From this evaluation of the company's competitive intelligence

advertisement

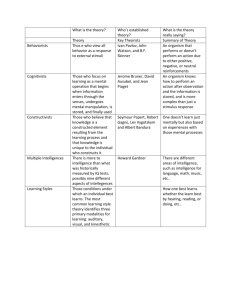

The Added Value of Competitive Intelligence Five types of intelligence attitudes Authors : Dr Daniel Rouach, Professor at ESCP-EAP Patrice Santi, Research Associate at ESCP-EAP (article to be published in 2000 in the European Management Journal) I. Introduction Competitive Intelligence tracks the activity of direct and indirect competitors in a range of areas : general business activity, business development activity, strategic thrusts and tactical manoeuvres in different sectors or new activities (sometimes designed to confuse and mislead), market encroachments, patent registration, research activity, etc. school2 specialising in the management of innovation, technology transfer and competitive intelligence. It seeks to synthesise and optimise the knowledge accumulated by the GTI Lab, notably through the completion of three major work packages: - The elaboration of a “Competitive Intelligence Tool Box”3, which was edited for the Ministry of Industry in 19994. This research project aimed to provide first knowledge on the Competitive Intelligence (CI) concept, practical examples of CI best practices, and tools for the setting up and developing of CI systems. It includes a series of transparencies, illustrative charts and diagrams on the concept, case studies or illustrations on more than 15 companies practising CI5, and pedagogic as well as practical tools for the implementation of CI systems within the corporate environment (information sources, key success factors, do’s and don’ts, etc.). - The editing and publishing of two books6 and six articles dealing with CI issues. These articles were published in major French and international magazines or business newspapers. - The setting up of three international conferences on the “World-wide Tour of Competitive Intelligence”, which gathered consultants, Government officials and academic experts on Competitive Intelligence may be seen as a radar screen spotting new opportunities or helping avert disasters. It enables the firm to observe its environment. Further, the intelligence reflex empowers the firm to monitor its own development. All too frequently, business leaders are left in the dark because they overlook crucial data or ignore information which at first sight seems insignificant. But what exactly does it consist of? What are the limits of its scope? The objective of this article is to present the main characteristics of the Competitive Intelligence concept and to describe how it has become a real management practice that is now developing inside most leading companies in the world. We are going to give our definition of this concept but also to have a look at the definitions that we have found in the literature. Finally, we are going to see how it is developed within companies. This article will seek to answer the following key questions: What are the different types of Intelligence attitudes? How companies practice Competitive Intelligence – best practice examples It is the result of the research work which has been realised between 1998 and 2000 by the GTI Lab1, a research laboratory of the ESCP-EAP business See GTI Lab’s Web site at http://research.eap.net/gtilab/ 1 2 ESCP-EAP is a French graduate management school based in Paris, Oxford, Berlin and Madrid. 3 “Kit Veille – Naviga’Veille”, Dr. Daniel ROUACH, September 1999. 4 This initiative was launched by the Paris Chamber of Commerce. 5 Notably Nestlé, Motorola, Gemplus, Aérospatiale, Sanofi, Ciments Français, Essilor, Guerbet, L’Oréal, Ericsson, and Oberthur. 6 “Le Management du transfert de technologie, l’art de coopérer, innover, veiller ”, Presse Universitaires de France, 1999. “La Veille technologique et l'Intelligence économique ”, collection Que Sais-Je, Presses Universitaires de France, 1996 with update in 1999. 1 Competitive Intelligence, Knowledge Management and Benchmarking. Through the completion of these projects, the GTI Lab was given the opportunity to interview specialists from leading companies such as Ericsson, Nokia, IBM, or L’Oréal, and expert consultants from all over the world. In addition, attendance to conferences and workshops organised outside ESCP-EAP allowed to gather valuable inputs from renowned speakers and lecturers. II - From Information to Intelligence - Overview of the Competitive Intelligence concept In an article Michael E. Porter and Victor E. Millar 7 pointed out how information changes the industry structure and, in so doing, alters the rules of competition. The information revolution, as Porter and Millar put it, creates competitive advantage by giving companies new ways to outperform their rivals. Information technology, in particular, is affecting the entire process by which companies create their products. It is permeating the company’s value chain at every point, transforming the way value activities are performed and the nature of linkages among them. It not only affects how individual activities are performed but, through new information flows, it is also greatly enhancing a company’s ability to exploit linkages between activities, both within and outside the company. Information technology is affecting competitive scope and reshaping the way products meet buyer needs. The emergence of an old management practice Over the past few years, CI has become a management concept on its own. As we will see, many leading companies are now integrating it in their organisational culture. Intelligence practices, however, have long been developed by companies all over the world. The German have for centuries understood its benefits. Back in the fifteenth century, the House of Fugger, from its base in Augsburg, disseminated manuscript newsletters to provide its key officers a steady flow of confidential political and commercial information8. Modern German intelligence grew in the eighteenth century: scouting the European continent, the Germans discovered that they could compete with established French and British firms by applying foreign scientific advances to their own industrial processes. They Michael E. Porter and Victor E. Millar, “How information gives you competitive advantage”, Michael E. Porter on Competition and Strategy, Harvard Business Review1991. 8 Taken from Jean-Marie Bonthous, Understanding Intelligence Accross Cultures, the International Journal of Intelligence and counterlintelligence. 7 rapidly developed their own base of education and research as a foundation for technological innovation. By the late 1800s the Germans held international rights to many formulas and processes, particularly in the chemical field. Japan was forced to open its doors when it realised, with the arrival of the warships of Commodore Matthew C. Perry in 1854, that after two centuries of self-imposed seclusion, the ocean no longer provided a natural shield against technologically superior military powers. In 1868, Emperor Meiji (“the enlightened”) launched a program of communitarianism, nationalism, and modernisation, with the intention of enabling the country to compete with the West by absorbing the best Western practices. Meiji was among the first to understand that the “not invented here” syndrome was incompatible with global competition. After World War II, the country was stripped of its military power, and converted its military espionage capability into an economic intelligence powerhouse, and since then has dedicated its forces toward building a national, integrated business intelligence system with unlimited scope and time horizon. In the early 1950s, Japan busily sent tens of thousands of market researchers around the world to assess the potential of the photographic market, which was to be their major breakthrough. Japan is the only country that has managed to create a national system of intelligence, whereas more liberal economies have not been able to integrate national and business interests. One reason is that Japan and intelligence have grown hand in hand. The pledge of allegiance of the Imperial Kingdom, dating back to 1868, stated that it was every subject’s duty to gather information about the rest of the world. The system has been in place for more than 130 years: it is mature, effective, and efficient. Information serves as the axis and the central structural support of the nation’s companies. From a more general point of view, the competitive intelligence approach highly benefits from other management concepts that have been developed over the past decades. Knowledge Management, in particular, is one of the most influential concepts in today’s business environment. A 1998 report by KPMG found that 43 percent of the U..K.’s leading firms (66 percent of those with over 2,000 employees) had some kind of Knowledge Management scheme. The fact is that a growing number of companies have created the job of chief knowledge officer (CKO), including leading firms like Hewlett-Packard, General Electric, Xerox and Motorola. Pricewaterhouse Coopers, for example, schedules regular internal conferences with associated 2 “Knowledge Fairs” to harvest thoughts, experiences and war stories. The U.S. Army uses an “After Action Review” to codify soldiers’ learning and apply it rapidly for the next group going into action. top U.S. corporations have since joined the research consortium. IBM’s Institute for Knowledge Management (IIKM) is a membership uniting executives from outfits like General Motors, Xerox and the World Bank, with Knowledge Management experts from industry and schools such as Boston University, Stanford and Wharton. Ernst & Young opened a Centre for Business Knowledge in 1994 in Cleveland, Ohio, and two dozen From information to intelligence: the raison d’être of Competitive Intelligence For the GTI Lab, a first definition of the Competitive Intelligence concept can be as follows: Figure 1 – the Competitive Intelligence concept Competitive intelligence: Definition Competitive intelligence is the art of locating, collecting, processing and storing information to be made available to people at all levels of the firm with a view to shaping its future, but also protecting its present against competitive threat. It is legal and it respects a code of ethics. In other words, competitive intelligence is the transfer of knowledge from the environment to the organisation with respect to established rules. © GTI Lab, ESCP-EAP Information is definitely at the centre of the concept. As suggested in the definition however, Competitive Intelligence covers wider goals and stakes that just gathering this information. When presenting the intelligence concept, Leonard M. Fuld9 reveals all the dimensions hiding behind crude, basic information: “Sometimes, it’s almost easier to describe what intelligence is not, rather than what it is. It is not reams of database printouts. It is not necessarily thick, densely written reports. It is most certainly not spying, stealing, or bugging. In its most basic description, intelligence is analysed information”. Information is factual, as Larry Kahaner10 explains: it is numbers, statistics, scattered bits of data about people and companies and what they have been doing that seems to be of interest. Intelligence, on the other hand, is a collection of information pieces that have been filtered, distilled, and analysed. For Kahaner, the basis of competitive intelligence is precisely knowing the difference between information and intelligence : “Intelligence, not information, is what managers need to make decisions. Another term for intelligence is knowledge”. In their “Competitive Intelligence Guideline”, Pierre Achard and Jean-Pierre Bernat11 highlight the added value provided by competitive intelligence managers, whose role is to enrich data throughout the information cycle. As shown in the following diagram, these manager transform information into an exploitable intelligence which can be used decision makers. 9 Leonard M. Fuld, The New Competitor Intelligence, Wiley 1995. 10 Larry Kahaner, Competitive Intelligence, Simon & Schuster, 1996. 11 Pierre Achard, Jean-Pierre Bernat, L’Intelligence Economique, Mode d’Emploi, ADBS Editions, 1998. 3 Jean-Philippe Deschamps and P. Ranganath Nayack, from Arthur D. Little, Inc.15 distinguish three main types of intelligence. Figure 2 – the information cycle From Data to Intelligence The information cycle Human intelligence Data Collection Selection Exploitable Information Information Analysis Synthesis Source: Pierre Achard, Jean-Pierre Bernat, L’Intelligence Economique : Mode d’Emploi, ADBS Editions, 1998 Bringing added value to information and being able to transmit it is the major purpose of intelligence initiatives. In an economy where the only certainty is uncertainty, the one sure source of lasting competitive advantage is knowledge12. For Peter Drucker13, who defines information as “data endowed with relevance and purpose”, companies must now be able to build a system capable of fostering and optimising this added value if they want to survive. According to him, companies will have to be more and more knowledgebased organisations, composed largely of specialists able to direct and discipline their own performance through organised feedback from colleagues, customers, and headquarters, and who will be able to transform their data into information. Market Intelligence and insights are needed to provide a road map of current and likely future trends in customer needs, demands, and preferences; of new markets and creative segmentation opportunities; and of major shifts in marketing and distribution. Competitive Intelligence and insights are needed to evaluate how the competitive intensity will evolve over time, through changes in competitors’ structure, the emergence of new substitution products, or new entrants in the industry. Technology Intelligence and insights are needed to assess the cost/benefit potential of current and new technologies as well as to make a tentative forecast of future discontinuities in technology evolution with their resulting opportunities and threats. For the GTI Lab, the CI concept can be segmented into 4 main categories, which are quite in line with Deschamps and Raganath Nayack’ vision: - The marketing/commercial intelligence, which mainly gathers and analyse information from customers, suppliers and sub-contractors, buyers and distributors. - The competitors intelligence, which focuses on competitors related issues, including for example pricing policies, arrival of substitute products, or competition’s development policies. - The technical and technology intelligence, which deals with fundamental and applied research, factories and processes, and norms and patents. - The strategic and societal intelligence, which includes regulation, financial and tax issues, economical and political issues, as well as social and human resources aspects. This fourth type of intelligence, which is often practised in many companies, mainly aims to observe and analyse social behaviour trends. Defining competitive intelligence’s scope In a broad sense, competitive intelligence covers the monitoring of information about the entire industry at hand14. It consists of detecting the “ weak signals ”, i.e. the barely recognisable trends which could lead to a change in the environment of the company. Its function is to alert management sufficiently early, thanks to the relevant information, to all scientific and technical innovation, or any environmental move which is likely to change the firm’s economic landscape. 12 Ikujiro Nonaka, The Knowledge-Creating Company, Harvard Business Review on Knowledge Management, Harvard Business School Press, 1998. 13 Peter F. Drucker, The Coming of the New Organization, Harvard Business Review on Knowledge Management, Harvard Business School Press, 1998. 14 Thomas Durand, François Farhi, Charles de Brabant, For an intelligent approch to competitive intelligence, Forthocoming in "Keepting Track of Science and Technology", W.B. Ashton and R.A. Klavans, Batelle Press 1994. 15 Jean-Philippe Deschamps and P. Ranganath Nayack, Product Juggernauts – How companies mobilize to generate a stream of market winners, Harvard Business School Press, 1995. 4 Following figures present these main intelligence types. Figure 3 – the fourth types of intelligence Competitive Intelligence: a system of linked and interdependant activities 1 Marketing Intelligence 4 Strategic & Societal Intelligence Technical & Technology Intelligence 3 2 Competitor Intelligence © GTI Lab, ESCP-EAP Figure 4 – the intelligence pyramids Competitive Intelligence mainly includes four types of intelligence Suppliers and sub-contractors Competitors Market Intelligence Customers Competitor Intelligence Buyers Distributors 1. The market intelligence: Which customers? Which suppliers? Price Social Ressources Humaines 2. The competitor intelligence: Which competitors ? Regulation Financial & tax issues Fundamental & applied research Technology Intelligence Factories and processes Substitute products Societal Intelligence Patents and norms 3. The technology intelligence: which technologies? Economic and Political Social and Human Resources 4. The strategic intelligence and others: Which regulations? Which strategies? © GTI Lab, ESCP-EAP III – Analysing the Competitive Intelligence Process 5 From knowledge management and information technology to added value Competitive Intelligence systems In a world where mass information is highly accessible, notably through the developing of Internet facilities and through the globalisation of business activities, one may wonder how common knowledge might lead to competitive added value and increase the company’s efficiency. In Business @ the Speed of Thought 16, Bill Gates maintains that the most meaningful way for a company to differentiate from its competition is to do an outstanding job with information : “How you gather, manage, and use information will determine whether you win or lose. There are more competitors. There is more information available about them and about the market, which is now global. The winners will be the ones who develop a world-class digital nervous system so that information can easily flow through their companies for maximum and constant learning”. When analysing the situation, Gates observes that even companies that have made significant investments in information technology are not getting the results they could be. For him, this gap is not the result of a lack of technology spending: “ In fact, most companies have invested in the building blocks: PCs for productivity applications; networks and electronic mail for communications; basic business applications. The typical company has made 80 percent of the investment in the technology that can give a healthy flow of information yet is typically getting only 20 percent of the benefits that are now possible. The gap between what companies are spending and what they are getting stems from the combination of not understanding what is possible and not seeing the potential when you use technology to move the right information quickly to everyone in the company”. According to Bill Gates, the job that most companies are doing with information today would have been fine several years ago. Getting rich information was prohibitively expensive, and the tools for analysing and disseminating it were not available in the 1980s and even in the early 1990s. But on the edge of the twentyfirst century, the tools and connectivity of the digital age give companies a way to easily obtain, share, and act on information in new and remarkable ways. For Bill Gates, Competitive Intelligence would probably be highly supported and driven by technology : “For the first time, all kinds of information – numbers, text, sound, video – can be put into a digital form that any computer can store, process and forward. For the first time, standard hardware combined with a standard software platform has created a scale that make 16 Bill Gates, Business @ the Speed of Thought, Penguin Books 1999. powerful computing solutions available inexpensively to companies of all sizes (…) We have infused our organization with a new level of electronic-based intelligence”. In its essence however, competitive intelligence appears as a whole culture characterised by specific attitudes and management practices which concern everybody in the company. For Leonard M. Fuld17, “the framework of a successful intelligence system is build on and around the culture of each organization. In other words, intelligence systems – despite the computerbased applications this concept conjures up – are very much a human issue”. From his side, Kahaner insists that competitive intelligence is a whole process, not a mere function in the company. According to him, it appears “in all aspects of your business as one seamless, continuous activity not relegated to one area, division or unit”. Kahaner conceives the competitive intelligence process as a system characterised in four steps18: 1. Planning and Direction 2. Collection of data 3. Analysis 4. Dissemination The Planning and Direction step is when an intelligence action is defined and launched, therefore initiating a process which will lead to the delivery of the information to the end user. During that phase, particular attention has to be paid to the understanding of the user’s need. As Kahaner puts it, “intelligence has various uses: strategic planning, research and development, entry strategies, acquisitions, market timing, and technology assessment”, and the success of the process will highly depend on the capability of the intelligence manager to find out what top management needs to know and why. The time frame involved is also critical, as it will determine how to allocate resources and what types of collection processes to use. Depending upon the time available and the intelligence items requested, the intelligence will then set up a plan outlining what information should be collected. Once its action plan completed, the intelligence manager goes back to the user to make sure it fits his needs. The Collection step involves obtaining the raw data that will be turned into usable intelligence. As synthesised by Jean-Marie Allin19, three types of data can be distinguished: 17 Leonard M. Fuld, The New Competitor Intelligence, Wiley 1995. 18 Larry Kahaner, Competitive Intelligence, Simon & Schuster, 1996. 19 Jean-Marie Allin, Competitive Intelligence - French and US ways of practizing Competitive Intelligence, 1997. Presentation document on competitive 6 The Open Source Information, also called White Information, represents the open source information, which can be found in public databases, newspapers, or publications. Companies like Dun & Bradstreet, Lexis-Nexis or Reuters provide an important quantity of data. The firms nowadays subscribe to such databases in order to find their main source of intelligence. The Internet is also an important source of information. The open source intelligence is mainly an electronic intelligence. The Grey Information, which represents nonpublic domain information. The grey information is provided through public sources which are only opened to insiders, people who are inside a diffusion circle. This information can be found through visiting trade shows, bringing back information from a network of salesmen, or subscribing to very specific types of publications, which are ignored by competitors. An example for that kind of information is the information salesmen can collect by visiting the customers of the firm about the competitors. That kind of intelligence is mainly human intelligence. Black Information / Espionage: the black information is the information gathered through illegal ways, such as usurpation of employees identities, computer piracy, burglary or phone lines tapping. That kind of intelligence is proscribed by firms’ code of ethics and of course, by law. This kind of intelligence is both electronic intelligence and human intelligence. Figure 5 – Classifying the information types Classifying according to information types C la ss ifica tio n a c co rd in g to in fo rm a t io n ty p es 80 % C O L D IN F O R M A T IO N W h ite In f o rm a tio n 20 % H OT S E C RE T G re y I nfo r m a t io n B la c k I nfo r m a t io n I n d u s tri al es p i on a g e C om p eti tive In tell igen ce G re y In fo rm a tio n 75 % B l a ck In for m a ti o n 25 % © GTI Lab, ESCP-EAP The Analysis step is the core element of the process. Analysis is, as Kahaner defines it, “the process of taking information – often seemingly unconnected information – and turning it into intelligence”. It is, for Leonard M. Fuld20, both an art and a discipline, which enables to convert information into intelligence. It is, most of the time, “a process of winnowing the good from useless information and finding a framework in which to add value to that good information (…) The analysis need not be complicated, only complete and accurate”. As shown in the following figure, the dissemination step is described by Kahaner as the last step, but also the first in the cycle. It is the time when the analyst suggests possible course of action based on his work, and when the intelligence resulting from its recommendations is distributed to the end user and to others in the company who can use it. White Information represents the main part of information (around 80%). As illustrated in the following schema, among the 20% which are left, Grey Information is estimated to represent 75% of it. Competitive Intelligence, which is legal and respects a code of ethics, and therefore does not include industrial espionage, is particularly focused on that part of the information. intelligence practices. Taken from Http://www.geocities.com/ WallStreet/Floor/7918/main_eng_resume.html. 20 Leonard M. Fuld, The New Competitor Intelligence, Wiley 1995. 7 Figure 6 – the intelligence cycle The Intelligence Cycle 1. Planning and Direction 2. Collection 3. Analysis 4. Dissemination in ion llect o 2. C lann I. P tion irec D d g an ion alysis 3. An 4. D isse m ina t Source: Larry Kahaner, Competitive Intelligence, Simon & Schuster, 1996. In Leonard Fuld’s description of the competitive intelligence process, the analysis step is followed by an action phase, which includes the storing and delivering of the intelligence, but also the protection of the company’s business activities (preventing for instance possible information leaks), and the recommendation’s implementation. Other representation of the competitive intelligence process might also be that of Ashton and Stacey21, who include a sixth step in the CI process: the auditing of the system’s performance. The purpose of the evaluation is to improve future operations by making them more responsive to company needs, to further clarify those needs and to adjust practices accordingly. From this evaluation of the company’s competitive intelligence process starts a new cycle which takes into account the experience of previous actions. The Science and Technology intelligence process Collect Source Materials 2 Data Analyze Source Data 3 Information Needs Targets Sources Methods Needs Plan 1 Intelligence Activities Intelligence Information System Deliver 4 Information Products Intelligence . feedback Evaluate 6 Performance Program Performance Apply Intelligence Results 5 Impacts SOURCE : Ashton, W.B. and Stacey, G.S. (1995) ‘Technical intelligence in business: understanding technology threats and opportunity’ Int. J. Technology Management, Special Issue on the Management of Technological Flows Across Boundaries. Figure 7 – the intelligence process Ashton, W.B. and Stacey, G.S. (1995) ‘Technical intelligence in business: understanding technology threats and opportunity’ Int. J. Technology Management, Special Issue on the Management of Technological Flows Across Boundaries, Vol. 10, No.1, pp.79-104. 21 8 IV- The five types of intelligence attitudes Competitive intelligence can range from a “ watching out ” attitude, that is watching out and being prepared to react, to a “ hunting ” attitude – looking out for specific information, which a specific aim in mind. Generally speaking, we would distinguish five types of intelligence attitudes: 1. The warrior attitude. In this case, the intelligence manager is very pro-active when it comes to investing. The manager is continuously on the lookout for opportunities. 2. The assault attitude: the manager is also very proactive, above all in highly competitive areas. Many ex-military intelligence specialists become competitive intelligence professionals in civilian life. 3. The active attitude: the manager is always looking for strategic information through normal sources. However, the company ’s information system is not really structured. 4. The reactive attitude: the manager only responds when attacked from outside. The sleeper’s attitude: the management team shows no interest in competitive intelligence and knowledge management and shows no fear of the competition – ‘More out of ignorance than of boldness’. 5. Such classification can be represented as shown in the following diagram: Figure 8 – the competitive intelligence matrix The 5 competitive intelligence attitudes Offensive 5 + « Warrior » Intelligence manageres 4 + Active Offensive Intelligence managers 3 + 2 Inactive 1 + + 0 1 Amateurs Active Intelligence managers Reactive intelligence managers Sleepers 2 3 Professionals 4 5 Expertise © GTI Lab, ESCP-EAP 9 They’re also turning to consultants and “ information vendors ” for help. As shown in the following table, such classification enables to locate a company according to its CI practices. “ There’s much less room for mistakes than there was in the past ”, said John E. Prescott, a professor of business administration at the University of Pittsburgh. Figure 9 – Some best practice examples The 5 types of Intelligence attitudes: best practice examples Type of Intelligence attitude 1. »WARRIORS" France/ Exemples : L'Oréal ELF Michelin SHELL Aerospatiale Europe ABB Bouygues Ciments français SKFDassault Aviation United-States Exemples : Boeing Corning AT & T Motorola Xerox General Electric Rockwell Mariott Kraft General Mills Japan/Asia Exemples : Les Sogo Shoshas NEC Mitsubishi Toshiba Canon Big Japanese and Korean firms 2. OFFENSIVE 3. ACTIVE Thomson CSF Guerbet Nestlé IBM Europe Saint Gobain Air Liquide Siemens CEA DTA La Poste Lafuma Airbus Hutchinson Schneider SEP Alcatel Snecma Sanofi Nutrasweet Federal Express McDonnell Douglas (1997) Big American Big French firms firms Toyota Nissan Daewoo Nomura Chinese companies Japanese SME ’s American SME ’s And some SME ’s 4. REACTIVE 5. SLEEPERS Of French SME ’s *Cas d'entreprises les plus souvent citées par presse et ouvrages spécialisés.Sources d'informations publiques/liste non exhaustive © GTI Lab, ESCP-EAP Some Examples NUTRASWEET has an assault attitude “ Nutrasweet’s patent on the artificial sweetener aspartame was due to expire in 1982, and the company faced possible disaster as chemical and sugar companies planned moves on the market. So Nutrasweet began analysing competitors’ prices. Customer relations, expansion plans and advertising campaigns. The company used the information - called competitive intelligence - to cut costs, improve service and preserve most of its market. Flynn said competitive intelligence practices are worth $ 50 million a year to his company ”. The watchful eyes of business intelligence enable the firm to observe its environment. Further, the intelligence reflex will empower the firm to monitor its own development. All too frequently, business leaders are left in the dark because they overlook crucial date or ignore information which at first sight seems insignificant. A culture of intelligence will improve the performance of these and the other players in the firm. NESTLE has an active attitude “ We maintained over 80 percent of our market ”. Nutrasweet Co. chairman Robert E. Flynn said. With increasingly tough global competition and helterskelter advances in information technology, many companies are forming their own competitive intelligence units. Through more than 130 years of history, Nestlé has grown form a two-product company focusing essentially on infant nutrition to one of the largest food companies world-wide. The food industry is highly innovative: about 5000 new products are launched every year. In Germany, 25 % of 10 Nestlé’s sales are made up with products which did not exist three years ago. These figures emphasise the essential role played by R&D as a drive for innovation. feeds into the system information about what is going on outside, technological breakthroughs, etc, so that they can be worked on in the company. ” R&D in the food industry is characterised by its high level of multidisciplinarity, since innovation requires to combine multiple competencies, such as food science, processing, nutrition and bioscience. Nestec resorts to external sources and sub-contractors in disciplines of basic research which are not deemed core competencies. It co-operates with laboratories and universities around the world. Nestec looks at what can be useful outside its field of activity: innovation in fine chemistry, pharmaceuticals or aircraft industry may be of major interest for agricultural scientists. There is no way to outguess which technologies might prove most useful: the solution lies in experiments of various solutions through exchanges and dialog with scientists and industrials Since its creation, Nestlé has played along these rules and built its success on technological innovation. Technological breakthroughs introduced by Nestlé include such early products as lacteal flour Henri Nestlé 1867. Innovation may also take the shape of new processes (example of a totally new process to manufacture soluble coffee powder, introduced in 1937), as well as improved product quality (example of the suppression of carbohydrate support for Nescafé, 1950). The ultimate goal of Nestlé’s R&D specifically consists of achieving a better understanding of the food chain and its nutritional value - from raw materials to processed products, with a view to providing consumers with products ensuring health, well-being and pleasure. Nestlé’s R&D apparatus lies at the core of vast exchanges of information, where external researchers bring in new ideas and concepts, where market analysis and date collection help set up the R&D agenda. Therefore, business intelligence is increasingly critical to ensuring competitive advantage. “New systems of gathering and using intelligence from outside the company could also be required”, says Jan Ekholm from Nestlé. One cannot raise the question of R&D at Nestlé without introducing Nestec. Nestec acts within Nestlé as a separate entity in charge of basic research, through the Nestlé Research Center and the R&D department that it commands. Nestec is open to its environment. Nestlé considers technology as an asset. Therefore, acquiring additional knowledge constantly appeared as a key factor in establishing the group as a key player. Nestlé uses an information system that gathers information from outside the company, including technological breakthroughs and socio-economic trends (e.g consumers tastes). Indeed, market and fashions constitute the external side of the driving forces of innovation . In addition, competition stands among the sources of innovation. Innovation requires means to combine all those factors. For Jan Ekholm, the most important things are to try and create a culture of innovation in your company, and knowing your consumers. “ For that purpose senior management are linked to an information system ”, that CONCLUSION The cult of business intelligence exists. Intelligence professionals form a caste and the Japanese are probably the High Priests of the business intelligence community. It has been estimated that Japanese firms spend over 1,5 % of their sales revenue on the worldwide collection and processing of intelligence. They keep a close watch on patents (the Japanese buy four times more patents than they sell, but at the same time register each year more than 30.000 patents compared with less than 2.000 in France), they visit exhibitions and fairs, participate in numerous conferences and seminars, acquire publications and databases, undertake industrial missions, make use of trainees in a large number of countries as well as a multitude of expatriate researchers and teachers and study rival products. Their know-how in the systematic collection of information remains a major competitive asset for Japanese firms. Strikingly, education now needs to adapt to the tidal wave of new technologies and know-how as well. The flurry of intelligence is shaking the foundations of our learning and knowledge formation. In the words of Professor André Giordan, research director at the University of Geneva, “ For engineers, over half the data available to them will be useless in five years. 90 % of the knowledge that our children will learn in their lifetime has not yet been produced... The acceleration of knowledge forbids a canon of learning as in centuries gone by, or even a guaranteed access to the exploding body of science. In response to knowledge inflation, education has too often resorted to massive syllabuses at the expense of scientific method. The focus needs to shift to self-directed learning which is the use of documentation sources, multimedia and computer simulations to approach reality ”. Engineers in the 21st Century will rely massively on direct access to business intelligence on the worksite, both as an information source and as a learning resource about their world. The advantages which it can offer are numerous: 11 - - - - saves times : the right information can be found quickly helps make the right technological choices : technological information points to the relevant choices avoids situations of unpatentability : “ patent intelligence ” eliminates fatal errors contributes decisive input to negotiations : “ competitive intelligence ” leads to better results helps the company to be conscious of its own scientific and technological assets by comparing itself continuously with its competitors. helps to detect market threats and opportunities helps to pinpoint the right strategies in areas which are difficult to access helps to detect all sorts of threats and to protect oneself them. 12