Chapter 21

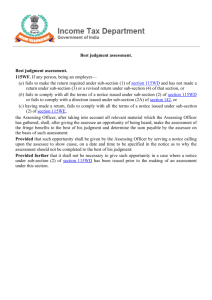

advertisement