Forward Rates – Self Study

advertisement

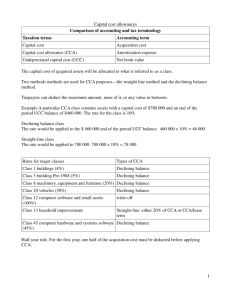

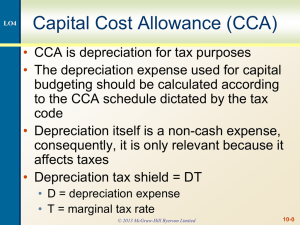

Forward Rates – Self Study � The t-period forward rate for a loan repaid in period n is denoted n-tfn � E.g., 2f5 is the 3-period forward rate for a loan repaid in period 5 (and borrowed in period 2) � The following formula is useful for calculating t-period forward rates: 1+n-tfn = [(1+rn)n / (1+rn-t)n-t]1/t � Given the data presented below, determine 1f3 and 2f5 If we observe r1 = 8%, r2 = 9%, r3 = 9.5%, r4 = 9.75% and r5 = 9.875% � Results: 1f3=10.257795%; 2f5=10.462232% ________________________________________________________ Selected CCA classes Class Rate Asset 1 4% Brick buildings (acquired after 1987) 6 10% Fences and frame buildings 8 20% Manufacturing and processing equipment 10 30% Vans, trucks, tractors, and computer equipment 16 40% Taxicabs and rental cars 22 50% Excavating equipment Steps to Calculate Yearly CCA Deductions and CCA Tax Shields 1. Determine the asset class and relevant CCA rate. See table above. 2. Determine the first CCA deduction (assumed to be at the end of the first year). Revenue Canada imposes the “half-year rule” (or 50-percent rule) for the first CCA deduction. CCA1 = ½∙C∙d where C = initial cost of the asset, d = CCA rate 3. Calculate CCA tax shield (tax saving): CCA tax shieldt = CCAt∙Tc 4 5. 6. 7. Determine the undepreciated capital cost (UCC) remaining for the beginning of the next year. For t>1, UCCt,beginning = UCCt-1,ending = UCC t-1beginning – CCA t-1 Determine the next CCA deduction. (The “half-year rule” does not apply after the 1st CCA deduction.) For t>1, CCAt = UCCt,beginning∙ d Go to step 3 and continue. Note: Since only a percentage of UCC is deducted each year as CCA, the UCC will never drop to zero. Thus, the CCA and CCA tax shields will also continue forever. If an asset is sold in a future time period, then the UCC at that time is reduced by the sale price. This results in lower CCA deductions and lower CCA tax shields following the asset sale. Example: DuoCity Taxi is considering expanding its fleet. The cost of the new taxis is $1,000,000 now. Taxis fall under CCA Class 16 and are allowed a CCA rate of 40%. DuoCity’s tax rate is 45% and the relevant opportunity cost of capital is 15%. Assume the taxis relevant to this project will be sold at the beginning of the 6th year for $100,000. The project will generate revenues in excess of expenditures of $450,000 per year for 5 years. The project will also require an immediate working capital increase of $50,000, no intermediate changes, and a reversion to normal working capital requirements at the end of 5 years. Year CCA CCA tax shield Ending UCCt = Beginning UCC t+1 CCA CCA tax shield Ending UCCt = Beginning UCCt+1 1000,000*.4 *1/2 = 200,000 800,000 * .4 = 320,000 192000 200,000* .45 =90000 320,000 * .45 = 144000 86,400 1000,000 -200,000 = 800,000 800,000 – 320,000 = 480,000 288,000 1 2 3 4 5 Year 1 2 3 4 5 Year 115200 51,840 172,800 69120 31,104 3,680 0 ($) Asset Purchase/sale -1,000,000 Net Revenue 0 less Expense Working Capital -50,000 Net -1,050,000 1 ($) 2 ($) 3 ($) 4 ($) 5 ($) 0 0 0 0 100,000 247,500 247,500 247,500 247,500 247,500 0 0 0 0 50,000 247,500 247,500 247,500 247,500 397,500 NPV of above cash flows =-$145,765.10 PV of CCA tax shields =$289,657.62 NPV of the project =$143,892.52 with CCA tax shield formula but NPV with the yearly CCA tax deduction approach is $143,293.73 If the asset is sold for an amount greater than its initial cost, a capital gain is said to occur. Capital Gain = Sales Price – Initial Cost When there is capital gain, the UCC is reduced in the year of the sale by the initial cost, C, and an additional tax is applied to the capital gain. Capital Gains Tax = ½∙capital gain∙Tc Calculate the PV of CCA tax shield and the PV of capital gains tax assuming the taxis were sold for… $500,000 $1,200,000 IF No Capital gain then use this formula for PV CCA tax shield k 1 C d Tc 2 S d Tc 1 PVCCA Tax Shields n k d 1 k k d 1 k n IF Capital gain then use this formula for PV CCA tax shield PVCCA Tax Shields (when Sn C) k 1 C d Tc 2 C d Tc 1 k d (1 k ) k d (1 k ) n When calculating the project NPV, don’t forget to deduct the PV of the capital gains tax too by using Capital Gains Tax = ½∙capital gain∙Tc.