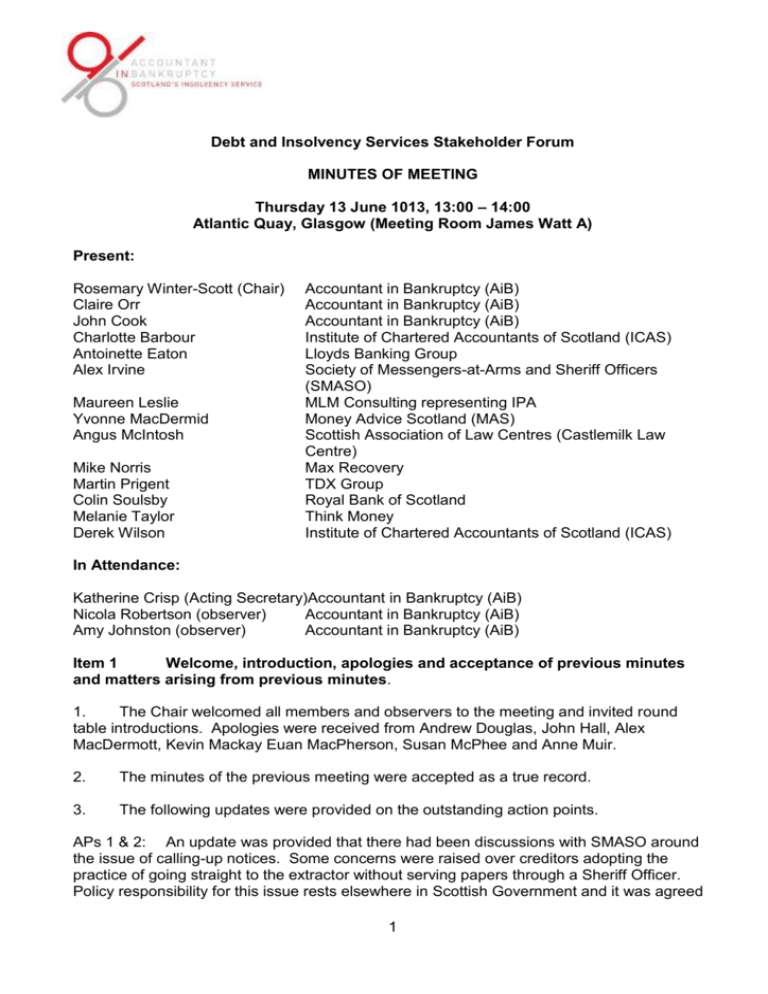

Debt and Insolvency Services Stakeholder Forum MINUTES OF

advertisement

Debt and Insolvency Services Stakeholder Forum MINUTES OF MEETING Thursday 13 June 1013, 13:00 – 14:00 Atlantic Quay, Glasgow (Meeting Room James Watt A) Present: Rosemary Winter-Scott (Chair) Claire Orr John Cook Charlotte Barbour Antoinette Eaton Alex Irvine Maureen Leslie Yvonne MacDermid Angus McIntosh Mike Norris Martin Prigent Colin Soulsby Melanie Taylor Derek Wilson Accountant in Bankruptcy (AiB) Accountant in Bankruptcy (AiB) Accountant in Bankruptcy (AiB) Institute of Chartered Accountants of Scotland (ICAS) Lloyds Banking Group Society of Messengers-at-Arms and Sheriff Officers (SMASO) MLM Consulting representing IPA Money Advice Scotland (MAS) Scottish Association of Law Centres (Castlemilk Law Centre) Max Recovery TDX Group Royal Bank of Scotland Think Money Institute of Chartered Accountants of Scotland (ICAS) In Attendance: Katherine Crisp (Acting Secretary)Accountant in Bankruptcy (AiB) Nicola Robertson (observer) Accountant in Bankruptcy (AiB) Amy Johnston (observer) Accountant in Bankruptcy (AiB) Item 1 Welcome, introduction, apologies and acceptance of previous minutes and matters arising from previous minutes. 1. The Chair welcomed all members and observers to the meeting and invited round table introductions. Apologies were received from Andrew Douglas, John Hall, Alex MacDermott, Kevin Mackay Euan MacPherson, Susan McPhee and Anne Muir. 2. The minutes of the previous meeting were accepted as a true record. 3. The following updates were provided on the outstanding action points. APs 1 & 2: An update was provided that there had been discussions with SMASO around the issue of calling-up notices. Some concerns were raised over creditors adopting the practice of going straight to the extractor without serving papers through a Sheriff Officer. Policy responsibility for this issue rests elsewhere in Scottish Government and it was agreed 1 that this action should be passed to colleagues if SMASO can provide appropriate evidence of current practice. AP 3: Clarification was provided that this will not be an issue. Contributions would not be taken from universal credit. AP4: On agenda for discussion. AP5: Some information had already been provided to AiB and will be looked at through the DASH review forum. Other DISSF members to send list of desired information to AiB. AP6: If AiB identified examples of this practice they would refer to OFT if appropriate. No outstanding action points Item 2 DISSF Brief Paper ; DISSF(13-14)01 4. An overview of the Q4 stats within the DISSF briefing paper was provided. The figures will be provisional until validated. Trust Deed numbers showed an 11% drop, and sequestrations showed an ever greater decrease across the year. The figures also demonstrated an increase in the number of people using the certificate for sequestration route which has partly accounted for the drop in the number of people using the LILA route into bankruptcy. 5. An update on the upcoming DAS marketing campaign was provided. Following the success of the first campaign in 2012 a second one, to coincide with the changes to the DAS regulations, is planned for this summer. 6. There was an update on the completion of the Corporate Plan. It had been published on the website and hard copies would be distributed once available. Action Point : AiB to provide DISSF members with a hard copy of the Corporate Plan when it is published. 7. An overview of the annual Stakeholder events was presented. Events would be held in Glasgow, Edinburgh and Inverness in the late autumn. Workshops would be organised based around the Bankruptcy Reform Bill and the DAS and PTD regulations. DISSF members were asked to volunteer to chair the closing panel session. Item 3 Legislation update including: DAS and PTD regulations & Bankruptcy Bill 8. It was confirmed that the new DAS regulations were laid in Parliament on 20 May 2013, they are due to be debated in a Committee on 19 June and will come into force on 2 July, subject to Parliament agreement. The main changes were outlined. 9. An update on the introduction of The Bankruptcy and Debt Advice (Scotland) Bill was provided. The Bill was introduced to Parliament on 11 June. Policy change around the period of acquirenda was discussed as this had changed from one year to four years. 2 10. A number of improvements have been proposed to Protected Trust Deeds (PTDs) and the new regulations should commence autumn 2013. There would be a removal of the requirement to advertise the trust deed in the Edinburgh Gazette, instead it would be published on the Register of Insolvencies. 11. The Common Financial Tool (CFT) working group has not met for a couple of months in order that AiB could conduct research into the two current tools. The new requirement for 48 monthly payments means that ensuring the level of contributions are sustainable is very important. There was discussion about what figures would be adopted and it was explained that detailed analysis had been carried out and a recommendation would be put forward regarding which tool would be used. The tool would apply to all statutory solutions in Scotland. A question was raised as to how the tool would be utilised if trigger figures were outside normal parameters and it was confirmed that AiB would need to endorse any situations like this as consistency must be maintained. This would be discussed with the working group and detailed guidance would be produced. 12. The initiative undertaken by the Money Advice Trust and Step Change Charity to potentially develop a single tool for the calculation of surplus income was discussed. A question was asked around whether the new tool would be adopted in future as its outcomes would likely differ from the current models. In response, it was explained that any new tool would be examined once it is developed. Confirmation was provided that the figures used in the CFT calculation would be reviewed annually. 13. There was a further query on how the CFT would be promoted prior to the Bill commencing and this would need to be considered. Organisations would also need to think about the systems required. Communication would be key so the industry would be ready for all of the changes. Item 4 Money Advice Service’s debt advice quality framework 14. The question was asked as to what discussions had taken place to recognise existing accreditation and whether further accreditation would be required. An explanation was given that no further accreditation would be required as the Scottish National Standards were very rigorous and there was a lot of favour for the model in place in Scotland. A response to the consultation would be produced. Item 5 Regulatory issues including: Updates from ICAS, IPA, etc. and DAS inclusion in any regulatory monitoring process 15. It was agreed that a regular update from IPA should be a standing item on the agenda for a verbal report. Action Point : IPA and ICAS to provide an update at next meeting. 16. To improve transparency on the performance of individual companies, it was confirmed that AiB will publish, as part of its annual report and accounts, Form 7 returns at the conclusion of trust deeds in terms of dividends payable and costs incurred. The data has currently been sent to Trustees for validation. The Scottish Government’s position was that data collected should be published continuously rather than waiting for FOI requests. 3 17. There was a discussion on the regulatory issue of DAS inclusion in the monitoring process and whether RPBs were looking at DAS cases when reviewing the IPs’ caseload or only insolvency cases. It was discussed that the approach to regulation should be consistent across all bodies and that IPs should be monitored as a whole across all their work. The AiB’s view is that IPs are able to undertake the DAS work as a result of being an IP, hence their IP assessment should look at their DAS work. It was noted that some IPs were starting to build up a DAS portfolio. If the trend continues to grow it may need to be subject to a separate review. Action Point : JC to provide information to ICAS members who are active in DAS. Item 6 approval Debtor Issues : Freezing of bank accounts and Payday lending post DPP Freezing of bank accounts : AiB staff have reported that debtors were not clear that their bank accounts could be frozen once they had entered into bankruptcy. Thought was given to how the correct advice should be communicated to people. 18. 19. Action point 4 from the previous meeting was then discussed and an explanation was given that no action was required as we already advertise bankruptcies on a public register which creditors can access. Payday lending: There was some concern that people in approved DAS DPPs were continuing to access credit through payday lenders. When in DAS, debtors are unable to access credit without informing creditors of their DPP and may only do so in prescribed circumstances. If there has been no disclosure, this may lead to the revocation of the DPP. Additionally it was confirmed that the DAS regulations prevent creditors commencing any diligence to recover debt incurred after approval of the DPP where the creditor has failed to comply with the lending restrictions prescribed in the regulations. . Action Point: All DISSF members to advise AiB of any instances where debtors have entered into a payday loan post DPP so that any trends can be identified. Action Point : DAS review board to look into this and review trends in order to target advice and discussion. Item 7 AOB 20. It was noted that Lloyds Bank had been approached by some organisations querying whether they would be willing to include them into a fair share contribution scheme. Action Point : AE to provide more information to John Cook. 21. The continuing misuse of the DAS register was discussed. Concerns persist that information obtained from the register is being used to generate leads for alternative debt solutions. It was pointed out that access to DAS had changed and 2 pieces of information were required to be able to use the Register. It was also noted that there had to be a balance to protect both debtors and creditors. Action Point : DISSF members to advise AiB of any organisations who are adopting this practice so AiB can investigate. 4 22. Information was provided that since April a specific local authority has seen a 40% rise in rent arrears due to the bedroom tax. In some areas there was a 50% rise. There is the potential that ultimately these increased levels of debt may lead to increased insolvencies. 23. The next meeting will take place on 8 October 2013, at Victoria Quay, Edinburgh. 24. The Chair thanked all members for attending and closed the meeting. Katherine Crisp Acting DISSF Secretary June 2013 5