primary activities are the planning, organization, and oversight of such entities, such as parent or holding companies of health care providers. The Health Care Entities Topic applies to the following types of health care entities: a. Clinics, medical group practices, individual practice associations, individual practitioners, emergency care facilities, laboratories, surgery centers, and other ambulatory care entities b. Continuing care retirement communities c. Health maintenance organizations and similar prepaid health care plans d. Home health agencies e. Hospitals f. Nursing homes that provide skilled, intermediate, and less intensive levels of health care g. Drug and alcohol rehabilitation centers and other rehabilitation facilities h. Integrated delivery systems that include one or more of the above types of entities Activity to Date (issues previously addressed by SAPWG, Emerging Accounting Issues WG, SEC, FASB, other State Departments of Insurance or other NAIC groups): None Information or issues (included in Description of Issue) not previously contemplated by the SAPWG: None Convergence with IFRS: IFRS does not provide any specific guidance on the disclosure of charity care. Staff Recommendation: Staff recommends that the Working Group move this item to the nonsubstantive active listing and expose nonsubstantive revisions to SSAP No. 54—Individual and Group Accident and Health Contracts to adopt the ASU 2010-23 definition of charity care, and adopt with modification the charity care disclosure within ASU 2010-23: 37. Management’s policy for providing charity care1, as well as the level of charity care provided, shall be disclosed in the financial statements. Such disclosure shall be measured based on the provider’s direct and indirect costs of providing charity care services. If costs cannot be specifically attributed to services provided to charity care patients (for example, based on a cost accounting system), management may estimate the costs of those services using reasonable techniques, with the method used to identify or estimate such costs disclosed. Funds received to 1 Charity care represents health care services that are provided but are never expected to result in cash flows. Charity care is provided to a patient with demonstrated inability to pay. Each entity establishes its own criteria for charity care consistent with its mission statement and financial ability. © 2015 National Association of Insurance Commissioners 2 Ref #2015-01 offset or subsidize charity services provided, for example, from gifts or grants restricted for charity care or from an uncompensated care fund, also shall be disclosed. 38. Refer to the preamble for further discussion regarding disclosure requirements. Relevant Literature 39. This statement adopts the definition of charity care, and adopts with modification the disclosure within ASU 2010-23, Health Care Entities, Measuring Charity Care, as applicable. 40. This statement incorporates the requirements of Appendices A-010, A-225, A-641, A820, A-822 (as applicable), the Actuarial Standards Board Actuarial Standards of Practice and the actuarial guidelines found in Appendix C of this manual (as applicable). 41. This statement rejects FASB Statement No. 60, Accounting and Reporting by Insurance Enterprises relating to accounting and reporting for individual and group accident and health contracts. Effective Date and Transition 40. This statement is effective for years beginning January 1, 2001. Contracts issued prior to January 1, 2001 shall be accounted for based on the laws and regulations of the domiciliary state. State laws and regulations shall be understood to include anything considered authoritative by the domiciliary state under the individual state’s statutory authority and due process procedures. A change resulting from the adoption of this statement shall be accounted for as a change in accounting principle in accordance with SSAP No. 3. The disclosure related to charity care shall be applied prospectively beginning (adopted date). Staff Review Completed by: Linda Hunsucker – November 2014 Status: On March 28, 2015, the Statutory Accounting Principles (E) Working Group moved this item to the nonsubstantive active listing and exposed nonsubstantive revisions to adopt with modification ASU 201023, Health Care Entities, Measuring Charity Care. The exposed statutory accounting revisions adopt the charity care definition from ASU 2010-23, and adopt with modification the charity care disclosure. G:\DATA\Stat Acctg\3. National Meetings\A. National Meeting Materials\2015\Spring\NM Exposures\15-01 ASU 2010-23 - HCE.doc © 2015 National Association of Insurance Commissioners 3