MLC MasterKey Investment Service Fundamentals

Fund Snapshot

MLC Wholesale IncomeBuilder™

Fund Overview

About the Fund

Key Information

The Fund aims to provide returns from companies that are expected to deliver

a growing dividend stream over time.

APIR Code MLC0264AU

The Fund is expected to generate tax effective returns by:

Status Onsale

Product Size as at 31 May 2014

$245.03M

investing in companies expected to have high franking levels, and

carefully managing the realisation of capital gains.

Commencement Date

22 Jan 1998

You can assess the performance of the Fund against the S&P/ASX 200 All

Industrials Accumulation Index over rolling 4 year periods.

Important Announcements

30 Jun 2013

Indicative Investment Fee

The Indicative Investment Fee for the MLC Wholesale IncomeBuilder Fund was reduced from 0.97% pa to 0.72% pa on

the 1st June 2013. The Indicative Investment Fee shown in the Fund Profile Tool represents an annualised fee and is

calculated using the average Investment Fee for the fund over the past 12 months. Consequently, while the Investment

Fee is 0.72% from the 1st June 2013 the change will not be fully reflected in the Fund Profile Tool until 1 June 2014.

Please accept our apologies for this inconvenience.

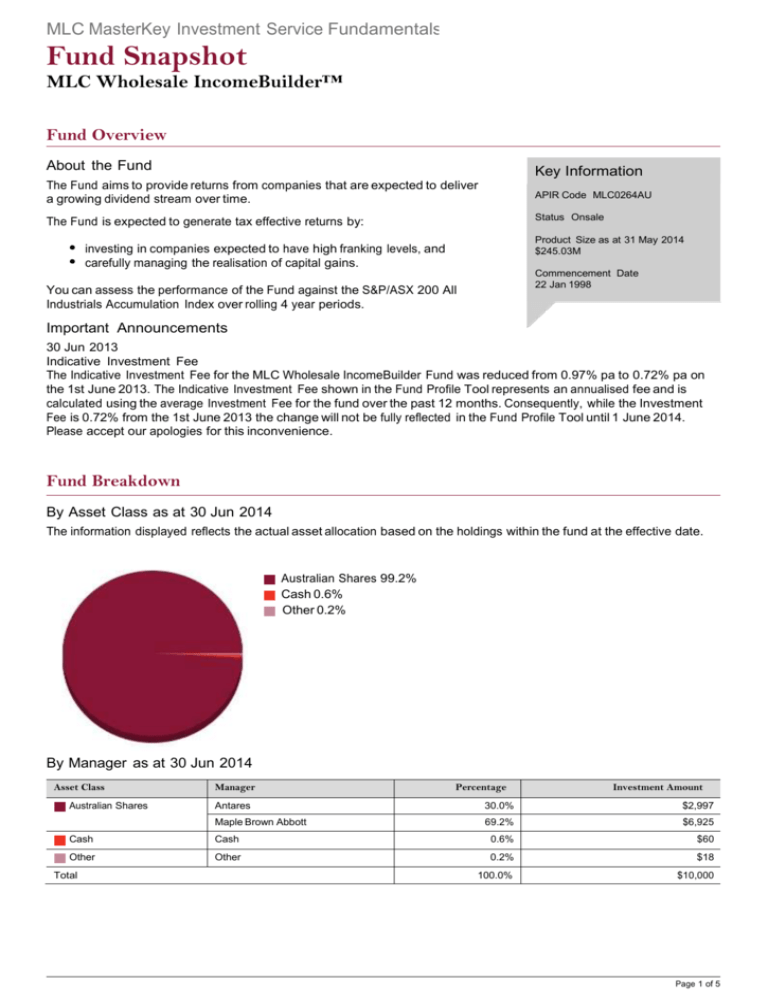

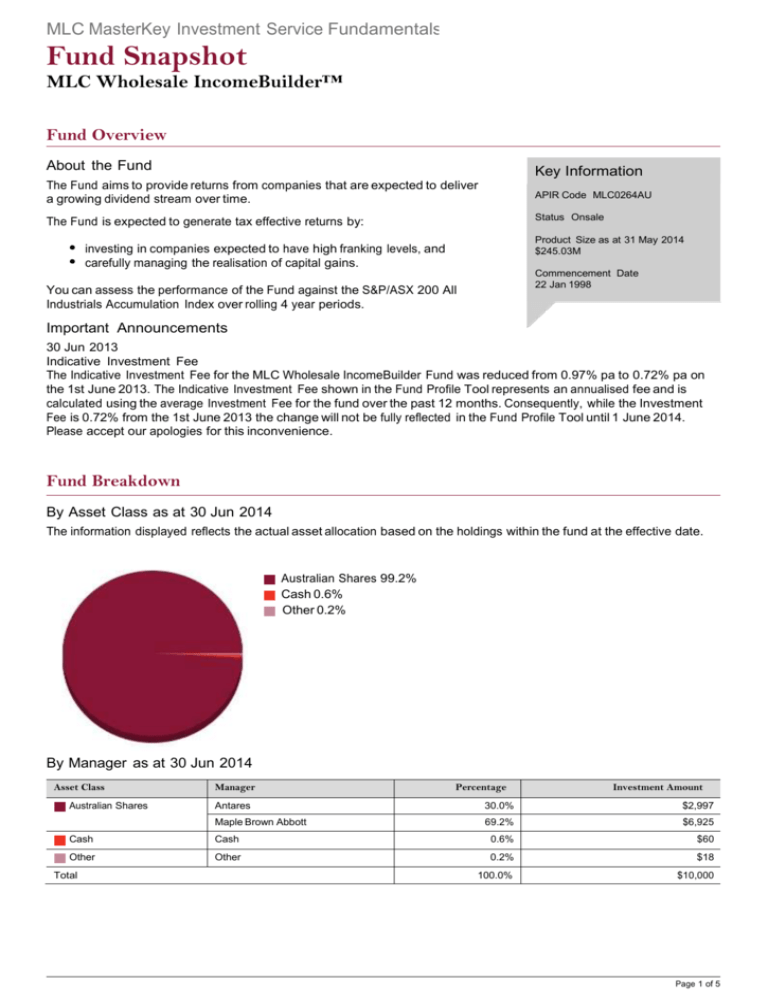

Fund Breakdown

By Asset Class as at 30 Jun 2014

The information displayed reflects the actual asset allocation based on the holdings within the fund at the effective date.

Australian Shares 99.2%

Cash 0.6%

Other 0.2%

By Manager as at 30 Jun 2014

Asset Class

Australian Shares

Manager

Percentage

Investment Amount

Antares

30.0%

$2,997

Maple Brown Abbott

69.2%

$6,925

Cash

Cash

0.6%

$60

Other

Other

0.2%

$18

100.0%

$10,000

Total

Page 1 of 5

MLC MasterKey Investment Service Fundamentals

Fund Snapshot

MLC Wholesale IncomeBuilder™

Stock Holdings

Top Stocks for Fund as at 31 May 2014

The Top Stocks for Fund have a one month reporting delay.

Stock Description

Industry

Country

Percentage

Investment Amount

ANZ BANKING GROUP

Financials

Australia

10.2%

$1,025

WESTPAC BANKING CORP

Financials

Australia

9.9%

$986

NATIONAL AUSTRALIA BANK

Financials

Australia

9.3%

$928

TELSTRA CORP

Telecommunication Services

Australia

8.2%

$821

WESFARMERS

Consumer Staples

Australia

6.7%

$674

COMMONWEALTH BANK OF AUSTRALIA

Financials

Australia

5.9%

$594

SUNCORP-METWAY

Financials

Australia

3.5%

$349

AMP

Financials

Australia

3.4%

$336

STOCKLAND TRUST

Real Estate Investment Trusts (REITs)

Australia

3.3%

$325

ASX

Financials

Australia

2.7%

$275

Performance

Historical Performance

Absolute Fund Returns as at 30 Jun 2014

Returns for periods one year or greater are calculated on an annualised basis. All returns are calculated using end of

month redemption prices assuming all distributions are reinvested and are net of management fees which may include

administration fees, issuer fees and investment fees and prior to any individual tax considerations, and do not allow for

initial entry fees.

The returns outlined below represent historical performance only and is not an indication of future performance. The value

of an investment may rise or fall with changes in the market. Returns are calculated in accordance with FSC Standard No

6.

3 month

Fund Performance

6 month

1 Year

3 Years

5 Years

10 Years

Since Inception

22 Jan 1998

2.0%

4.0%

16.3%

15.1%

12.9%

8.1%

8.5%

Growth

-1.0%

-0.1%

9.6%

8.6%

7.3%

2.1%

3.7%

Distribution

3.0%

4.1%

6.7%

6.5%

5.7%

6.0%

4.8%

Page 2 of 5

MLC MasterKey Investment Service Fundamentals

Fund Snapshot

MLC Wholesale IncomeBuilder™

Commentaries

Fund Commentary

As at 30 June 2014

The fund produced a total return of 2.1% (before fees and tax) in the quarter to 30 June 2014. This was 0.8% above the

1.3% return of the S&P/ASX200 All Industrials Accumulation Index. Over the year to 30 June, the index returned 17.1%

and the fund returned 17.1% (before fees and tax), which was 0.3% below the index return.

The profit reporting season that concluded in March 2014 confirmed the Australian market as a whole is on track to

record high single-digit earnings growth for the financial year. The next profit reporting period in August and September,

covering company results to 30 June, will be an early guide on whether earnings expectations for the 2015 financial year

are likely to be met. This will be important, as the funds managers warn that the share prices of many companies already

reflect a positive profit outcome in the year ahead and are looking fully priced.

The funds managers remain focused on identifying companies selling at realistic prices that are well positioned to support

the objective of growing income. There have been rewards from decisions by both the funds investment managers to

increase holdings in companies they expected to achieve a recovery in earnings and pay higher dividends. One of those

companies, Harvey Norman, has declared total dividends in the last 12 months that are 23.5% above the previous year

and its share price increased by 25.6% in the year.

Contributors to the funds total return this quarter included:

an overweight position in Echo Entertainment Group Limited

not investing in QBE Insurance Group Limited, and

an overweight position in Duet Group .

Detractors from total returns included:

an overweight position in Coca-Cola Amatil Limited

an underweight position in Commonwealth Bank of Australia, and

an overweight position in National Australia Bank Limited.

Over the year to 30 June, good returns have come from companies in the Financials ex-LPTs sector that have dividend

certainty. Resource and Consumer Discretionary company returns have also improved due to better profits and

favourable valuations.

In the year to 30 June, contributors to the funds total return included:

not investing in QBE Insurance Group Limited

an overweight position in Fairfax Media Limited, and

an overweight position in APN News & Media Limited.

Detractors from total returns included:

not investing in Macquarie Group Limited

an overweight position in Metcash Limited, and

an overweight position in Coca-Cola Amatil Limited.

Note:

- Please refer to the Market commentary for an overview of what happened in domestic and global markets over the

quarter.

- Fund commentary for this fund will be updated two to three weeks after the end of the month

Page 3 of 5

MLC MasterKey Investment Service Fundamentals

Fund Snapshot

MLC Wholesale IncomeBuilder™

Market Commentary

As at June 2014

Returns to 30 June 2014*

Asset class

3 mth (%)

1yr (%)

3yr (%)

5yr (%)

10yr (%)

Cash

0.7

2.7

3.6

3.9

5.0

Australian bonds

3.1

6.1

7.0

6.9

6.5

Global investment grade bonds (hedged)

2.6

7.8

7.9

8.4

7.8

A-REITs

9.3

11.1

15.3

14.3

2.3

Global REITs (hedged)

7.8

15.3

13.6

22.5

na

Australian shares

0.9

17.4

10.4

12.2

9.0

Global shares (hedged)

5.4

23.9

14.8

17.3

9.4

Global shares (unhedged)

3.3

19.9

15.6

11.4

4.8

Sources: Datastream, MLC Investment Management. *Annualised returns except for 3 month.

Benchnark data include UBS Bank Bill Index (Cash), UBS Composite Index (Aust bonds) Barclays Global Aggregate hedged to A$ (Global bonds),

S&P/ASX200 A-REIT Accumulation Index (A-REITs), MLC Global property strategy benchmark hedged to A$ (Global REITs), S&P/ASX200

Accumulation index (Aust shares) and MLC global equity strategy benchmark (MSCI All Country Indices hedged and unhedged in A$).

World share markets enjoyed good gains over the quarter, although a stronger Australian dollar did detract from

unhedged global share returns. While the Australian share market produced a positive return, it significantly

underperformed overseas markets, as mining stocks weakened in response to a falling iron ore price.

Bond yields fell in all the major world bond markets, producing solid gains for fixed income investors. Lower bond yields

also provided a boost to listed real estate securities around the globe. Australian real estate securities were the best

performing asset class for the quarter. In addition to lower bond yields, the sector benefitted from a takeover bid for the

Australand Group and news that shareholders had approved the restructure of Westfield.

Share prices have continued to rise, despite heightened geopolitical uncertainty. The crisis in the Ukraine is still

unresolved. More worryingly, Iraq, keeper of the worlds fifth largest oil reserves, is teetering on the brink of collapse, as

radical Islamist forces gain control of large swathes of Iraqi territory. Despite these developments, markets remained well

supported by an improving US economy, some better economic news from China, and the fact that monetary conditions

remain favourable for financial markets. During June, the European Central Bank took further steps to encourage bank

lending and economic growth. The Federal Reserve signalled that the unwinding of its quantitative easing program would

remain gradual, and that interest rates would remain extremely low for some time to come.

In Australia, the Federal Budget didnt appear to have any lasting impact on financial markets. While many individual

measures remain highly controversial, the budget is likely to exert only a modest drag on Australias economic growth over

the coming years. The Australian economic data released over the quarter were quite mixed. Australias economy

expanded at a faster than expected pace in the March quarter. Employment growth has improved, there are some signs of

a pick-up in investment outside of the mining industry, and private sector credit is still expanding. However, both business

and consumer confidence remain fragile, and investment in mining is expected to continue declining.

The Reserve Bank of Australia left interest rates unchanged over the quarter, and has signalled its intention to leave rates

unchanged for some time to come.

Page 4 of 5

MLC MasterKey Investment Service Fundamentals

Fund Snapshot

MLC Wholesale IncomeBuilder™

Information in this report does not take into account your objectives, financial situation or needs. Before acting on the information you should consider

whether it is appropriate to your situation. You should consider the relevant Product Disclosure Statement before making a decision about the product.

Past performance is not a reliable indicator of future performance. Please also see Advice Warning and Important Information.

MLC Limited (ABN 90 000 000 402 AFSL 230694) is the issuer of:

MLC MasterKey Investment Bond

MLC Nominees Pty Ltd (ABN 93 002 814 959 AFSL 230702 Trustee of The Universal Super Scheme ABN 44 928 361 101) is the issuer of:

MLC MasterKey Business Super (including MLC MasterKey Personal Super), MLC MasterKey Superannuation, MLC MasterKey Super, MLC MasterKey

Super Fundamentals, MLC MasterKey Allocated Pension, MLC MasterKey Pension, MLC MasterKey Pension Fundamentals, MLC MasterKey Term

Allocated Pension

MLC Investments Limited (ABN 30 002 641 661, AFSL number 230705) is the issuer or operator of:

MLC Investment Trust, MLC MasterKey Investment Service, MLC MasterKey Investment Service Fundamentals, MLC MasterKey Unit Trust, MLC

Investments Limited also trades as MLC Private Investment Consulting.

NULIS Nominees (Australia) Limited (ABN 80 008 515 633 AFSL 236465):

trustee of the MLCS Superannuation Trust ABN 31 919 182 354 is the issuer of Navigator Eligible Rollover Fund ABN 32 649 704 922;

trustee of the MLC Superannuation Fund ABN 40 022 701 955 is the issuer of MLC Wrap Super and MLC Navigator Retirement Plan.

Navigator Australia Limited (ABN 45 006 302 987 AFSL 236466) is the Operator and issuer of:

MLC Wrap Investments, MLC Wrap Self Managed Super and MLC Navigator Investment Plan.

© You are only authorised to use the data and content for the purpose of research, validation and monitoring of your personal investments. You may not

redistribute the data and content to any other person under any circumstances.

2013 Morningstar, Inc. All rights reserved. The data and content contained herein are not guaranteed to be accurate, complete or timely. Neither

Morningstar, nor its affiliates nor their content providers will have any liability for use or distribution of any of this information. To the extent that any of the

content above constitutes advice, it is general advice that has been prepared by Morningstar Australasia Pty Ltd ABN: 95 090 665 544, AFSL: 240892

(a subsidiary of Morningstar, Inc.), without reference to your objectives, financial situation or needs. Before acting on any advice, you should consider the

appropriateness of the advice and we recommend you obtain financial, legal and taxation advice before making any financial investment decision. If

applicable investors should obtain the relevant product disclosure statement and consider it before making any decision to invest. Some material is

copyright and published under licence from ASX Operations Pty Limited ACN 004 523 782 ("ASXO"). DISCLOSURE: Employees may have an interest in

the securities discussed in this report. Please refer to our Financial Services Guide (FSG) for more information at http://www.morningstar.com.au/fsg.asp

Page 5 of 5