Literature Review 2 - Claudia De la Rocha

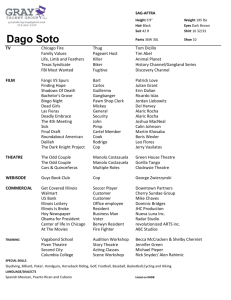

advertisement

De la Rocha | 1 Claudia de la Rocha Professor Adams English 1312 April 07, 2009 Literature Review Anatomy of a breakdown by Mike Flynn and Testimony of Chairman Bernake on the Economic Outlook by Chairman Ben S. Bernake before the Joint Economic Committee in the U.S Congress, are the two sources that I will analyze and compare, to approach the subject of the Economic Crisis for the video of the class. Anatomy of a breakdown, is a very long article that explains how the Great Financial Panic of 2008 started, its origins, the actions of the Bush Administration before the Financial Crisis, the roots of the crisis, the Fannie and Freddie Mac roll, the tremendous crash, the 700 billion bailout and finally the “solutions¨. Chairman Ben S. Bernake, discussed the financial and economical situation and provided an outlook of the financial markets to the members of the committee. Mr. Bernake approached the theme of AIG, Lehman Brothers, and how these institutions affected the global financial markets, despite the effort of the Federal Reserve and the Treasury to support them. The Federal Reserve actions and the Treasury efforts are also explained, but these activities did not help the global financial markets. The stress affected channels such as the credit, consumer loans, bonds, investment, real estate, consumer spending, production, job creation, economic growth, employment, real disposable income, real after tax income, and the purchase of motor vehicles. On the positive side, the oil and gasoline prices came down improving the consumer confidence, but the mortgages, De la Rocha | 2 construction and international trade were considerable declined. Finally Mr. Benake explained the inflation outlook and ended with a forecast of the market. For the conclusion he used this statement; in order to have an economic recovery, the stabilization of the financial system provided by the intervention of the Federal Government, is a precondition of it. The fact that both articles talk about the economic crisis, Anatomy of breakdown explained it as a whole, while Mr. Bernake was more focused of the negative effects, some positive points and one solution for the various channels affected. The contrast was easy to detect, one is more objective, defines the problem clearly, and the other was more political, because of the audience. I think that the Great Financial Panic of 2008 should be defined as Mike Flynn did. With and introduction, defenition of the problem, the characters involved, the causes, the effects and most of all with a very detailed explanation. It was more college level, and provided the audience with a certain feature of complete understanding. This article is similar to our group design project and will be a good source, where we can find almost all the information needed. Summarizing both articles, I came out with an outline, and because of all the events that happened, it is easier to visualize the big topic like shown above: Great Financial Panic of 2008 1. Introduction a. The housing bubble, from 1997 to 2006 b. Bush administration frantic steps to stop the bleeding. c. $700 billion bailout De la Rocha | 3 2. The Roots of the Crisis a. 1977 ´s… Community Reinvestment Act (CRA) b. 1990´s… The idea of the ¨ affordable housing” c. 3. 1993 ´s… “Closing the Gap: A Guide to Equal Opportunity Lending”. If you don’t have money, you cannot lend it (2001). a. Interest rates b. Treasury securities c. Mortgage-backed securities d. Investment houses e. The growth in the trade of the mortgage-backed securities. 4. Fannie and Freddie a. The roll of Fannie Mae and Freddie Mac in creating the crisis. b. The chief mission of Fannie and Freddie. c. The Audition by PricewaterhouseCoopers (2003). i. Political powerhouses ii. The “extensive financial fraud” iii. The two interesting transactions De la Rocha | 4 iv. Fined by The Office of Federal Housing Enterprise Oversight and the Securities and Exchange Commission. d. The subprime bender 5. The Crash a. The collapse of the mortgage-backed security market b. The Fed and the Treasury Department intervention c. The collapse of Bear Stearns d. The collapse of Lehman Brothers e. AIG over-exposed 6. The Bailout a. The rumors b. ¨Broke the buck¨ i. “That’s when the market freaked out”. c. The government intervention i. Expansion of reciprocal currency arrangements with foreign central banks. ii. Assisted money market mutual funds facing heavy redemptions iii. Increased liquidity in short-term credit market. De la Rocha | 5 iv. The $700 billion 7. The effects in the financial markets and economic situation a. Weak labor market b. Elevated inflation c. Stress in the financial markets d. Downturn in the housing market e. Slowdown of the economy f. Falling home prices g. Deterioration of the mortgage-related assets h. Weak economic activity i. Turbulent conditions in the Global Financial Market i. The fall of the equity prices ii. The cost of the short-term credit iii. The dry up of the liquidity in many markets iv. Losses at a large money market mutual fund v. Extensive withdrawals vi. Reduce of the asset values De la Rocha | 6 vii. Restriction of the flow of credit to households and businesses j. Threat of the economic growth k. Restriction of credit l. Tightened of mortgage credit terms m. Disruption of the commercial paper market and other forms of financing. n. Slow spending, production and job creation o. Unemployment p. Fallen of the real after-tax income q. Increases in the prices of energy and food r. Fell of retail stores sales and motor vehicles sales s. Slowdown in the construction of commercial and office buildings t. Business outlays for equipment and software declined u. Slow business productions and sales v. Net exports declined w. Rose of inflation x. Fallen of oil prices 8. Possible Solutions De la Rocha | 7 a. Factors that will promote the return of the economy to higher levels: b. Stimulus by the monetary policy c. Lower oil and commodity prices d. Increasing stability in the mortgage and housing markets e. Natural recuperative powers of the economy f. Stabilization of the financial system i. A precondition for economy recovery The arrangement of the topic as an outline will provide a quick outlook in order to make it easier to understand and cover it up during the video planning. That is, it helps as a guideline and organizes the team’s ideas; helps select the most important points and establishes the beginning and the end. For my teammates this will be easier to visualize and convert it to a storyboard, approach all the important themes and discard unnecessary information. De la Rocha | 8 Works Cited SIRS Government Reporter.“Testimony of Chairman Bernanke on the Economic Outlook.” Ben S. Bernanke. Sept. 24, 2008. SIRS Knowledge Source.06 April 2009 <http://0-www.sirs.com.millenium.itesm.mx:80> SIRS Researcher. “Anatomy of a Breakdown.” Mike Flynn. Jan 2009. SIRS Knowledge Source. 06 April 2009 . <http://owl.english.purdue.edu/owl/resource/557/01/>.