The Korean Securities Class Action Act: A Study In Comparative Law

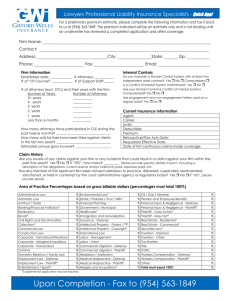

advertisement

The Korean Securities Class Action Act: A Study In Comparative Law On January 1, 2005, the Korean Securities-Related Class Action Act (the "Act") came into force. The Act is based on U.S. federal legislation, which has been criticized as open to abuse by attorneys filing frivolous lawsuits. We will examine: What lessons can be learned from the history of litigation under the U.S. Securities Acts? What revisions did the Korean legislature adopt in order to overcome some of teh problems with the U.S. Act? Will these revisions be successful? A. Introduction B. The Securities Class Action in the United States 1. What is class action? 2. Benefits of class actions in the securities context: Deterrence Private enforcement Compensation to victims Market efficiency Removal of Korean discount 3. Abuse of securities class actions in the United States: Plaintiffs' attorneys Prevalence of strike suits "Professional plaintiffs" Unfair settlements 4. The Public Securities Law Reform Act of 1995 ("The Reform Act"): "Rebuttable presumption" in selecting lead plaintiff Heightened pleading standard Document #: 1372829 Safe harbor for forward looking statements A motion to dismiss stays discovery Reasonable attorney's fees for plaintiff's counsel Mandatory sanctions 5. Was the Reform Act successful? Since 1996, there have been an average of 212 filings per year, as compared to an average of 190 filings per year before the Reform Act was passed. C. Of 1733 cases filed since the Reform Act, only 9 have gone to trial. Record settlement awards announced after the Reform Act: Enron Corp., 2006, $7,099,000,000 Cendant Corp., 2000, $3,528,000,000 WorldComm, Inc., 2004, $2,575,000,000 Lucent Technologies, 2003, $517,000,000 BankAmerica Corp, 2002, $490,000,000 Raytheon Company, 2004, $460,000,000 Waste Management, Inc., 2002, $457,000,000 Rite Aid Corporation, 2003, $320,000,000 Bristol Myers Squibb Co., 2004, $300,000,000. Daimler Chrysler AG, 2003, $300,000,000 Oxford health Plans, Inc., 2003, $300,000,000 Korea's New Securties-Related Class Action Act is Modeled After the U.S. Statutes: Will It Lead To The Same Abuses? 1. Class actions limited by subject matter: Falsification of securities registration statements or prospectuses; Falsification of annual, semi-annual or quarterly business reports; Document #: 1372829 Use of inside information for securities transaction; Manipulation of market conditions; and Fraudulent audits. 2. Suits against small companies barred until January 1, 2007 For causes of action involving insider trading or market manipulation, shareholders may file class action suits against any publicly traded companies beginning in 2005. However, for causes of action involving false disclosure such as fraudulent audits and fraudulent registration statements or prospectuses, shareholders may not file class action suits against companies with assets of less than two trillion won approx. US $2 billion) until January 1, 2007; and shareholders may file suits against companies with assets of two trillion won or more beginning in 2005, subject to 2 year grace period for past accounting irregularities pursuant to the recent Amendment. Only approx. 80 Korean companies meet that standard, as of early 2004. 3. Lead Plaintiff/Counsel There are limits on lead plaintiff and lead counsel. A lead plaintiff or lead counsel must "adequately represent" the members of the class The lead plaintiff or lead counsel cannot have served as lead plaintiff or lead counsel if they had previously been lead plaintiff or lead counsel in three or more class actions within the last three years 4. Restrictions on Plaintiff class: Size and stake minimums: Document #: 1372829 At least 50 plaintiffs must be a part of the class before the complaint is filed. The injured class must be a group of 50 or more persons and the class must hold at least .01 percent of the total number of securities issued by the defendant corporation. Relevant legal or factual issues must be "common" to all members of the class. The class action lawsuit must be an "adequate and efficient" means of fulfilling the rights of, and protecting the interests of, the class members. 5. Procedure: Simple complaint No early dismissal Limited discovery Jury v. Judge: 6. Influence of regulatory agencies on class certification: The court may take into consideration any preliminary inquiries or opinions submitted by an overseeing institution, with respect to the act of giving rise to the cause of action for the damage claim. 7. Risk of loss is on the Plaintiff: Under the Act, fee-shifting applies. If the plaintiff's lose, they must pay part of the Defendant's litigation costs. 8. Filing & Upfront Costs: The Act requires an application fee that is a certain percentage (approx. 0.175 to 0.25%) of the claim amount depending upon the magnitude of such amount. The maximum limit is W50,000,000 (approx. US $50,000). It also requires an "advance payment" for part of the litigation costs. 9. Cultural Differences D. Conclusions Document #: 1372829

![[2012] NZEmpC 75 Fuqiang Yu v Xin Li and Symbol Spreading Ltd](http://s3.studylib.net/store/data/008200032_1-14a831fd0b1654b1f76517c466dafbe5-300x300.png)